The Predictive Investor - 10/13/24

Expect more wildly inaccurate forecasts

Welcome to The Predictive Investor weekly update for October 13th, 2024!

The destruction we’ve seen in the wake of the hurricanes last week is devastating, and I hope all our readers out there are staying safe. It’s another reminder of the very real human impact that many of the events we talk about continue to have.

Looking now at the economic impact, the hurricanes will no doubt impact payroll numbers and other economic data in the weeks ahead, which will cause many mixed signals.

But we’ve been through this before. Since Covid, there’s been tremendous disruption in the economy, including:

Inflation

Rising interest rates

Bank failures

Unwinding of the Yen carry trade

Record deficit spending

Labor unrest and strikes

Extreme weather

Layoffs

War

This disruption has led to a barrage of wildly inaccurate economic forecasts. Most analysts are trying to get it right. But many are capitalizing on the emotional nature of these events for PR purposes.

It’s more important than ever to not allow yourself to get derailed by every little twist and turn. A rules-based approach to investing, like the one we talk about here, is critical to making rational decisions and getting consistent and predictable results.

Here’s my takeaways from the week.

Google is screwed

Last week a federal judge ruled that Google GOOG 0.00%↑ must open its app store to competitors as part of an antitrust lawsuit by Epic Games. This comes after a ruling by the U.S. District Court in August that the company has an illegal monopoly on the search engine market.

And the Justice Department is proposing a series of reforms that would essentially break up the company’s Chrome and Android businesses. (Read)

Google’s woes are being compared to what Microsoft faced in the 90s, but the situations are very different. Google’s reach is much broader, spanning mobile, search, digital ads, and app distribution. And the reforms the government is proposing are much more aggressive.

The political climate is also different this time. More than 40% of the S&P 500’s market cap is under investigation for violating antitrust laws. Expect more shoes to drop regardless of who wins the election.

And yes, I do think Google’s relative performance against tech will be very disappointing going forward.

The government’s dilemma

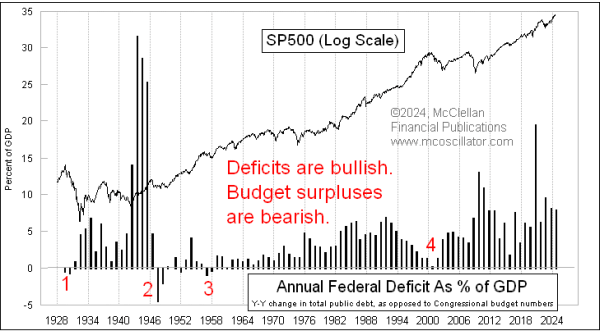

Longtime readers know I’ve been very concerned about the exponential growth of government debt. But the lack of serious proposals to get the situation under control shouldn’t be surprising.

The reality is deficit spending supports economic growth. If the government were to drastically cut spending to bring the debt under control, it would spark a recession. That’s not something either political party would accept. So the status quo continues.

Eventually this will end in crisis. Either the market will recognize that most of this debt will never be repaid back and reprice everything. Or the massive amount of money printing will severely erode the purchasing power of the dollar. More likely, it will be some combination of both of these.

This is bullish for stocks, real estate and precious metals. Very bearish for cash, bonds, and other fixed income instruments like pensions and annuities.

Manufacturing resurgence

Manufacturing jobs have now surpassed pre-pandemic levels, making this recovery the first time since the 1970s that the sector has regained all the jobs it lost in a prior recession. (Read)

This is the result of all the government incentives to reshore supply chains, something that is especially bullish for small companies, which tend to have a higher proportion of revenue from domestic activity than large caps.

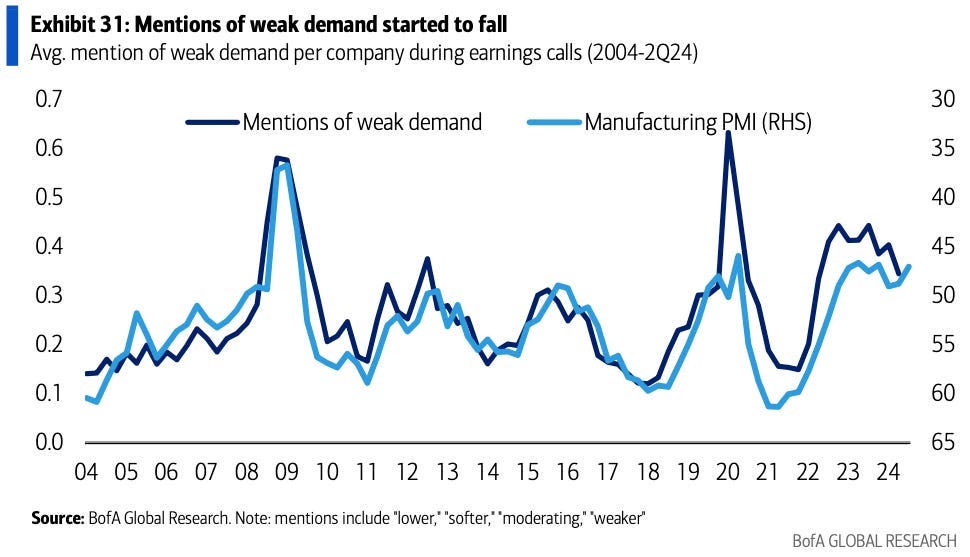

Although the job gains have been uneven, there are some signs manufacturing will continue to strengthen. Mentions of weak demand during earnings calls has been falling for two years, which is highly correlated with an increase in Manufacturing PMI.

A pair of ETFs for the ages

There’s been a steady drip of cyberattack reports for months, most recently from American Water, the largest water utility in the U.S. (Read)

According to Ponemon Institute nearly 60% of U.S. companies increased their cybersecurity budgets this year compared to 2023. And governments around the world are increasing defense spending at a rapid pace, with no slowdown in sight. These are dangerous times and security, both digital and physical, is now a massive growth industry.

Most of my work here is focused on individual companies, but for those who like ETFs here’s two picks to capitalize on the security trend: Global X Defense Tech ETF SHLD 0.00%↑ and Global X Cybersecurity ETF BUG 0.00%↑.

Both ETFs offer global diversification and focus on the tech leaders in each sector. And both have recently broken above previous resistance, with their 20 and 50-day moving averages trending up.

Stock Ratings

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

Rating changes

I changed the rating on HRTG 0.00%↑ to Sell. The stock sold off on some bad PR, along with fears over exposure to cities damaged by the recent hurricanes. While I think the selloff was an overreaction, the stock fell out of the top 50 qualifying companies outperforming the S&P 500. The stock is up more than 2X since our buy recommendation, so now is a good time to take profits.

New Addition - Willdan Group, Inc. (WLDN)

I’m adding coverage of Willdan Group, Inc. WLDN 0.00%↑ with a Buy rating. The company is a leading provider of consulting services to utilities, government agencies, and the private sector, and helps clients reduce energy consumption, optimize energy infrastructure and improve sustainability. The company has recently closed a number of large projects ranging from energy audits, infrastructure improvements and smart city initiatives. The stock is trading at a price-to-sales ratio of 1.06 vs. an industry average of 1.36 and has outperformed the S&P 500 by 60% over the last 12 months. EPS for Q2 increased 231% year-over-year and the company raised its full-year guidance. The company will continue to benefit from investment in data centers driven by AI, accelerating demand for energy, and clean energy initiatives.