Market Brief - October 22, 2023

Welcome to The Predictive Investor Market Brief for October 22nd, 2023!

Stocks slid last week on a surge in treasury yields and uncertainty around the war in the Middle East. The turmoil in congress doesn’t help either, as we’re less than 30 days away from another potential government shutdown.

On the bright side, earnings reports have been pretty good so far. Last week 70% of the S&P 500 companies that reported earnings beat consensus EPS expectations. Big tech earnings begin on Tuesday, and could be the catalyst for a bounce up. But for any sustained rally to happen we’ll need to see a retreat in interest rates and oil prices.

Weekend Reads

The Great Reset of Property Prices Is Underway. Brace for More Carnage. The global financial crisis that began in 2007 reshaped the real estate market. Today, commercial real estate is facing a similar “Great Reset.” Property valuations are resetting, capital availability is restricted, and investment activity is curtailed. Thanks to stress on properties’ balance sheets, the situation is set to get worse. (Barron's)

How to Invest During Times of War: After reviewing the data on asset class returns, the evidence suggests that you should own equities, real estate, and short-duration fixed income instruments if you want to preserve your wealth during periods of international conflict. (Of Dollars And Data)

The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations: For generations, financial advisers touted the 60-40 strategy as the single best way for ordinary people to invest. The idea is simple: owning stocks in good times helps grow your wealth. When stocks have a bad year, bonds typically perform better, cushioning the blow. Not anymore. (The Wall Street Journal)

SEC Head: Financial Crash Caused by AI 'Nearly Unavoidable': Gensler’s comments are notable because something similar has already happened. In 2010, the stock market briefly “flash crashed” by over a trillion dollars and immediately rebounded—an unprecedented occurrence that did not result in wider shocks but left regulators and market participants looking for answers. Regulators eventually concluded that high-frequency trading algorithms had contributed to the crash with a cascade of rapid trades. (Vice)

Inflation is following an ‘eerily similar’ path as the one taken in 1966-1982

Source: MarketWatch

Market Technical Analysis

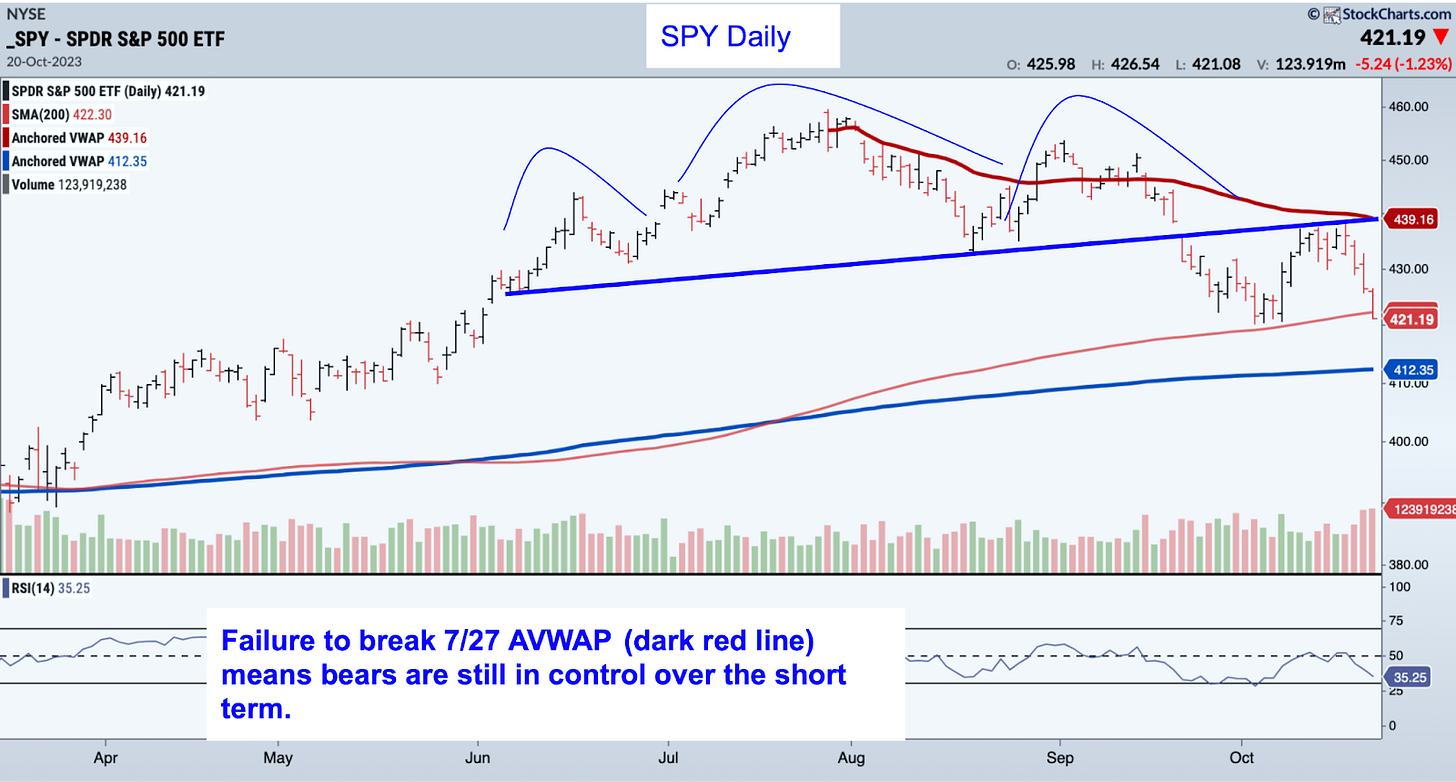

S&P 500 (SPY)

SPY closed the week at its 200 day moving average, our initial downside target. We are due for a bounce up, but if the market can’t hold at this level, it will trigger a wave of selling that will take it down to the 10/13/22 AVWAP (dark blue line). This is a critical level, as it represents the average price since the bull market began and therefore is the point that will determine whether the bears can retake control over the intermediate term. In the meantime we will continue to look for opportunities to add to the portfolio. The best time to buy is when pessimism is high.

Stock Spotlight

Occasionally in our research we come across a stock that meets many of our buy criteria, but is just out of reach for qualifying for our portfolio. We choose to highlight them here because they still offer a compelling case for investment consideration.

Matrix Service Company (MTRX)

Matrix Service Company fits the spirit of our strategy as an undervalued stock on the move. With a market cap of $338M, MTRX is just barely too large to qualify for our portfolio. However, the stock is cheap, trading for just 0.4 times sales, and has strong price momentum. The stock’s 12-month performance vs. the S&P 500 is 145%.

Please note this is not investment advice. Always conduct your own due diligence before making investment decisions.