Optimism without euphoria

The Predictive Investor - 6/1/25

Markets continue to climb, but the mood is far from exuberant. This rally is being driven not by hype or mania, but by steady data, improving fundamentals, and cautious optimism. It’s a classic “climb the wall of worry” environment. The kind that can be quietly powerful.

This doesn’t mean recession risk is zero. But the message is clear: the economy is not crumbling. In fact, it’s doing what late-cycle expansions often do: digesting shocks, reallocating capital, and quietly growing.

Here’s what we’re watching, and why it matters.

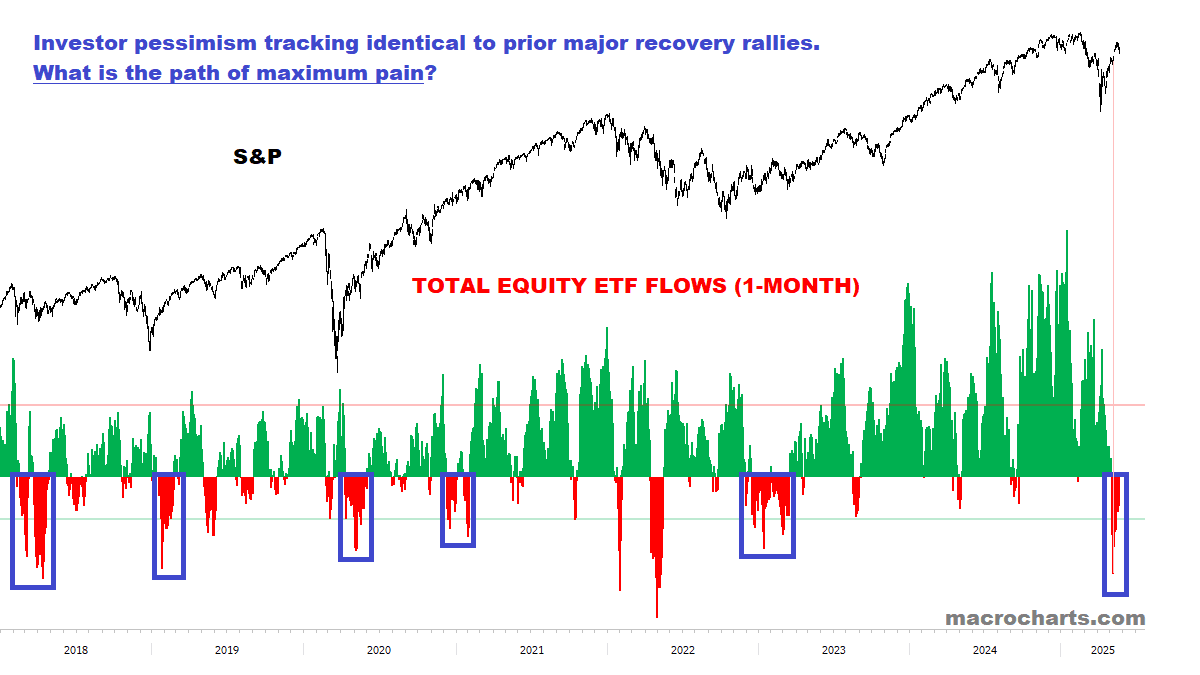

Stocks climb the wall of worry

One of the more counterintuitive indicators of a healthy bull market?

Selling.

Equity ETF flows are still negative, indicating investors are selling into strength. This is the kind of cautious sentiment that has accompanied every major recovery cycle in recent years.

Markets top on extreme bullish sentiment. Today’s backdrop is more cautious than euphoric, more hedged than greedy. If anything, this wall of worry is the bull market’s best friend.

The consumer is stronger than you think

Household leverage — the ratio of total liabilities to total assets — is far below levels seen prior to the 2008 recession. Which means consumers today are much more resilient in the face of economic disruption.

While consumers have been shifting towards more defensive spending patterns, consumer spending is not at risk of collapsing.

Good news for an economy where consumer spending accounts for 70% of GDP. It's an anchor of stability in a world where government deficits are out of control.

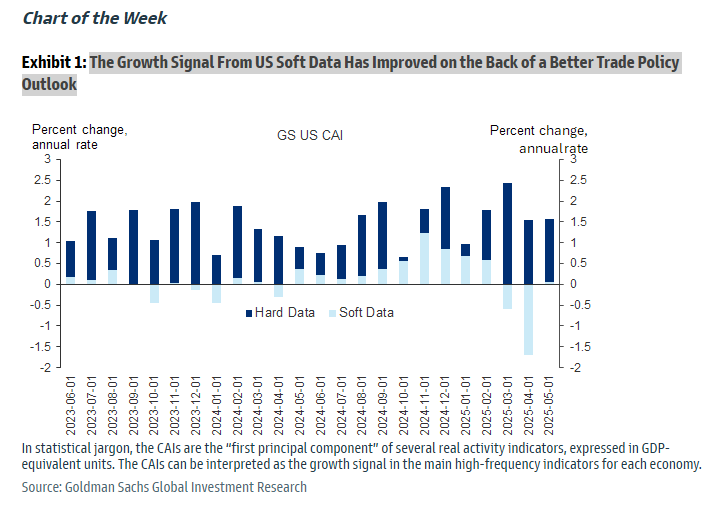

Growth signal from soft data improves

Soft data has improved dramatically over the last few weeks as the outlook from trade policy gets clearer. And improving hard data continues to confound those in the recession camp.

While the courts delivered some continued thrash on tariffs last week, ultimately this is a short-term phenomenon.

Businesses have a better idea of where the administration wants to land on tariff policy. Increased clarity helps businesses plan ahead.

This doesn't mean we're booming, but it does mean that fears of an immediate downturn may be overblown.