Profits, Productivity, and Policy: The Market’s New Engine

From AI-driven efficiency to industrial reshoring, the trends we bet on are gaining strength.

We’re now deep into Q2 earnings season, and the results continue to impress.

According to the latest FactSet data:

81% of S&P 500 companies have beaten EPS estimates (above the 5-year average of 78%),

81% have topped revenue estimates, and

The blended earnings growth rate for Q2 for the S&P 500 now sits at 11.8%, the third consecutive quarter of double-digit earnings growth for the index.

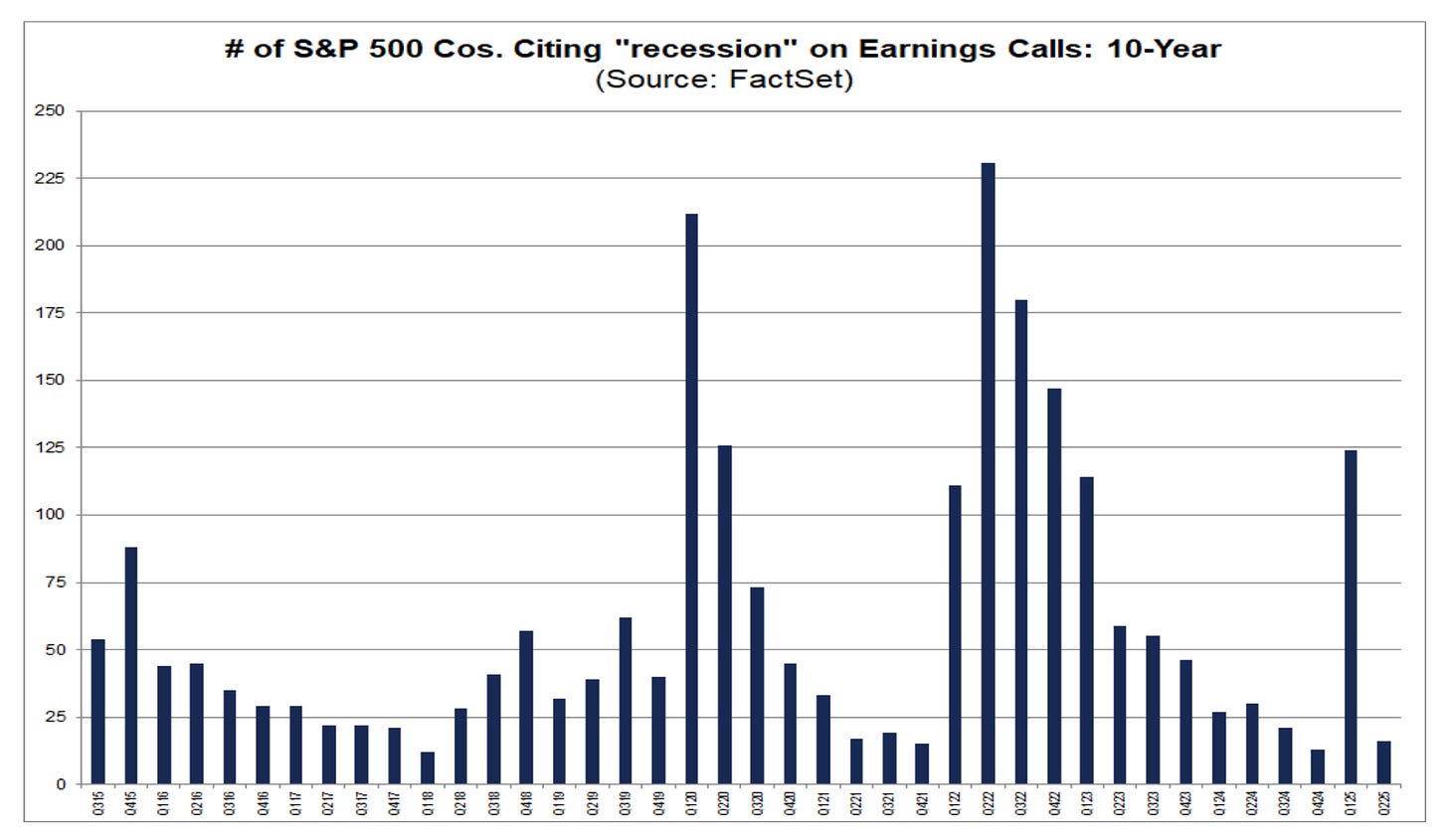

One telling stat?

The number of companies mentioning “recession” on earnings calls has collapsed to just 16 (from 124 in Q1).

Meanwhile, CEO confidence is on the rise as tariff uncertainty continues to fade.

This is what a resilient market looks like. Let’s break it down.

Industrial reshoring picks up speed

Two of our holdings, Tutor Perini TPC 0.00%↑ and Willdan Group WLDN 0.00%↑, reported earnings this week that support one of our highest conviction themes: the reshoring of U.S. industrial capacity.

TPC highlighted strong momentum across transportation and infrastructure projects tied to federal funding.

WLDN noted increased demand for energy efficiency and grid modernization, a direct response to national industrial policy.

Both stocks are up more than 2X from our initial buy price. While the long-term story remains intact, it’s not a bad time to consider taking some profits.

AI is delivering on productivity

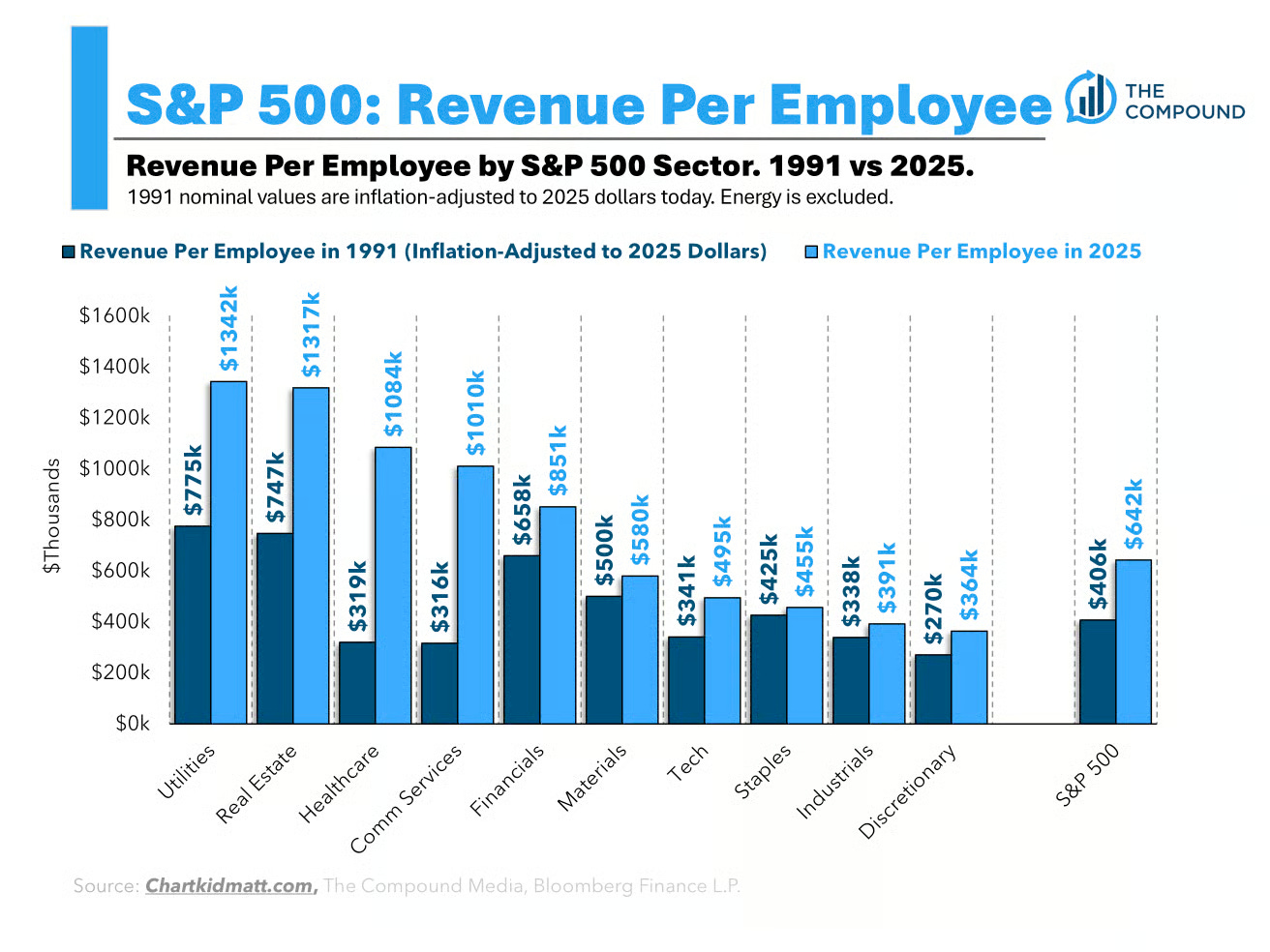

One of the most underreported but powerful developments this earnings season? Rising revenue per employee.

While critics continue to argue AI is all hype, companies are beginning to show real productivity gains. This is exactly how long-term technology adoption plays out:

Initial skepticism

Massive capex

Slow ramp

Then… exponential output

We’re entering that final phase now. It’s showing up in the numbers.

Electricity costs climb as AI booms

The data center boom is pushing electricity demand to new highs, and power prices are rising as a result.

This isn’t just a headline, it’s a fundamental shift in utility economics.

Utilities that can deliver power to AI-driven infrastructure (think data center hubs in TX, AZ, VA) are in a structurally stronger position.

The grid is becoming the bottleneck, and investment will follow.

It’s yet another way the AI buildout is rippling across the economy, and a reason to keep select regulated utilities on your watchlist.

Treasury yields send a message

The Fed follows the market, and the market expects cuts.

Last week, the 2-year Treasury yield fell sharply, signaling rising investor expectations for Fed rate cuts ahead. At the same time, the 30-year Treasury struggled, with tepid demand at auction and weak price action.

What does it mean?

While the bond market is betting on slower growth and a friendlier Fed, the long end of the curve reflects fiscal pressure and rising debt issuance.

This backdrop supports growth stocks and risk assets, especially if the Fed begins to ease by Q4 or early 2026. As always, follow the bond market, it usually gets it right first.

Price follows earnings, exactly as it should

Valuations may be elevated on the S&P 500, but so are profits.

It’s exactly why our rules-based approach centers on earnings strength.

Forget the headlines, forget the Fed chatter, forget sentiment swings. The market follows results. And right now, the results are strong.

When price and earnings are moving in lockstep, it’s a sign the market is functioning rationally. That’s your cue to stick to the process.

Final thought

There’s been a steady flow of news on the geopolitics front which we haven’t even talked about. But the core insight remains the same: The market rewards results. Our job is to prepare, not predict.

We’re in a highly dynamic, AI-accelerated, stimulus-supported economy that’s also facing fiscal strain and potential policy shifts.

Rather than react to every twist and turn, we build our portfolio around what matters most:

Earnings momentum

Sector leadership

Repeatable patterns

The rest is just noise.