Market Brief - November 12, 2023

Welcome to The Predictive Investor Market Brief for November 12th, 2023!

Stocks closed the week modestly higher, as yields stabilized. Seasonality favors the continuation of the bullish trend, and this week brings some market-moving news that will determine where we head from here.

The CPI print comes out on Tuesday, and PPI and retail sales come out on Wednesday. Traders will be looking to assess the strength of consumer spending and whether consumers can continue to drive economic growth.

One story that did get a lot of attention on social media was an interview with billionaire investor Stanley Druckenmiller, where he criticized Janet Yellen for not refinancing the country’s debt when interest rates were near zero. As is often the case with stories that take off on social media, the important takeaway got lost in the noise.

The U.S. government did review options for refinancing the debt, both under the Trump and Biden administrations. But there was not enough investor demand for treasuries at those low rates to make a meaningful impact. It turns out even the U.S. government does have limits on what it can borrow.

This will play out according to the laws of supply and demand. If the government continues to spend at its current trajectory and flood the market with treasuries, rates will remain high until spending shrinks. If the Fed steps in to artificially lower rates by buying up treasuries, we get more inflation. There are no good options. In the meantime, for cash investments we recommend short term treasury bills, I bonds, floating rate notes, and TIPS. Even at 5%, 30-year treasuries are just too risky.

Weekend Reads

How Does the World’s Largest Hedge Fund Really Make Its Money? Ray Dalio’s investing tactics have always been a closely kept secret, even inside Bridgewater Associates. Several years ago, some of Wall Street’s biggest names set out to discover his edge. (The New York Times)

The US Housing Market Has Become an Impossible Mess: Americans with cheap loans don’t want to sell. Those without homes can’t afford to buy. Will anything budge? (Bloomberg)

Moody’s cuts U.S. outlook to negative, citing deficits and political polarization: Moody’s Investors Service on Friday lowered its ratings outlook on the United States’ government to negative from stable, pointing to rising risks to the nation’s fiscal strength. (CNBC)

Citadel’s Ken Griffin sees high inflation lasting for decades: Billionaire Ken Griffin, head of the Miami-based hedge-fund manager Citadel, said higher baseline inflation may go on for decades, caused by structural changes that are pushing the world toward de-globalization. (MarketWatch)

Small companies tend to be more domestically focused than their large cap counterparts. While de-globalization is likely to keep inflation above the Fed’s 2% target, it will be a huge tailwind for small company stocks. There’s never been a better time to invest in small companies.

The pandemic has broken a closely followed survey of sentiment: Americans’ opinions about the state of the economy have diverged from reality

Source: The Economist

Market Technical Analysis

S&P 500 (SPY)

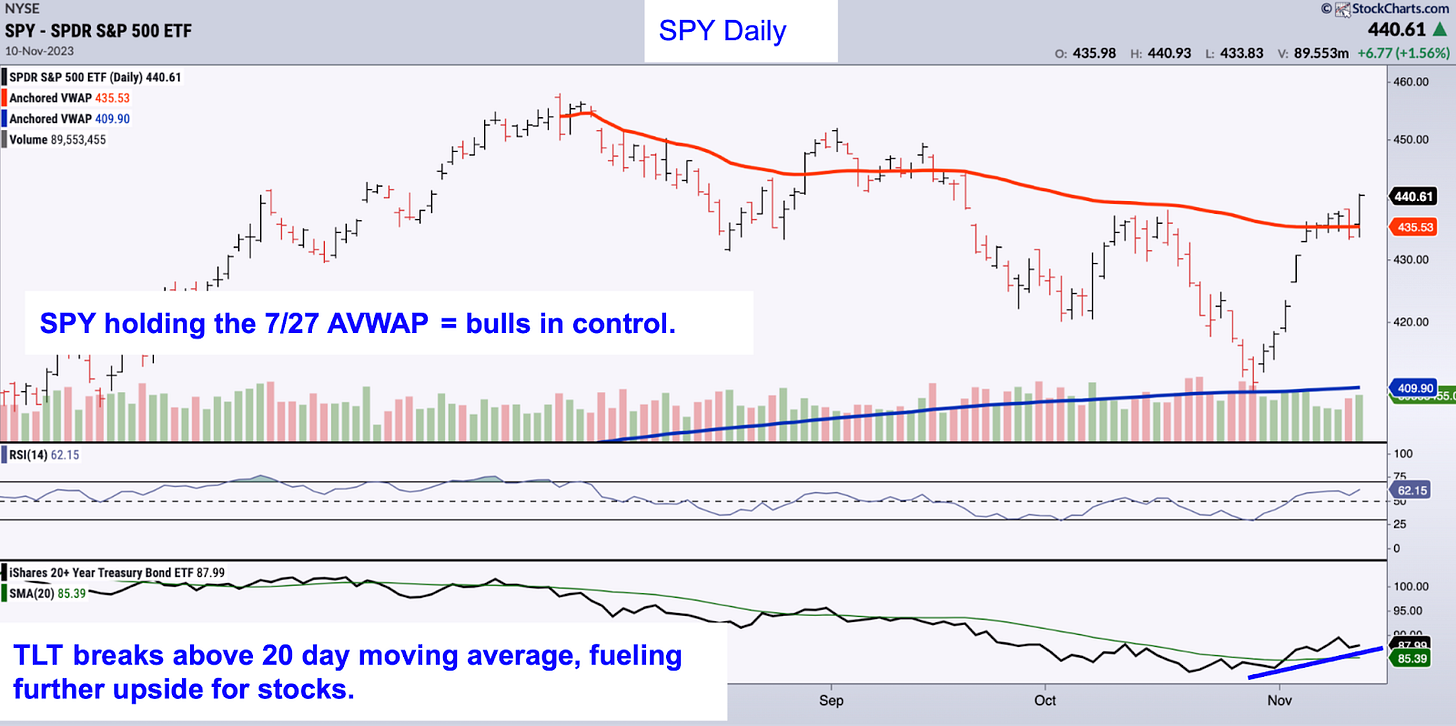

Last week we expected SPY to close one of the price gaps from the previous week. While it looked like that was going to happen on Thursday, the index ended the week strong, closing above the 7/27 AVWAP. This is good news, as it means the bulls are back in control of the market.

Long term bonds continue to show price strength, something we highlighted 2 weeks ago as having the potential to fuel a rally in stocks. That scenario has come to fruition, with TLT holding above its 20-day moving average. Clearly the path of least resistance for stocks is up.

We took some gains this week as two of our stocks hit their targets, and will wait to see how the market digests this week’s economic news before taking any additional trades.