The Fed’s big reveal? Nothing new

The Predictive Investor - 3/23/25

Welcome to The Predictive Investor weekly update for March 23rd, 2025!

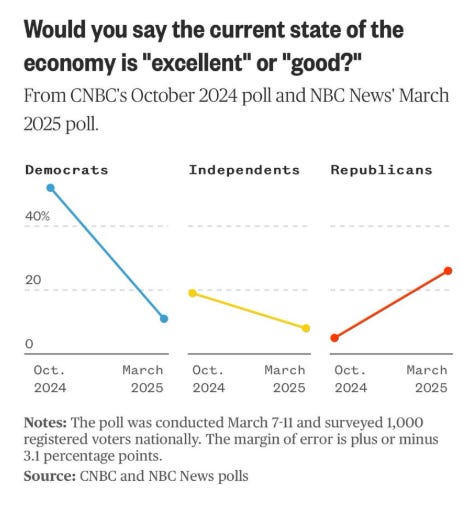

Consumer sentiment surveys continue to sit at record bearish levels, but it’s also getting harder to rely on their accuracy. Response rates have been declining for years, and responses are increasingly political.

As if that weren’t challenging enough, much of what is driving the market is beyond our control: tariffs, layoffs, cuts to government spending etc.

In times like this, it’s important to renew your focus on what you can control: stock selection and risk management.

If you’ve had a hard time dealing with the recent volatility, that’s a sign to revisit your asset allocation.

For stock selection, the uncertainty has posed both challenges and opportunities. More to come in the next Portfolio Review later this week.

Until then, here’s my takeaways from the week.

Fed declares the obvious

The Fed left the funds rate unchanged, citing increased uncertainty. They also cut their growth forecast, and increased their inflation target for the year. If that doesn’t convince you they’re simply reacting to the market I’m not sure what will.

The latest Truflation reading is at 1.79%, which means the Fed is not only behind the ball once again, but will likely have to cut rates more times than the 2 cuts their dot plots show.

Anyway, obsessing over the Fed’s every word is pointless. Our job as investors is to buy companies that will be successful despite the uncertain environment we find ourselves in.

Google makes its largest acquisition ever

The implications of Google’s $32 billion acquisition of Wiz go beyond enhancing its cloud security capabilities.

It comes on the heels of Anthropic raising $3.2 billion (read) and the UAE committing $1.4 trillion in the U.S. economy over the next decade (read).

Despite the short term uncertainty, money will continue to be available for mission-critical initiatives. And Trump’s efforts to reduce regulation will continue to bring investment into the U.S. economy and increase M&A activity, which will especially benefit smaller companies.

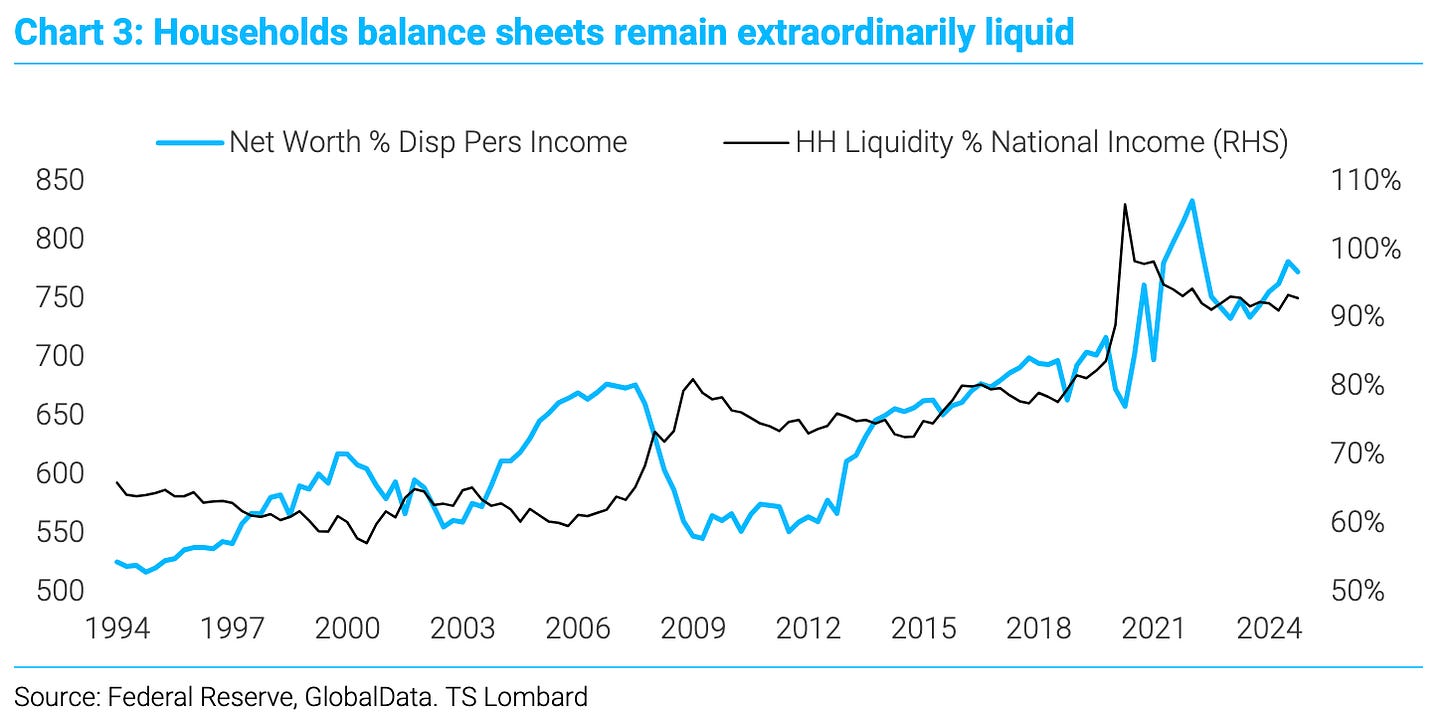

Household net worth at record levels

While fears over the economy may have caused consumers to cut back on retail spending, household net worth is still near record levels, including for lower net worth percentiles.

Ultimately, the labor market will have a much bigger impact on consumer spending than low sentiment.

The unemployment rate remains below the long term average, with job openings exceeding unemployment. And wage growth remains above inflation, which will support consumer spending and the economy.

Don’t expect an immediate rebound

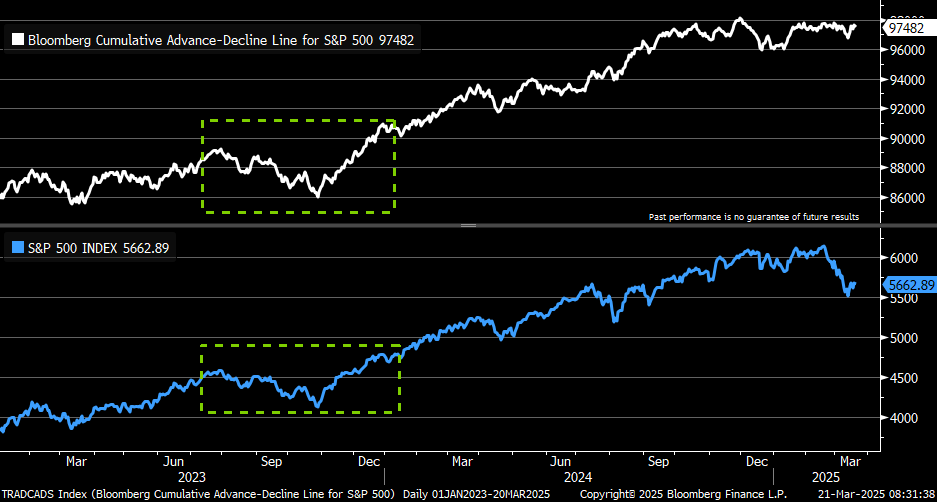

Despite extreme bearish sentiment readings and oversold technicals, we should not be surprised the market is taking some time to stabilize.

During the last correction, it took about 5 months for the index to get back to new highs.

Therefore, a U-shaped recovery is more likely. We would need a major catalyst for a faster rebound (i.e. clarity around tariff policy, or a resolution of the Ukraine war).