Sector Rotation Strategies with ETFs and Funds

Explore sector rotation strategies using ETFs and mutual funds, comparing their costs, flexibility, and management styles to enhance your investment approach.

Sector rotation is about shifting investments between different sectors based on economic trends. ETFs and mutual funds make this process easier by offering exposure to entire sectors without picking individual stocks. Here’s what you need to know:

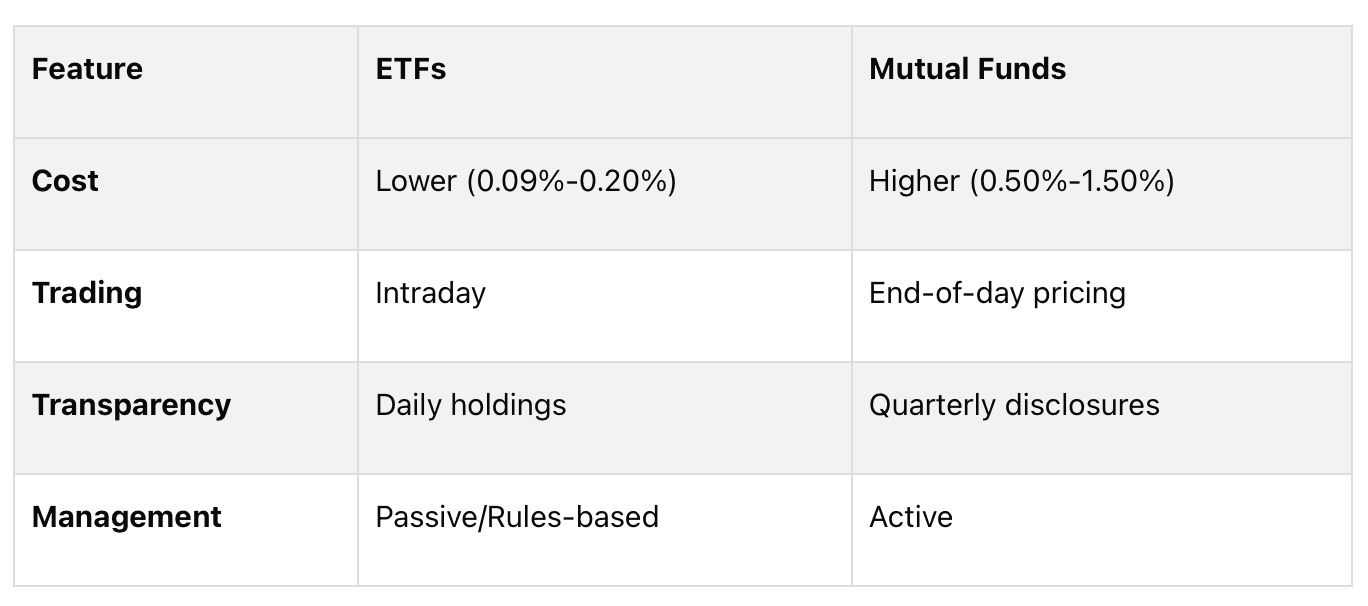

ETFs: Lower fees (0.09%-0.20%), intraday trading, and daily transparency. Ideal for active investors who adjust portfolios frequently.

Mutual Funds: Higher fees (0.50%-1.50%), end-of-day pricing, and professional management. Better for long-term investors who prefer active management.

Key Difference: ETFs are cost-effective and flexible, while mutual funds focus on active management but come with higher costs and less trading flexibility.

ETFs are often better for those seeking lower costs and flexibility, while mutual funds suit those valuing professional management. Pick based on your style and goals.

What Are The Best ETFs For Sector Rotation? - Learn About Economics

1. ETFs for Sector Rotation

ETFs have become a popular choice for investors looking to implement sector rotation strategies. They simplify the process by offering direct exposure to specific sectors, eliminating the need to research and pick individual stocks.

Cost and Fees

One of the key benefits of using ETFs for sector rotation is their low cost. Broad sector ETFs typically charge expense ratios ranging from 0.09% to 0.20% annually, which is far lower than the fees associated with actively managed mutual funds, often exceeding 1% per year.

Additionally, most major U.S. brokers now offer commission-free trading, further reducing costs for investors who frequently adjust their portfolios. That said, it’s important to watch out for bid-ask spreads, particularly with smaller or niche sector ETFs, as these can quietly add to your trading expenses.

Liquidity and Flexibility

ETFs stand out for their intraday liquidity. Unlike mutual funds, which only settle at the end-of-day price, ETFs can be traded throughout the day, giving you the flexibility to respond to market shifts as they happen.

High trading volumes in major sector ETFs - often reaching millions of shares daily - ensure tight bid-ask spreads and make it easy to enter or exit positions. This liquidity is a major advantage for investors aiming to adjust their portfolios based on economic signals. For example, if economic data suggests a shift from expansion to contraction, you can promptly switch from cyclical technology ETFs to more defensive utility ETFs without waiting for the market to close.

This liquidity also plays a critical role in how performance models manage the balance between returns and risk in sector rotation strategies.

Performance and Risk

Sector rotation strategies often rely on systematic models to optimize ETF performance. For instance, the iQUANT.proETF Sector Rotation Model uses a disciplined approach. It starts with 11 sector ETFs and an inverse S&P 500 ETF, filters out those trading below their 9-month moving average, ranks the remaining ETFs by long-term momentum, and selects the top five. If fewer than five sectors meet the criteria, the remaining allocation shifts to a Treasury Bill ETF. This portfolio is rebalanced quarterly in February, May, August, and November.

Another example is Logical Invest‘s Momentum Rotation strategy, which keeps things simple by allocating 70% to SPY (the S&P 500 ETF) and 30% to the sector ETF showing the highest three-month momentum, rebalancing monthly. Even this straightforward momentum-based approach can potentially outperform a traditional buy-and-hold strategy.

However, the success of ETFs in sector rotation depends heavily on timing. Poor timing can lead to increased portfolio volatility and underperformance, as market conditions can change rapidly. It’s also worth noting that past performance is no guarantee of future results.

Risk management is crucial in sector rotation strategies. Some models advocate shifting to cash or Treasury ETFs during widespread market downturns instead of staying fully invested in equities. The Main Sector Rotation ETF (SECT)takes this a step further by dynamically rotating among sectors based on valuation and market trends. This approach aims to outperform the S&P 500 during bullish markets while reducing losses during downturns.

2. Mutual Funds for Sector Rotation

Mutual funds bring active management and sector-specific strategies to the table, offering a distinct approach to sector rotation compared to ETFs. While both aim to provide sector exposure, mutual funds take a more managed, long-term route. Their structure introduces unique considerations, especially when it comes to cost, liquidity, and performance - key factors that can influence their role in a sector rotation strategy.

Cost and Fees

Sector-focused mutual funds often come with higher costs compared to ETFs. Their expense ratios typically range from 0.50% to over 1.50% annually, depending on whether the fund is actively or passively managed. This difference can add up over time, especially when compared to the generally lower costs associated with ETFs.

On top of that, mutual funds may include additional charges like front-end or back-end loads (ranging from 3% to 5.75%) and other fees such as 12b-1 fees, redemption fees, or transaction fees. For investors who frequently rotate between sectors, these fees can significantly eat into returns. In contrast, ETFs often benefit from commission-free trading offered by many brokers, making them a cost-effective option for more frequent adjustments.

Liquidity and Flexibility

One of the key limitations of mutual funds in sector rotation is their end-of-day trading structure. Unlike ETFs, which allow intraday trading, mutual funds can only be bought or sold at the end-of-day net asset value (NAV). This means investors cannot react to market changes in real time, which can be a disadvantage in fast-moving markets.

Additionally, many mutual funds impose short-term trading fees or restrictions to deter frequent buying and selling. These policies can make it harder to execute a dynamic sector rotation strategy, where quick adjustments are often necessary to capitalize on market trends.

Performance and Risk

Mutual funds often rely on active management, where portfolio managers handpick stocks within a specific sector. While this approach has the potential to generate alpha, it also adds an extra layer of uncertainty. The fund’s success hinges not only on the timing of sector moves but also on the manager’s ability to select the right stocks.

Sector rotation strategies using mutual funds can lead to higher volatility and may even underperform broader market indexes. This is partly because sectors are influenced by a variety of industry-specific factors, which can make it harder to predict performance trends.

Another challenge is the delayed disclosure of holdings. Mutual funds typically report their portfolio holdings quarterly, with a 30–60 day lag. As a result, investors may be working with outdated information, which can hinder timely adjustments to their sector allocation. Furthermore, unexpected events or shifts in economic conditions can have a significant impact on sector performance, and the inherent delay in mutual fund transactions makes it harder to respond quickly.

For investors who prefer a longer-term approach and value professional management, mutual funds can still play a meaningful role in sector rotation strategies. However, the added costs, reduced flexibility, and potential for outdated information should be carefully weighed against their benefits.

Advantages and Disadvantages

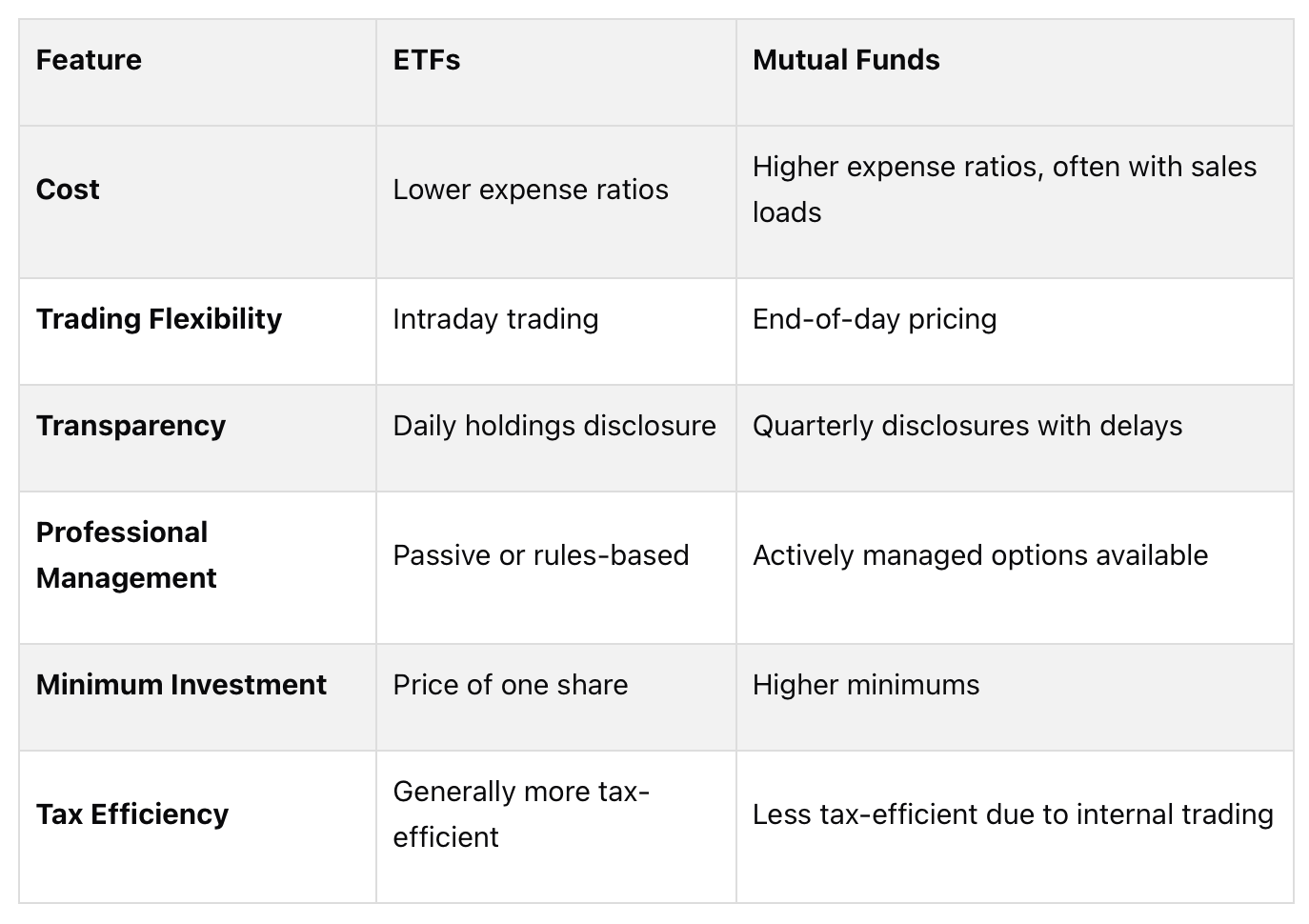

When deciding between ETFs and mutual funds for sector rotation, it’s important to weigh their strengths and weaknesses. The right choice depends on your investment approach, time frame, and sensitivity to costs. Below, we break down the key differences to help you make an informed decision.

ETFs stand out for their flexibility and low costs. They allow intraday trading, so you can respond quickly to market shifts - an advantage for tactical sector adjustments. ETFs also come with lower expense ratios and daily holdings disclosures, making them ideal for precise sector allocation. However, trading fees and bid-ask spreads can add up, and the ease of trading might tempt some investors into overtrading, which could hurt returns due to poor timing decisions.

On the other hand, mutual funds focus on professional management but come with higher costs and less flexibility. Their expense ratios are typically higher, and some may include sales loads, which can chip away at your returns over time. The end-of-day pricing structure limits your ability to react to intraday market movements, a potential drawback during volatile periods. Additionally, mutual funds disclose their holdings quarterly, which can leave investors with less timely information. Restrictions on short-term trading further reduce their adaptability.

For investors using systematic or rules-based strategies, ETFs are often the better choice. Their lower costs and ability to execute precise timing decisions align well with disciplined, methodical investment approaches.

Ultimately, your choice will depend on your investment style. If you’re an active investor who values control over timing and costs, ETFs are likely the better fit. On the other hand, if you prefer a hands-off approach with professional management, mutual funds, despite their higher fees and reduced flexibility, might suit your needs better.

Conclusion

Deciding between ETFs and mutual funds ultimately depends on your investment goals and how you prefer to manage your portfolio. ETFs stand out for their lower costs, flexibility to trade throughout the day, and transparency, making them a strong choice for those looking to make strategic sector moves or respond quickly to market trends.

For active investors who prioritize cost efficiency, ETFs offer the ability to pivot based on economic signals. For instance, rising interest rates might make financial sectors more appealing, or strong GDP growth could point toward opportunities in cyclical industries. With ETFs, you can act on these shifts during market hours, aiming to capture gains in favorable conditions while limiting losses when markets pull back.

On the other hand, if you value professional management and are comfortable with higher fees and end-of-day pricing, mutual funds could be a better fit.

For those just starting out with sector rotation strategies, ETFs provide a practical entry point. Their lower expense ratios help you retain more of your returns, and their transparency ensures you know exactly what you’re investing in. As your understanding of market dynamics grows, you’ll likely appreciate the ability to adjust your holdings as conditions evolve.

FAQs

What are the tax efficiency differences between ETFs and mutual funds when using sector rotation strategies?

ETFs tend to be more tax-friendly than mutual funds, largely because of how they’re structured. With ETFs, the in-kind creation and redemption process helps investors sidestep capital gains taxes when shares are bought or sold within the fund. Essentially, you’re only likely to face capital gains taxes when you decide to sell your ETF shares.

Mutual funds, on the other hand, can create surprise tax bills. When securities within a mutual fund are sold, capital gains are often distributed to all shareholders - even if you haven’t sold your shares. This makes ETFs a more attractive option for investors who prioritize tax efficiency, especially when using sector rotation strategies.

What risks should I consider when timing sector rotation strategies with ETFs?

Timing is everything when it comes to sector rotation strategies. Getting it wrong - whether by entering or exiting a sector too early or too late - can mean missed opportunities or even magnified losses. Sudden changes in the economy or unexpected news events can also throw off the timing, adding another layer of complexity.

Another factor to consider is the cost of frequent trading. Constantly adjusting sector allocations can rack up transaction fees and create tax liabilities, which can chip away at your returns over time. To navigate these challenges, sticking to a rules-based strategy is key. This kind of disciplined approach helps you avoid decisions driven by emotion or speculation, keeping your strategy grounded and focused.

How can investors weigh costs and professional management when choosing between ETFs and mutual funds for sector rotation?

When choosing between ETFs and mutual funds for sector rotation, it’s important to weigh the trade-offs between cost and professional management.

ETFs are generally more affordable, thanks to their lower expense ratios, and they trade on exchanges like stocks. This makes them a flexible, cost-efficient choice for investors who prefer a hands-on, self-directed strategy. In contrast, mutual funds tend to have higher fees but offer the advantage of professional fund managers who actively manage the portfolio, making adjustments as needed.

The right choice depends on your priorities. Consider your investment goals, comfort with risk, and whether you value the lower costs and independence of ETFs or the expertise and active oversight that mutual funds provide. For those who prefer a budget-friendly, do-it-yourself approach, ETFs might be the way to go. On the other hand, mutual funds could be a better fit if you’re looking for professional guidance to navigate sector trends.