Market Brief - October 29, 2023

Welcome to The Predictive Investor Market Brief for October 29th, 2023!

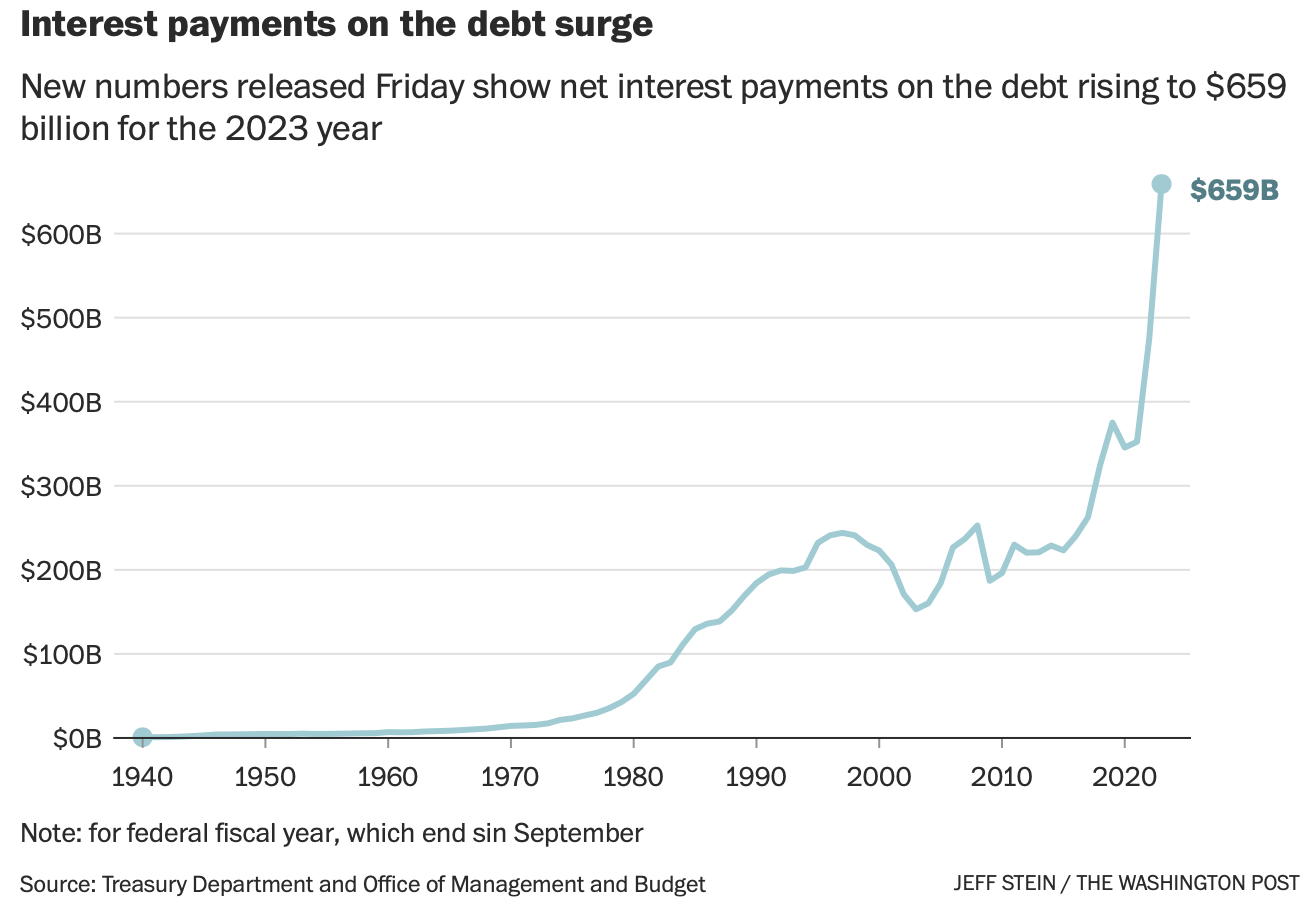

Stocks continued their slide, with the S&P 500 down 2.5% last week. Investors are preoccupied with the escalating war in the Middle East. And high rates have put pressure on the housing market, and make it more costly for the government to finance deficit spending.

That said, there are a number of positive factors that could lead to a turnaround in stocks:

Q3 GDP growth was the strongest in nearly 2 years.

Earnings are strong. 17% of S&P 500 companies have reported Q3 earnings so far, with nearly 80% beating EPS estimates.

Bearish sentiment is near extremes. The latest AAII Investor Survey shows above-average pessimism for 6 of the last 8 weeks.

Stocks are oversold and we’re seeing signs that bonds are stabilizing (see below). We’ll be looking for opportunities to add to the portfolio this week. We’ll also be publishing our November Portfolio Review to highlight any opportunities in our existing holdings.

Weekend Reads

What Did We Learn From the Last Bull Market? Low interest rates breed lax investment habits. Most shareholders realize that the good times will eventually cease. However, because investment sentiment is contagious, it can be difficult to reconcile the head with the heart.(Morningstar)

Indexing, private markets considered key disrupters of past 50 years: The rise of index funds and, more recently, private markets investments have been key disrupters in the story of U.S. retirement savings that Pensions & Investments has been covering over the past 50 years. The ripple effects — which have thoroughly reordered a world of 60% stock, 40% bond pension portfolios run by bank trust departments — continue to be felt, even as newer influences, such as technology and artificial intelligence, appear poised to power the next wave of change. (Pensions & Investments)

Jay Powell's Greenspan moment: The Fed is increasingly concerned about "above-trend" growth. In the mid-1990s, Greenspan grappled with it, too, and wisely held off on raising rates. That's the right move again today. (Stay-At-Home Macro)

U.S. payments on debt spike to $659 billion, nearly doubling in two years

Source: The Washington Post

Market Technical Analysis

S&P 500 (SPY)

Last week we said if SPY can’t hold its 200 day moving average, “it will trigger a wave of selling that will take it down to the 10/13/22 AVWAP (dark blue line).” This is exactly what happened. We’re now at a critical level of support - the volume weighted average price since the bull market began last October. This is an area that has seen volume climaxes several times since October 2022. RSI dipped into oversold territory, setting the stage for a potential bottom.

Treasury Bonds (TLT)

Over the last few weeks we’ve been highlighting how the breakdown in stocks accelerated with surging interest rates/falling bond prices. Treasury bonds are now attempting to put in a bottom. TLT made a new low on the 19th, followed by a high volume reversal bar on the 23rd, all on improving relative strength. A reversal in bond prices (falling yields) should coincide with a bottom in stocks.