The Predictive Investor - 9/22/24

Relief from the Fed

Welcome to The Predictive Investor weekly update for September 22nd, 2024!

Last week I wrote that the Fed should cut by 50, but that I expected them to cut by 25. What a nice surprise to see them do the right thing.

I actually view this more aggressive move as an admission that they should’ve cut rates back in July. But either way, it brings a number of positive developments:

Lower rates for loans and credit cards will ease pressure on millions of consumers.

Mortgage rates have already come down in anticipation of the Fed’s move and will continue to do so, which will start to revive the housing market.

Lower rates on money markets and CDs will drive some of the money on the sidelines into stocks.

The trillions of dollars in business loans that are due in FY25 will be able to be refinanced at more favorable rates, helping to reaccelerate growth in 2025.

Areas of the market that tend to be more interest rate sensitive, like small companies, dividend stocks and cyclical stocks, may start to catch up to growth.

Here’s my takeaways from the week.

The big money is buying

I was anticipating volatility to increase after the Fed announcement, although that hasn’t really happened so far. Too bad. Volatility is the best time to buy.

It’s important to realize much of this volatility is manufactured by Wall Street. Traders at large institutions routinely play on people’s fears in order to create selling, so they can accumulate shares at lower prices.

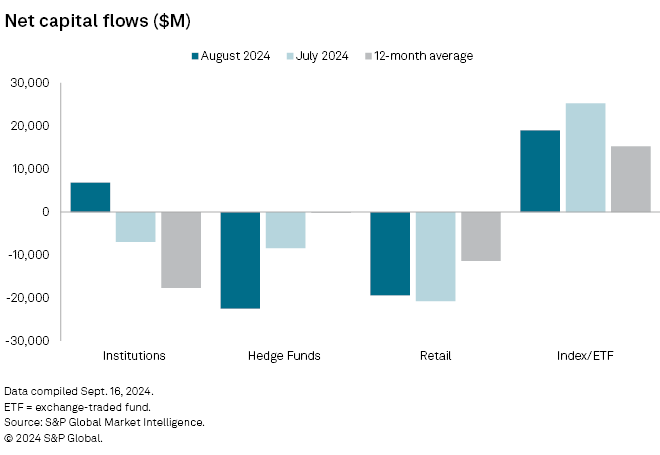

Looking at capital flows last month, as soon as the market sold off institutions began buying shares. They bought a net $6.8 billion in stocks last month, after being net sellers over the previous 12 months. August was the first month that institutions were net buyers of stocks since last December.

Hedge funds and retail investors tend to be trend followers, and therefore were net sellers as the market sold off from its July high.

Stocks are now back at all time highs, making it clear who came out ahead.

China bull turns bearish

One of China’s biggest bulls, Bridgewater founder Ray Dalio, finally turned bearish over the intermediate term. (Read)

China’s weakening economy is starting to resemble the deflationary forces that have plagued Japan over the last three decades.

None of this should be a surprise if you’ve been reading along. Last August I advised to stay out of China, and instead offered up India and Australia ETFs as the best way to play growth in Asia.

Since that time, the iShares India ETF (INDA) is up 34.7%, the iShares Australia ETF (EWA) is up 23.9% and the iShares China ETF (MCHI) is down 4.2%.

It’s important to look beyond the headlines if you want to anticipate moves in the market. This wasn’t a hard one to miss for those of us playing offense.

The robotics revolution

Chipotle is finally making headway into automating its kitchen ops, with robotics that can cut and peel an avocado in 26 seconds, and build salads and bowls for digital orders. (Read)

There’s no question robotics will be a huge growth industry, with applications in restaurants, health care, manufacturing, and on the battlefield. Less clear is which companies will be able to effectively leverage it to improve the bottom line.

For example, when McDonalds introduced automated kiosks for ordering food, the general thinking was this would allow them to reduce headcount and therefore improve profitability. What actually happened was that the average customer ordered more food through the touchscreen kiosks than they did at the cash register, which created more demand for kitchen staff. So the labor saved at the cash register was just reallocated.

Adoption of new technology often creates unintended outcomes. One thing is certain though: the global robotics market is set for explosive growth.

For those who prefer the diversification of an ETF, the Global X Robotics & Artificial Intelligence ETF BOTZ 0.00%↑ is worth a look to capitalize on this macro trend.

Big tech gets into the energy business

The big news in the utility space was the deal between Constellation Energy and Microsoft to re-open the Three Mile Island nuclear plant to power data centers. (Read)

With all this money being spent on AI capability, big tech is waking up to the reality that leveraging AI will take more energy than is currently available. If this spurs more development of nuclear energy it will be a good thing. Nuclear power represents the best opportunity for abundant, carbon-free electricity.

But the plant will not open until 2028. And meanwhile, demand for energy will continue to rise.

Might be worth nibbling at XLE or IYE while the market is consumed with lower oil demand from China.