Risk Management with Position Sizing in Multi-Asset Portfolios

Explore effective position sizing strategies for multi-asset portfolios, balancing risk and returns to align with your investment goals.

Position sizing is a crucial aspect of managing multi-asset portfolios. While choosing the right assets is important, determining how much to allocate to each asset can significantly impact risk and returns. This article explores four common strategies for position sizing:

Fixed Percentage: Allocate a set percentage to each asset, offering simplicity but limited risk adjustment.

Risk Parity: Balance risk contributions across assets based on their volatility, requiring constant monitoring.

Kelly Criterion: Use probabilities and expected returns to calculate optimal allocations, though it can be aggressive and complex.

Equal Weighting: Distribute investments evenly across all assets, reducing concentration risk but increasing turnover and exposure to smaller, volatile assets.

Each method has its strengths and weaknesses, making it essential to align your choice with your goals and risk tolerance. Some investors combine approaches for better results, such as pairing fixed percentages with risk parity adjustments. Whichever method you choose, consistency and regular reviews are key to long-term success.

Why Position Size Matters in Investing | EP151

1. Fixed Percentage Position Sizing

Fixed percentage allocation is one of the simplest ways to structure a multi-asset portfolio. With this method, you assign a specific percentage of your portfolio’s total value to each asset or asset class, regardless of how the market or individual assets behave.

For instance, you might choose to allocate 60% of your portfolio to stocks, 30% to bonds, and 10% to commodities. If your portfolio totals $100,000, this would mean $60,000 goes to stocks, $30,000 to bonds, and $10,000 to commodities. As the value of your portfolio shifts over time, you rebalance regularly to maintain these fixed proportions.

Risk Control

While fixed percentage sizing offers basic diversification, its ability to manage risk is limited. It doesn’t account for the varying levels of volatility or changing market conditions across asset classes. This means your portfolio could remain vulnerable to the inherent ups and downs of each asset class without any built-in mechanism to adjust for risk. These shortcomings highlight the trade-off between the simplicity of this approach and its practical challenges in managing risk effectively.

Complexity

The standout benefit of fixed percentage sizing is its straightforwardness. You don’t need to deal with complex formulas, advanced risk models, or detailed volatility assessments. Once you’ve decided on your target allocations, the main task is occasional rebalancing to ensure your portfolio sticks to those percentages.

However, determining the right percentages isn’t always easy. It requires a clear understanding of your risk tolerance and investment goals. This balance between ease of use and the constraints it imposes makes fixed percentage sizing a practical but somewhat rigid option for portfolio management.

Suitability for Multi-Asset Portfolios

This method is particularly well-suited for long-term, buy-and-hold investors who prefer a hands-off approach. If you’re someone with a long investment horizon and higher tolerance for risk, fixed percentage allocation can work effectively.

It’s a reliable way to maintain steady exposure to various asset classes over time, helping investors capture the long-term growth potential of different markets. For those building core portfolios with major asset classes like domestic and international stocks or bonds, this method provides a stable and predictable framework.

Drawbacks

Despite its simplicity, fixed percentage sizing has some major downsides, especially for multi-asset portfolios. One of the biggest issues is its inability to adapt to market conditions. It doesn’t adjust for shifts in volatility or changes in market dynamics. During turbulent periods when asset class correlations tend to rise, this approach may fail to provide the level of risk protection investors expect. For example, in a highly volatile market, your portfolio’s risk exposure stays the same, leaving it vulnerable to potential losses.

Another drawback is that this method can limit gains in trending markets if allocations are too conservative. It’s also inflexible, leading to overexposure or underexposure when market conditions change. For instance, if one asset class becomes more volatile or correlations between assets shift, fixed allocations might unintentionally concentrate risk in ways you didn’t anticipate.

Finally, this approach isn’t ideal for everyone. Short-term traders or those with low risk tolerance may find it unsuitable. Fixed percentages assume that your chosen allocations will remain appropriate across all market conditions - a scenario that rarely plays out in reality.

2. Risk Parity

Risk parity offers a more dynamic way to allocate investments, focusing on balancing risk rather than just dividing up capital. Instead of assigning fixed percentages to each asset class, the goal here is to ensure that every asset contributes roughly the same amount of risk to the overall portfolio. This approach shifts the focus from “how much money” to “how much risk” each asset brings to the table.

At its core, risk parity adjusts allocations based on how volatile each asset is. For example, if stocks have a volatility of 15% and bonds have 5%, the portfolio might allocate three times more to bonds to level out the risk contributions. This way, the portfolio isn’t overly reliant on the performance of any single asset.

Risk Control

One of risk parity’s strengths is its ability to manage portfolio volatility. By ensuring no single asset class dominates the risk, it creates a more balanced exposure across market conditions. This is achieved by continuously adjusting position sizes based on each asset’s volatility, helping to maintain a diversified risk profile.

This method proves especially useful when asset correlations shift unexpectedly. However, it does have its limits. Since risk parity relies on volatility as its main measure of risk, it doesn’t factor in tail risks, liquidity issues, or fundamental valuations. During extreme market stress, when correlations between assets rise dramatically, even a well-constructed risk parity portfolio can face steep losses. Despite these challenges, risk parity remains a key tool for balancing portfolio risk in multi-asset strategies.

Complexity

Implementing risk parity is more complex than sticking with fixed percentage allocations. It requires constant monitoring of each asset’s volatility, often using historical data or advanced forecasting models. As market conditions change, the portfolio must be rebalanced to maintain equal risk contributions, making the process both frequent and intricate.

This level of complexity often necessitates professional tools like portfolio management software or sophisticated spreadsheet models. Without these, managing a risk parity strategy effectively can be a daunting task.

Suitability for Multi-Asset Portfolios

Risk parity works particularly well for diversified portfolios that include a mix of asset classes with varying levels of volatility. It’s especially effective when combining traditional options like stocks and bonds with alternatives such as commodities, REITs, or international investments.

The approach appeals to investors aiming for consistent risk exposure across different economic cycles. By naturally reducing allocations to more volatile assets during turbulent times, risk parity can help deliver steadier returns over the long run. This makes it a good fit for those with medium to long-term goals who prioritize managing risk over chasing maximum growth.

Institutional investors and experienced individuals often favor risk parity because it removes emotion from the allocation process. By relying on quantitative measures rather than personal biases or market timing, it provides a systematic way to manage risk.

Drawbacks

Despite its advantages, risk parity has its downsides. One major issue is its reliance on historical volatility data, which doesn’t always predict future market behavior. If volatility changes rapidly, a risk parity portfolio can end up poorly positioned for new market conditions.

Another drawback is the cost of implementation. Frequent rebalancing leads to higher transaction fees and, in taxable accounts, potential tax consequences. These costs can significantly reduce the approach’s benefits, particularly for smaller portfolios.

Risk parity also tends to favor lower-volatility assets like bonds over growth-oriented ones like stocks. While this can provide stability, it may lead to missed opportunities during strong bull markets, frustrating investors seeking higher returns.

Finally, the strategy’s complexity can be a hurdle. It’s not always easy for investors to understand or stick with, especially during periods of underperformance compared to simpler approaches. This can lead to abandoning the method at the worst possible time, undermining its long-term effectiveness. These limitations underscore the importance of carefully evaluating whether risk parity aligns with your investment goals and risk tolerance.

3. Kelly Criterion

The Kelly Criterion is a mathematical formula designed to calculate the optimal position size based on the probability of success and the potential payoff. Created by John Kelly Jr. in 1956, this method is now widely used to guide investment decisions, aiming to maximize long-term growth while keeping risk in check.

The formula, f = (bp - q) / b, determines the fraction of capital to allocate. Here, b represents the odds, p is the probability of winning, and q is the probability of losing. In the world of investing, this translates into deciding how much of your portfolio to allocate to an asset, factoring in its expected return and associated risks.

Risk Control

One standout feature of the Kelly Criterion is its built-in risk management. Unlike fixed-percentage allocation methods, it adjusts position sizes dynamically. When the odds are less favorable, it reduces allocation, and when the odds improve, it increases the position size. This approach balances both potential gains and risks, ensuring that you don’t overextend on any single position.

For instance, in scenarios where expected returns are low or the risk-adjusted performance of an asset is poor, the formula automatically cuts back on allocation. This eliminates emotional decision-making and enforces a disciplined approach, which can be particularly helpful in volatile markets.

However, the Kelly Criterion isn’t without its challenges. Its “full Kelly” approach often suggests position sizes that might feel overly aggressive for many investors. To address this, a fractional Kelly approach is commonly used, where only 25% to 50% of the suggested allocation is applied. This adjustment reduces volatility while still retaining the benefits of the formula’s principles.

Complexity

Using the Kelly Criterion effectively requires detailed analysis and constant updates. You need accurate estimates of expected returns, probabilities of success, and potential losses for each asset. These inputs often involve complex modeling or subjective judgment, making them difficult to obtain.

The complexity increases further in multi-asset portfolios, where correlations between assets play a significant role in overall risk. Since the formula assumes independent bets, its effectiveness diminishes when assets are interrelated, especially during periods of market stress. This interconnectedness can make the theoretical optimization less reliable in practice.

Additionally, the formula demands frequent recalculations. As market conditions change, expected returns and probabilities shift, requiring ongoing adjustments to maintain optimal allocations. This makes the Kelly Criterion more suitable for quantitative investors with access to advanced tools and strong mathematical expertise, as opposed to individual investors managing diversified portfolios.

Suitability for Multi-Asset Portfolios

The Kelly Criterion can be applied to multi-asset portfolios, but its aggressive nature makes it better suited for concentrated portfolios with a few well-researched positions. It works best when you can make accurate predictions about individual asset performance, which is often easier for professional traders or hedge funds with access to sophisticated models.

For individual investors, applying Kelly across a wide range of asset classes with varying risk profiles and time horizons can be challenging. The formula tends to favor assets with higher expected returns and lower volatility, which may lead to concentrated positions. While this can boost returns if the analysis is correct, it can also reduce diversification - a key goal for many multi-asset investors.

Drawbacks

The Kelly Criterion’s biggest limitation lies in its reliance on precise input estimates. Even small errors in forecasting expected returns or probabilities can lead to suboptimal or overly risky position sizes. Since these estimates often rely on historical data or subjective assumptions, they may not accurately reflect future performance.

Another issue is the potential for extreme portfolio allocations. The formula can suggest highly volatile positions, which may lead to significant losses during market downturns. This volatility often causes investors to abandon the strategy at the worst possible times, negating its theoretical benefits.

Frequent rebalancing is another drawback. Constant adjustments to maintain optimal positions can rack up transaction costs and tax liabilities, especially in taxable accounts. These additional costs are not accounted for in the formula and can erode the benefits of the strategy.

Lastly, the Kelly Criterion assumes that future returns follow predictable probability distributions. However, financial markets are often unpredictable, with black swan events and structural changes rendering historical data irrelevant. During such periods, the formula may suggest allocations that are poorly suited to the new market environment, diminishing its reliability when it’s needed most.

4. Equal Weighting

Equal weighting spreads your investment capital evenly across all assets in a portfolio. Unlike market-cap-weighted strategies, which prioritize larger companies, this method gives every asset an equal say in the portfolio’s performance, regardless of its size or market value.

By doing so, equal weighting shifts the focus away from dominant large-cap companies and redistributes it more evenly across smaller-cap stocks. This approach is built on the idea that each asset deserves an equal share of influence, creating a more balanced exposure across the portfolio.

Risk Control

One of the key benefits of equal weighting is its ability to reduce concentration risk. Instead of having your portfolio heavily influenced by a handful of mega-cap companies, this method spreads the risk more evenly. The result? Broader exposure across industries and sectors, which can help prevent any single asset from having an outsized impact on your returns.

But while it reduces reliance on large-cap stocks, it doesn’t eliminate risk altogether. As experts have pointed out:

“Equal-weighting changes the risks – it doesn’t remove them.”

This strategy tends to increase exposure to smaller, more volatile stocks. While smaller stocks can boost performance during market recoveries, they also come with greater price swings. Historically, this has led to higher overall portfolio volatility. Equal-weighted portfolios often shine during market rebounds, as smaller stocks tend to recover faster, but they may lag during downturns when investors gravitate toward the stability of larger companies.

Complexity

At first glance, equal weighting seems simple - just divide your capital equally among all assets. There’s no need for advanced math or complex modeling, making it conceptually straightforward.

However, the simplicity comes with operational challenges. Equal-weighted portfolios require frequent rebalancing to maintain their allocations, which can result in higher transaction costs and potential tax implications. For example, over the past decade, the S&P 500 equal-weight index experienced more than five times the two-way turnover of the S&P 500 market-weight index. This higher turnover can add to the complexity and cost of managing the portfolio.

Suitability for Multi-Asset Portfolios

Equal weighting can be a great fit for multi-asset portfolios, especially if you’re looking to avoid the pitfalls of predicting which assets will outperform. It’s particularly appealing for investors who value broad diversification and want to minimize the concentration risks that come with market-cap-weighted strategies.

Research supports its effectiveness. A study updated through 2023 found that the equally weighted portfolio remains a tough benchmark to outperform. Even during major market disruptions like the 2008 financial crisis and the COVID-19 pandemic, equal weighting delivered competitive risk-adjusted returns.

That said, the approach works best when paired with thoughtful asset selection. Picking assets that truly diversify across industries, sectors, and asset classes is crucial. Equal weighting ensures that each selected asset has a meaningful impact on your portfolio’s overall performance.

Drawbacks

The biggest downside of equal weighting is its departure from how the market naturally allocates capital. While market-cap-weighted portfolios reflect the actual composition of the market, equal-weighted portfolios create an artificial structure that doesn’t align with broader market dynamics.

Another issue is unintended factor exposures. Equal weighting tends to tilt toward small-cap and value stocks while reducing exposure to momentum. While this isn’t inherently bad, it means you’re taking on specific factor risks, whether you’re aware of it or not.

Market conditions can also pose challenges. When large-cap stocks or certain sectors dominate, equal weighting may underperform because it prevents your portfolio from fully benefiting from those trends. This can lead to frustration during periods of underperformance, testing your discipline to stick with the strategy. Abandoning the approach during these times can be tempting but often leads to exiting at the worst possible moment.

In short, equal weighting is a strategy that requires a clear understanding of its risks and rewards, as well as the discipline to maintain it through market cycles.

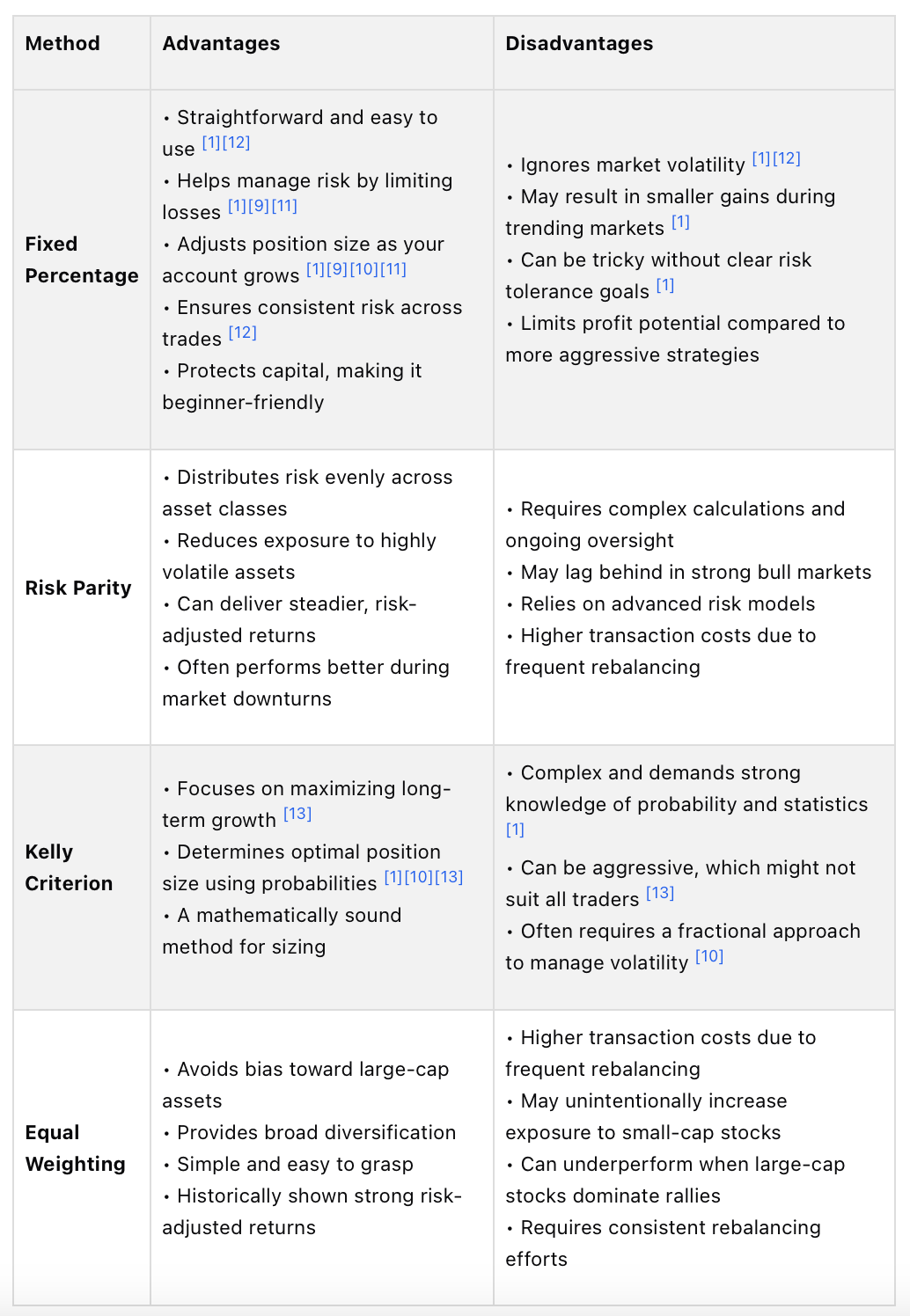

Advantages and Disadvantages

Each position sizing method comes with its own pros and cons, which can significantly influence your portfolio’s performance and risk profile. By understanding these trade-offs, you can select the approach that aligns best with your investment goals and risk tolerance. Below is a comparison of key factors like ease of use, risk management, and adaptability to market conditions.

This breakdown highlights how each method performs under different market conditions, helping you evaluate their fit for your portfolio.

Simplicity vs. Effectiveness

Simpler strategies like fixed percentage and equal weighting are easy to implement but lack adjustments for market volatility. For instance, while fixed percentage methods are effective at preserving capital, they don’t account for changing market conditions, which could leave your portfolio vulnerable during periods of high turbulence.

On the other hand, more complex approaches, such as the Kelly Criterion and risk parity, aim to fine-tune portfolio performance. The Kelly Criterion calculates position sizes based on probabilities and potential returns, but its complexity makes it less accessible for most investors. Risk parity, meanwhile, redistributes risk across asset classes, offering a more balanced approach - but it requires constant monitoring and sophisticated modeling.

Adapting to Market Changes

Fixed percentage and equal weighting strategies are static, meaning they don’t respond to shifts in market volatility. In contrast, risk parity methods adjust automatically, redistributing risk to help stabilize portfolios during market stress. Similarly, the Kelly Criterion can adapt to market changes if probability estimates are updated regularly, giving it an edge in dynamic conditions.

Cost Implications

Frequent rebalancing often leads to higher transaction costs. For example, equal weighting requires regular adjustments, which can increase turnover and expenses. Fixed percentage methods, however, are generally more cost-efficient since they only require rebalancing when account capital changes. This makes them particularly appealing for long-term investors who prioritize keeping costs low while preserving capital.

Matching Methods to Investor Profiles

The right position sizing method depends on your experience and objectives. Fixed percentage sizing is ideal for beginners due to its simplicity and focus on capital preservation. More seasoned investors, however, might prefer strategies like risk parity or a fractional Kelly approach, which offer greater precision and adaptability. By aligning your method with your expertise and risk tolerance, you can build a portfolio that performs consistently across various market cycles.

Conclusion

Position sizing plays a key role in portfolio management, yet it often doesn’t get the attention it deserves. The four methods we’ve discussed - fixed percentage, risk parity, Kelly Criterion, and equal weighting - each bring unique ways to manage risk in multi-asset portfolios. However, no single method works perfectly for everyone or every situation.

Your choice should align with your experience, risk tolerance, and investment goals. For beginners, fixed percentage approaches are often a good starting point. They’re simple to apply, help safeguard capital, and don’t demand constant oversight. For seasoned investors, risk parity strategies can be particularly useful in volatile markets, though their complexity means they’re best suited for those comfortable with active portfolio management. The Kelly Criterion is mathematically precise, but many investors find that a fractional Kelly approach strikes a better balance between risk and reward. Meanwhile, equal weighting offers simplicity and diversification, making it an appealing option for those seeking a straightforward strategy.

Interestingly, many successful investors blend these methods rather than sticking rigidly to one. For example, you might use fixed percentage sizing for your core holdings while applying risk parity techniques to smaller, more opportunistic positions. Or you could combine equal weighting with adjustments inspired by the Kelly Criterion across different asset classes.

Remember, position sizing is just one piece of the broader risk management puzzle. Regular portfolio reviews, clear investment goals, and disciplined rebalancing are equally important. The key is to develop a system that you can apply consistently over time, regardless of market conditions.

To explore structured, rules-based approaches to portfolio management, resources like The Predictive Investor can offer helpful frameworks. Ultimately, the best approach is one that aligns with your skills, comfort level, and long-term objectives - and that you can stick with, even when markets get tough.

FAQs

What is the best way to choose a position sizing method that matches your risk tolerance and investment goals?

When deciding on a position sizing method, the first step is to evaluate your risk tolerance and investment goals. One popular strategy is to risk a small, fixed percentage of your portfolio - usually between 1% and 3% per trade. This approach helps limit potential losses while staying within your personal comfort zone for risk.

You’ll also want to think about how much loss you can handle - both emotionally and financially. Strategies like fixed percentage risk or adjusting position sizes based on market conditions can strike a good balance between risk and reward. By tailoring your method to fit your objectives and market perspective, you set yourself up for a sustainable and effective investing strategy.

What challenges and costs should investors consider when using risk parity in a multi-asset portfolio?

Implementing risk parity in a multi-asset portfolio isn’t without its hurdles. One of the primary concerns is the use of leverage. While leverage is meant to even out risk across assets, it can also magnify losses when markets take a downturn, making it a double-edged sword.

Another challenge lies in the reliance on historical risk data. Markets are unpredictable, and past risk levels don’t always mirror future volatility, which can undermine the strategy’s effectiveness.

Liquidity constraints and changing market dynamics also come into play. These can lead to higher transaction costs and limit the portfolio’s ability to adapt quickly. Such issues tend to become more pronounced during periods of rising interest rates or when markets face significant stress. Addressing these challenges head-on is vital to successfully applying this strategy.

How does the Kelly Criterion handle correlations in a multi-asset portfolio, and what are the potential risks of using it?

The Kelly Criterion integrates correlations within a multi-asset portfolio by leveraging the mean and covariance of asset returns. This method evaluates how assets interact with one another, aiming to find optimal position sizes that balance diversification and long-term growth potential.

That said, using the Kelly Criterion isn’t without its challenges. It heavily depends on accurate estimates for inputs like expected returns and correlations. If these estimates are off, it can lead to over-leveraging or excessive exposure to specific assets, which might increase volatility or even cause substantial losses. Moreover, the Kelly approach can be quite sensitive to shifting market conditions, making it less reliable in unpredictable or volatile environments.