Market Brief - May 28, 2023

Blowout earnings and guidance from Nvidia delivered the catalyst to strengthen the divergences already present in the market. Nasdaq closed up 2.5% for the week vs. a flat Russell 2000 and S&P 500, and a loss of 1% for the Dow. With a debt deal nearly finalized, we think there’s continued upside for tech stocks over the next week or two. But June is historically a very weak month for stocks. So we will need to see broader participation in this rally in order to increase our allocation.

Russell 2000 (IWM)

IWM failed to break $180 once again. Our stance remains neutral until we see a decisive break either above or below this trading range.

Nasdaq (QQQ)

Thanks to blowout earnings from Nvidia, the Nasdaq closed the week up 2.5%. With an imminent deal to resolve the debt ceiling, this momentum is likely to continue. But June is seasonally a very weak month for tech stocks. We’ll be watching price and volume action closely in the $350-$355 range to assess the continued strength of this rally.

Dow Jones Industrials (DIA)

Last week we said DIA was likely to head down to $325 before offering any potential upside, but we didn’t expect that to happen so quickly. On Thursday DIA hit a low of $325.82 before bouncing back and closing just above $330, negating a potential island reversal from May 4. DIA has been in a downtrend all month, making a series of lower highs and lower lows since May 1. Our outlook for DIA continues to be bearish.

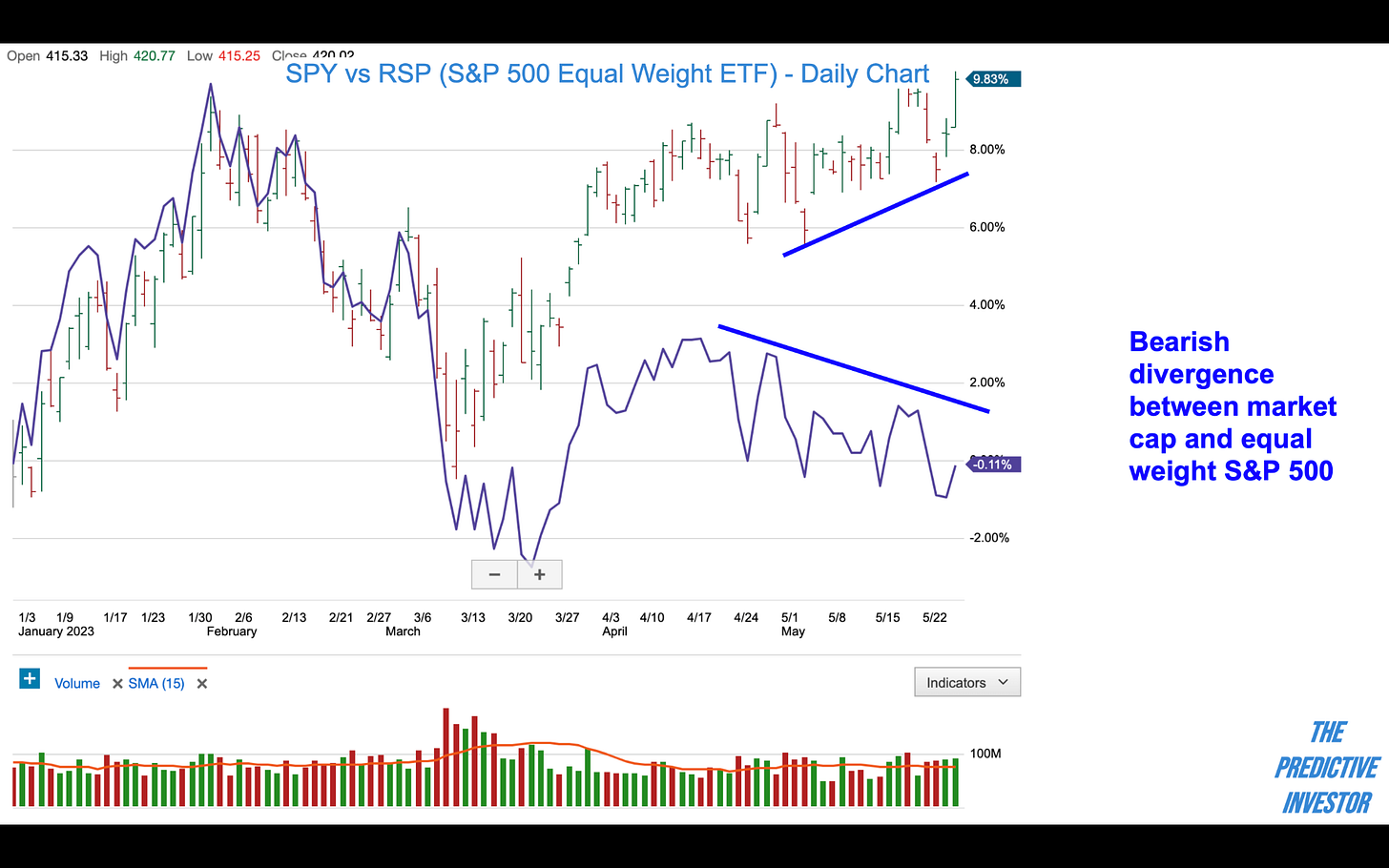

S&P 500 (SPY)

SPY has confirmed the QQQ breakout, closing at a YTD high, but fewer and fewer stocks are driving the index higher, as shown in the chart below. The market-cap weighted ETF hit a new high for the year, while its equal-weight counterpart remains in a downtrend. This kind of bearish divergence is more typical of a bear market rally than the start of a new bull market.

Market Sentiment

VIX - Neutral

VIX increased slightly over the last few weeks as the debt ceiling negotiations unfolded, but not as much as we thought. VIX remains below its 20-week average, but above its lows for the year.

Investor Sentiment - Moderately Bullish

The latest AAII Investor Sentiment Survey shows bullish sentiment increased 4.5% week-over-week, but still remains below its historical average. Bearish sentiment remains flat week-over-week, and remains above its long term average. At a market top you’d expect to see more extreme bullish sentiment, which suggests this rally has more room to run.

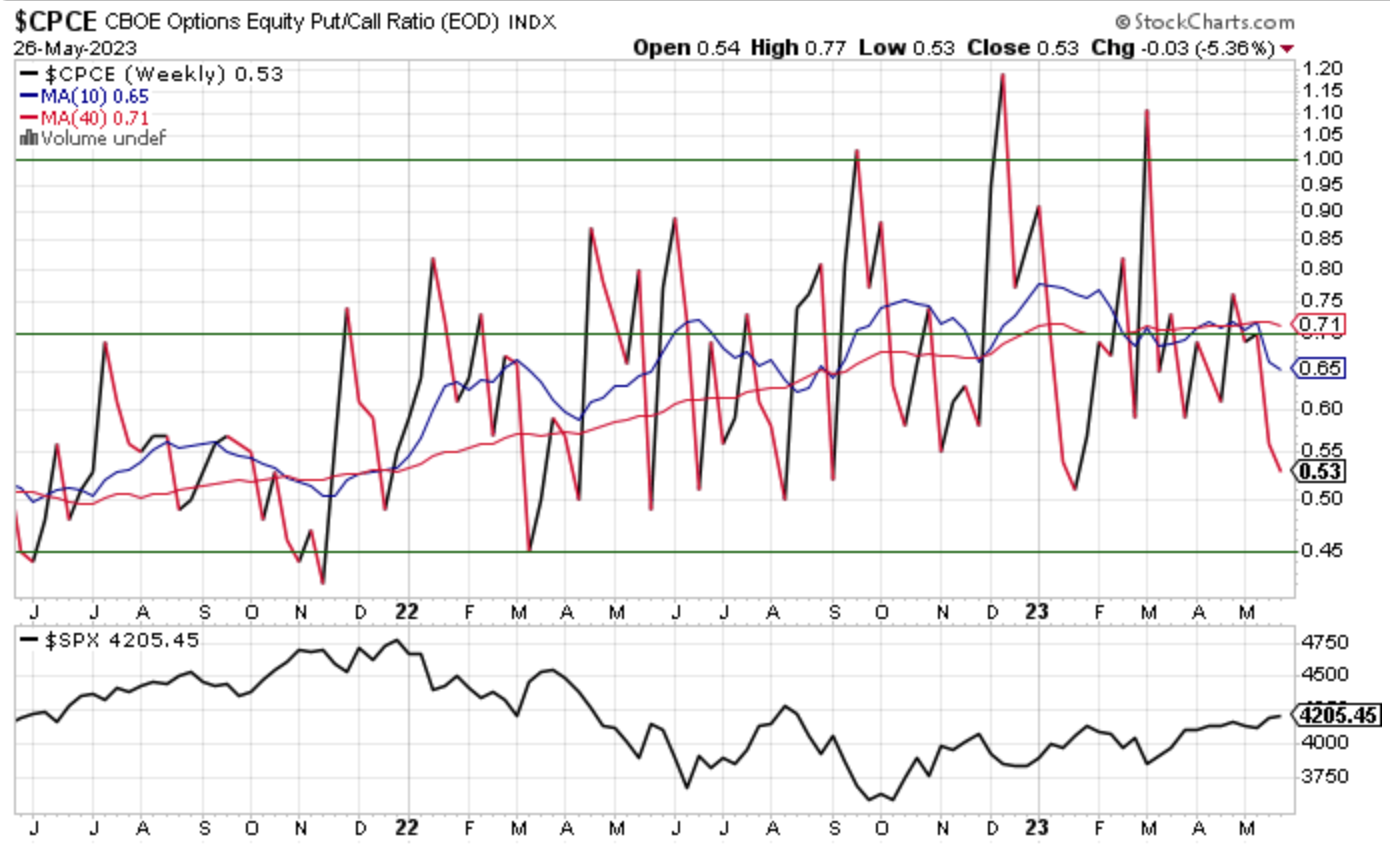

CBOE Equity Put/Call Ratio - Bearish

The chart below shows the CBOE Equity Put/Call Ratio against the S&P 500. We are not quite at an extreme reading, but almost there, suggesting increasing complacency among investors.

The bottom line: Although SPY confirmed the QQQ breakout, it did so with fewer stocks participating, and we are heading into a historically weak month for the market. We have 5 open positions in the portfolio vs. an average of 20. We’ll need to see increased buying across a broader set of stocks in order to put more cash to work.