The Predictive Investor - 9/1/24

The Mag 7 stumbles

Welcome to The Predictive Investor weekly update for September 1st, 2024!

Here’s something no one had on their bingo card heading into earnings season. The Magnificent 7 just had its worst month relative to the S&P 500 since December 2022. And yet the S&P 500 equal-weight index closed at another all time high. August was a great month outside of big tech.

Much of this has to do with the high expectations heading into earnings season. Let’s take Nvidia, the highest profile earnings call last week. The company beat both sales and earnings estimates, but sold off anyway because the upside beats were smaller than they were the previous quarter.

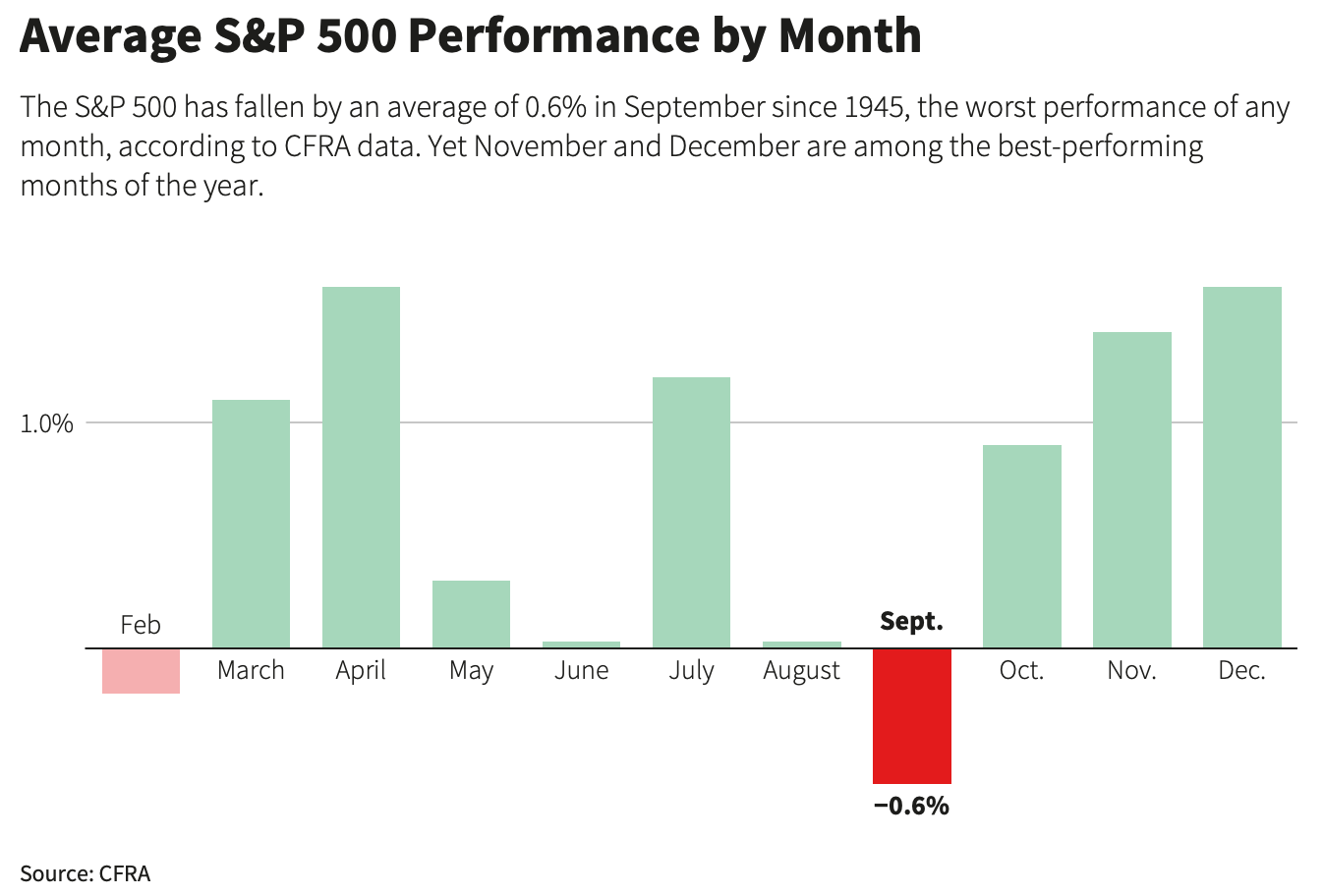

AI spending is not likely to slow down any time soon. But high expectations plus rich valuations are a recipe for continued volatility in a seasonally weak period.

Since 1945, the S&P 500 has posted an average loss of -0.6% in September, making it the worst month for stocks.

The good news is the economic fundamentals continue to favor a bullish outlook. So the best way to prepare for volatility is to get your buy list ready.

Here’s our takeaways from the week.

Q2 GDP revised up

Last quarter’s GDP was revised up to 2.8%, up from 1.4% in Q1. (Read)

The growth was powered by strong consumer spending and increased business investment.

U.S. corporate profits rose to a new all-time high last quarter.

Despite high interest rates and inflation, the economy is incredibly resilient. Not what you’d typically see if a recession was imminent.

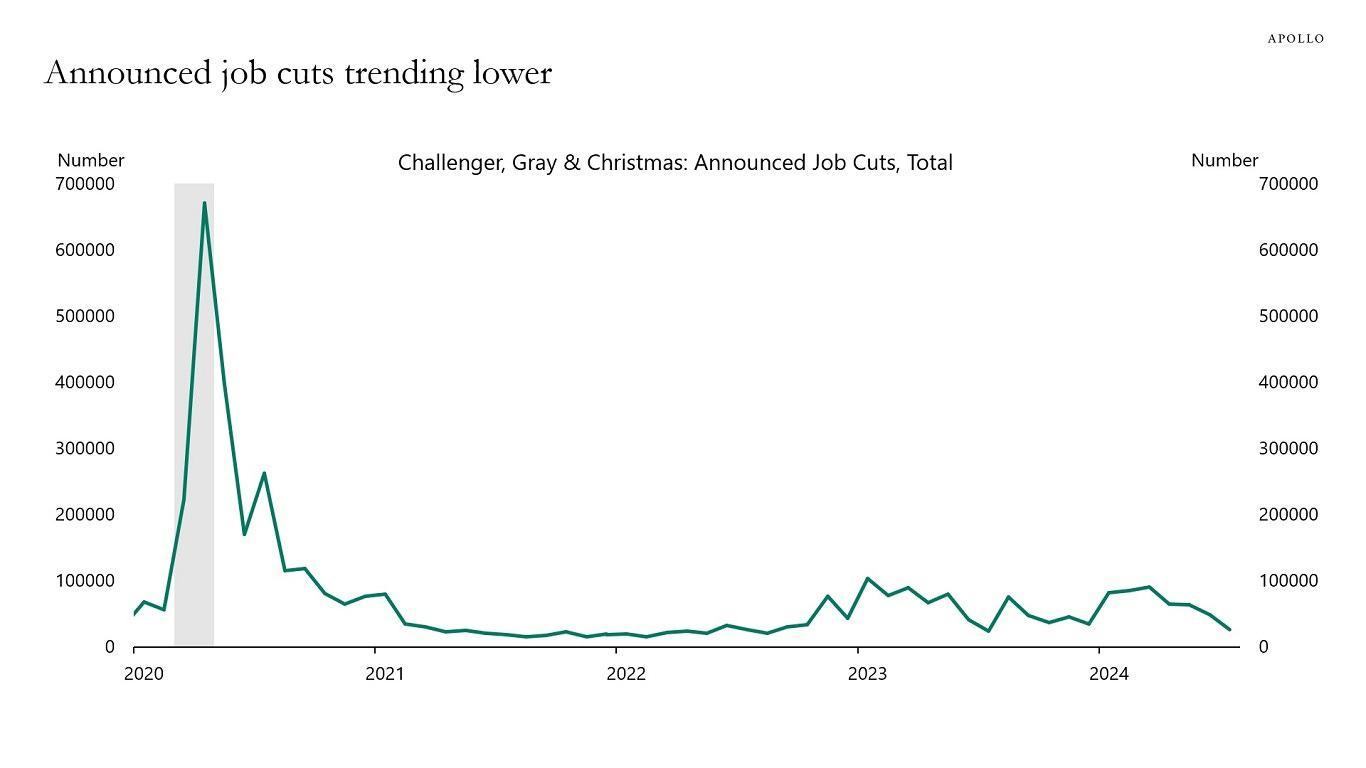

Leading labor indicators are bullish

Look at the unemployment rate during any recession, and you’ll see it spikes up pretty quickly as economic conditions deteriorate. That fear is what sparked volatility after the downward revision to the jobs numbers two weeks ago.

But leading indicators of unemployment do not suggest we’re in for a huge spike. Layoffs remain at a record low, and planned job cuts are trending down.

Rate cuts are a foregone conclusion at this point, but this week’s job numbers will determine the magnitude of the cut.

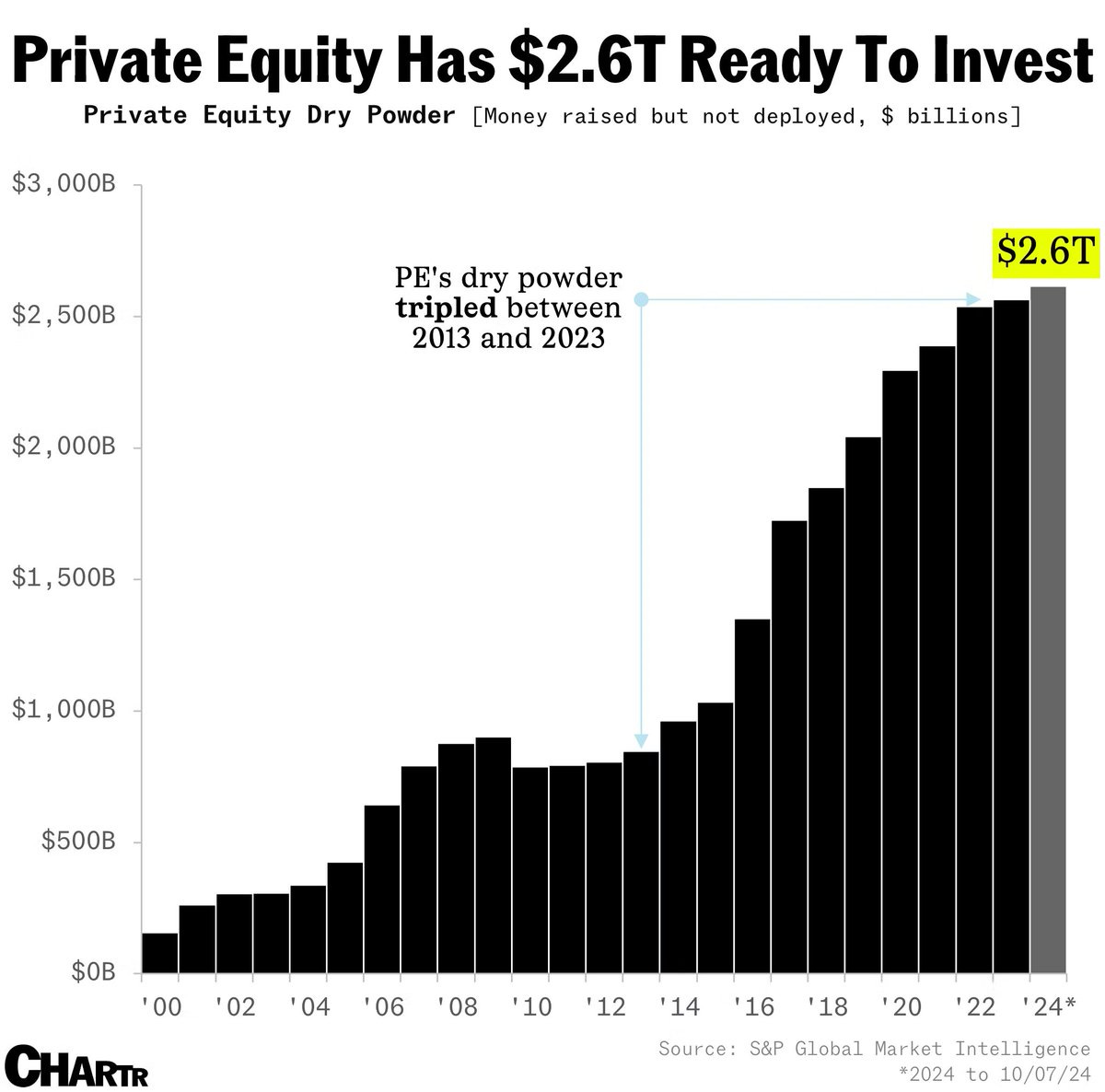

$2.6 trillion ready to be deployed

Private equity firms have amassed $2.6 trillion in cash, and this year has already seen nearly double the number of megadeals ($5 billion or more) than all of 2023.

According to Citywire, there’s also been a surge of PE money invested into small companies, with heavy premiums being paid to buy out listed companies under $1.5B.

This will provide a huge tailwind to our portfolio, as more money coming into the space will raise multiples and increase M&A activity across the board.

We continue to believe small companies are set for a historic run. If you’ve got sufficient exposure to small companies, great. If not, it’s not too late to upgrade to paid, We would love the opportunity to earn your business.