Market Brief - March 31, 2024

Now’s the time to go long energy (if you haven’t already)

Welcome to The Predictive Investor Market Brief for March 31st, 2024!

One of the greatest things about being a momentum investor is being able to spot trend changes in real time, before higher prices are justified by the fundamentals. This is what caused us to become bullish on energy in late 2020. Oil prices had bottomed earlier that year, and we saw significant accumulation of energy shares, as more and more small energy companies began to meet our buy criteria.

Longtime subscribers know we’ve been bullish on energy since then. In fact, some of the biggest gains in our portfolio come from energy stocks. Although the price of oil has pulled back a bit from its high in 2022, the supply/demand factors favor higher prices.

Geopolitical tensions are causing supply disruptions in Russia and the middle east, and OPEC is extending its production cuts into next quarter. Energy demand continues to grow, driven by rising population and prosperity in emerging markets, along with investment in new technologies. AI and crypto require massive amounts of energy, and investment in those areas is not going to slow down any time soon.

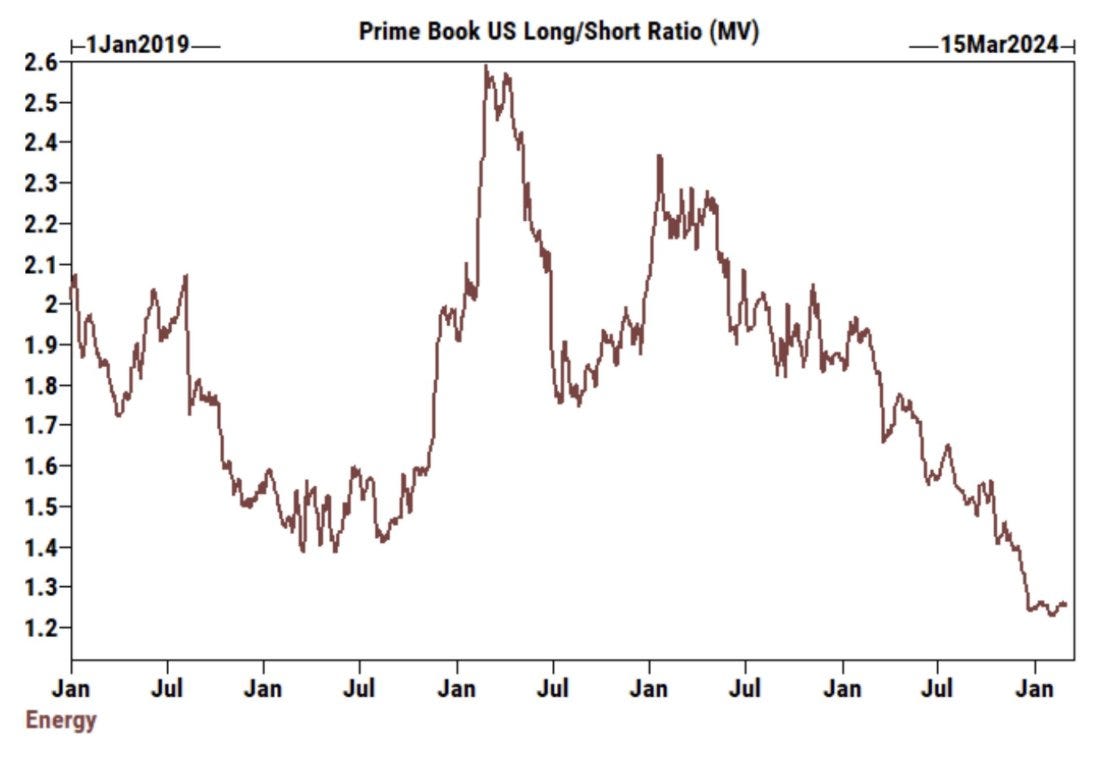

Despite the favorable fundamental backdrop, institutional investors have overlooked the sector. In fact, hedge funds are the least long in energy stocks in five years (chart below).

When a sector has historic bearish sentiment combined with positive momentum in shares, there is often significant upside potential.

Paid subscribers are up 90% in less than 6 months on one of our favorite micro cap energy plays, but we’re just getting started. If you haven’t upgraded to a paid subscription yet, you can join the party by clicking here. We would love the opportunity to earn your business.

Weekend Reads

Remember the Silicon Valley Bank Disaster? (Washington Monthly)

"Unfortunately, but not surprisingly, the banking industry has opposed the banking agencies’ efforts to respond to the regional panic and improve the regulations that apply to large banks. Having benefited from explicit and implicit protection from the government, Wall Street now wants the public to forget that the regional banking crisis ever happened."

Putin's Oil Industry Is in Trouble (Newsweek)

"Gasoline production in Russia has fallen after a series of strikes by Kyiv on the country's oil refineries, figures show. Rosstat, Russia's Federal State Statistics Service, said that in the week ending March 24, the nation's production of motor petrol fell by approximately 7.4 percent to 754,600 tons compared to the week prior, when production was at 815,300 tons, local media reported."

Tesla’s Terrible Quarter Catches Some Analysts Asleep at the Wheel (WSJ)

"The big gap between the analyst consensus and what investors actually expect also implies that official earnings estimates are too high. Currently, the consensus earnings per share for 2024 is $2.87, which compares with a share price of $180 to give a forward earnings multiple of 63. But the real multiple of what investors expect is probably a lot higher. Tesla’s stock is even more expensive than it looks."

Why the U.S. could be on the cusp of a productivity boom (Axios)

"The rise in global interest rates and inflation are evidence of stronger global demand. Many countries are experiencing labor shortages that may incentivize more productivity-enhancing investment. And artificial intelligence and related technologies create big opportunities."

Retailers Turn to ‘Extreme Bargains’ to Lure Shoppers as Consumer Spending Underwhelms (Yahoo Finance)

"It’s a similar situation in the US, where consumer spending started the year weaker than expected, while inflation was higher than forecast, helping explain the shopping pullback. That contributed to defaults in the retail sector of the US high-yield bond market soaring past 5.4% in the last 12 months, nearly double the 22-year average of 2.8%, according to a March 1 report by JPMorgan Chase & Co."

Market Technical Analysis

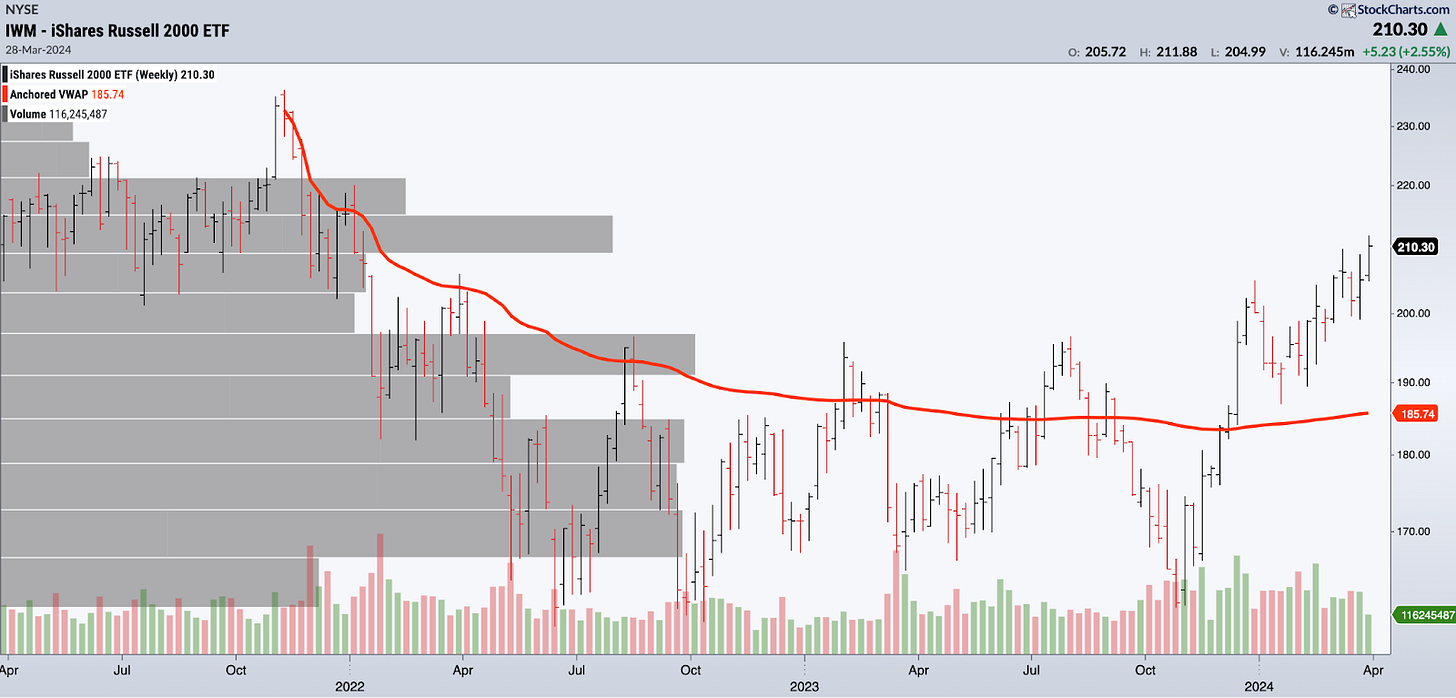

Russell 2000 (IWM)

The small cap index closed the week at a two-year high, and the volume-weighted price since the top in 2021 has been trending up since December. We are watching the index closely, as $210-$215 is the last area of major price resistance. Clearing that range will mean the bull market is finally ready to broaden beyond mega cap tech.