The Predictive Investor - 9/29/24

Stocks defy bearish seasonality

Welcome to The Predictive Investor weekly update for September 29th, 2024!

Stocks gained modestly this week, defying seasonality trends in one of the worst-performing months historically for the S&P 500.

The rally is broadening out after the Fed rate cut as expected. More S&P 500 stocks are above their 50 and 200-day moving averages now than back at the July high.

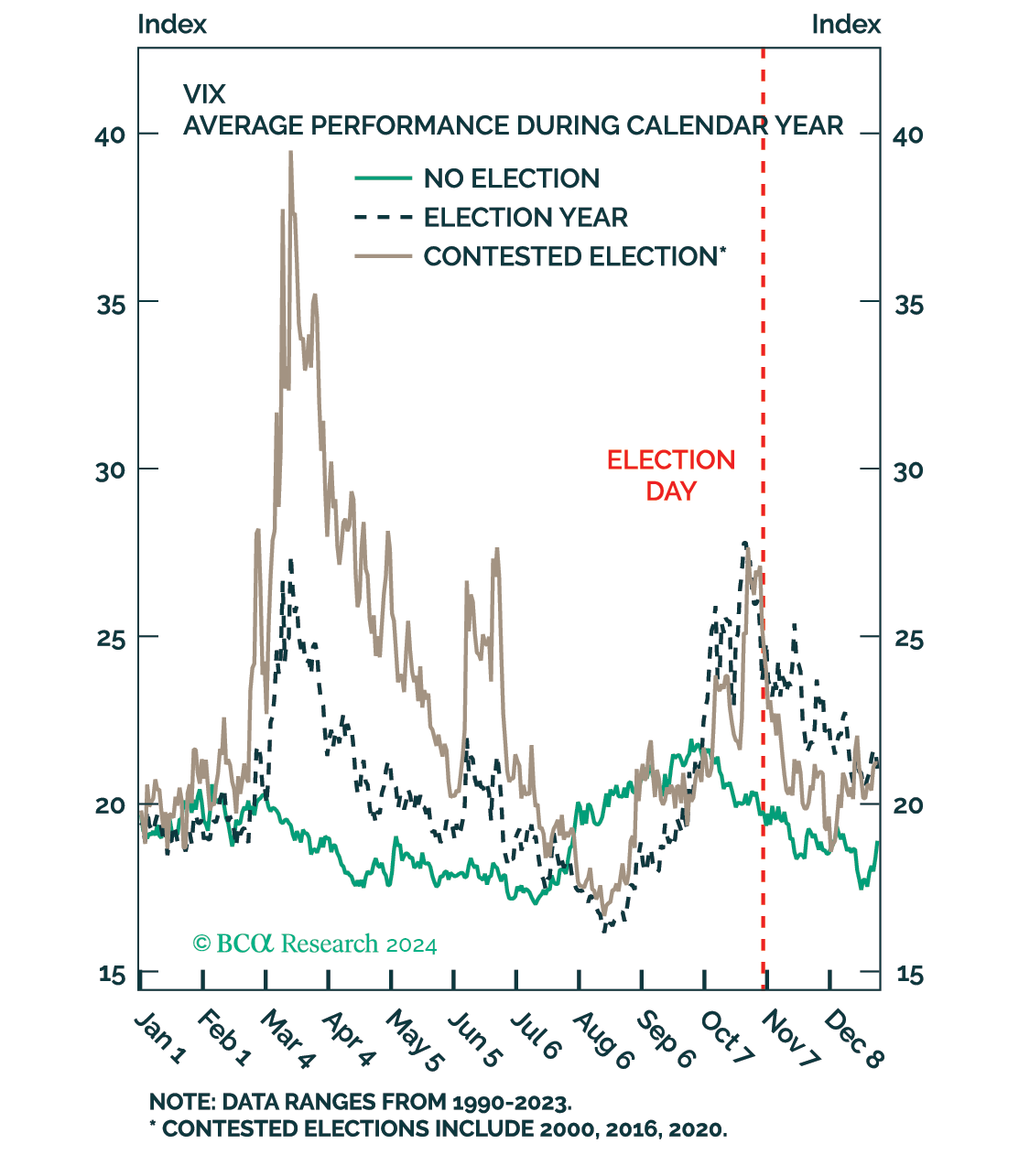

And yet, election season is just now kicking into high gear. Volatility typically rises ahead of election day, but falls quickly afterwards as the uncertainty over various policy proposals fade and take a back seat to overall economic trends.

Here’s my takeaways from the week.

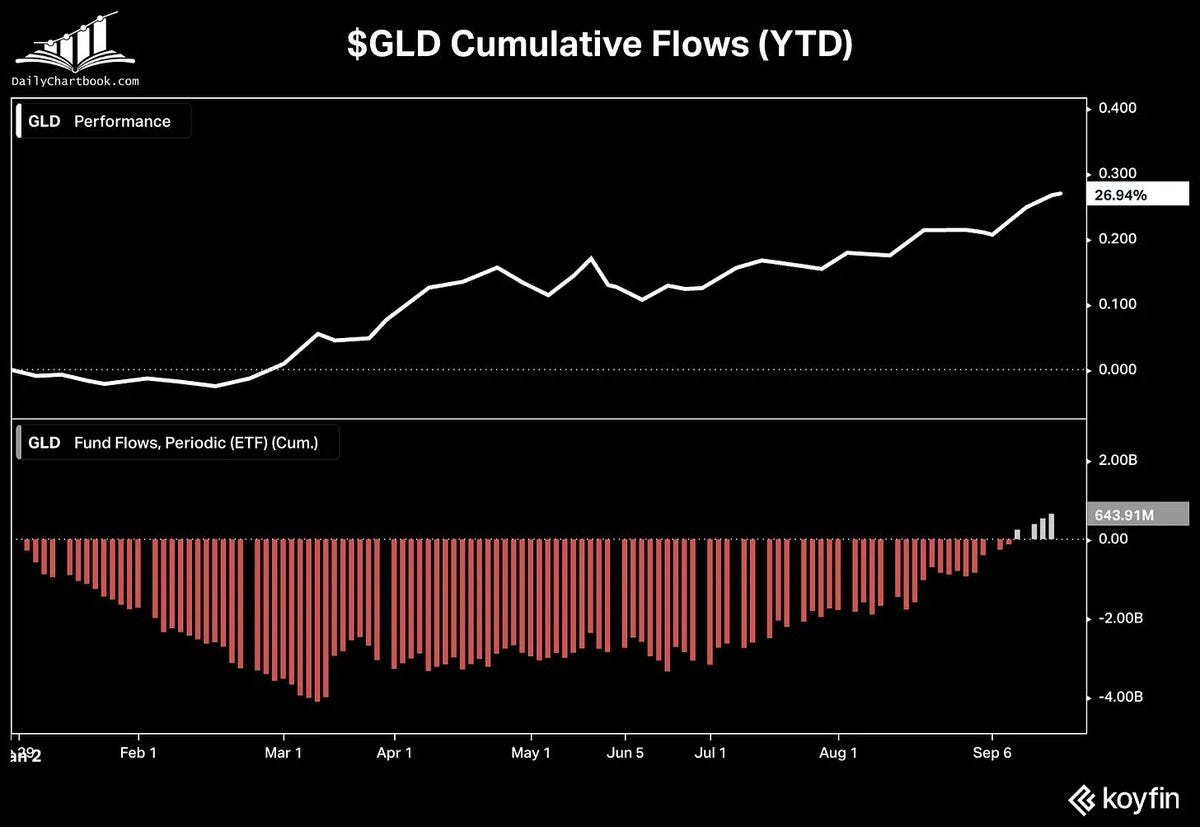

Gold ETF flows turn positive

I’ve never been a huge fan of gold, but the current macro environment favors it. Which is why I’m surprised that cumulative flows into the largest gold ETF ($GLD) have only just now turned positive YTD.

The investment thesis for gold is fairly simple. The high levels of government debt and money printing are making central banks nervous, and they’ve been selling off fiat currency reserves to buy gold. Demand for the previous metal is strong in China, both from institutions and retail investors. And the ratio of gold relative to stocks is at a historic low.

Paid subscribers know I’ve recently taken a position in a micro cap gold mining company, as I think M&A will pick up as gold prices continue to rise. But for less active investors It’s not a bad idea to consider putting a portion of your portfolio into a gold ETF.

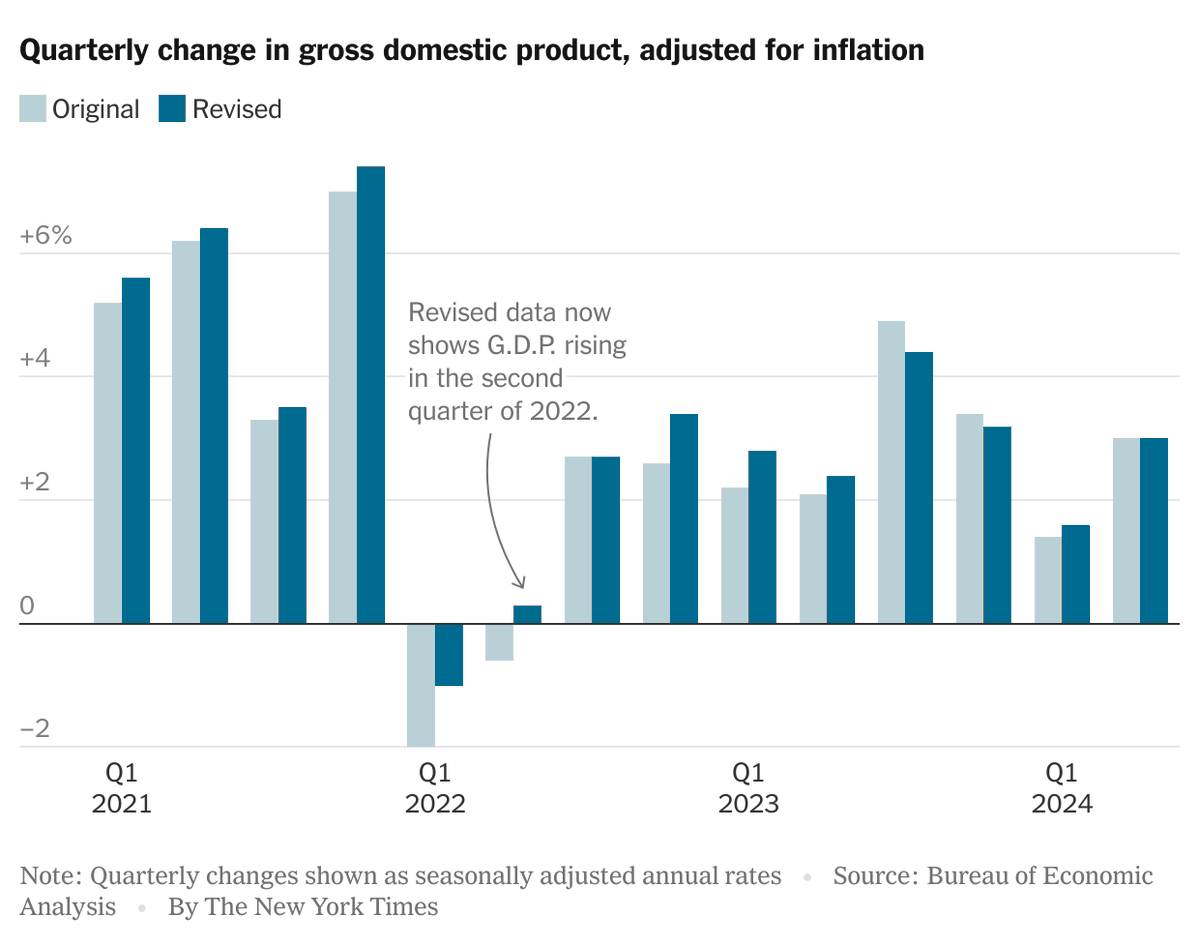

The recession that never was

A technical recession is what economists call two consecutive quarters of negative economic growth. And it’s what many of us thought happened in early 2022, as the market was discounting the impact of Fed rate hikes.

Annual GDP revisions now show that the economy grew slightly in the second quarter of 2022, so the technical recession never actually happened.

It’s another reminder of the risks of being overly dependent on data to drive policy and investment decisions. It’s also a reminder from a sentiment perspective you want to be cautious when there’s near-unanimous consensus on the direction of any market.

It’s been a while since we’ve had a bull market that was so hated by both economists and investors, and that makes it more likely that we have more room to run.

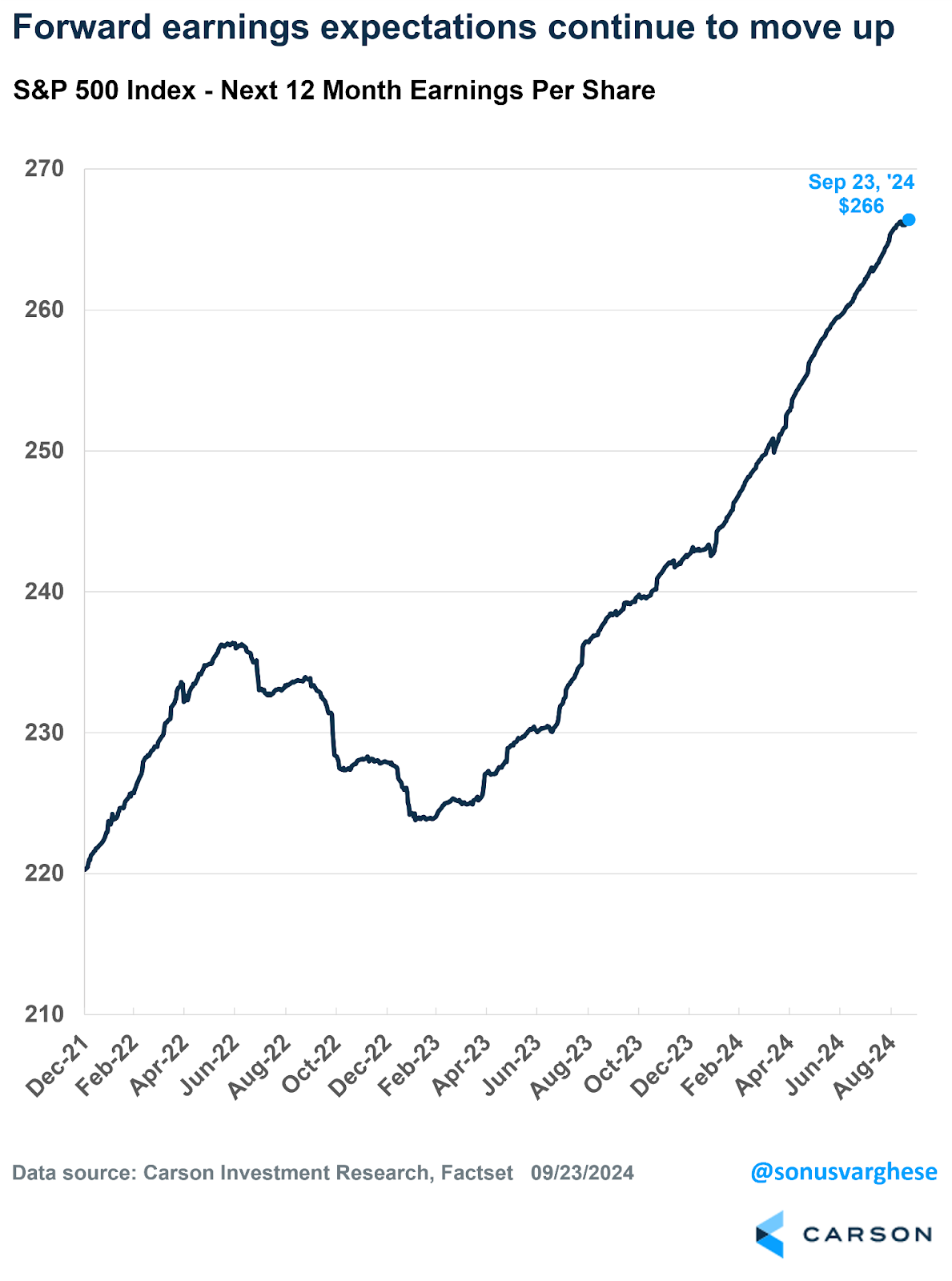

S&P rally driven by improving fundamentals

Forward 12-month EPS for the S&P 500 index is up 19% since the beginning of 2023, when I turned bullish on this market.

We’ve heard the word ‘bubble’ a lot lately, but a market is not in a bubble when prices are supported by improving fundamentals. All that cost cutting that companies went through after the pandemic delivered significant improvements to margins and earnings.

Ultimately profits drive stock prices, and there seems to be much more of those to come in the next year.

Saudi Arabia abandons production cuts

Saudi Arabia is abandoning its $100 oil price target in order to preserve its market share. (Read)

The country needs $100 oil to fund its economic development programs, but the recent production cuts failed to deliver higher prices in the wake of slowing demand from China and increased production in the U.S.

Long term I’m bullish on energy, but short term much depends on the outcome of the U.S. election. Either way, this news is good for midstream companies, especially tankers.

Stock Ratings

I changed the rating on nine stocks to Sell, as all nine fell below the momentum criteria required to qualify for purchase.

See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.