Market Brief - March 3, 2024

Stocks continue their melt-up

Welcome to The Predictive Investor Market Brief for March 3rd, 2024!

Earlier this year we flagged declining momentum in the SPX and projected a weak Q1 for stocks, based on seasonality in election years. While we have one month left in the first quarter and are still seeing an overbought market on declining momentum, the uptrend persists.

As we noted coming into last month, a large gain in February is rare, but historically when the SPX is up 5%+ in February, the market gains an average of 8% the rest of the year.

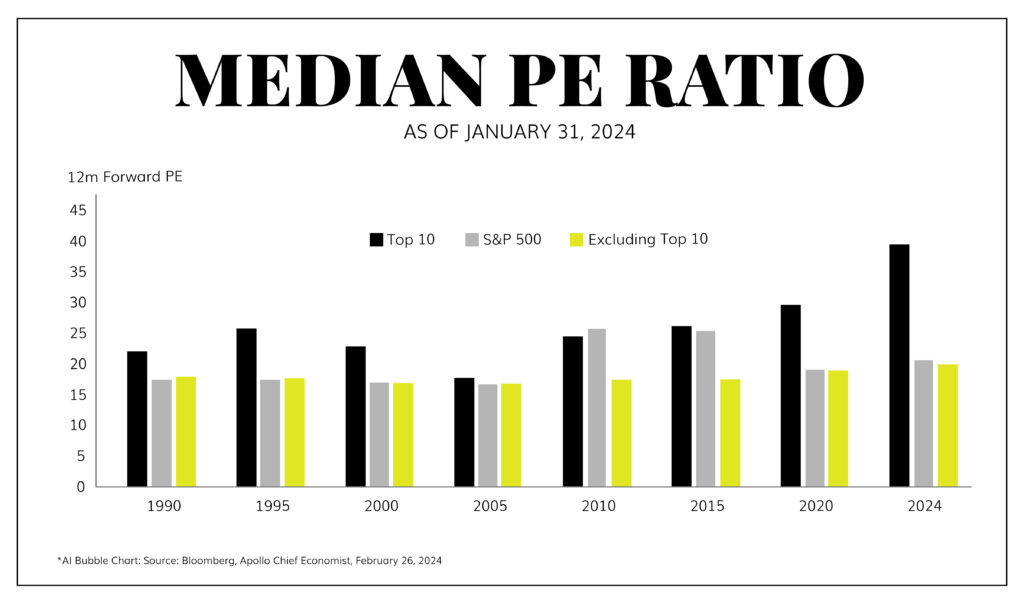

That said, the valuation of market leaders is at the highest levels in history (chart below), and performance for some of those leaders is starting to lag. Microsoft, Apple and Alphabet lagged the SPX in February, and Tesla is down nearly 20% year-to-date.

Smaller companies are still cheap, and we continue to believe they offer the best opportunities for outsized gains in the months ahead.

Weekend Reads

The World Is in for Another China Shock (WSJ)

“A sequel might be in the making as Beijing doubles down on exports to revive the country’s growth. Its factories are churning out more cars, machinery and consumer electronics than its domestic economy can absorb. Propped up by cheap, state-directed loans, Chinese companies are glutting foreign markets with products they can’t sell at home.”

Pimco Sees Swelling Deficit Dragging Bonds ‘Back to the Future’ (Yahoo Finance)

“Pacific Investment Management Co. is warning that US fiscal profligacy threatens to drag the Treasury market back to 1980s, a time when bond vigilantes demanded far higher compensation to own longer-dated bonds.”

Fed Rate Cuts Delayed: AI Stock Boom Is The Big, Unstated Reason (Investor's Business Daily)

“Federal Reserve Chairman Jerome Powell, at his latest news conference, offered at least five reasons why policymakers chose at their Jan. 31 meeting to punt on Fed rate cuts for a while. Yet he left out what may be the most straightforward explanation: the S&P 500's historic AI-driven tear — and the risk of fanning the flames.”

Apple to Wind Down Electric Car Effort After Decadelong Odyssey (MSN)

“The two executives told staffers that the project will begin winding down and that many employees on the car team — known as the Special Projects Group, or SPG — will be shifted to the artificial intelligence division under executive John Giannandrea. Those employees will focus on generative AI projects, an increasingly key priority for the company.”

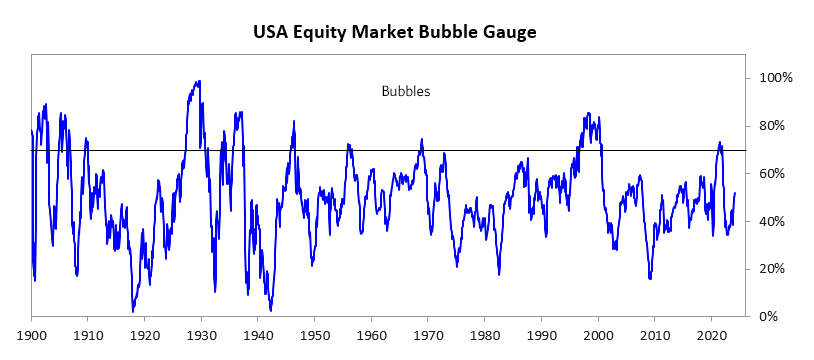

Ray Dalio: Stocks are not in a bubble (Ray Dalio)

Market Technical Analysis

Russell 2000 (IWM)

Longtime subscribers know we like to use the VWAP as an indicator to assess the strength of key turning points in the market. For nearly two years, the Russell 2000 was stuck between the volume-weighted price since the 2016 low and the volume weighted price since the 2021 high. We are now comfortably above these key levels, which means most investors in the index are now in the green. This week the index closed at a two year high.

We believe this is a sign that the bull market will start to broaden this year. The good news is most of the compelling opportunities in our list of qualifying stocks are already in our portfolio. This week we will publish a portfolio review, where we’ll highlight the best buys in our open positions.