Market Brief - March 24, 2024

Bears go into hibernation

Welcome to The Predictive Investor Market Brief for March 24th, 2024!

Last week the Fed gave a huge green light to the bulls. In summary, rates were left unchanged which was expected, and “dot plot” projections point to 3 rate cuts later this year, with the fed funds rate declining to 3.1% by 2026.

It’s unclear that the economy needs rate cuts, as inflation is still above target, GDP is growing and the labor market remains strong. But as the saying goes, one should never fight the Fed. Especially in an election year, when they are unlikely to deliver bad news unless they absolutely have to. Rate cuts may actually help lower inflation indirectly, by spurring construction projects that would increase the supply of housing (shelter costs are roughly a third of the CPI).

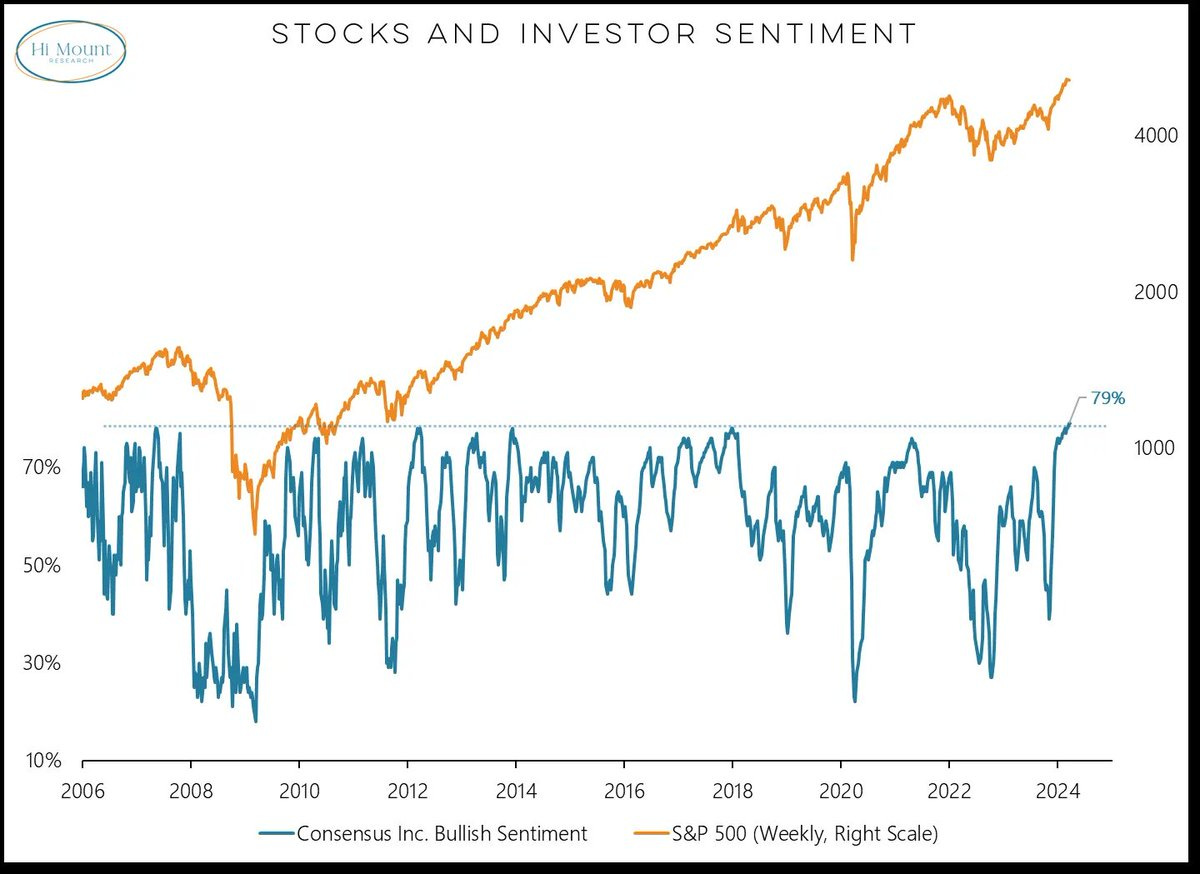

Sentiment among investors is decidedly bullish. Nearly 80% of analysts surveyed by Consensus Inc. are bullish.

Small speculators are now at their most bullish position since Sentimentrader began tracking their positioning.

With sentiment this extreme, there is a risk that any disappointing news could spur a profit-taking correction. We’ve expected this to happen in Q1 based on seasonality trends, but with a week left in the quarter, that is unlikely to occur. And so it’s important to recognize that sentiment analysis is more art than science.

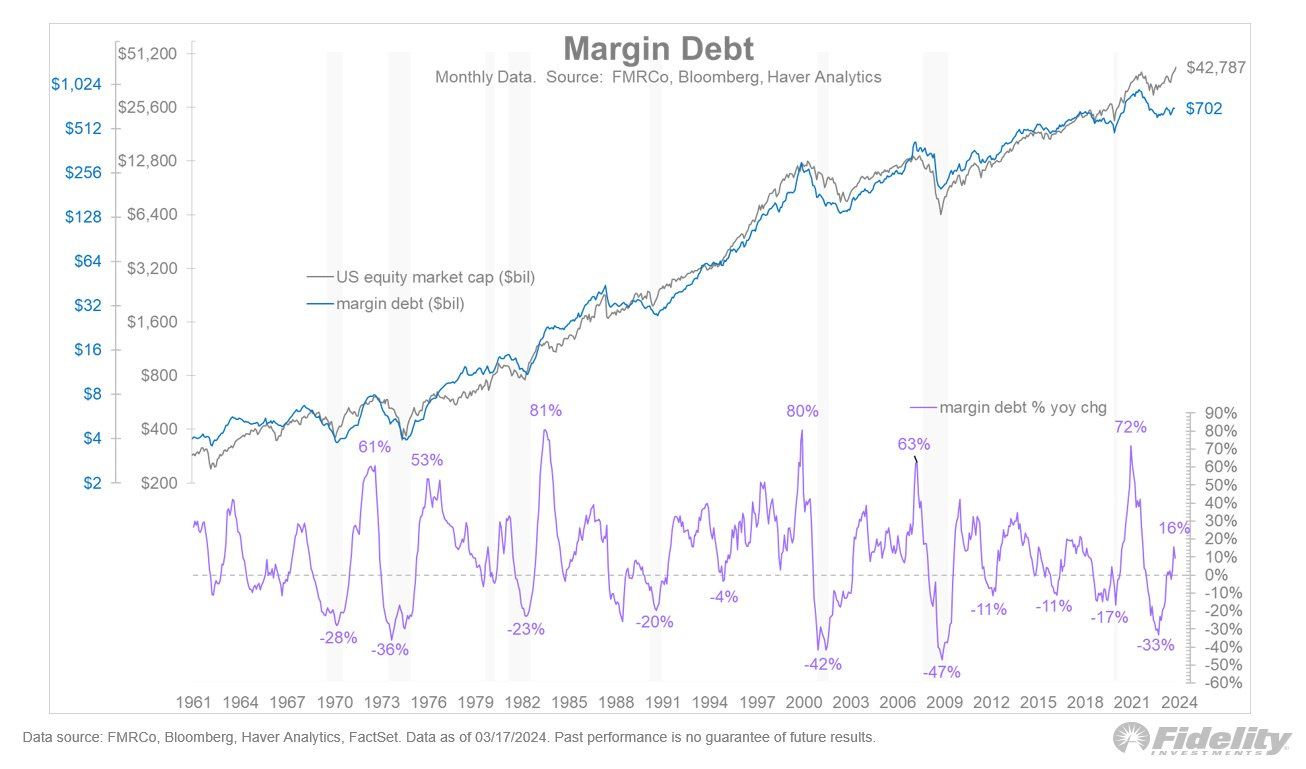

It’s also important to realize there is still a lot of dry powder on the sidelines. Margin debt is nowhere near past extremes. And if rates come down as expected, institutions will certainly make use of cheaper money to accumulate equities, driving the market higher.

Weekend Reads

The inverted yield curve and the Leading Economic Index have failed as recession predictors (Yahoo Finance)

“The recessionary signals we’ve been reading about over the past two years have come amid massive bullish tailwinds like record job openings and excess savings, which have proven to be more reliable leading indicators during the current economic cycle. Maybe next time the yield curve and the LEI will be right and timely. But not this time.”

Wall Street optimism on stocks is at its highest level since early 2022, BofA survey shows (CNBC)

“Such surges in optimism can be contrarian indicators, meaning they often are good times to sell. However, BofA said average cash balances remain at 4.2%, above the 4% threshold that would trigger a sell signal. The bank's "Bull & Bear Indicator" is at 6.5, which is "bullish but not yet extreme bullish," said Michael Hartnett, BofA's chief investment strategist.”

'We are essentially in a new Gilded Age’: As workers get laid off, CEOs and shareholders gobble up hundreds of billions in profits (Fortune)

“This past year has been marked by layoffs in the finance, tech, and media sectors as many CEOs claim to need to downsize in light of economic strain. But it seems as if corporations are doing better than ever. Revenue and profits at Fortune 500 companies grew significantly between 2014 and 2022, hiking even more in the years after the pandemic hit. In the same breath that Meta’s Mark Zuckerberg announced layoffs for more than 10,000 workers in the name of a “year of efficiency,” the company announced a fresh $40 billion stock-buyback option. Less than a year later, Meta announced plans to buy back another $50 billion.”

The U.S. Faces the Same Risks Ancient Rome Faced in Caesar’s Day (Time)

“It’s hard not to see the resemblance between Caesar’s day and our own. Both featured conflict between populist politicians and a conservative establishment, which spiraled from legislative gridlock to the politicization of the criminal justice system. Resentment begot extreme measures and such measures demanded still sharper replies. While America’s military remains happily apolitical, Roman armies escalated the conflict from the courts to the battlefield. Officials who filed charges spurred outrage and sharpened the divides that would lead Rome to autocracy in the coming decades, a risk the United States may face today.”

Market Technical Analysis

S&P 500 (SPX)

Despite waning momentum and seasonality favoring a correction, last week’s Fed news clearly favors the bulls. The 20-day EMA has provided reliable support for the SPX since the November bottom. A close below this level and/or RSI falling below 50 would cause us to become bearish over the short term.

Russell 2000 (IWM)

IWM is now comfortably above the AVWAP from the 2021 high, and has finally started to make a series of higher highs and higher lows. There is resistance at $210, but the Fed’s guidance on lower rates should provide a significant tailwind for small companies, which tend to be more interest-rate sensitive than their larger counterparts.

Bonds (TLT)

Bonds rallied last week, but are still in a trading range. We don’t foresee any big move in stocks until this consolidation ends with an up or down move.

Last Week’s Trades

We removed two stocks from the portfolio last week.