Market Brief - September 10, 2023

Welcome to The Predictive Investor Market Brief for September 10th, 2023!

Stocks were under pressure last week, led by the Russell 2000, which declined 3.6% for the week vs. a 1.3% weekly loss for the S&P 500.

Oil prices rose sharply this week after Saudi Arabia and Russia agreed to extend their production cuts, which complicates the Fed’s efforts to bring inflation down. Jobless claims for the week ending on September 2nd were the lowest since February, which may give the Fed another reason to keep rates higher for longer.

Apple, which represents just over 7% of the S&P 500, declined 6% after news that Chinese officials are prohibited from using Apple devices. This adds to the fear that geopolitical tensions might make it more difficult for U.S. companies doing business there.

For now, these are mostly short term concerns, which means the market could continue consolidating over the next few weeks. But earnings and productivity are improving, which should continue to deliver solid economic growth over the intermediate term.

Weekend Reads

How BYD snatched Tesla’s crown: “They are designing, engineering, and manufacturing globally competitive vehicles,” Tu Le, founder of Sino Auto Insights consultancy, told Rest of World. “That should scare the shit out of every foreign automaker because no one can touch a $15,000 or $18,000 electric vehicle and be profitable. No one, not even Tesla.” (Rest of World)

Recession Signal From Yield Curve May Not Work, ECB Says: Ed Yardeni, an economist who’s been covering the market since the 1970s, has proposed that the US curve inversion is signaling the slowdown in inflation that typically accompanies a recession, but not the actual recession itself. (Bloomberg)

The incredible American consumer: The biggest driver of the surprisingly resilient US economy has been the ability and willingness of Americans to shrug off the bad vibes and buy “everything that isn’t nailed down”, as Chris Rupkey puts it. Consumer spending doesn’t seem to be slackening much either. Quarter-on-quarter growth did slow from a blockbuster 4.2 per cent in the first three months of 2023 to 1.7 per cent in the second quarter, but it’s currently tracking at 3.2 percent in the current one. (Financial Times)

How Slowing Inflation Can Hit Corporate Profits: High inflation helped boost earnings at many companies, but now comes the hangover. The Commerce Department last week reported that after-tax U.S. corporate profits were down 9.4% in the second quarter from a year earlier—a more severe drop than the 2.9% decline in earnings per share registered by companies in the S&P 500, as estimated by Refinitiv. (Wall Street Journal)

Market Technical Analysis

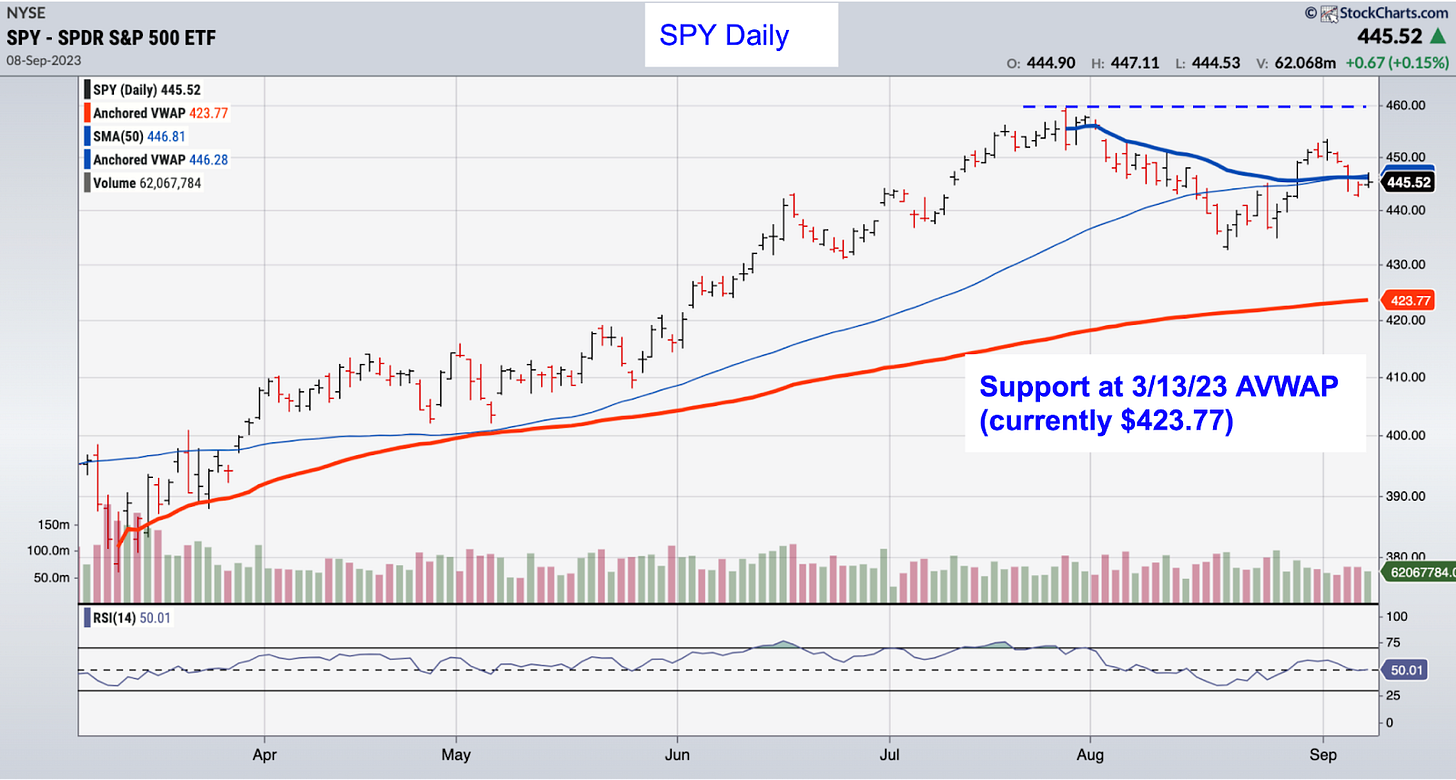

S&P 500 (SPY)

Stocks continue to consolidate, with SPY about halfway between support at the March 13th AVWAP and long term resistance of $460. There’s been a series of higher highs and lower lows since August 18th, but the index is struggling to hold its 50-day moving average. Historically September is one of the worst months for the large cap index, so we will likely see continued consolidation over the next week.

Russell 2000 (IWM)

IWM failed to hold its 50 day moving average, but is near two areas of strong support: the 3/24/23 AVWAP (average price since the March lows) and price support of $180. Our portfolio managed to deliver an 8% gain in August (vs. a loss of -4.9% for the Russell 2000), and we continue to believe small companies offer the best value in this market.

Market Sentiment

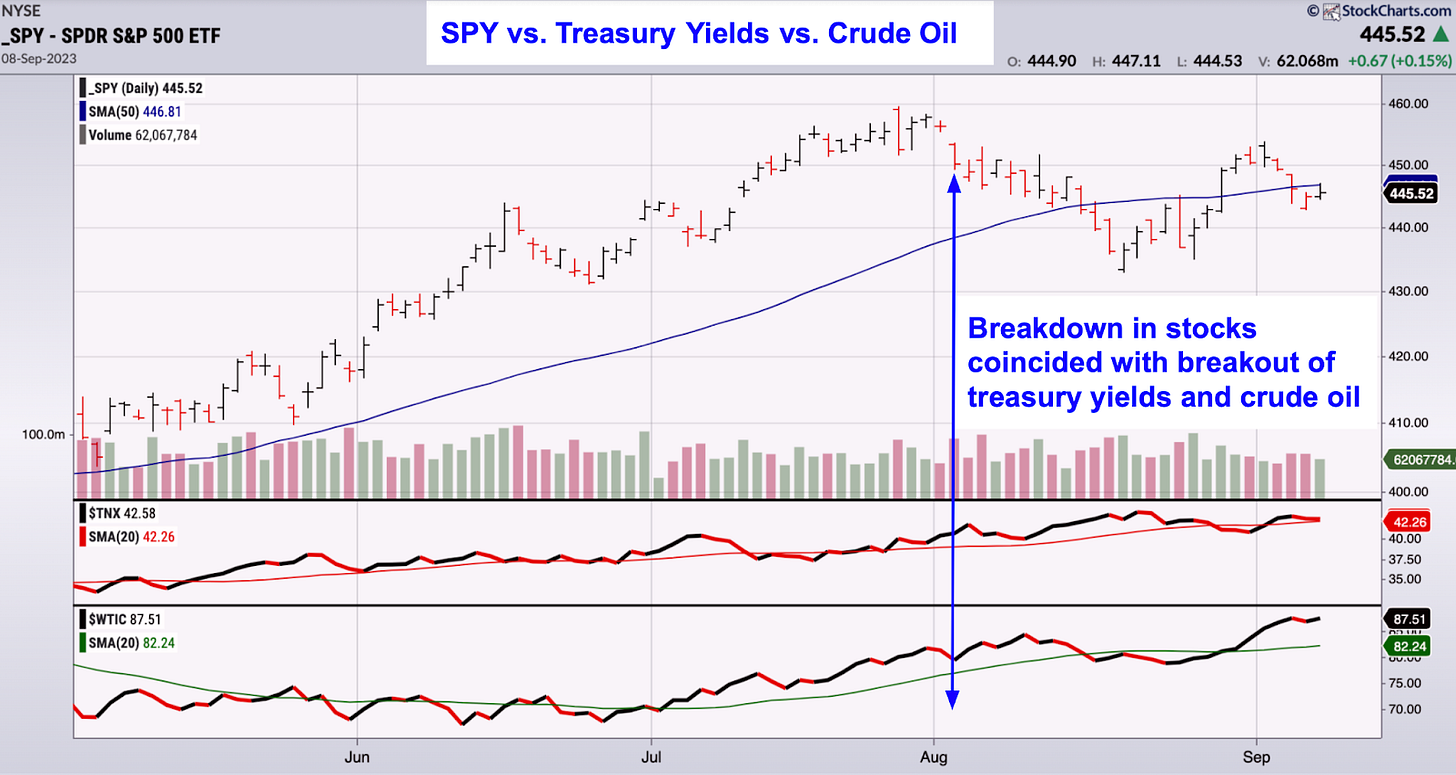

Sentiment surveys are mixed. There was a drop in optimism in the CNN Fear and Greed Index, but the latest AAII Investor Sentiment Survey showed above average bullish sentiment for the first time in 4 weeks. This all tracks with price movement that lacks direction. Rising treasury yields and crude prices present short term headwinds for stocks (chart below). The concern is rising energy costs could deliver a higher inflation reading than expected. We will likely wait until after the CPI/PPI reports this Wednesday and Thursday before taking any additional trades.