Market Brief - March 10, 2024

A rotation out of big tech?

Welcome to The Predictive Investor Market Brief for March 10th, 2024!

Last week we called out big tech valuations as a near-term risk for the market, and that narrative seems to be gaining steam. Relative performance for a number of big tech stocks vs. the S&P 500 is at or near 52-week lows.

Meanwhile the S&P equal weight index the week at an all time high for the fourth week in a row, suggesting that the money leaving big tech is being deployed elsewhere. This technical backdrop comes amid news that Warren Buffett trimmed his stake in Apple by 1% in Q4 of 2023, and put more money into Chevron and Occidental Petroleum.

If this is indicative of a sector rotation by large investors, it would be good news for areas of the market that are undervalued, including the small companies we focus on.

Weekend Reads

Jamie Dimon and Ray Dalio Warned of an Economic Disaster That Never Came. What Now? (WSJ)

“‘I got it wrong because, ordinarily, when you raise interest rates it curtails private-sector demand and asset prices and slows things down, but that didn’t happen,’ Dalio said. ‘There was a historic transfer of wealth: The balance sheets of the private sector improved a lot and the balance sheet of the government deteriorated a lot.’”

Amid explosive demand, America is running out of power (MSN)

“A major factor behind the skyrocketing demand is the rapid innovation in artificial intelligence, which is driving the construction of large warehouses of computing infrastructure that require exponentially more power than traditional data centers. AI is also part of a huge scale-up of cloud computing. Tech firms like Amazon, Apple, Google, Meta and Microsoft are scouring the nation for sites for new data centers, and many lesser-known firms are also on the hunt.”

What’s the Investment Case For Gold? (A Wealth of Common Sense)

“If you look at the gains since 1980, they tell a different story. From 1980-2023, gold was up just 3.2% per year. That lagged the returns for stocks (+11.7%), bonds (+6.5%) and cash (+4.0%). In that same timeframe, the annual inflation rate was 3.2%, meaning gold had a real return over a 44 year period of a big fat zero.”

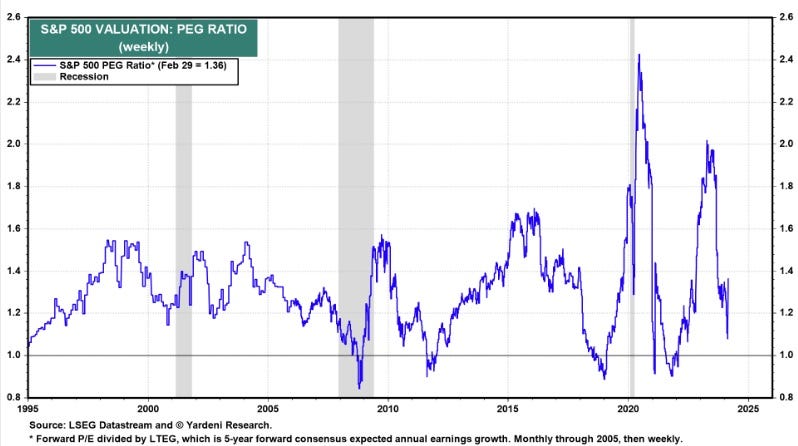

PEG ratio for the SPX is near historical averages (Stock News)

Market Technical Analysis

Nasdaq 100 (QQQ)

The QQQ put in a high volume bearish reversal bar on Friday, mostly driven by the selloff in semiconductor stocks. The semiconductor index declined by 4% week-over-week. Is that enough of a decline to satisfy short term profit-taking? We’re not convinced. Traders will likely attempt to fill the gap between $425 and $433, which is near the 50-day moving average.

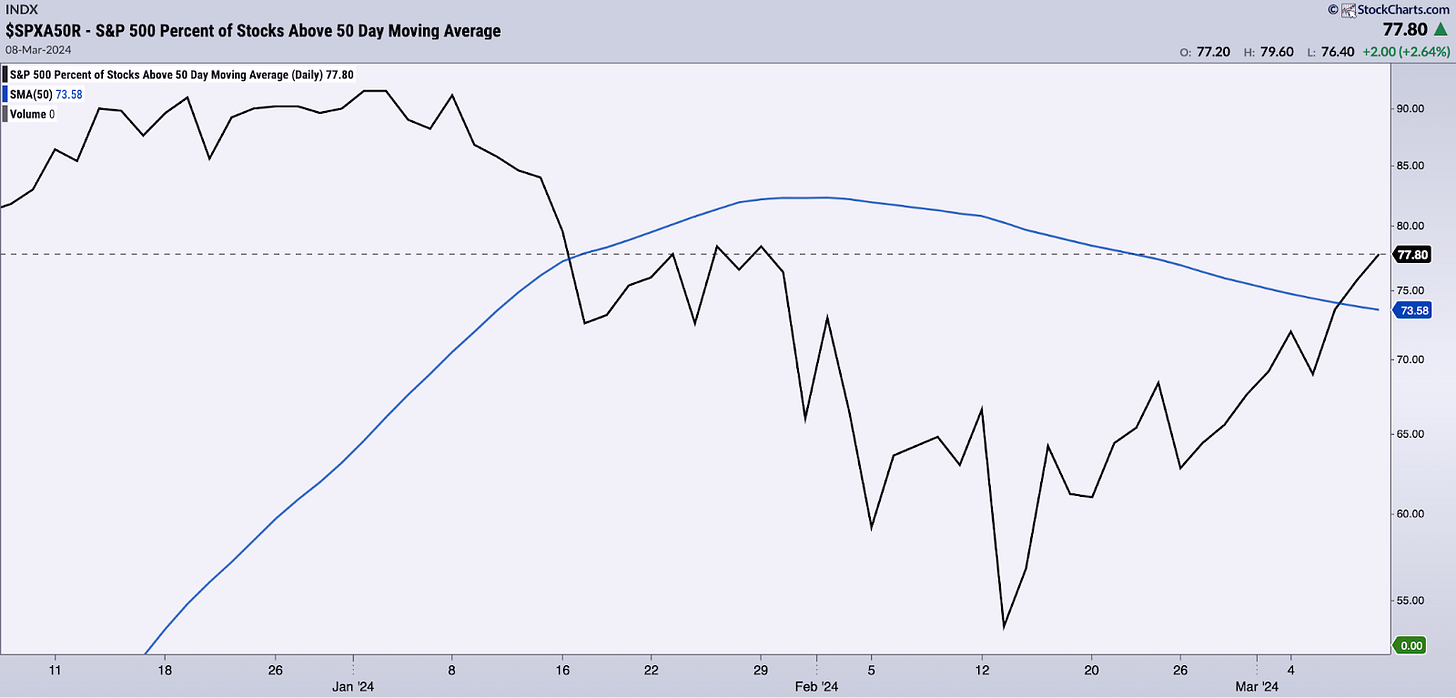

Breadth

Despite the selloff in some of the SPX’s biggest components, the percentage of stocks above their 50-day moving average is increasing. This suggests a rotation out of the mega caps into areas of the market that are less stretched from a valuation perspective.