Market Brief - June 9, 2024

Mixed jobs data delivers rally

Welcome to The Predictive Investor Market Brief for June 9th, 2024!

Stocks rebounded on mixed jobs data. 272k jobs were added in May (vs. 182k expected). Stocks initially sold off on the news, as a strong economy gives the Fed less reason to cut rates. However, job openings fell more than expected, and the unemployment rate ticked up to 4%, the highest in over two years.

The labor market remains strong, but traders are betting that the softness under the surface will help ease inflation just enough for the Fed to loosen monetary policy.

This week’s Fed meeting will give us an updated dot plot, with Fed members' predictions for how many rate cuts, if any, should be expected over the next year. We should expect some volatility around the news this week, as it will have an impact on the direction of bond yields.

Overall, our intermediate term outlook remains unchanged. Here’s why.

$7.3 trillion on the sidelines

In addition to the improving household net worth, there’s a record $7.3 trillion in money market funds. (Read)

There are many investors who missed out on the rally over the last year. And improving fundamentals will encourage investors to put this cash to better use.

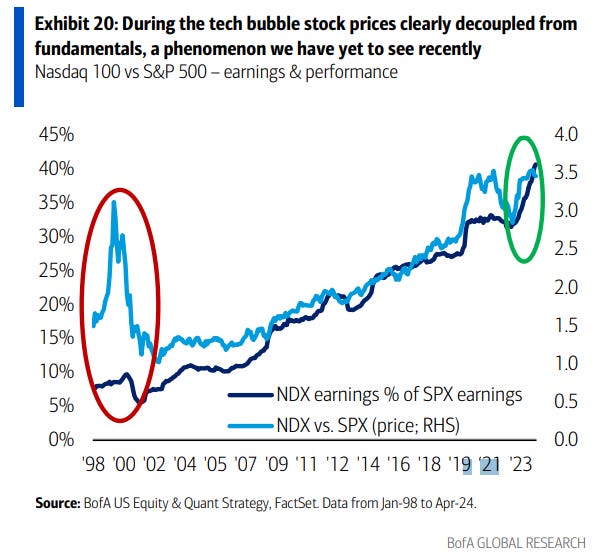

No bubble in sight

Tech valuations have been in the news lately, and certainly there are companies trading at nosebleed valuations. But on average the fundamentals are keeping up with stock prices. This is exactly what we want to see - stock prices are being driven by improved earnings, not speculation.

Zombie Apocalypse?

We’ve already covered the risks of rising government debt. But corporate debt is also a problem for a large cohort of distressed companies, called zombie companies. These companies typically have such high debt levels that they can barely cover their interest payments.

The number of publicly traded zombie companies has soared to 7,000 globally, and 2,000 in the U.S. alone. (Read)

These companies employ at least 130 million people across numerous countries, and their ability to survive largely depends on the direction of interest rates. A wave of bankruptcies could have a major impact on both the stock market and economy. This represents the biggest risk for the market outside of geopolitics.

Market Technical Analysis

S&P 500 (SPX)

The SPX rallied off its bullish reversal bar and hit all time highs last week. However, breadth remains pretty weak. The number of companies above their 50-day moving average remains far below levels seen in April. RSI is flattening out, suggesting further consolidation ahead.