Market Brief - September 24, 2023

Welcome to The Predictive Investor Market Brief for September 24th, 2023!

Stocks closed lower for the week, led by tech and small caps, after Fed Chair Jerome Powell made it clear rates are likely to stay higher for longer. While this was not unexpected, the markets reacted decisively. Treasury yields surged and the major indexes had one of their worst weeks since March.

We’ve been warning about a correction for weeks, and now that it’s finally here, we will shift our focus to signs of a bottom. Momentum indicators are approaching oversold territory, and bullish sentiment is falling fast. With the prospect of a government shutdown and very little economic news over the next few weeks, the market appears ripe for an uptick in volatility and a selling climax sometime in October.

Weekend Reads

The Tech Trade Is Showing Cracks. Higher Rates for Longer Spell More Trouble. Technology stocks have powered the 2023 market rally—and become increasingly expensive in the process. Now, a growing expectation that the Federal Reserve will keep interest rates higher for longer threatens to stifle the trade, potentially dimming the outlook for indexes like the S&P 500 that are heavily influenced by tech. That is because investors’ yearslong enthusiasm for tech shares was fueled not just by innovation at software and hardware companies, but also by ultralow interest rates that made the future profits promised by those companies especially valuable. Traders were willing to pay higher multiples of a tech company’s near-term earnings to share in its far-off growth. (WSJ)

Lessons from a century of inflation shocks: Inflation will take longer to tame than most people think, but taming it doesn’t necessarily mean much higher unemployment, and premature loosening of monetary policy could be dangerous. Those are the main conclusions from a new IMF working paper published on Friday, which examined lessons from over 100 separate inflation shocks on 56 countries since the 1970s. (FT)

The Inflation War Has Been Won; Time To Start Fighting The Recession: A Recession just doesn’t appear one day. It is a gradual process that takes the economy from positive to negative growth. Economist David Rosenberg, in his recent daily missives, has pointed out that in going from positive to negative growth, the economy must transition through zero growth. His conclusion is that we are close to that today, and, perhaps, that is what the “soft-landing” proponents are looking at. (Forbes)

AI and the cloud to unlock billions in annual productivity gains for small and medium businesses: Cloud computing and artificial intelligence (AI) technologies are going to unlock significant gains in productivity and job creation as they’re adopted by small and medium businesses tackling economic and societal challenges in fields like education, healthcare and agriculture according to new research. (Fox Business)

Market Technical Analysis

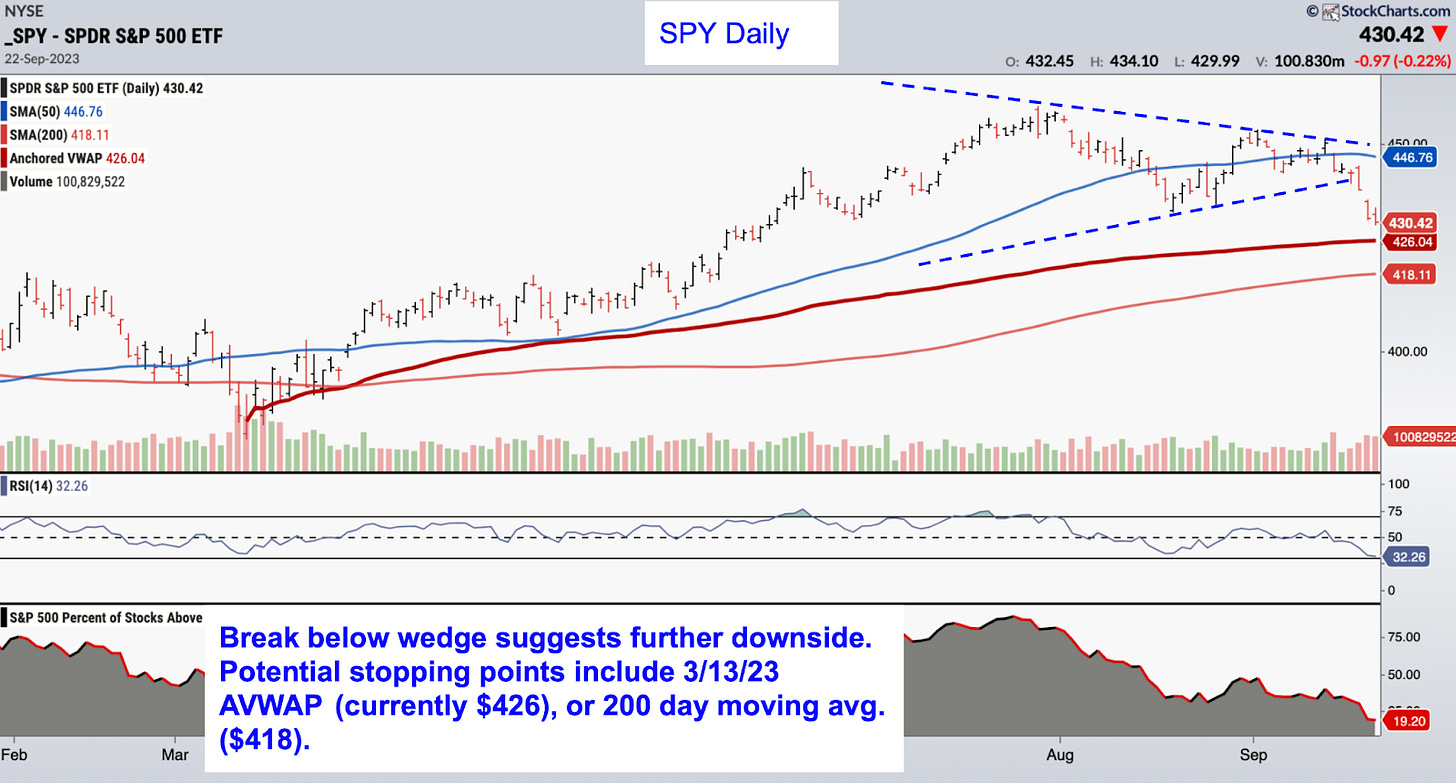

S&P 500 (SPY)

Updated chart from last week is below. The break below the wedge pattern suggests further downside ahead. The index will likely test the 200 day moving average, currently at $418. That said, momentum indicators are nearing oversold levels, and just 19% of S&P stocks are trading above their 50 day moving average (a reading near previous intermediate term bottoms). So we may see a short term bounce on the way to the final bottom.

Market Sentiment

Measures of investor sentiment show waning optimism. The CNN Fear & Greed Index has been dropping deep into Fear territory over the last few weeks. While sentiment indicators do not always give the most accurate timing signals, significant highs and lows are often accompanied by extreme readings. We were early in calling a top when the index entered extreme greed territory in late June, but the market ultimately did give us the correction we were expecting. We are now not that far off from levels where the market has made previous lows. Over the next few weeks we’ll be looking for a reversal in sentiment accompanied by improving technicals in order to begin buying more aggressively.