Market waiting for a trade deal

The Predictive Investor - 4/20/25

Welcome to The Predictive Investor weekly update for April 20th, 2025!

Stocks are in standby mode, waiting for the outcome of ongoing trade negotiations. Trump had some high profile meetings with Japan and Italy, but no deals have been announced.

While some quick wins will help reassure the market, I don’t see a quick rebound until there’s clarity on policy with our larger trading partners - Canada, Mexico, the EU and China. The longer we’re in limbo, the bigger the drag on economic growth.

Here’s my takeaways from the week.

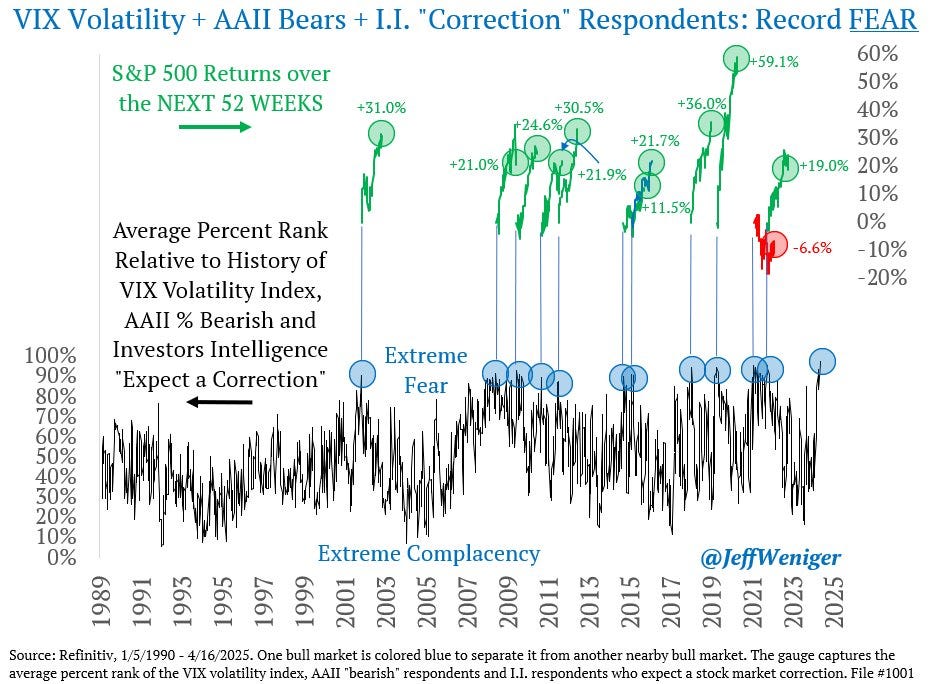

Sentiment flashes huge contrarian signal

The chart below caught my attention, because it aggregates the AAII and Investors Intelligence Survey along with the VIX into a sentiment reading. The market is now registering more fear than during the Great Recession. Forward returns for the S&P 500 at these levels have been strong the majority of the time.

I continue to believe that the markets will surge higher as soon as there’s clarity around trade policy. The best thing you can do now is to position your portfolio accordingly. History shows the rewards are far greater for investors who buy during times of extreme fear than for those who wait until it feels safe.

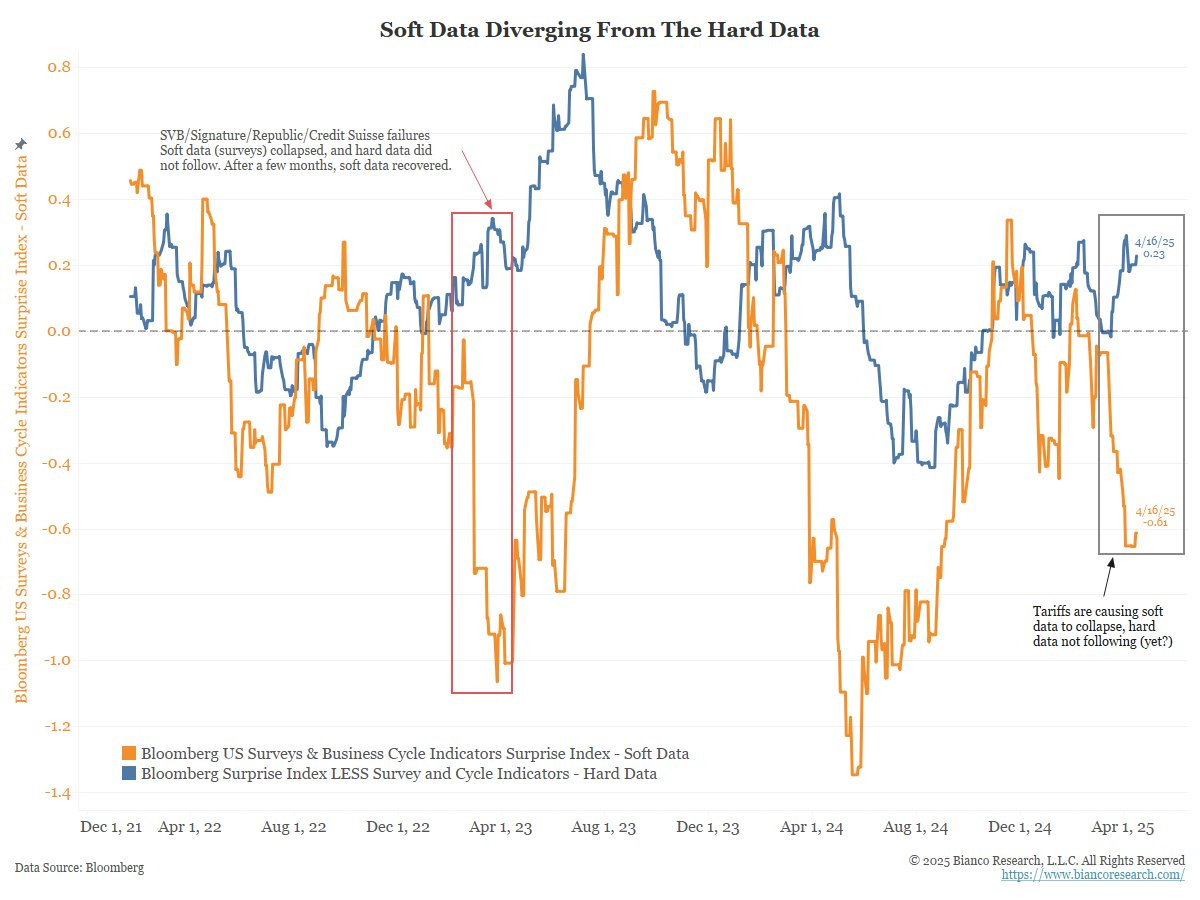

Hard data not at recession levels

Meanwhile, economic data continues to defy sentiment. Weekly jobless claims came in at 215k vs. 225k expected, below the average recessionary levels. Retail sales also beat expectations, although some of that was likely due to consumers pulling in purchases to get ahead of tariffs.

Jim Bianco posted the chart below on X, showing that soft data (i.e. sentiment) typically lags behind hard data. That hasn’t been happening this time around.

From Jim:

“If the hard data does not turn lower in the next few weeks to month, we will have to start asking if there has been a big misunderstanding about the impact of tariffs on the economy.”

Anyone who tells you they know how this will play out is fooling themselves.

Focus on companies that will thrive regardless

Last week a judge ruled that Google GOOG 0.00%↑ is in violation of antitrust laws. (Read)

No surprise there. You may remember I told you back in October that Google was screwed. Next in the hot seat is Meta META 0.00%↑.

But many of our holdings continue to thrive.

Like ADMA Biologics ADMA 0.00%↑, which sold off with the rest of the market, but rebounded quickly when investors realized that its entire supply chain is based in the U.S. The company is in a good position to capitalize on rising demand for domestically-made healthcare products. The stock is now back near its all time high.

Palantir PLTR 0.00%↑ has also held up relatively well, signing a deal with NATO to build an AI-enabled battlefield operations platform. (Read)

There are plenty of companies that are well positioned to thrive despite the chaos. Our job is to find them.

Wishing a Happy Easter to those who celebrate!