Market Brief - November 5, 2023

Welcome to The Predictive Investor Market Brief for November 5th, 2023!

Stocks rose sharply last week, with the S&P gaining 5.9% in one of the best weeks in months. Small caps did even better, gaining 7.6% for the week. The rally was driven by a decline in interest rates, along with a balanced outlook from the Fed.

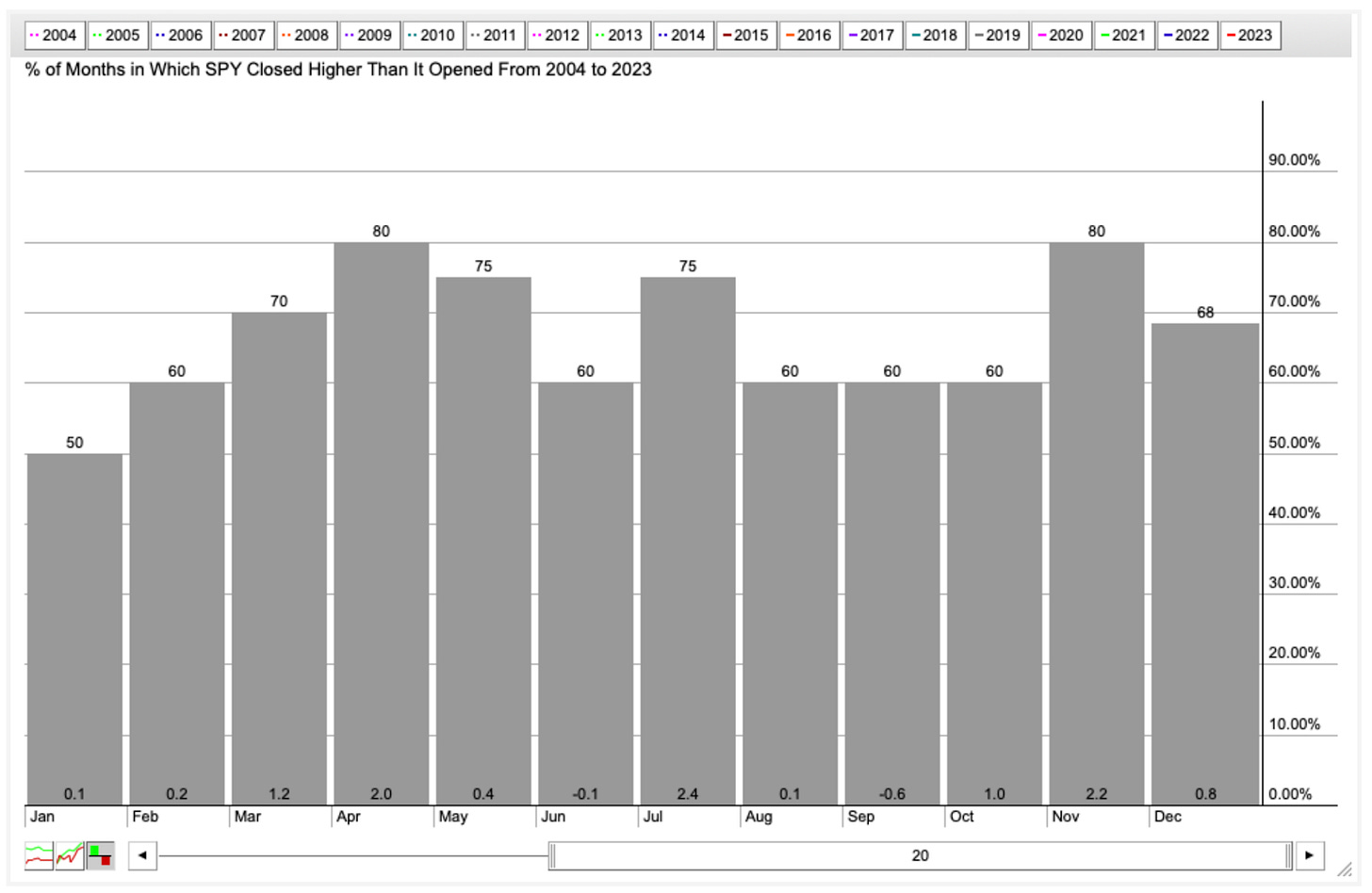

But the market was already anticipating these developments, which we noted last week. Stocks were oversold and bonds were in the process of bottoming, which we predicted would spur a rally in stocks. We’re also entering a month that historically has been very positive for stocks: over the last 20 years stocks were positive in November 80% of the time (see chart below).

That said, the rapid advance has now put stocks at an area of short term resistance. And there is still a high level of fear among investors, so it’s unlikely they will chase prices higher. A modest pullback from these levels would not only make sense but provide a great buying opportunity.

Weekend Reads

Rich countries are stumbling into a debt trap: The fear stalking financial markets is that the government of the world’s largest economy – and the issuer of its only true reserve currency – is at risk of falling into a debt trap, as a vicious circle of higher borrowing costs and larger deficits sends the stock of debt on an uncontrolled upward spiral. (Reuters)

The Secretive Industry Devouring the U.S. Economy: Private equity has made one-fifth of the market effectively invisible to investors, the media, and regulators. (The Atlantic)

The race to create the 'Amazon of real estate' could change homebuying forever: Companies are racing to develop platforms that guide users seamlessly from beginning to end of a home purchase. Other changes, like higher standards for real-estate agents and more transparent agent commissions, could make things simpler for homebuyers who are currently faced with a complex, overwhelming, and oftentimes frustrating process. (Business Insider)

Great news about American wealth: Not only did every group get richer, but inequality decreased across multiple lines — age gaps, racial gaps, educational gaps, urban-rural gaps, and overall inequality all narrowed over the last three years. (Noahpinion)

Stocks in November: A historically bullish month

Market Technical Analysis

S&P 500 (SPY)

What a rally! We went from support to resistance in 5 days. When the index closed at the 10/13/22 AVWAP last week we said that it was “an area that has seen volume climaxes several times since October 2022. RSI dipped into oversold territory, setting the stage for a potential bottom.” We did see that reversal, but the rapid advance suggests a knee jerk reaction to lower yields that was likely triggered by a wave of short covering. Holding the 10/13/22 AVWAP was important - it means the bull market is still intact. The index is now at resistance. It would be natural to expect a modest pullback that closes either of the gaps created by Thursday and Friday’s opens before a sustained move higher.