The Impact of Interest Rates on Your Investments

Understanding how interest rates impact stocks, bonds, and real estate can help investors make informed decisions in fluctuating markets.

Interest rates directly affect your investments, from stocks and bonds to real estate. Here's what you need to know:

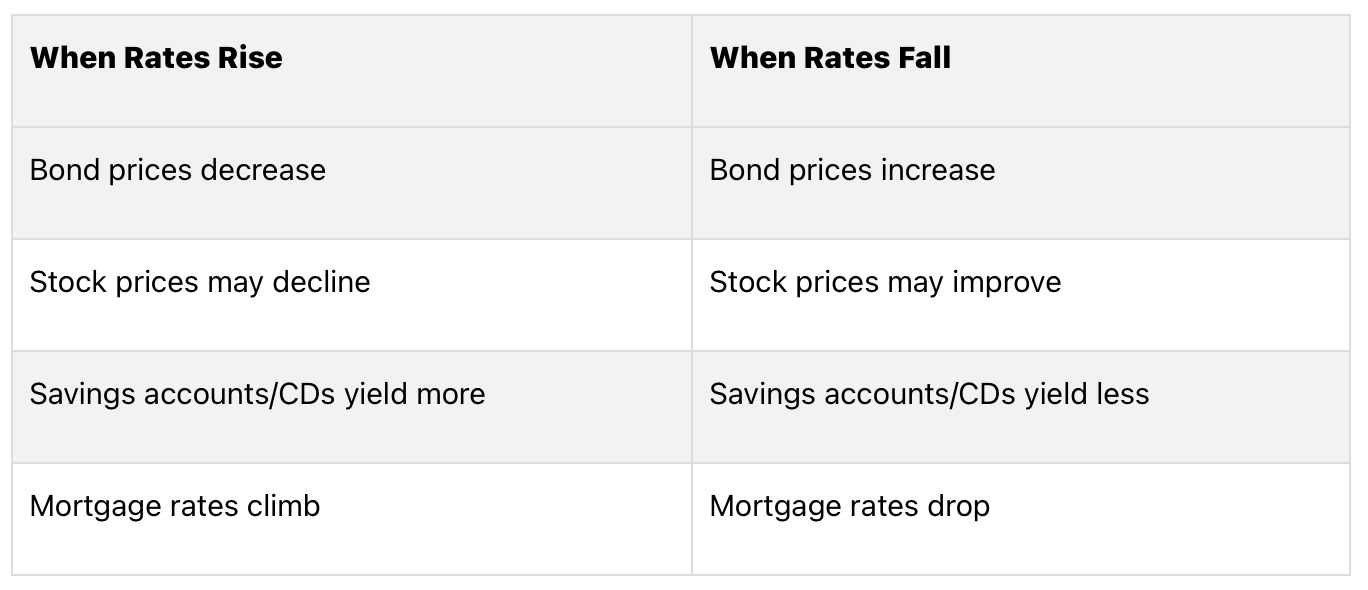

Rising Rates: Bond prices drop, stocks may decline, and mortgage rates increase. However, savings accounts and CDs offer better returns.

Falling Rates: Bond prices rise, the stock market may improve, and mortgage rates decrease. Savings accounts and CDs yield less.

Key Impact Areas:

Stocks: Higher rates increase borrowing costs for companies, potentially lowering stock valuations.

Bonds: Prices move inversely to rates; long-term bonds are more sensitive.

Real Estate: Higher rates increase mortgage costs, reducing affordability and cooling demand.

Quick Comparison Table: How Rates Affect Investments

Takeaway: Diversify your portfolio, shorten bond durations during rising rates, and focus on growth sectors when rates fall. Stay informed about Federal Reserve policies to make smarter investment decisions.

How Interest Rates Affect Your Investments: Stocks, Bonds, Real Estate | Andrew Baxter

How Interest Rates Impact Different Types of Investments

Interest rate changes don't impact all investments equally. Knowing how different asset classes respond to rate shifts can help you make informed decisions about where to allocate your money. Let’s break down how three key investment types - stocks, bonds, and real estate - react to changes in interest rates.

Stocks: The Complex Reaction to Rate Changes

Stock prices often respond in complicated ways to changes in interest rates. When rates go up, companies face higher borrowing costs, which can directly affect their valuations. For instance, Goldman Sachs Research found that a 100-basis-point change in real Treasury yields correlates with about a 7% shift in the S&P 500 forward price-to-earnings (P/E) ratio [7].

However, the reason behind rising rates plays a crucial role. As David Kostin, Chief US Equity Strategist at Goldman Sachs Research, explains:

"Equities typically appreciate alongside rising bond yields when the market is raising its expectations for economic growth but struggle when yields rise due to other drivers, like fiscal concerns." [7]

Different sectors of the stock market react differently to rate changes. For example, financial institutions such as Bank of America (BAC), JPMorgan Chase (JPM), and Goldman Sachs (GS) often benefit from rising rates because they can charge more for loans and increase their profit margins [2][6]. On the other hand, consumer staples are generally less affected by rate hikes compared to companies focused on discretionary spending [2].

Small companies, which tend to rely more heavily on borrowing, feel the pinch of higher rates more acutely. Rob Haworth, Senior Investment Strategy Director at U.S. Bank Asset Management, points out:

"It reduces or eliminates the equity market's margin for error. This is especially true for smaller companies, which are most dependent on borrowing and will face higher interest costs given persistently elevated interest rates." [4]

Larger corporations, however, often shield themselves from immediate rate volatility. 72% of S&P 500 debt is locked into fixed rates extending beyond 2028 [7], which helps them avoid a sudden increase in borrowing costs.

Bonds: The Inverse Relationship with Rates

Bonds follow a straightforward rule: when interest rates rise, bond prices fall, and when rates fall, bond prices rise[8][10]. This inverse relationship occurs because new bonds enter the market with updated yields, making older bonds with lower yields less attractive.

For instance, if new bonds offer higher yields, the price of existing bonds drops until their returns align with the current rates. Conversely, when rates fall, bonds with higher locked-in yields become more valuable.

The sensitivity of a bond's price to rate changes depends on its duration. Longer-term bonds experience greater price swings compared to shorter-term ones. A 30-year Treasury bond, for example, will react more dramatically to rate shifts than a 2-year note [8][9].

The U.S. fixed-income market is massive, accounting for 39.2% of the $128 trillion in outstanding securities worldwide [10]. This scale means that bond market movements can significantly impact investment portfolios, especially for those holding bond funds in retirement accounts like 401(k)s or IRAs.

Investors can potentially take advantage of falling rates by selling bonds before maturity when their prices rise [10]. However, timing the bond market is inherently risky [9]. A diversified bond portfolio with varying maturities can help manage this risk more effectively [9].

Real Estate: The Ripple Effects on Property Values

Real estate, a tangible asset class, is particularly sensitive to interest rate changes because most buyers rely on mortgages. Higher rates drive up monthly payments, reducing affordability and cooling demand in the housing market.

The numbers highlight this shift. The average 30-year mortgage rate has hovered near 7% as of May 2025, doubling from the near-3% rates seen in early 2022 [11]. This dramatic rise has reshaped the housing market.

For example, on a $400,000 loan, the monthly payment increased by over $1,200 as rates climbed, translating to an additional $14,400 annually [13].

Mortgage payments now consume a larger portion of household incomes, rising from 26% to 36% of a typical income [13].

This affordability crunch has created a lock-in effect, where existing homeowners are reluctant to sell. Nearly 60% of active mortgages carry interest rates below 4% [13], making it financially impractical for many to take on a new mortgage at today’s higher rates.

The commercial real estate sector faces similar challenges. Higher rates increase financing costs for developers and investors, potentially lowering property values and slowing new construction [12].

For real estate investors, strategies to navigate rate fluctuations include securing fixed-rate loans, diversifying property types, and focusing on properties that generate steady cash flow to offset higher borrowing costs [12]. Adapting to these changes can help investors manage risks and find opportunities in a shifting market.

How to Adjust Your Investment Strategy When Rates Change

Shifting your portfolio to align with rising or falling interest rates can help you navigate market changes effectively.

What to Do When Interest Rates Rise

When rates go up, it's smart to focus on reducing exposure to duration risk and targeting sectors that thrive in a higher-rate environment.

Shorten bond durations: Move from long-term bonds to short- and medium-term ones to minimize price declines. Adding floating-rate debt and TIPS can also help manage volatility [14].

Consider financial stocks: Financial companies often benefit from higher borrowing costs [2][5].

Focus on raw material consumers: Stocks of companies that heavily consume raw materials may offer opportunities [14].

Trim vulnerable sectors: Reduce holdings in industries that are negatively impacted by rising rates.

Use a bond ladder strategy: This approach can help spread out rate risk while maintaining a steady income stream [14].

David Terrell, Sales Manager at City National Securities, underscores the importance of sticking to your financial goals:

"If you have a goal-based financial plan and there is an attractive rate out there that gets you to your goal, consider taking it" [15].

When rates rise, staying flexible and goal-oriented is key to managing your investments effectively.

What to Do When Interest Rates Fall

Falling rates call for a shift toward growth-focused investments and longer-duration assets. Here’s how to adjust:

Look to dividend-paying sectors: Sectors like utilities and REITs become more appealing when their yields outshine declining bond yields [5].

Focus on large, stable companies: Companies with strong cash flows and balance sheets can take advantage of cheaper debt to refinance or fund expansion [5].

Time your bond purchases: Historical data suggests buying bonds one month before the first rate cut of a cycle can yield nearly 300 basis points of excess return compared to buying after the Fed starts cutting rates [17].

Jeff Moore, Manager of the Fidelity Investment-Grade Bond Fund, sees opportunities ahead: "I think the next 2 years could be a high total return environment for bond funds" [18].

Capitalize on capital-intensive sectors: Sectors like technology and utilities often benefit from lower borrowing costs [16].

Explore insurance opportunities: Rate cuts can create unique dynamics in the insurance sector, as explained by Yehuda Tropper, CEO and life insurance advisor at Beca Life: "In the insurance sector, rate cuts create an interesting dynamic that many investors overlook" [16].

Lower rates often drive demand for insurance products as businesses and consumers seek alternatives to lower-yielding investments [16].

Managing Risk When Interest Rates Change

Fluctuating interest rates can unsettle even experienced investors, but with thoughtful risk management, you can protect your portfolio. The key lies in understanding how different assets respond to rate shifts and preparing your investments to handle volatility.

Using Diversification to Reduce Rate Risk

Diversifying your portfolio with assets that react differently to interest rate changes is a proven way to minimize risk. When one part of your portfolio struggles, another can often help balance the impact.

While the relationship between stocks and bonds may shift over time, true diversification goes beyond just combining these two asset types. Here are some strategies to consider:

Blend bond durations: Include a mix of short-term, intermediate, and long-term bonds. Short-term bonds mature quickly and can be reinvested at higher rates when rates rise, while long-term bonds can provide stability when rates fall.

Explore alternative investments: Options like renewable energy projects or microfinance often remain steady under varying rate conditions [3].

Add geographic and sector diversity: Incorporating investments from different countries and industries can help smooth overall returns [19].

Consider active bond management: Actively managed strategies can adjust portfolios to respond to rate changes, such as shifting into shorter or intermediate-duration bonds [20].

Rob Haworth, Senior Investment Strategist for U.S. Bank, highlights the impact of rate changes:

"Changes in the interest rate shift prices for fixed income investments, either improving or diminishing total returns" [19].

Haworth also cautions against concentrating too much in one area:

"It's important to avoid adverse selection or investing a large percentage of your portfolio in a single security that proceeds to lose significant value in the market" [19].

By maintaining a balanced approach, you can prepare for a variety of market conditions, even when high-yield opportunities seem enticing.

Don't Chase High Yields Without Understanding the Risk

Diversification can mitigate risk, but chasing high yields without thorough research can lead to trouble. When interest rates are low, it’s tempting to pursue higher returns, but these investments often come with significant risks that can erode your gains.

The numbers tell the story. In 2010, high-yield bond funds attracted $75 billion in new sales, while floating-rate loan funds grew from $15 billion in 2008 to $60 billion by April 2011 [23]. Similarly, sales of structured retail products jumped 38% in 2010, increasing from roughly $33 billion to $54 billion [23].

Rick Nott, Senior Wealth Advisor at Lourd Murray, advises caution:

"Investors should always question outliers: anything that offers what seems like a higher or better return or yield than the average. There is no magic in finance, so there will always be a reason. There may be good reasons, but the higher the yield than the average, the closer you should look to find out why" [22].

High-yield investments come with several risks that can intensify during rate changes:

Credit risk: Companies with weaker financials may struggle to refinance debt as rates rise. Lisa McKnight, Managing Director at Peapack Private Wealth Management, notes:"These factors hinder consistent cash flow required for debt repayment. If the company is facing financial distress, they may prioritize other payments over bond repayments, increasing the risk of default" [22].

Interest rate risk: High-yield bonds are particularly vulnerable to rising rates, which can amplify concerns about credit quality [21].

Liquidity risk: Some high-yield investments are harder to sell quickly, which can lead to significant losses [21].

Instead of chasing high yields, focus on risk-adjusted returns. Research high-yield investments carefully, looking for strong revenue growth, profitability, and manageable debt levels [22]. Diversified funds, such as mutual funds or ETFs, can also reduce risk by spreading exposure across multiple issuers [22]. Most importantly, ensure your investments align with your financial goals and risk tolerance [21]. A well-thought-out, long-term strategy is far more sustainable than pursuing the highest available yield.

During times of rate uncertainty, yield traps - investments with high yields but weak fundamentals - become more common [22]. Stay informed about economic trends and rely on sound investment principles. By aligning your approach with these risk management strategies, you’ll not only navigate rate changes effectively but also build a stronger, more resilient portfolio.

Conclusion: Making Interest Rate Changes Work for You

Interest rates play a pivotal role in shaping the investment landscape. By grasping how these rates interact with different asset classes, you can make smarter, more proactive decisions instead of simply reacting to market shifts.

The connection between interest rates and investments is clear: when rates go up or down, markets respond quickly, influencing stocks, bonds, and real estate values [5]. This dynamic creates both risks and opportunities for investors, offering a chance to refine strategies and protect portfolios.

For example, rising rates often put pressure on stock prices but can benefit sectors like financials. Bonds typically move in the opposite direction of rate changes, and real estate values tend to follow rate trends [1]. A recent case in point: when the Federal Reserve raised the federal funds rate from 0.25% in March 2022 to a range of 5.25%–5.50% by July 2023 to fight inflation, investors who adjusted their portfolios saw rewards. Despite these rate hikes, the U.S. economy grew by nearly 3% in both 2023 and 2024 [24]. These examples underline the importance of managing risk through diversification.

Key Points for Better Investment Decisions

Adapt your strategy to the rate environment. Flexibility is crucial, as interest rates directly impact asset performance. Eric Freedman, chief investment officer for U.S. Bank Asset Management, highlights the importance of monitoring Treasury yields:

"The 10-year Treasury yield is a key barometer for risk assets such as stocks. At 4.50%, we're in a pretty good spot. If 10-year Treasury yields jump to 5% or higher, that would be more problematic" [4].

Diversify to manage risks effectively. Spread your investments across different asset types and set realistic expectations for returns. During periods of rising rates, shorter-term bonds or alternative assets may offer better opportunities. Keep in mind that real interest rates - adjusted for inflation - are what truly matter [5].

Stay informed about Federal Reserve policies and economic trends. The Fed's current stance signals a departure from pre-2022 policies. Rob Haworth, senior investment strategy director with U.S. Bank Asset Management, explains:

"The Fed isn't headed back to the pre-2022 'zero interest rate' environment. Inflation may be settling in at a higher level, in the 2.5% to 3.0% range. If that's the case, the Fed is likely to ultimately set the federal funds target rate somewhere close to 3.0%" [4].

Finally, focus on building a diversified investment plan that aligns with your financial goals and accounts for broader economic indicators [5]. Stick to your strategy and consult financial professionals to ensure your portfolio can handle short-term market fluctuations [1].

Interest rate changes will always bring both challenges and opportunities. By understanding their impact on various investments, diversifying properly, and staying informed about economic trends, you can turn rate volatility into a valuable tool for building long-term wealth. Let these principles guide you as you navigate shifts in the rate environment, ensuring your portfolio remains robust and well-prepared for the future.

FAQs

How do higher interest rates affect home affordability and the real estate market in the U.S.?

When interest rates climb, mortgage rates follow suit, driving up monthly payments for homebuyers. Even a slight increase in rates can make a big difference, shrinking the pool of households able to afford a median-priced home. This often pushes buyers to either scale back their budgets or put their home-buying plans on hold.

As borrowing gets pricier, the demand for homes tends to drop, cooling home sales and slowing market activity. Paired with already steep home prices, this adds another layer of difficulty for both buyers and sellers navigating the real estate market.

How can investors safeguard their portfolios against the impact of changing interest rates?

Investors looking to shield their portfolios from the ups and downs of interest rate changes have a few solid strategies to consider. One approach is to limit exposure to long-term bonds, as these are more vulnerable to rate hikes. Instead, focusing on short- or medium-term bonds can provide more stability. Another smart move is creating a bond ladder, which staggers bond maturities. This tactic spreads out risk and allows reinvestment at potentially higher rates as bonds mature.

Shifting some focus to equities can also be a good idea, as they might offer stronger returns in a climate of rising rates. For those seeking additional protection, floating-rate bonds or interest rate hedged strategies can help balance risk while leaving room for gains. Lastly, keeping a cash reserve on hand ensures liquidity and flexibility, giving investors the ability to react swiftly and take advantage of opportunities during volatile market conditions.

How do interest rate changes affect different stock market sectors, and how can investors adjust their strategies to benefit?

Interest rate changes affect stock market sectors in different ways, largely depending on their sensitivity to borrowing costs and overall economic trends. Take financial stocks, for instance - they often perform well when rates go up because banks can charge higher interest on loans, boosting their profits. In contrast, sectors like utilities and real estate tend to feel the pinch. Higher rates increase their debt costs, cutting into their profitability. Similarly, growth-focused sectors such as tech may come under pressure since rising rates can make their projected future earnings less appealing.

Investors can adjust their strategies to align with these shifts. When rates climb, it might make sense to lean into sectors like financials or energy, while scaling back exposure to more rate-sensitive areas like utilities or real estate. Staying informed and making thoughtful adjustments can help investors navigate these changes and manage potential risks effectively.