Market Brief - March 17, 2024

Yellen admits higher rates here to stay

Welcome to The Predictive Investor Market Brief for March 17th, 2024!

Treasury Secretary Janet Yellen told reports it’s unlikely interest rates will go back down to pre-Covid levels. Her comments come amidst rising yields and higher inflation. CPI came in at +0.4% month-over-month (vs. 0.3% expected) and PPI came in at +0.6% month-over-month (vs. 0.3% expected).

This should come as no surprise to subscribers, as we’ve been alerting you to the likelihood of higher rates for longer for months now. But the markets have been in melt-up mode since last October partly due to the expectation of multiple rate cuts in 2024. Expectations at the start of the year were for six rate cuts, which have now been revised down to three.

FOMC meetings begin Tuesday. We should expect an uptick in volatility, especially if the Fed provides guidance that causes the market to re-adjust rate expectations yet again.

Weekend Reads

Boeing is in big trouble (CNN)

“That incident resulted in a temporary nationwide grounding of certain 737 Max jets, followed by congressional hearings, production and delivery delays, multiple federal investigations — including a criminal probe — and a stock that has lost a quarter of its value this year, shaving more than $40 billion off the company’s market valuation.”

Electric-Vehicle Startup Fisker Prepares for Possible Bankruptcy Filing (WSJ)

“Their rise also coincided with a surge of investor enthusiasm for companies that could potentially follow in Tesla’s footsteps and break into the highly competitive auto industry. Instead, the companies have struggled with the complexities of mass manufacturing and, more recently, with sputtering demand for battery-powered vehicles from American car buyers.”

Britain to sign biggest U.S. state-level trade pact yet with Texas (Reuters)

“Britain's business and trade ministry said the agreement with Texas, the second largest U.S. state economy, was targeting areas such as energy, life sciences and professional services. The agreement comes four months after a similar pact with Florida. Britain is also in talks with the likes of California, Colorado and Illinois.”

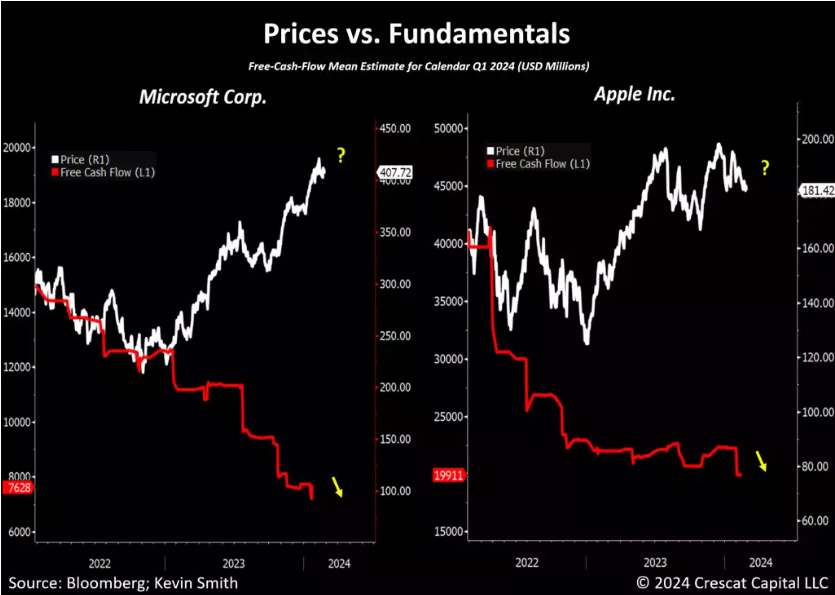

A Macro Shift at Hand (@Crescat_Capital)

Market Technical Analysis

Nasdaq 100 (QQQ)

Update to last week’s chart. Stocks will be in an uptrend until they’re not. But the technical pressure continues to favor a consolidation at the very least, especially with the rise in rates and inflation. Near term support at the 50-day moving average, about 2% below last week’s close. A more bearish scenario depends on what happens with bonds/rates.

Bonds (TLT)

TLT is sandwiched between the volume weighted price from the October low and the December high. That rally, and corresponding drop in rates, fueled the bull move in stocks. A decisive break below $92.15 would fuel a correction in equities.

Last Week’s Trades

We added one stock to the portfolio last week.