Risk Parity vs. Traditional Portfolio Allocation

Explore the differences between Risk Parity and Traditional Portfolio Allocation strategies, focusing on risk management and performance in various market conditions.

When building an investment portfolio, you’ll likely encounter two main strategies: Risk Parity and Traditional Allocation. Here’s a quick breakdown:

Traditional Allocation (e.g., 60% stocks, 40% bonds): Focuses on dividing your money into fixed percentages across asset classes. It’s simple, easy to manage, and widely used. But most of the portfolio’s risk (up to 90%) comes from stocks, making it sensitive to market downturns.

Risk Parity: Focuses on balancing risk equally across all assets, often by increasing exposure to low-volatility assets (like bonds) and reducing exposure to high-volatility ones (like stocks). It uses leverage to achieve better risk-adjusted returns but requires more complex management and frequent rebalancing.

Key Differences:

Risk Parity spreads risk evenly, while Traditional Allocation concentrates it in stocks.

Risk Parity often uses leverage; Traditional Allocation rarely does.

Traditional Allocation is simpler but less dynamic in managing risk.

Choosing the right strategy depends on your goals, risk tolerance, and willingness to handle complexity.

Traditional Portfolio Allocation Explained

What is Traditional Portfolio Allocation?

Traditional portfolio allocation is a straightforward investment strategy that divides capital among different asset classes based on fixed percentages. A well-known example is the 60/40 model, which allocates 60% of the portfolio to stocks and 40% to bonds. The goal here is diversification - balancing risk and return. Stocks are included to drive growth, while bonds provide stability and a steady income stream.

One of the biggest draws of this approach is its simplicity. Investors decide on target allocations, invest accordingly, and periodically rebalance their portfolios to maintain these proportions. This method offers a clear and structured way to manage investments.

How Risk Works in Traditional Allocation

In traditional portfolio allocation, risk is primarily managed through diversification. For example, in a 60/40 portfolio, the stocks are the main source of volatility, while the bonds help smooth out fluctuations. The combination creates a balance that aligns with the investor’s risk tolerance. Regular rebalancing ensures that the portfolio stays aligned with its original allocation and risk profile.

History and Popularity of the 60/40 Model

The 60/40 model has been a cornerstone of investment strategies in the U.S. for decades. Its popularity comes from its straightforward application of diversification principles and its balanced approach to growth and stability. This mix has made it a go-to framework for many investors, cementing its reputation as a reliable strategy.

Risk Parity Portfolio Methods

What is Risk Parity?

Risk parity takes a different approach to portfolio construction by focusing on how risk is distributed across asset classes, rather than just allocating a fixed percentage of capital. The idea is that each asset in the portfolio contributes equally to overall volatility, creating a more balanced risk profile. This stands in stark contrast to traditional portfolios, where equities often dominate the risk profile, sometimes accounting for as much as 90% of the total risk, even when the capital allocation appears balanced.

“Risk parity (or risk premia parity) is an approach to investment management which focuses on allocation of risk, usually defined as volatility, rather than allocation of capital.” - Wikipedia

The methodology behind risk parity rests on three main pillars: measuring risk through standard deviation, adjusting position sizes inversely to their volatility to balance risk, and employing leverage when necessary. This ensures that the portfolio’s risk budget is spread evenly across various asset classes, such as equities, bonds, commodities, and inflation-protected securities.

Risk Management in Risk Parity Portfolios

Risk parity portfolios are designed to balance volatility, diversification, and leverage. This means high-volatility assets, like stocks, are assigned smaller weightings, while lower-volatility assets, such as bonds, are given larger allocations to ensure all assets contribute equally to the portfolio’s overall risk.

An asset’s contribution to risk depends on three factors: its individual volatility, its correlation with other assets, and its weight in the portfolio. Including assets with negative correlations can further enhance diversification, helping to reduce the portfolio’s overall risk.

Leverage is a key tool in risk parity strategies. Since bonds typically have lower volatility than stocks, leverage is often applied to increase the returns of these lower-risk assets, aligning their risk contribution with that of higher-volatility investments. This approach allows risk parity portfolios to achieve returns similar to equity-heavy portfolios but with less overall risk.

For example, risk parity portfolios typically achieve Sharpe ratios between 0.7 and 0.9, outperforming the 0.4 to 0.6 range of traditional 60/40 portfolios. They also tend to experience smaller maximum drawdowns, typically between 15% and 25%, compared to the 35% to 45% drawdowns seen in traditional portfolios.

This balanced approach to risk lays the groundwork for precise and consistent portfolio rebalancing.

How to Implement Risk Parity

Implementing a risk parity strategy requires a disciplined approach, relying on robust modeling and active oversight. Historical data is analyzed to measure volatility and correlations between asset classes, making this strategy more dynamic than traditional portfolio methods.

Accurate risk modeling and ongoing monitoring are essential, as market conditions constantly evolve. To maintain equal risk contributions, frequent rebalancing is often necessary. This process involves integrating data on asset volatilities, correlations, and weights to ensure the portfolio remains aligned with its risk parity goals.

Though this level of active management demands more time and effort than traditional strategies, it can deliver better risk-adjusted returns.

Risk parity portfolios also tend to include a wider range of asset categories. Beyond the usual stocks and bonds, they may incorporate credit-related securities, real estate, commodities, and Treasury Inflation-Protected Securities (TIPS). This broader diversification helps the portfolio perform well across different economic conditions.

Risk Parity vs. Traditional Allocation: Side-by-Side Comparison

Main Differences in Methods and Risk Distribution

The classic 60/40 portfolio approach focuses on dividing investment dollars into fixed percentages - 60% in equities and 40% in bonds, for example. This method prioritizes capital allocation, but it doesn’t necessarily distribute risk evenly. In reality, equities often dominate the risk profile, as mentioned earlier.

Risk parity takes a different path. Instead of focusing on where the money goes, it emphasizes how risk is spread across asset classes. The goal is to ensure that no single asset class disproportionately influences the portfolio’s overall risk. This often means increasing exposure to lower-risk assets, like bonds, while scaling back on higher-risk ones, such as equities.

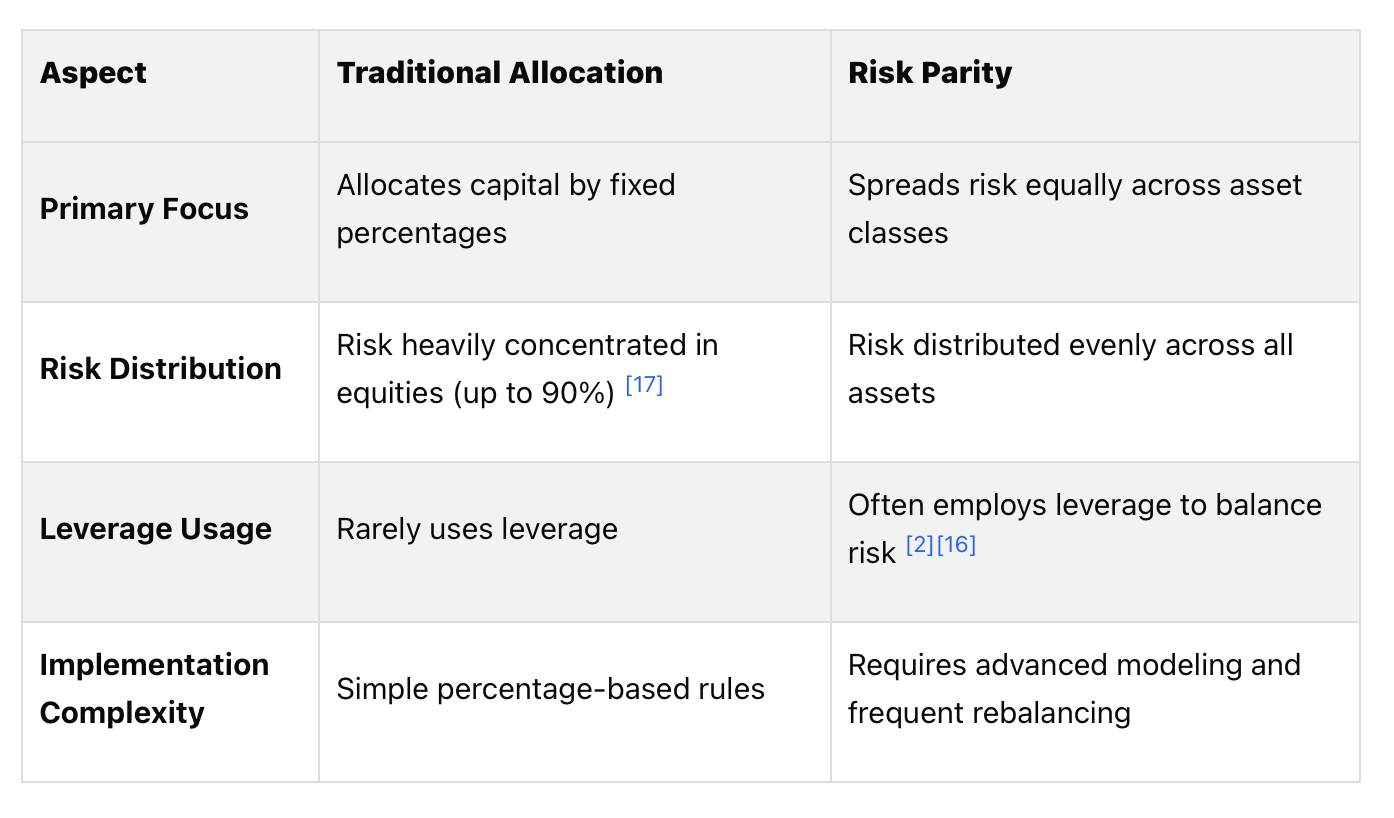

Unlike the straightforward percentage-based rules of traditional allocation, risk parity requires more advanced techniques. It relies on detailed risk modeling and regular rebalancing to maintain its balanced risk approach. The table below outlines the key differences between these two strategies.

Comparison Table: Risk Parity vs. Traditional Allocation

Performance in Different Market Conditions

The differences in risk distribution also influence how these strategies perform during market fluctuations. Traditional portfolios, with their heavy reliance on equities, can face sharp losses during market downturns. On the other hand, risk parity aims to reduce volatility by balancing risk contributions from various asset classes. This approach seeks steadier performance, even in turbulent markets.

That said, risk parity isn’t without its challenges. Because it often uses leverage, sudden shifts in asset correlations can create unexpected risks. While traditional allocation might excel in strong bull markets, risk parity is designed to deliver more consistent, risk-adjusted returns across a range of market environments.

Rethinking Diversification: Alex Shahidi on Risk Parity and the 60/40 Problem

Pros and Cons of Each Approach

Below is a breakdown of the strengths and weaknesses of both risk parity and traditional allocation strategies. Each approach offers distinct advantages and challenges, helping investors decide which aligns best with their objectives and risk tolerance.

Risk Parity: Benefits and Drawbacks

Risk parity stands out for its balanced risk exposure. Its key strength lies in distributing risk more evenly across asset classes, preventing equities from dominating the portfolio’s overall risk. This structure can lead to better diversification and potentially more consistent returns, even when markets fluctuate.

Another advantage is its flexibility. Unlike fixed dollar allocations, risk parity focuses on risk contributions, allowing it to adapt to shifting market conditions and evolving correlations between assets.

However, risk parity has its downsides. One major issue is its reliance on stable correlation assumptions, which often fail during market crises when correlations between assets tend to converge. This can undermine the diversification benefits precisely when they’re most needed.

Additionally, the strategy often uses leverage to balance exposures, which can magnify losses during adverse market conditions. It also depends on stable Sharpe ratios and requires meticulous calibration. This complexity demands sophisticated risk modeling, frequent rebalancing, and higher transaction costs, making it more resource-intensive to manage.

Traditional Allocation: Benefits and Drawbacks

Traditional allocation, such as the well-known 60/40 model, is much simpler to understand and implement. Its straightforward percentage-based rules make it accessible to most investors without requiring advanced modeling or constant adjustments.

The transparency of traditional allocation is another significant advantage. Investors can easily grasp what they own and why, without the need for leverage or complex risk calculations. This clarity makes it particularly appealing to individual investors and advisors explaining strategies to clients.

Traditional methods also boast a long performance history, offering reassurance to investors during uncertain times.

That said, traditional allocation has its limitations. It is highly sensitive to assumptions about returns, volatility, and correlations - small errors in these assumptions can lead to poor allocation decisions. The reliance on historical data is another drawback, as past performance often fails to predict future market behavior. This backward-looking approach can leave portfolios ill-prepared for emerging market trends.

Traditional strategies also struggle to account for tail risks or “black swan” events. They often assume a static investment environment, neglecting the dynamic nature of markets, economic shifts, and geopolitical events. Simplistic models for asset returns further compound the issue, as they typically assume normal distribution of returns, which rarely reflects actual market behavior.

Lastly, traditional allocation methods often overlook transaction costs and taxes, which can eat into real-world returns. Their inflexibility also makes it harder to adjust to changing market conditions, limiting diversification to a narrow range of asset classes or regions.

Implementation Guide for U.S. Investors

Deciding between risk parity and traditional allocation is just the beginning. The real work comes in implementing your chosen strategy within the U.S. market. Here, investors have to consider regulatory requirements, tax implications, and the variety of investment options available.

How to Implement Risk Parity

Risk parity involves more than just picking investments - it’s about using advanced risk modeling to calculate risk contributions across asset classes and adjusting for changes in correlations. Tools that measure volatility, correlation matrices, and covariance are essential for this process. Many individual investors rely on financial advisors or portfolio management software to handle these complexities.

Unlike traditional portfolios, which might rebalance quarterly or annually, risk parity often requires monthly adjustments to ensure each asset class maintains its target risk contribution. Additionally, many risk parity strategies use leverage to balance low-volatility assets with higher-volatility equities. If you choose this path, you’ll need to understand margin requirements and the costs of borrowing.

How to Implement Traditional Allocation

Traditional allocation is simpler and more accessible for most U.S. investors. For example, a classic 60/40 portfolio requires basic calculations and can be built using low-cost funds like the Vanguard Total Stock Market Index Fund(VTSAX) and Vanguard Total Bond Market Index Fund (VBTLX).

To implement this strategy, set target percentages for your portfolio, choose low-cost funds, and schedule periodic rebalancing. Traditional allocation typically requires less frequent rebalancing, which can improve tax efficiency. Using asset location strategies - placing investments in tax-advantaged accounts - can further enhance after-tax returns.

For an even easier approach, consider target-date funds. These funds automatically adjust allocations based on your retirement timeline, managing rebalancing internally and gradually shifting toward more conservative investments as you near retirement.

Rules-Based Investing for Portfolio Management

Whether you choose risk parity or traditional allocation, rules-based investing can streamline your portfolio management. By automating decisions about rebalancing, buying, and selling, a systematic approach removes emotional decision-making and ensures consistency.

For risk parity strategies, rules-based systems can handle the frequent rebalancing needed to maintain target risk contributions. These systems monitor changes in correlations, shifts in volatility, and deviations in risk budgets, automating adjustments to keep the portfolio on track.

Traditional allocation strategies also benefit from rules-based systems. Instead of rebalancing on a fixed schedule, you can set triggers based on percentage drift thresholds. This approach reduces unnecessary transactions while keeping your portfolio aligned with its goals.

Rules-based systems can also enhance tax-loss harvesting, identifying opportunities to realize losses for tax benefits without disrupting your portfolio’s overall structure. These systems can manage wash sale rules and suggest replacement securities automatically.

One of the biggest advantages of rules-based investing is its ability to maintain discipline during market volatility. For example, during the market fluctuations of 2020, systematic strategies helped investors avoid panic selling and capitalize on rebalancing opportunities that might otherwise have been missed.

Conclusion

Deciding between risk parity and traditional portfolio allocation comes down to matching the strategy with your personal investment goals and how much risk you’re comfortable taking on. Both methods have their strengths, but they cater to different types of investors and market scenarios.

Traditional allocation is straightforward, often relies on low-cost index funds, and offers simplicity in tax management. However, it tends to concentrate risk heavily in equities, which can be a drawback during market downturns. On the other hand, risk parity spreads risk more evenly across asset classes, aiming for steadier returns and better protection during market turbulence. That said, it’s a more complex strategy, often involving higher costs and the use of leverage, which can amplify losses in unfavorable conditions.

One crucial takeaway is that market conditions play a significant role. Traditional allocation often excels during strong equity bull markets, while risk parity can stand out in volatile periods or when asset class correlations shift unexpectedly. Neither approach works flawlessly in every scenario, making it essential to pick one that aligns with your investment philosophy and outlook.

Building on this, systematic, rules-based approaches can simplify the execution of either strategy. These systems help investors stay disciplined during market stress, automate rebalancing, and manage tax considerations efficiently. Whether you lean toward traditional allocation or risk parity, having a consistent, rules-driven framework can be invaluable.

For many U.S. investors, the choice boils down to how much complexity you’re willing to handle and your investment priorities. If you value simplicity and are comfortable with a portfolio that leans heavily on equities, traditional allocation is a solid option. If you’re seeking more advanced risk management and are prepared to navigate the added complexity, risk parity might be worth exploring.

FAQs

What are the risks of using leverage in a risk parity strategy?

Using leverage in a risk parity strategy can heighten both potential returns and potential losses. While the strategy seeks to distribute risk evenly across asset classes, it can result in notable financial challenges during market slumps.

Leverage brings liquidity risks into play, as you might require immediate access to cash or credit during turbulent times. It also raises counterparty risks and can strain cash flow, which might lead to insolvency or violations of financial agreements. These factors make navigating leveraged strategies especially tricky during periods of economic instability.

What makes risk parity a more balanced approach to portfolio allocation compared to traditional methods?

Risk parity takes a different approach to building portfolios by spreading risk more evenly across various asset classes. Traditional portfolios often lean heavily on stocks, which can concentrate risk in one area. In contrast, risk parity incorporates assets like bonds, which generally carry lower risk, to create a more balanced mix. This approach helps cushion the portfolio against market swings, delivering steadier results even during tough economic times.

Instead of focusing solely on how much capital is allocated to each asset, risk parity emphasizes balancing the risk each asset contributes. This can lead to more stable returns and improved risk-adjusted performance over the long haul. By reducing dependence on any single asset class, this strategy enhances diversification and provides a solid framework for navigating unpredictable market environments.

When might a traditional 60/40 portfolio perform better than a risk parity strategy?

When interest rates are on the rise, a traditional 60/40 portfolio can sometimes outshine a risk parity strategy. This is because higher yields can boost bond returns, something risk parity strategies might not capitalize on as effectively.

Moreover, if stocks and bonds start moving in the same direction - becoming positively correlated - the core diversification advantage of risk parity strategies can weaken. In these situations, the straightforward nature of a 60/40 allocation might offer greater stability and reliability.