The Predictive Investor - 9/8/24

September selloff

Welcome to The Predictive Investor weekly update for September 8th, 2024!

The S&P 500 closed the first week of September down more than 4%. No surprise there.

I’ve been warning of the potential for a September selloff for a few weeks now. Corrections are never fun, but offer incredible opportunities for the disciplined investor.

The best way to spend this time is to go over your buy list and put new money to work. And if you find yourself paralyzed by the volatility and worried about what might happen in the future, rethink your allocation. You might be too aggressively allocated to stocks.

The media would have you believe that the market sold off because of labor market weakness and a contraction in manufacturing. The reality is this selloff is primarily a function of the technical deterioration in big tech and semiconductors. The fundamental backdrop remains little changed from a week ago.

Here’s my takeaways from the week.

The labor market is soft but not recessionary

Lots of jobs data came out last week, most of it received negatively by the market. Job openings fell more than expected, and are at the lowest level in 3 years. And the economy added fewer jobs last month than was expected.

But the unemployment rate fell slightly from 4.3% to 4.2%, and remains well below the long-term average of 5.7%. Layoffs remain low and there are still more job openings than available workers.

We did not learn anything last week that fundamentally changed the outlook for the labor market. We were hoping for some clarity on the magnitude of the upcoming Fed rate cut, but it still remains a tossup between 25 and 50 basis points.

The manufacturing contraction is not a big deal

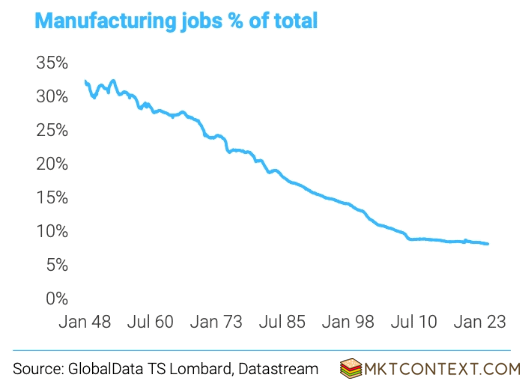

ISM manufacturing data came in weak, but has been in contractionary territory for 20 of the last 21 months. Manufacturing is only about 12% of GDP, and represents a small portion of the overall jobs market.

Therefore it has already been established that any momentum in growth will have to come from services.

Companies are still investing for the future

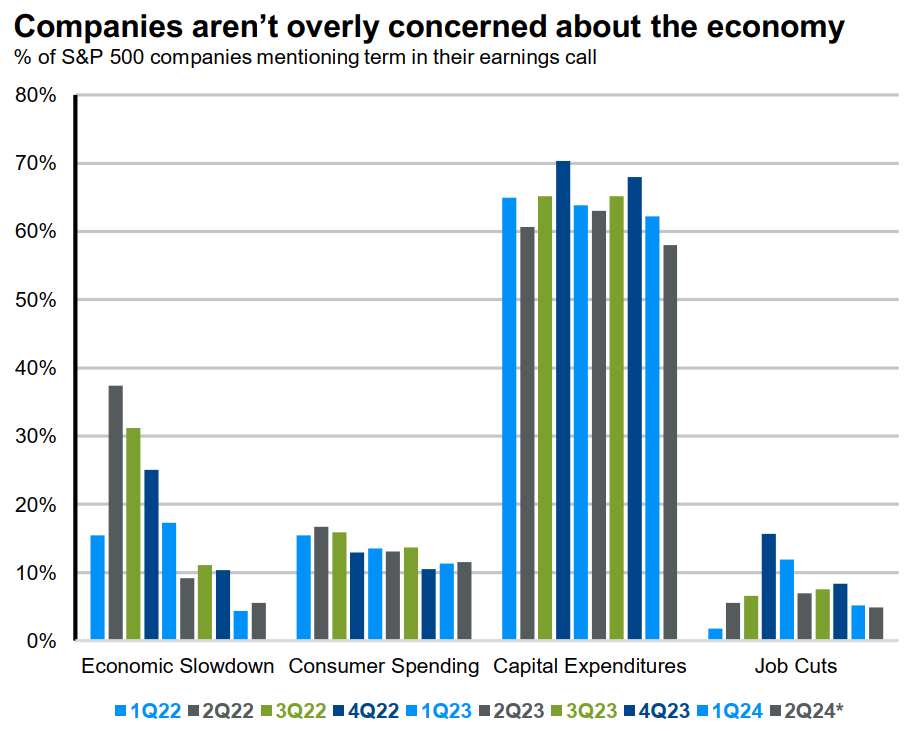

Total corporate capex hit an all time high in Q1. And there are no signs of a slowdown any time soon. Mentions of an economic slowdown and job cuts during Q2 earnings calls are well below their highs from 2022 and 2023. Mentions of capital expenditures remain high, driven by the longer term trends we’ve talked about before: AI, clean energy and the reshoring of supply chains. This represents an optimistic outlook by Corporate America, that should continue to drive economic growth.

Downside SPX target = 5,230

Again, last week’s selloff was mostly triggered by technical weakness in big tech, and especially semiconductor stocks. The recovery stalled just below the July highs, where speculators who were betting on a surge in stock prices post-earnings saw an opportunity to get out at near break even. None of this really changes the longer term business case for owning stocks.

The SPX closed the week below the 7/16 AVWAP (red line), indicating the selloff from that started in July is part of a larger corrective move.

At this point the best estimate for a downside target is the area that has served as support for previous pullbacks this year - the YTD AVWAP (blue line), currently sitting at 5,230.