Market Brief - October 8, 2023

Welcome to The Predictive Investor Market Brief for October 8th, 2023!

Stocks were mixed last week, with large caps managing a small gain while the Russell 2000 declined by 2.2%. While the September jobs blowout reinforced the notion that rates are likely to stay higher for longer, any news from last week will be overshadowed by the outbreak of war in the Middle East.

The expectation is stocks will open lower Monday along with a rebound in oil prices. In the past these kinds of conflicts had limited impact on the market. But there is a risk this conflict widens to other countries and provides a more substantial headwind for the global economy.

In the meantime, our strategy of sticking with the best performing companies continues to pay off. Our portfolio lost just 1% in September vs. -5.4% for the S&P 500 and -6.4% for the Russell 2000. With sentiment near peak fear, now is the time to begin looking for opportunities to add to the portfolio.

Weekend Reads

Americans Are Still Spending Like There’s No Tomorrow: A tough housing market has more consumers writing off something they’d historically save for, while the pandemic showed the instability of any long-term plans related to health, work or day-to-day life. So, they are spending on once-in-a-lifetime experiences because they worry they may not be able to do them later. (WSJ)

New York is breaking free of Airbnb’s clutches. This is how the rest of the world can follow suit: Many argue that Airbnb’s exponential growth – it is now valued at close to $100bn – is a key factor behind the soaring inflation in property prices and rents that is fuelling a global housing crisis. They will be hoping that interventions like New York’s will show them a way to take back cities across mainland Europe and the UK for people who actually live in them. (The Guardian)

What China's economic problems mean for the world: Analysts believe worries of an impending global catastrophe are overstated. But multinational corporations, their workers and even people with no direct links to China are likely to feel at least some of the effects. Ultimately, it depends on who you are. (BBC)

October Almanac: Bear-Killer, Bargain Month, Turnaround Month: Seasonally Speaking, October is the time to buy stocks, especially late October and especially tech stocks and small caps. October can evoke fear on Wall Street as memories are stirred of crashes and massacres. We use the term “Octoberphobia” to describe the phenomenon of major market drops occurring during the month. Market calamities can become a self-fulfilling prophecy, so stay on the lookout. (Almanac Trader)

This Time Really Is Different for the Economy. Just Look at the Job Market’s Confounding Strength. The Fed has lifted interest rates nearly a dozen times since March 2022, to a range of 5.25% to 5.5%. Headline inflation has fallen by two-thirds, from a peak of 9.1% to 3% on a year-over-year basis, and despite a recent uptick is poised to slow further as rent prices cool. Yet, the U.S. unemployment rate sits at 3.8%, a historically low level only slightly above the 3.6% that prevailed when the Fed first began raising rates. And there is little to suggest that unemployment will head much higher soon. (Barron's)

Market Technical Analysis

S&P 500 (SPY)

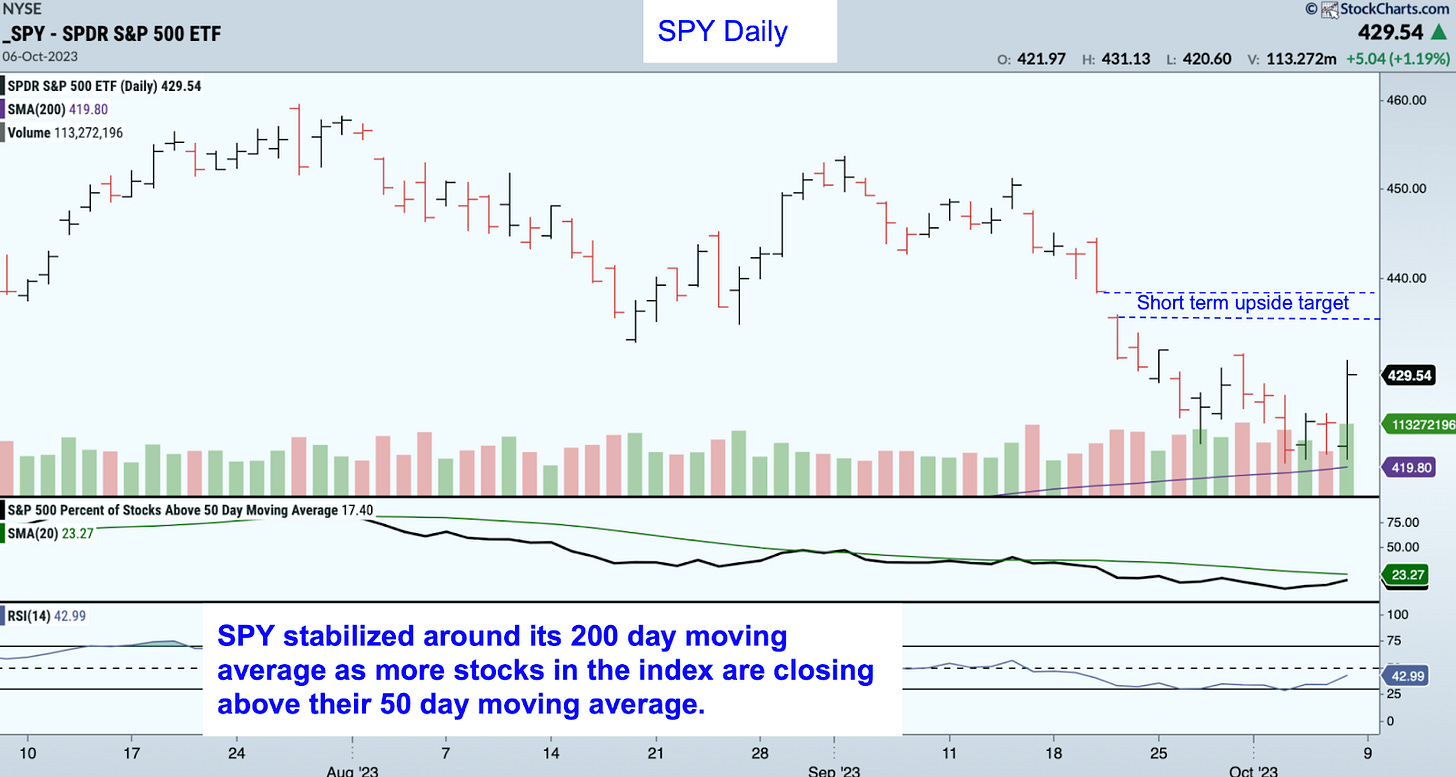

SPY has been trending sideways for the last several sessions, appearing to have stabilized near its 200 day moving average. RSI has moved out of oversold territory, with a slowly increasing number of stocks in the index closing above their 50 day moving average. Short term traders will likely try to close the gap in the $436-$438 range from roughly two weeks ago. Depending on the market’s reaction to the tension in the Middle East, we may begin looking for opportunities to add to the portfolio.

Intermarket Relationships

Interest rates and inflation have been the primary drivers of stock market performance YTD, so it’s no surprise that stocks stabilized as oil broke below its 20 day moving average. Lower energy prices lead to lower inflation. The geopolitical turmoil in the Middle East will likely cause a rebound in oil prices, but as long as the conflict doesn’t widen to other countries its impact on energy prices will be short-lived. As for interest rates ,the Fed has made it clear they will keep rates higher for longer, but the market tends to lead policy, not the other way around. So if the Fed is going to lower rates next year, yields will turn lower well beforehand.

Market Sentiment

From a sentiment perspective we’re nearly at the opposite of where we were at the market peak in July. Above average pessimism in the investor sentiment surveys along with low active manager exposure to US equities. At some point the pendulum will shift again as equity prices turn around. Now is the time to be looking for new opportunities. Our last Portfolio Review highlighted where we think the opportunities are in our current portfolio, and this week if the downward momentum stabilizes after the market’s likely selloff from the awful news out of the Middle East we will begin looking for new stocks to add to the portfolio.