Market Brief - May 21, 2023

Last week we indicated bearish divergence between tech and the rest of the market would likely continue, and that’s certainly been the case. There’s no question QQQ breaking above its August 2022 high is a bullish development. That said, there’s some reasons to remain cautious:

Advance/Decline line for Nasdaq remains near its low for the year, indicating there are still very few stocks behind this bullish price breakout.

Breakout has not been confirmed by the Dow, S&P 500 or Russell 2000, all of which remain below their August 2022 highs.

We added 3 stocks to the portfolio this week, but will be watching price action closely to see if the Nasdaq can hold above its breakout point.

Russell 2000 (IWM)

IWM remains in a consolidation pattern between $170 and $180. Our stance remains neutral until we see a decisive break either above or below this channel.

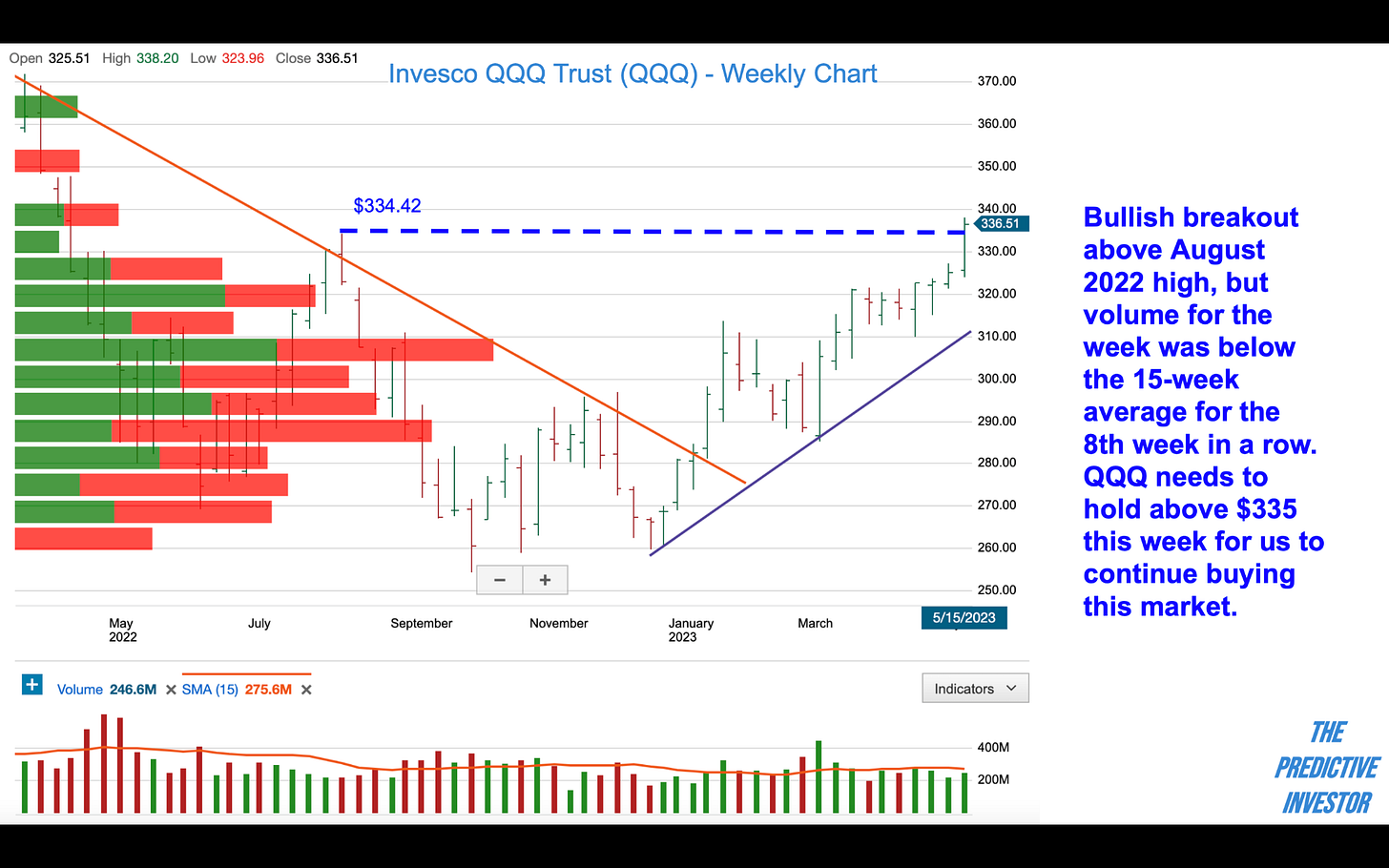

Nasdaq (QQQ)

QQQ took out its August 2022 high of $334.42 on higher volume vs. the previous week, but weekly volume was still below its 15-week average. Although we took 3 trades last week, we remain cautious. We need to see higher volume accumulation days and a larger percentage of stocks participating in this rally in order to buy more aggressively.

Dow Jones Industrials (DIA)

DIA is the weakest of the indexes, with most of the high volume days over the last 3 weeks occurring on distribution days.

S&P 500 (SPY)

SPY is following QQQ higher, taking out resistance at $415 and closing at a high for the year. But Friday gave us a high volume reversal bar. We need to see signs of high volume accumulation to have more faith in this bullish breakout.

Market Sentiment

From a contrarian perspective, sentiment indicators are mixed and therefore neutral. VIX remains well below its long term average, indicating a degree of complacency that is typical before market corrections.

But the latest AAII Investor Survey Sentiment Survey shows above-average levels of bearish inventors for the 13th week in a row. University of Michigan’s Consumer Sentiment Index reveals a similar pessimistic outlook. Corrections typically begin with above-average levels of optimism, not pessimism.

The bottom line: given the QQQ breakout and neutral sentiment, we added 3 positions to the portfolio. But we remain cautious given the divergence between tech and the rest of the market.