Market Brief - September 17, 2023

Welcome to The Predictive Investor Market Brief for September 17th, 2023!

Stocks were mostly flat last week, with inflation data delivering mixed results. Headline CPI was up 0.6% in August, which was in line with expectations and mostly driven by higher energy prices. Core CPI (which excludes food and energy) rose 0.3% in August (vs. 0.2% expected). The rise was indirectly driven by energy, as airlines raised prices in response to jet fuel costs.

Energy prices also had an outsized impact on retail sales, which rose 0.6% in August (vs. 0.1% expected). More than half the increase was due to higher gas prices.

We have a number of energy stocks in our portfolio which should continue to benefit from higher prices.

The Fed will deliver an interest rate decision on Wednesday. The market is not expecting another rate hike, which means extra emphasis will be placed on the Fed’s forward guidance.

Weekend Reads

Why the UAW Strike Isn’t the Biggest Problem for Ford and GM: A strike is only the most immediate issue facing the two biggest U.S. auto makers. The existential threat posed by electric vehicles is the bigger problem. EVs are finally taking off in the U.S., but EV-related losses are growing for Ford Motor and General Motors. Now, the companies have some hard decisions to make about how they will spend billions of dollars, decisions sure to have serious consequences for their stocks. (Barron's)

Everyone’s Worrying About China, But the Real Pain Is Coming From the Fed: For all the worries about the potential global spillovers from China’s economic troubles, it’s actually the US Federal Reserve that’s inflicting pain on much of the world at the moment. (Bloomberg)

The next phase of globalization is going to be awesome: There’s a narrative going around out there that globalization is over, that decoupling will carve up the world into smaller trading networks, or even into isolated autarkic nations. And there’s another narrative that economic development is over, and that China was basically the last country to industrialize. Both of these narratives are wrong. In fact, globalization is simply changing form, as it has many times in the past. Investors and executives at multinational companies should be getting ready for the next round. (Noahpinion)

People have money: Once again, people seem surprised by the strength of the American consumer. According to Census Bureau data released Thursday, retail sales in August increased by 0.6% to a record $697.6 billion. Higher energy prices played a significant role, as gas station sales jumped by 5.2%. But even if you exclude autos and gas, which can be pretty volatile over short-term periods, retail sales still rose by 0.2%. Most retail categories grew, including clothing, electronics, health and personal care, grocery, and restaurants and bars. (TKer)

US economy going strong under Biden – Americans don’t believe it: The US has roared back from the Covid recession by official measures. But two-thirds of Americans are unhappy about the economy despite consistent reports that inflation is easing and unemployment is close to a 50-year low. And the poll suggests many are unaware of or don’t believe the positive economic news the government has reported. (The Guardian)

Market Technical Analysis

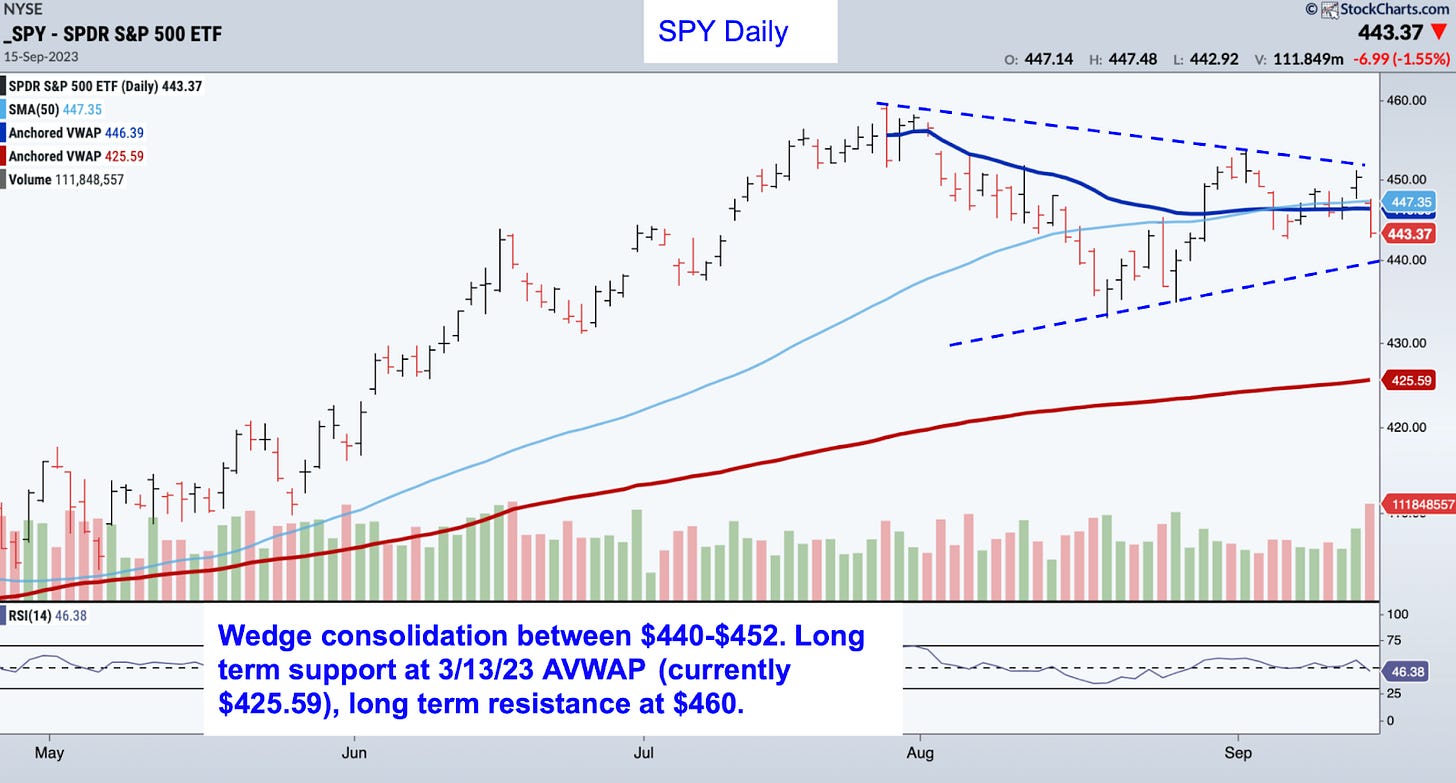

S&P 500 (SPY)

There’s very little to add from a technical perspective in a sideways trending market. Since the July highs, we’re seeing lower highs, but also higher lows, forming a wedge consolidation pattern between $440 and $452. Ultimately how this resolves will determine whether we test long term resistance at $460 or long term support at the 3/13/23 AVWAP (currently $425.59).

Small Company Stocks

Much has been made of the recent outperformance of mega cap tech, but we continue to believe that is a crowded trade. Small companies are less extended technically than their large cap counterparts, and trading at more attractive valuations. The chart below shows that small vs. large outperformance tends to mean revert over time. While the outperformance of large companies could continue for a bit, we think small companies are best positioned to outperform over the long term.