Retail investors panic

The Predictive Investor - 3/2/25

Welcome to The Predictive Investor weekly update for March 2nd, 2025!

Consumer sentiment and retail investor indicators are at panic levels, yet the S&P 500 was only down 5% from its all time high.

The fear is understandable, given all the news around layoffs, inflation ticking higher and impending tariffs. Additionally, many of the stocks retail investors follow closely, like the Mag 7, have sold off the hardest.

No one knows whether or not the selling is exhausted or the beginning of a longer drawdown. But historically, buying into weakness is far more profitable than trying to time the exact bottom.

There were also some constructive developments from a technical perspective last week.

The last ~10% correction in the S&P 500 ended on August 5th of last year. Last week’s selloff stopped right at the anchored VWAP from the August low, which served as support in January. RSI on the index has also turned up.

I went shopping last week and I hope you did too.

Here’s my takeaways from the week.

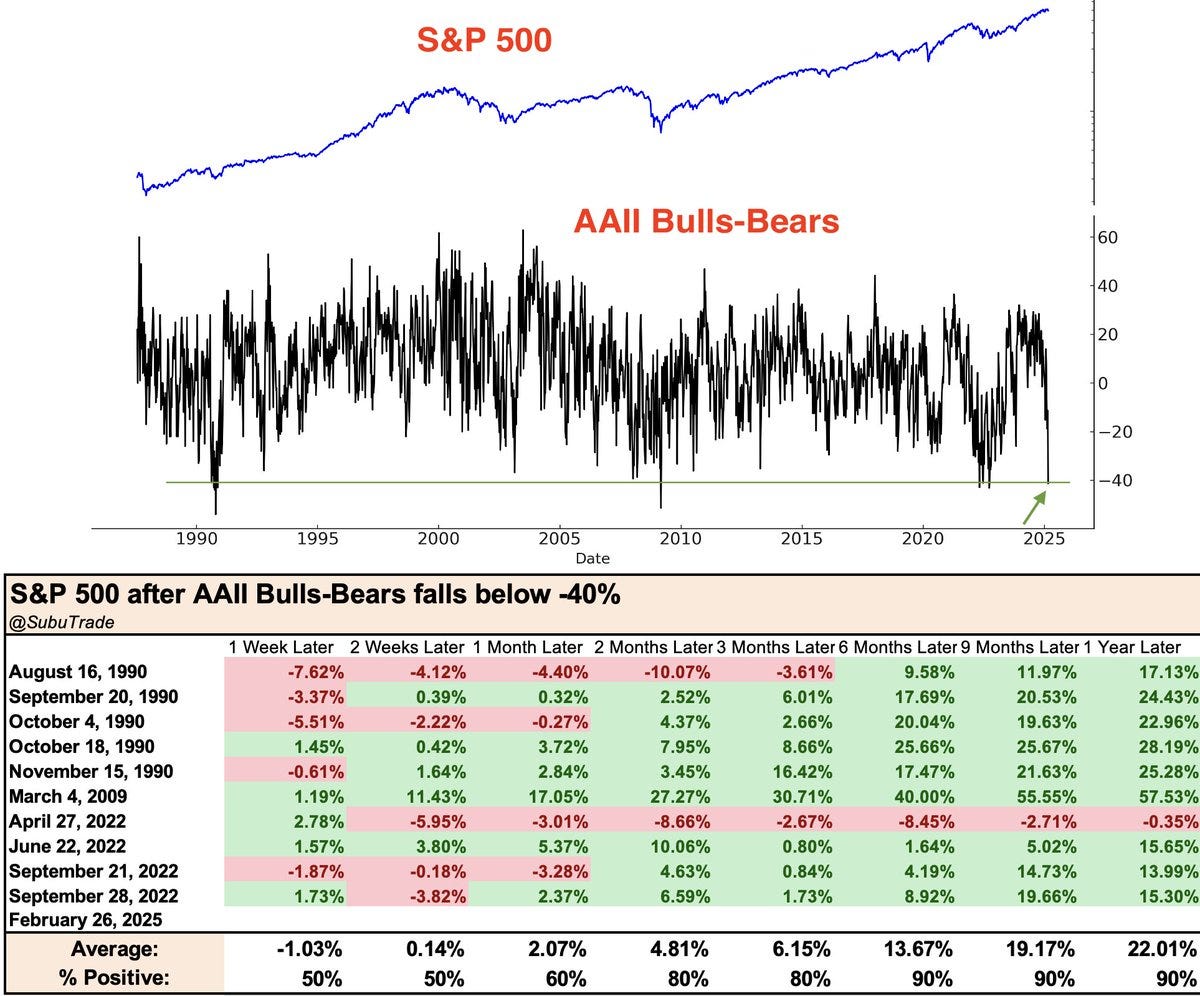

Retail investors are extremely fearful

The steady drip of news around layoffs, inflation, and potential trade wars are taking their toll. The Consumer Confidence Index dropped by the most since August 2021. And the last time the AAII Bulls-Bears fell this low was at the bear market bottom in 2022.

Buying during drawdowns is extremely hard, but very rewarding. Historically, pessimism at these levels has led to above-average 3-month returns.

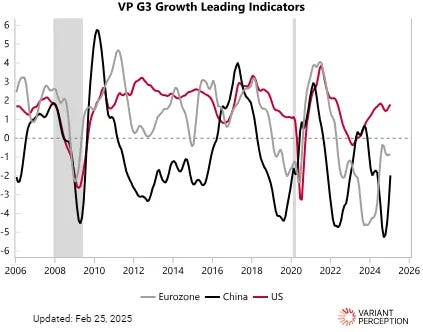

Full blown trade war is unlikely

The US economy remains relatively strong compared to Europe and China, which means other countries have far more to lose in the event of a trade war. That’s why investors are viewing these tariff announcements as negotiating tactics rather than fixed policy.

Corporate America is already exploring ways to adjust supply chains in response to potential tariffs, with many companies accelerating domestic investment. Apple is the latest company to announce a significant investment in domestic manufacturing. (Read)

Whether all of these tariffs happen or not, it’s more likely they are short-lived than the beginning of a protracted trade war.

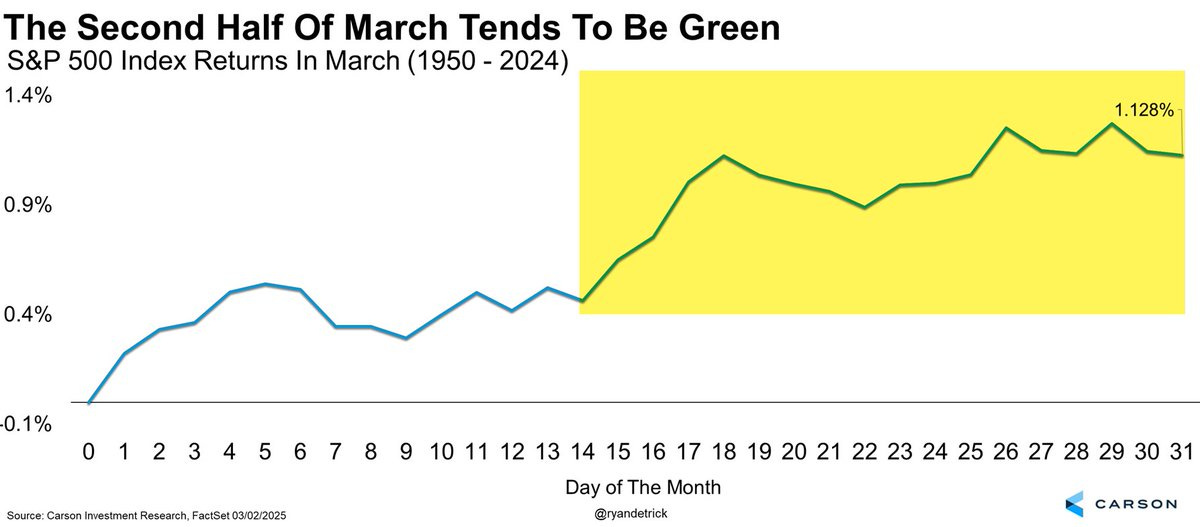

March is usually a strong month for stocks

In my update on February 9th, I flagged the fact that February is a historically lousy month for stocks, and advised to get your buy list ready in case of a selloff.

I added to a number of positions last week, but it’s not too late to take action.

Average returns in March for the S&P 500 since 1950 are 1.13% vs. -0.01% in February.

Stock selection matters more than ever

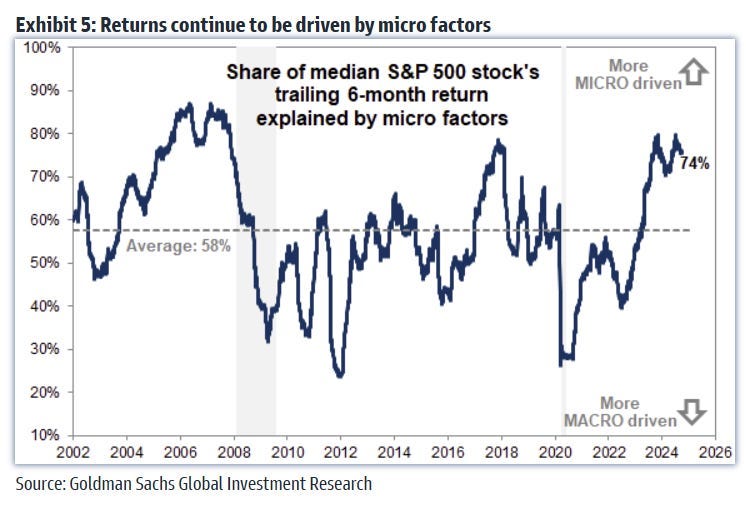

Over the last year, market returns have been more micro-driven than average. But indicators of a micro-driven market have been present for much longer.

Lower correlations among stocks, wide performance gaps between leaders and laggards in the same sectors and increased volatility around earnings reports are all signs of an environment that favors an active management approach.

The key to investing in uncertain times is to buy stock in companies that will be successful despite the uncertainty. And if you need some guidance, upgrade to a paid membership.

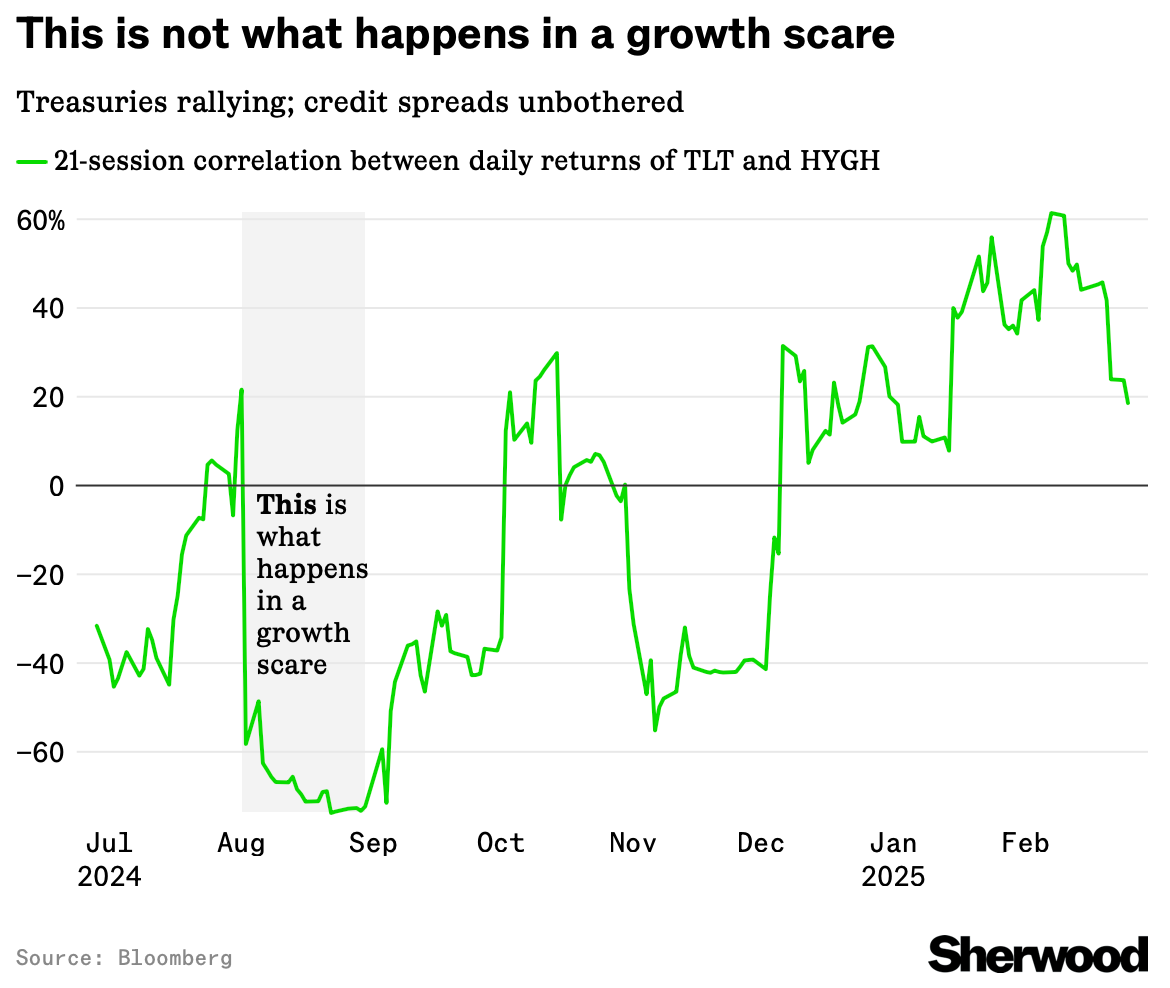

The bond market is not worried about growth

While retail investors are panicking, the bond market is signaling that recent market activity is more a result of short term noise than fears of an economic contraction.

While long term bonds have rallied, credit spreads haven’t widened much. Normally when the bond market fears a recession, credit spreads widen pretty significantly.

There’s always some degree of uncertainty in the financial markets. But investors who stick to a rules-based approach will be rewarded over the long term.