Strong August, Weak September?

September’s “curse,” Nvidia’s strength, and why central banks keep buying gold.

September has a reputation as the worst month for stocks, and the financial media has been quick to remind investors of it. But the lesson isn’t to stay out of the market.

History shows that volatility, if it does show up, often sets the stage for the next leg higher. Last September’s pullback was a great buy point.

If you’re prepared, the noise of seasonal weakness can become an opportunity rather than a reason to retreat.

Nvidia earnings: AI spending shows no signs of slowing

Nvidia (NVDA) reported another blockbuster quarter, with results that blew past Wall Street expectations. The key takeaway isn’t just that the numbers were strong, it’s that AI-driven spending continues to accelerate across industries.

This reinforces our view that we’re still in the early innings of the AI buildout. Companies aren’t pulling back; they’re doubling down. From cloud to enterprise to governments, demand for Nvidia’s chips underscores how structural this trend is.

This is a massive tailwind for many of the companies we hold and talk about regularly, including PLTR and WLDN.

Short-term pullbacks aside, it’s hard to argue against AI being one of the most durable investment themes of the decade.

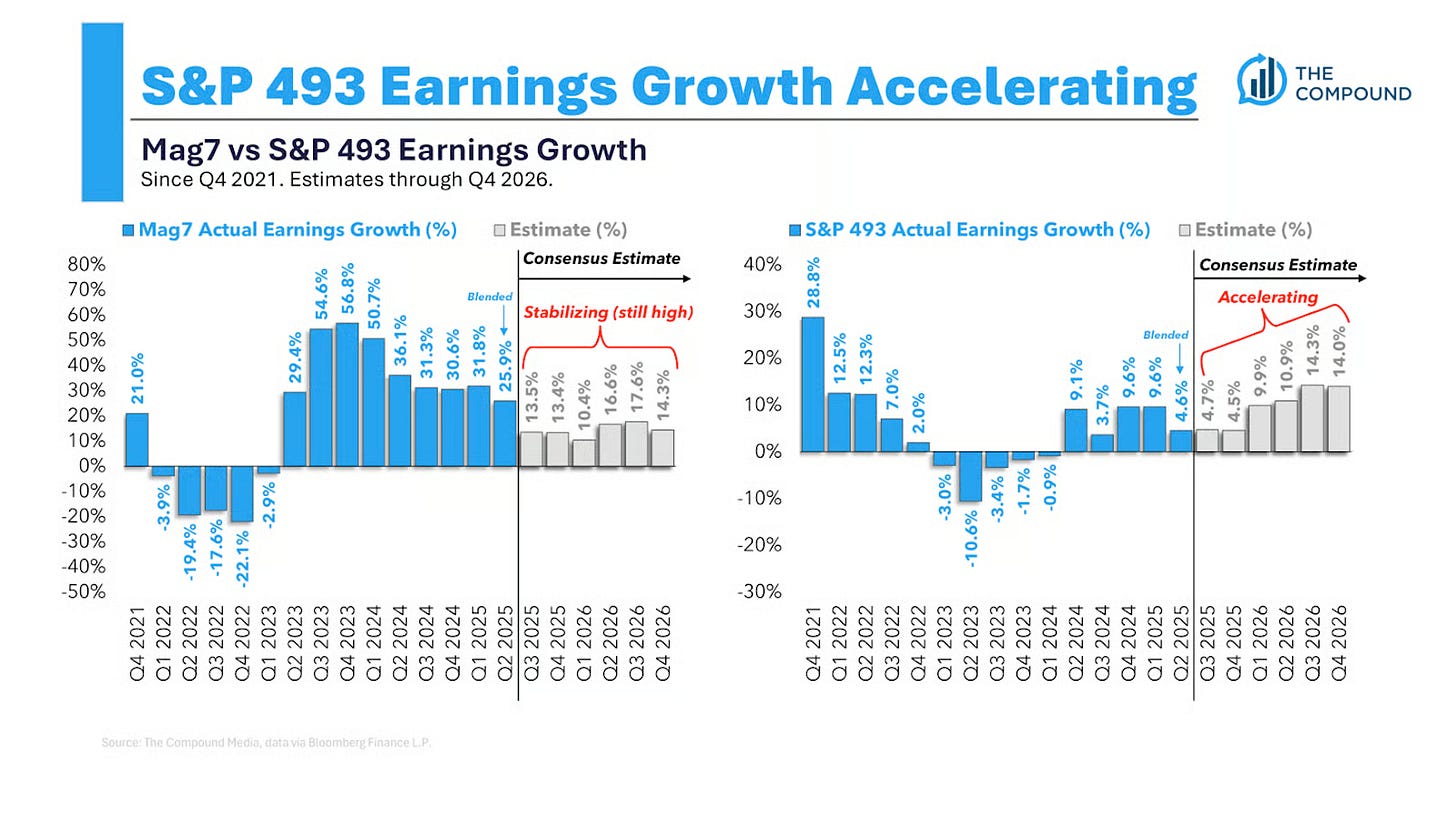

Earnings growth broadens beyond the Mag 7

While Nvidia and other mega-cap tech names dominate headlines, the broader market is quietly strengthening. Earnings growth for the “S&P 493” (the index excluding its seven largest names) is expected to accelerate in the quarters ahead.

At the same time, market breadth is improving: the average number of daily advancers in the S&P 500 is at its highest level since 2021.

That’s a strong sign that this is a fundamentals-driven market, not just a speculative frenzy like many analysts would have us believe.

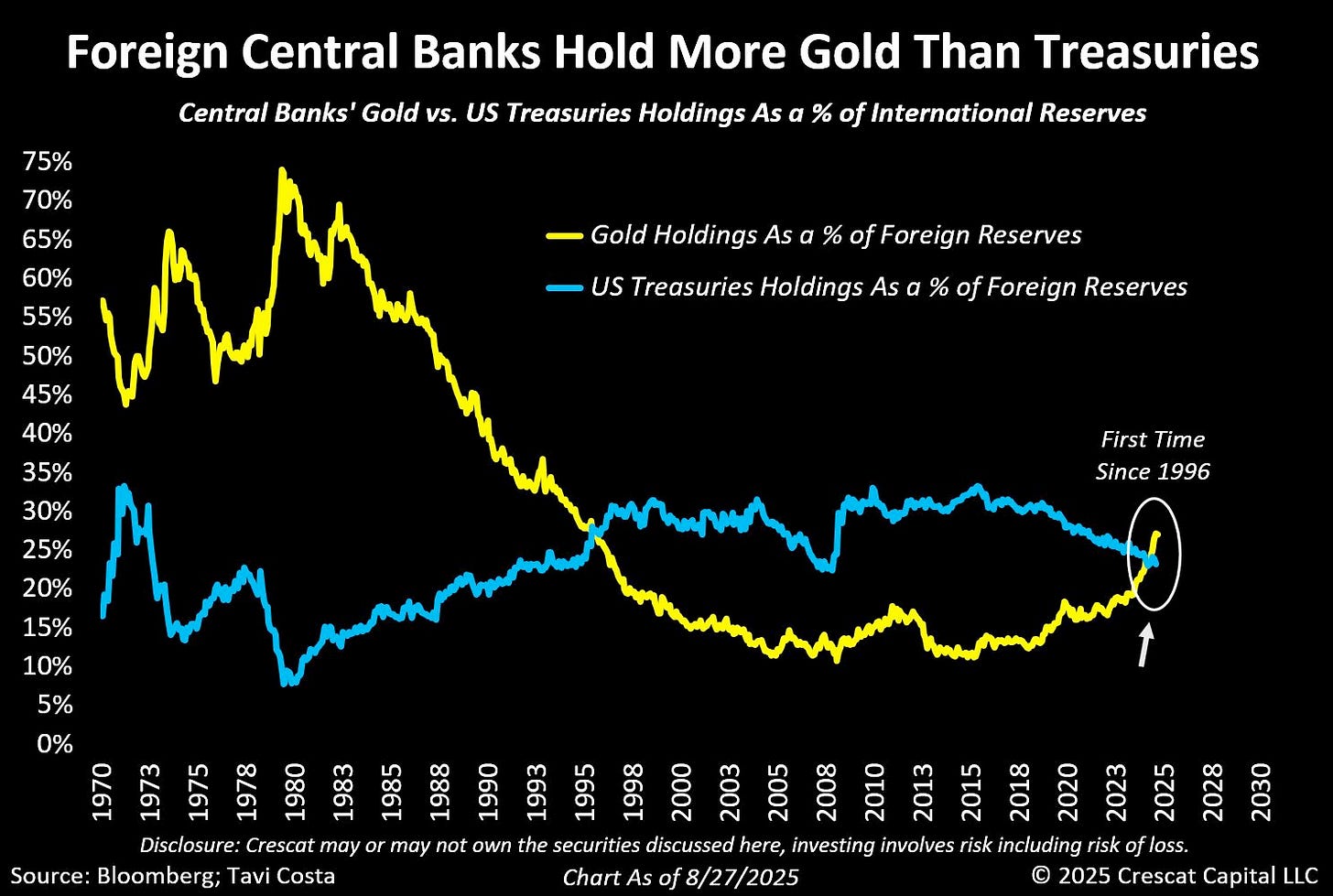

Central banks own more gold than US dollars

For the first time in decades, central banks collectively hold more gold than U.S. dollars in their reserves. That’s a striking shift, and one worth paying attention to.

Central bankers, who understand the risks of high government debt and long-term currency debasement better than most, are hedging against the erosion of fiat money’s value. This isn’t a trend that reverses overnight. It reflects a slow-moving but powerful shift in the global monetary system.

For investors, it’s a reminder that hard assets, whether gold, real estate, or commodity-linked equities, can play a crucial role in preserving purchasing power when trust in currencies wavers.

I’ve always recommended some allocation to gold to balance out volatility, but we’ve also just added a gold mining company to the portfolio to benefit from both price appreciation and leveraged upside in the sector (see this month’s portfolio review).

Trump’s push to oust Fed Governor Lisa Cook

President Trump has attempted to fire Federal Reserve Governor Lisa Cook, citing allegations of mortgage fraud. Cook has filed a lawsuit, claiming Trump lacks the legal authority to remove her. The two are duking it out in court.

While we don’t do politics here, it’s hard to ignore the market implications. Recent events have reinforced our bearish outlook on long term government debt.

The yield curve is already steepening, and if markets begin to doubt the Fed’s ability to act independently of politics, it raises the risk premium investors demand to hold long-dated Treasuries.

How to play it: one way to hedge this risk is through the Quadratic Interest Rate Volatility and Inflation Hedge ETF IVOL 0.00%↑. IVOL owns TIPS (Treasury Inflation-Protected Securities) but also holds options designed to benefit if long-term yields rise or interest rate volatility increases. In other words, it’s structured to profit if the bond market starts to question the safety of long-dated Treasuries, exactly the scenario political pressure on the Fed could trigger.

Final thought

It seems every week a new narrative surfaces that’s designed to keep investors out of the market. Recession fears, tariffs, AI bubbles, geopolitics. And yet, many of these fears turn out to be overblown.

That doesn’t mean the risks aren’t real. But the world is constantly adapting to changing circumstances.

The truth is, you’ll never get certainty in the markets. What really matters is having a process to navigate the uncertainty. Our rules-based strategy ensures we stay invested in the companies positioned to grow and adapt through the noise.

Volatility will come, and narratives will shift. But if you stay disciplined, it’s often when the market feels most uncertain that the best opportunities emerge.