Pullback ≠ Breakdown

Markets can correct 5–10% even in bull markets. The opportunity is knowing the difference.

Despite another stellar earnings report from Nvidia, big tech led a selloff that pushed volatility higher. The markets also got no help from the Fed, which continues to signal confusion rather than confidence, as they struggle to get a clear read on the economy after weeks of missing data during the government shutdown.

The negativity is now reaching extremes, and historically, that’s when markets bounce back.

Thursday was ugly

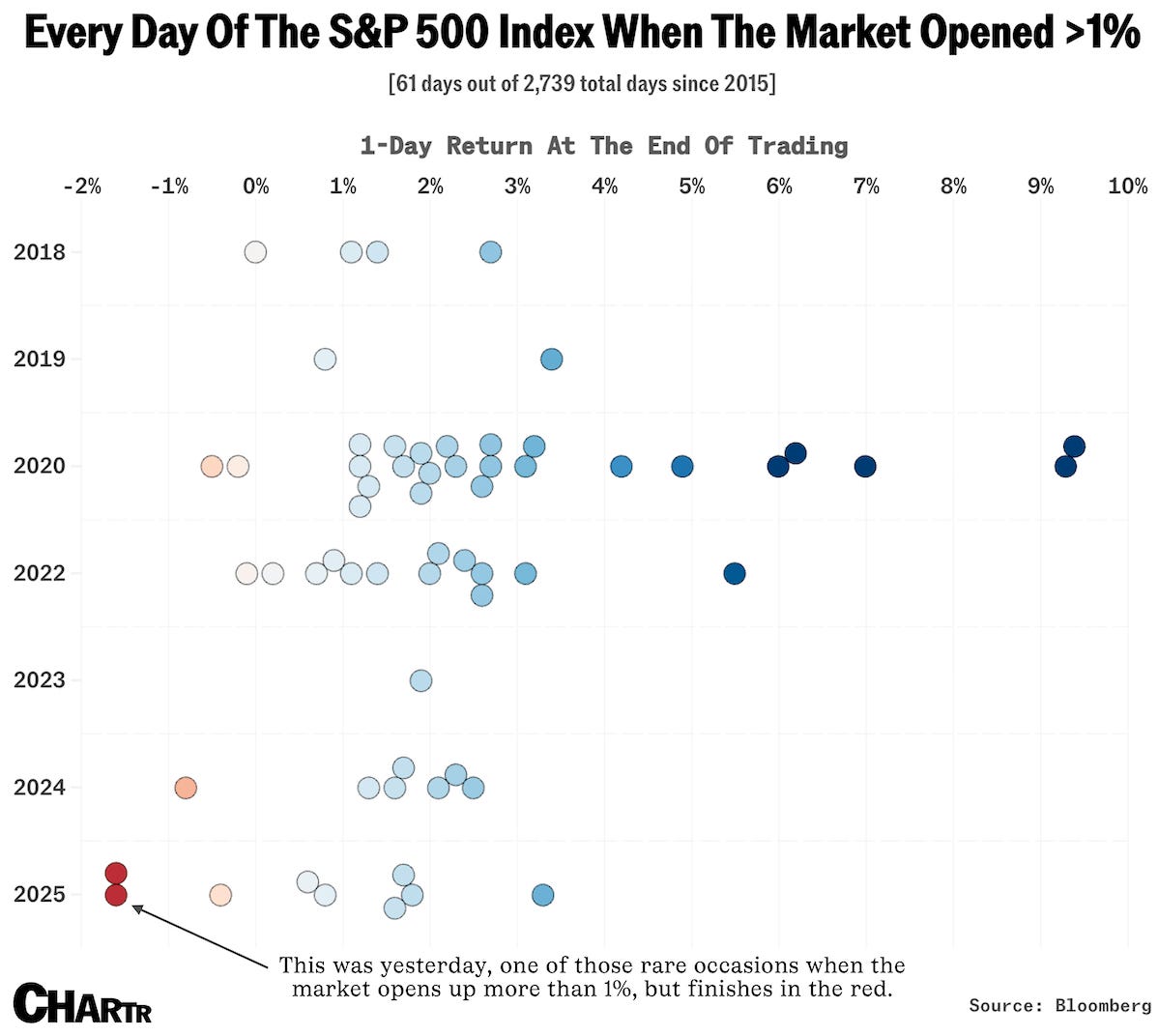

Stocks opened up more than +1% Thursday, normally a sign of strength. Instead, they finished sharply lower.

The last time we saw a similar reversal was April 8th during the tariff-driven selloff.

When sentiment turns this negative on only a ~5% pullback, it shows panic is driving prices.

Friday delivered a broad rally in most stocks

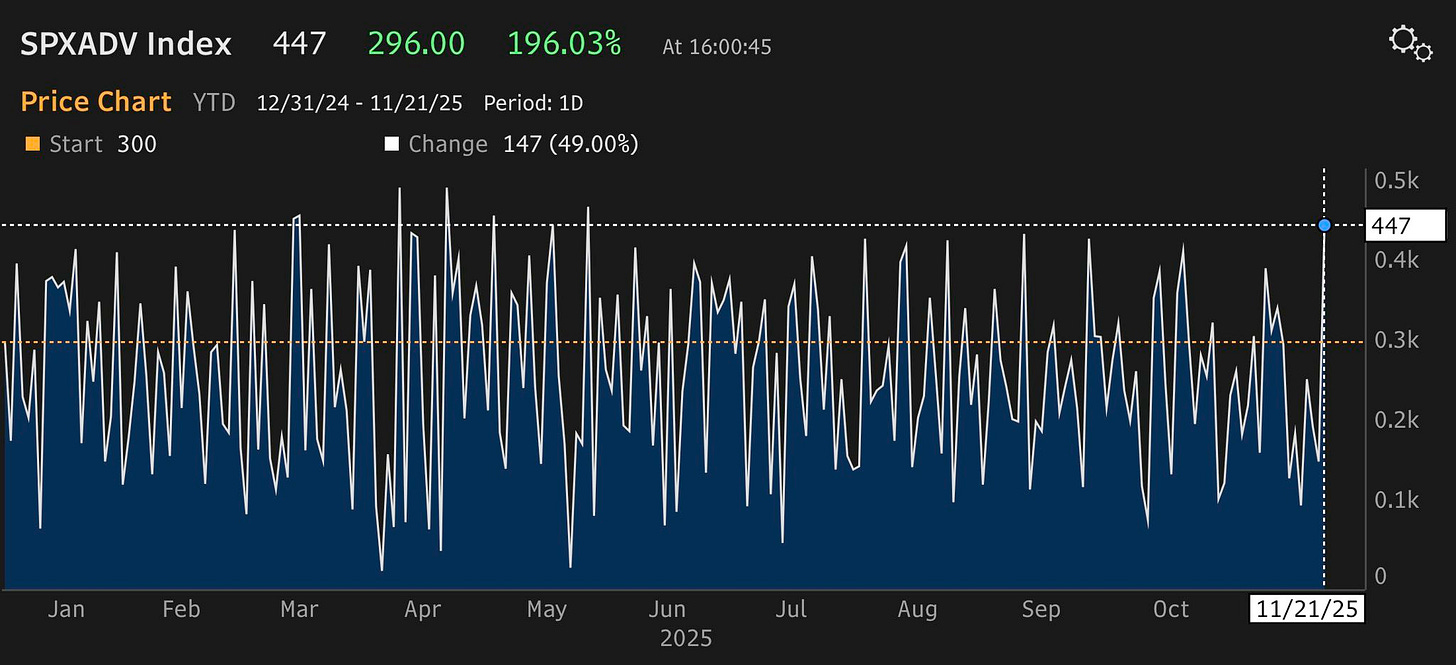

We saw encouraging breadth on Friday: 447 out of 500 S&P names closed higher.

But leadership was missing — NVDA, MSFT, AVGO, and TSLA all fell -1% or more.

Until buyers step back into big tech, expect continued chop in the indexes.

The good news

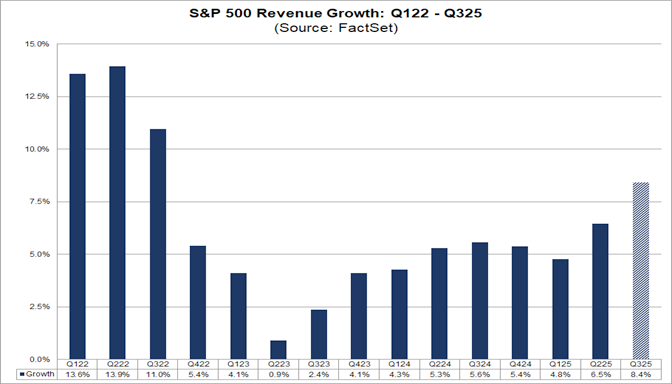

Under the surface, corporate America looks strong:

+8.4% revenue growth in Q3 — fastest since Q3 2022

13.1% net profit margins — the highest in FactSet history (back to 2009)

7th straight quarter of margin expansion

These are not recession numbers. Far from it.

Technical view

The pullback remains mostly structural. The S&P 500 is down ~5% from its highs, and will remain in a drawdown until it clears the anchored VWAP from its high on October 29th (red line on chart).

A 10% correction to 6,236 would align with anchored VWAP from April lows. Hitting those levels are unlikely but not abnormal after the huge rally over the last 6 months.

The setup leans more like a tactical reset than the start of a breakdown.

Final thought

This is a technical selloff, not a fundamental one.

The strongest companies are still growing revenue and expanding margins. Periods like this are when long-term investors can upgrade their portfolios at a discount.

Set your rules ahead of time — where you’ll deploy cash and how much — so you’re ready when opportunity shows up.

🔗 And if you need some guidance, see section #5 in How We Build a Market-Beating Portfolio for our playbook.