Shutdown? Markets don’t care

Investors look past politics as AI investment and rate cuts keep powering stocks.

The U.S. government shut down this week, and stocks went up anyway.

If that feels counterintuitive, it’s because investors know a shutdown won’t derail the biggest forces driving this market. The AI infrastructure buildout marches on, and expectations remain high that the Fed will continue lowering rates.

I’ll admit: I expected more volatility this fall. But the market had other plans. Instead of panic, we’re seeing resiliency. And yet, the loudest voices in the room are still calling for an AI bubble.

We may get a bubble eventually, but I don’t think we’re there yet. Here’s why…

Macro Focus

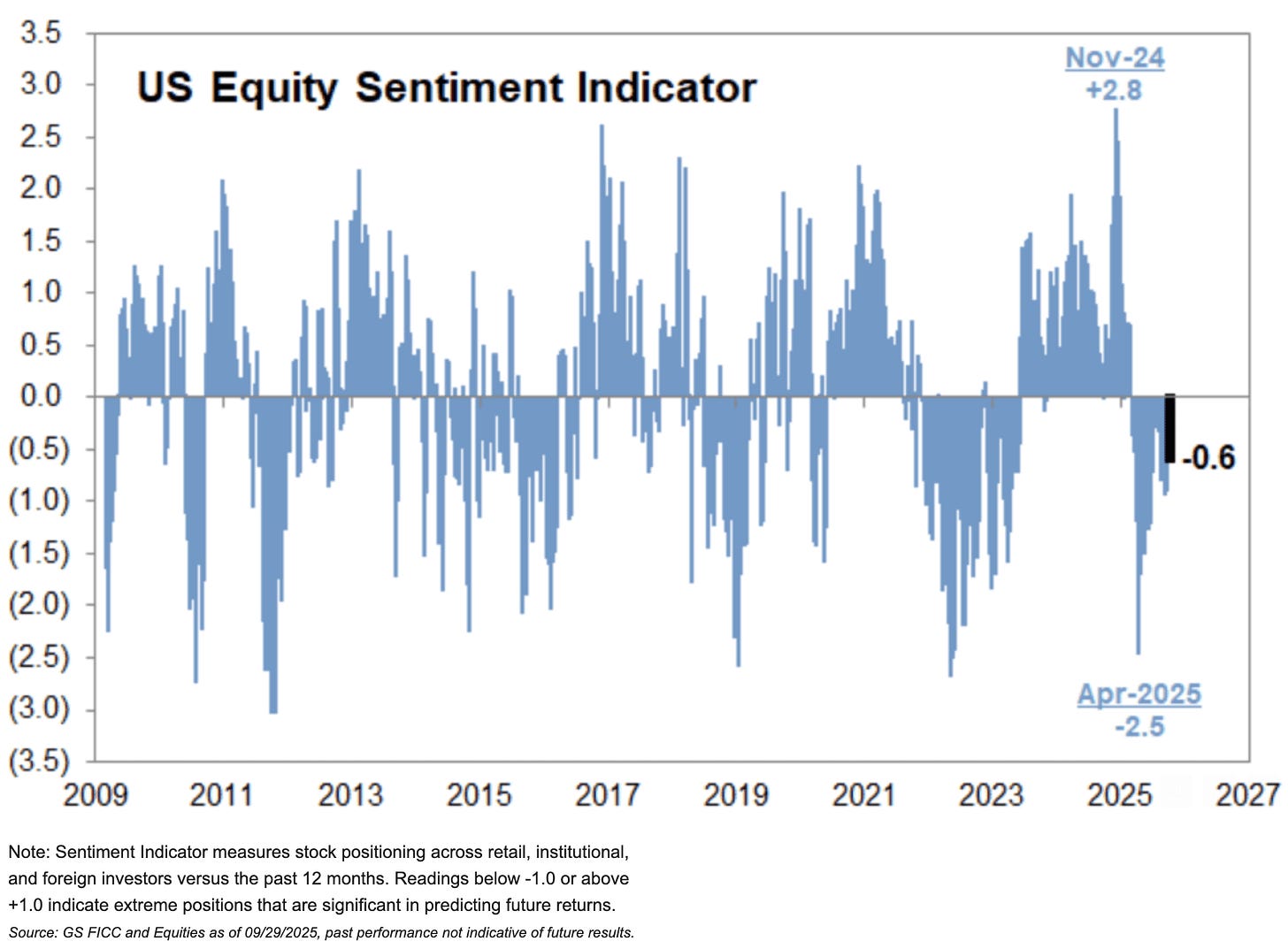

1. Institutions are still underweight stocks

Goldman’s U.S. Equity Sentiment indicator sits at -0.6, showing that institutional positioning in equities is still low. In other words, the big money is far from all-in, a clear sign we’re not at peak exuberance.

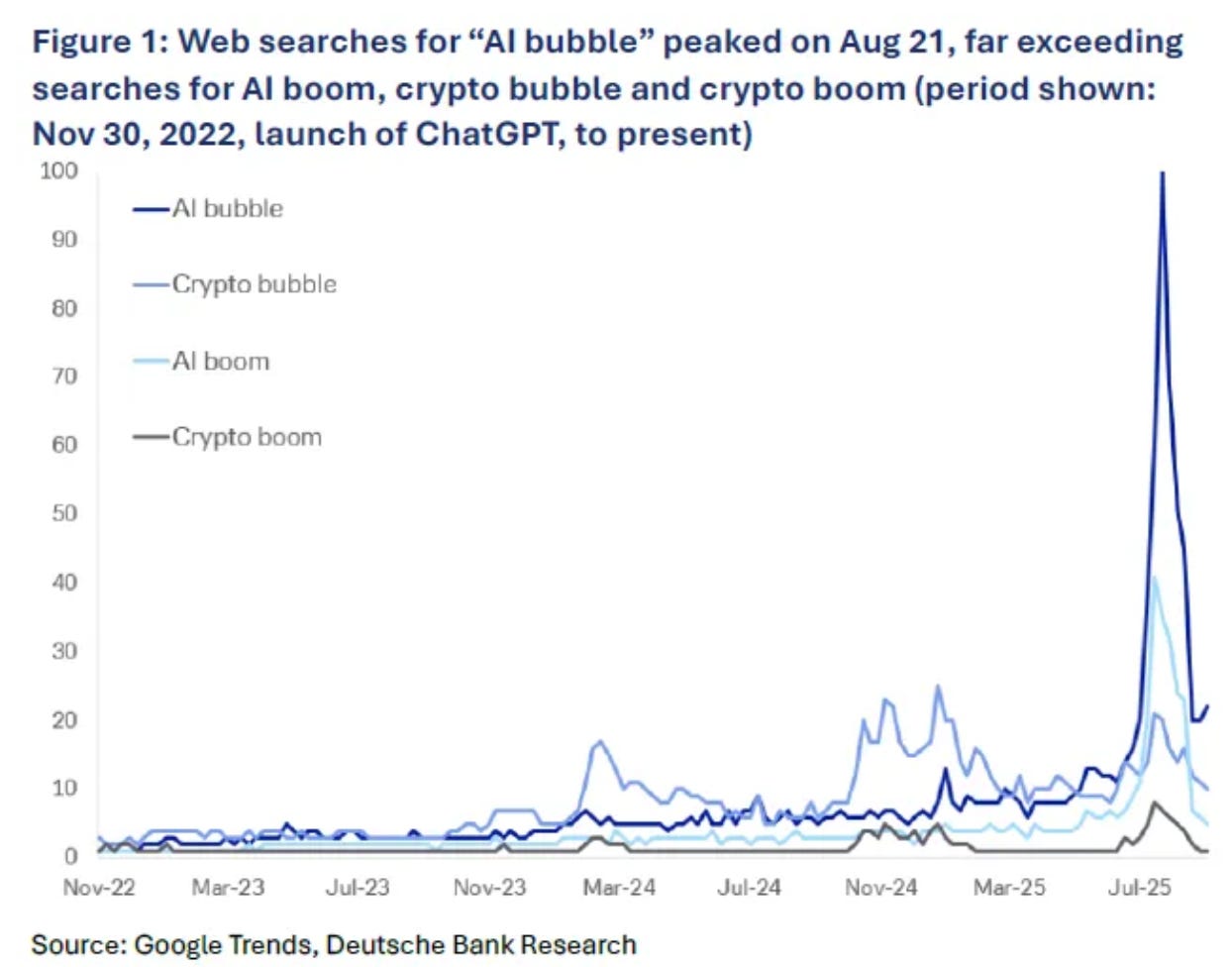

2. Bubbles don’t burst when everyone’s looking for one

Web searches for “AI bubble” hit a record in August, far outpacing searches for “AI boom.” When more people are worried about downside risk than chasing upside, that’s not the environment where markets typically top.

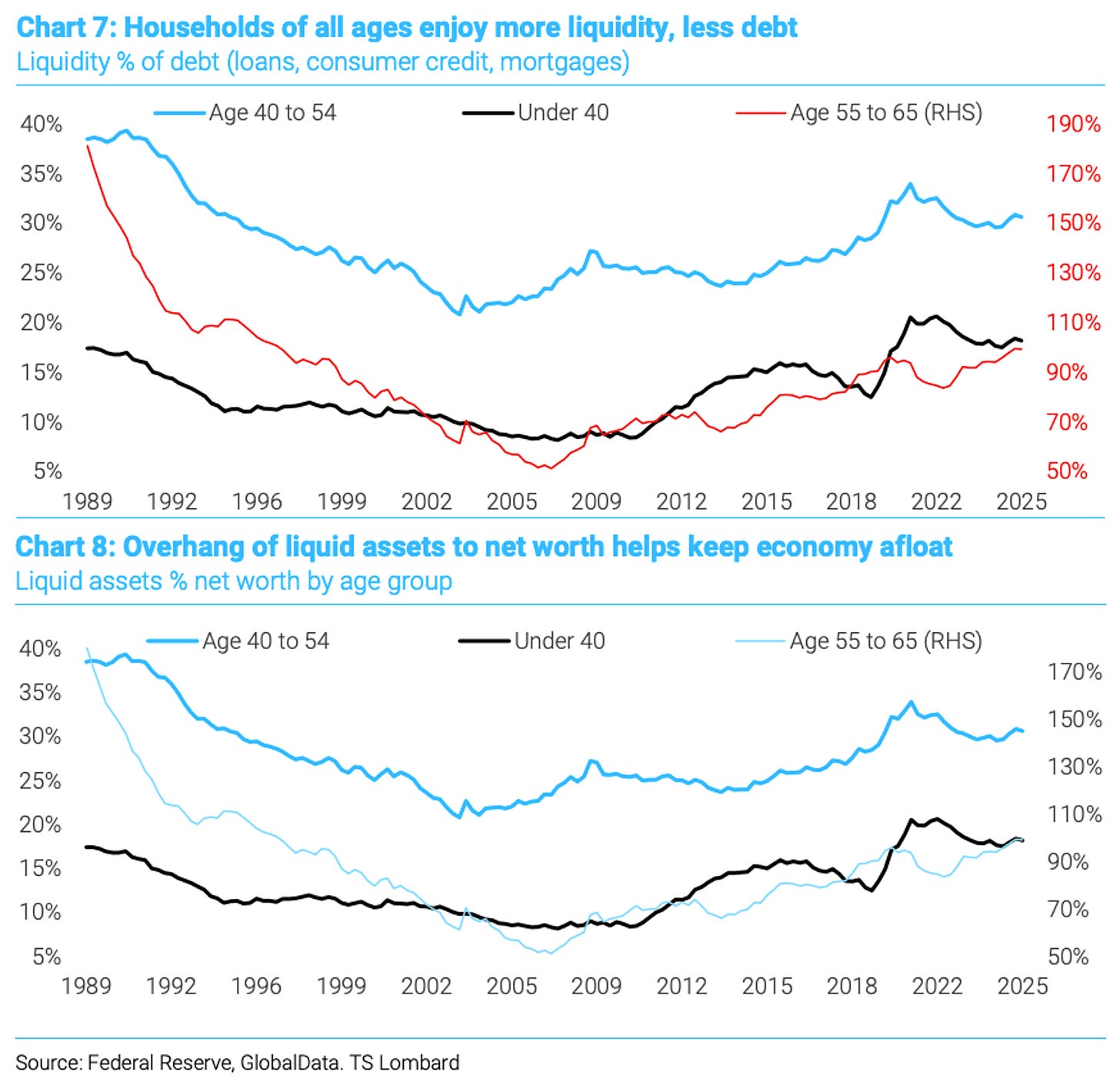

3. Retail investors still have firepower

Despite the perception that households are stretched, the data say otherwise. U.S. households still hold a large amount of liquidity relative to debt. And money market funds hold nearly $8 trillion in assets. That dry powder suggests the retail side hasn’t maxed out yet.

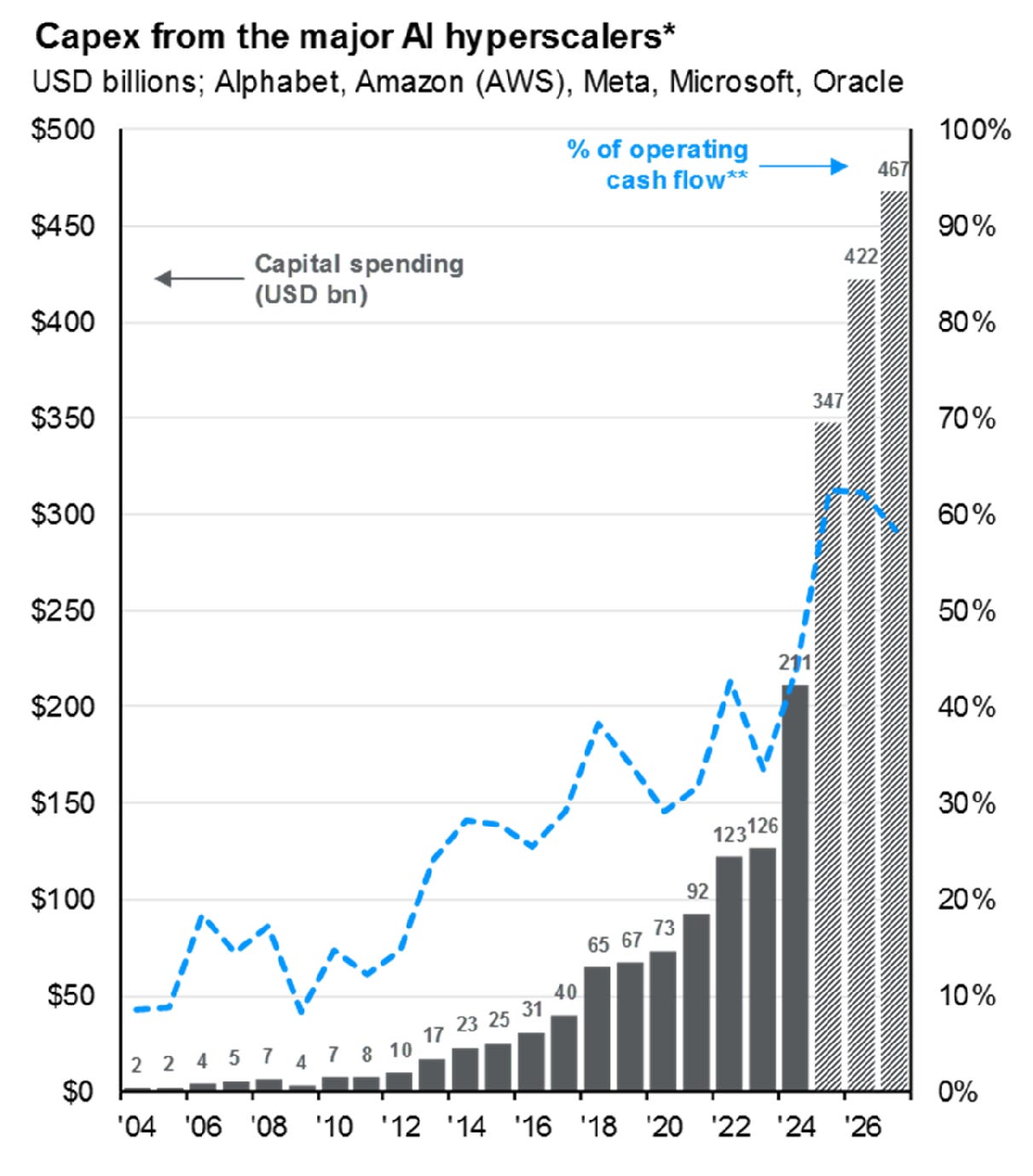

4. Hyperscaler capex will power more than just tech

JPMorgan estimates the top five mega-cap tech leaders will spend a combined $1.2 trillion on Capex between 2025 and 2027. Will they earn a return on that investment? That remains uncertain. But what is certain is the ripple effect: utilities to power data centers, industrial reshoring to support supply chains, and massive growth in data services. This isn’t just a tech story, it’s a broad, economy-wide growth cycle.

Portfolio Pulse

It was a light news week for our portfolio, but let’s talk about the big move in Palantir.

Palantir ($PLTR)

The stock took a hit Friday following a leaked Army memo flagging serious “high-risk” security concerns in a battlefield communications prototype, the NGC2 system, built in part by Palantir and Anduril. The market’s reaction was swift and the optics weren’t pretty. But the company quickly pushed back, calling the claims outdated and mitigated.

Why this doesn’t kill the thesis:

Prototypes are supposed to be tested and broken: The memo covers a development-stage prototype, not a final fielded system. Flaws at this stage are precisely what the testing phase is for. Palantir’s ability to respond, patch, and harden the system quickly is part of what distinguishes it in defense software.

Rapid rebuttal shows operational maturity: Palantir (and Anduril) didn’t stall, they pushed back publicly, claimed fixes, and reaffirmed system stability. That confidence helps preserve credibility.

Core thesis relies on scale, not perfection in every program: The bet is on Palantir’s ability to win systems integration, AI/ML, and command & control platforms at government scale, not just individual prototypes. Larger contracts, such as the U.K. AI deal and Boeing tie-ups, still stand and reflect structural trust beyond this one project.

While the memo rattled traders, it doesn’t unravel Palantir’s broader positioning as a mission-critical AI and software integrator.

Final thought

Yes, valuations in some parts of the market are extreme. But history shows valuations can remain stretched for much longer than skeptics expect. The key is sticking to a rules-based process that keeps us invested in the companies best positioned to lead. Predictions come and go—process endures.