Market Brief - November 19, 2023

Welcome to The Predictive Investor Market Brief for November 19th, 2023!

Another great week for stocks, led by the Russell 2000, which gained 5.4%! The strong advance was in response to economic news that all seems consistent with the soft landing scenario. Inflation data came in below estimates. And the 10-year yield fell further below its 50-day moving average, indicating a possible change in trend.

Several companies, including Walmart, Target and Home Depot, spoke about more cautious buying behavior from customers. The lagging effects of high interest rates are slowly moving through the economy.

This all makes it less likely the Fed will raise rates in December or January. And this is very good news for small companies.

The only market moving event this week is Nvidia earnings on Tuesday. While there’s always the potential for some volatility, over the last 10 years stocks closed Thanksgiving week in the green 80% of the time.

Weekend Reads

Why businesses are pulling billions in profits from China: The country's slowing economy, low interest rates and a geopolitical tussle with the US have sparked doubt about its economic potential. (BBC)

Weak Companies’ Low-Yielding Bonds Set to Hit Maturity Wall: Risk grows as a raft of junk-rated issuers, paying modest interest, must refinance their debt at much higher rates. (Chief Investment Officer)

Investors shake up VC market by raising money to buy out start-ups: Investors are shaking up the venture capital market by raising money to buy out start-ups that have been shunned by venture capitalists, taking advantage of economic headwinds to acquire promising companies at a discount. (Financial Times)

The U.S. Gets a C+ in Retirement: Social Security and 401(k) plans leave Americans less secure than retirees in much of the world, a new ranking finds. (The Wall Street Journal)

Stocks for the Long Run? Sometimes Yes, Sometimes No: When Jeremy Siegel published his “Stocks for the Long Run” thesis, little was known about 19th-century stock and bond returns. Digital archives have made it possible to compute real total return on US stock and bond indexes from 1792. The new historical record shows that over multi-decade periods, sometimes stocks outperformed bonds, sometimes bonds outperformed stocks and sometimes they performed about the same. (Taylor & Francis Online)

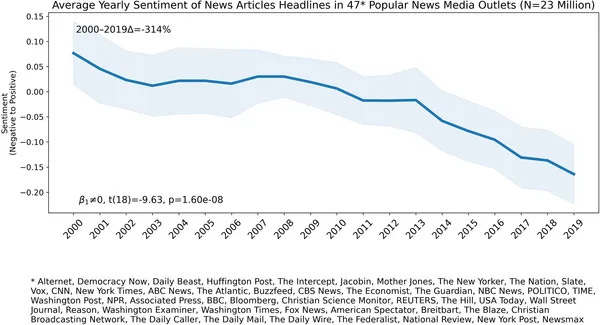

How Social Media Shapes Economic Perception: This is a sentiment analysis of news headlines over time - as you can see, it’s sucked. A part of this is the unfortunate business model of media - to drive clicks, you have to freak people out. But there are consequences to clickability!!

Source: Kyla's Newsletter

Market Technical Analysis

S&P 500 (SPY)

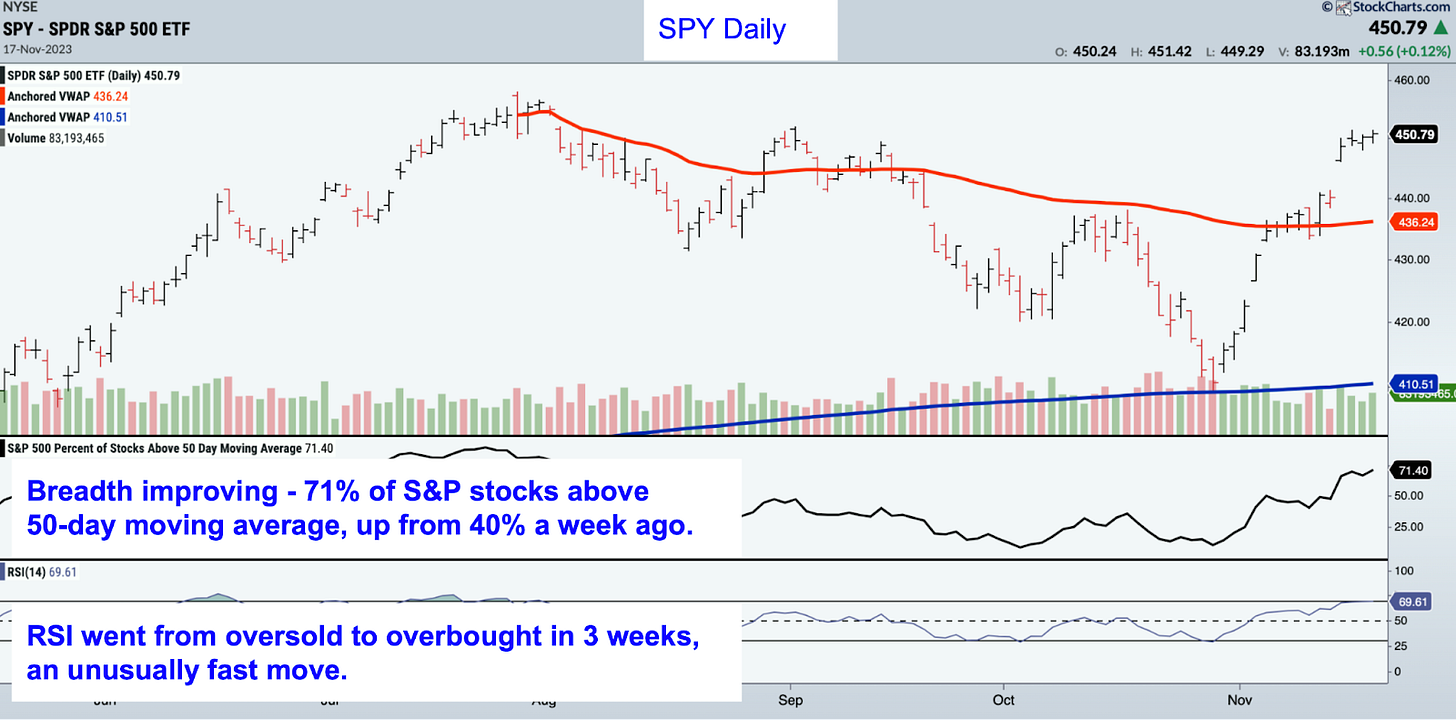

Last week saw a continuation of the upward momentum, and we added a couple stocks to the portfolio in the wake of positive economic news. The rally is broadening, with significantly more stocks above their 50-day moving averages than in the previous week. That said, RSI went from oversold to overbought in just 3 weeks. Stocks advance during most Thanksgiving weeks, but if we do get a mean-reverting pullback we would view that as a buying opportunity.

Russell 2000 (IWM)

Small companies led the advance this week, ending on a very bullish note. IWM gapped up above its 7/31 AVWAP and closed the week above that point of resistance. The index also broke above the neckline of a head and shoulders bottom pattern. While we don’t typically trade traditional chart patterns, the head and shoulders top from July was so spot on we felt the need to highlight it. The small cap index is very rate-sensitive, which is why it has been lagging all year. But near term this is very bullish. We’re looking at an initial upside target of $186.

Last Week’s Trades

We added two stocks to the portfolio last week. See our How-To Guide for a complete summary of our buy/sell criteria, portfolio management rules, and terms of service.