The Predictive Investor - 10/20/24

IMF joins the party far too late

Welcome to The Predictive Investor weekly update for October 20th, 2024!

According to the WSJ, the IMF is confident in a soft landing for the global economy and is set to release new economic forecasts next week. You’ll have to forgive me for not rushing out to get my hands on their latest report. This is the same group that told us a third of the world’s economies would be in a recession in 2023. (Read)

The stock markets bottomed two years ago this month. September marked the 5th consecutive month of increased retail sales. Unemployment remains below the long term average. And GDP is growing at 3%.

The economy “landed” months ago, and if you’re waiting for economists to confirm the obvious before making investment decisions, you will be very disappointed.

Here’s my takeaways from the week.

The nuclear renaissance

Microsoft Azure CTO is sounding the alarm that data centers cannot handle the growth of AI. (Read)

The country will not only need data centers large enough to house hundreds of thousands of processors to handle the workloads required by AI models, but also enough energy to power them.

Big tech has turned to nuclear energy as a solution, which can provide almost limitless clean energy around the clock. And tech’s involvement is helping speed up innovation in compact reactors, which are smaller and cheaper than large power plants.

Since Microsoft MSFT 0.00%↑ announced a deal with Constellation Energy CEG 0.00%↑ a few weeks ago, nuclear stocks have been on a tear. The Sam Altman-backed Oklo Inc. OKLO 0.00%↑ doubled in value last week alone.

The nuclear trend is still in the very early stages, and I’m not ready to buy an individual stock just yet. But increased investment in data centers is a foregone conclusion. For those who like ETFs the Global X Data Center & Digital Infrastructure ETF DTCR 0.00%↑ is worth a look.

Consumers are thriving

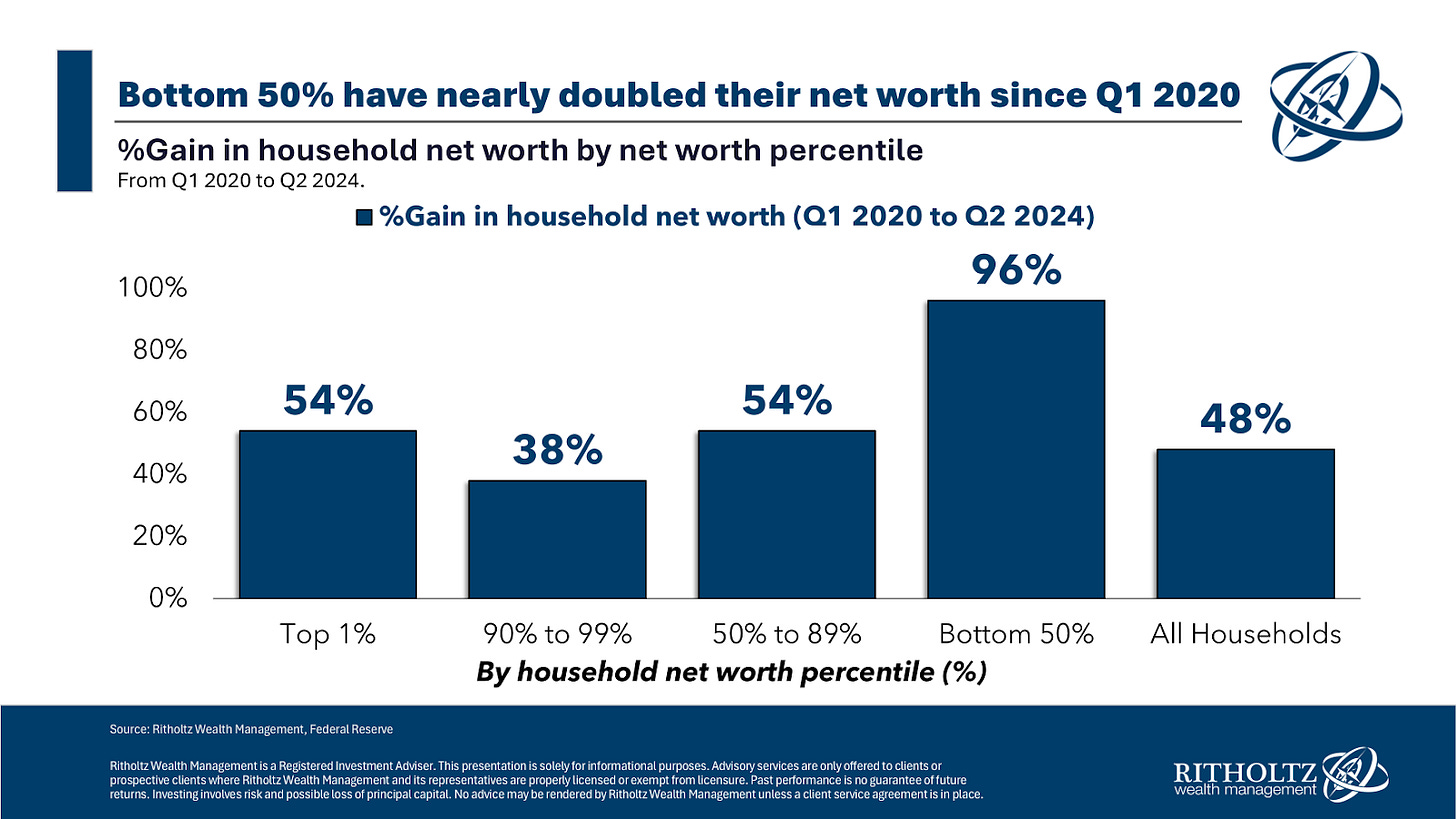

While the job market remains tough in certain areas of the economy and many are struggling with the effects of inflation, in aggregate consumers are much better off now than before the pandemic.

40% of Americans own their home without a mortgage, and home equity is at an all time high.

Household net worth is at an all time high.

Household debt to asset ratio is down about 25% since Q1 2020.

And the bottom 50% of households have nearly doubled their net worth since the start of the pandemic.

GDP estimates revised up

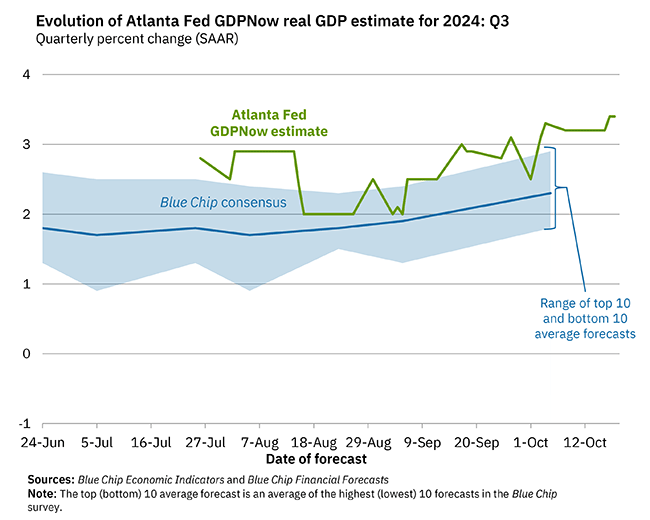

Consumer strength continues to power economic growth. The Atlanta Fed’s estimate for Q3 GDP growth increased to 3.4%, driven by September’s increase in retail sales.

The Redbook Index of retail sales in the U.S. increased 5.6% year-over-year, far above the long term average of 3.64%.

At this point, a resurgence of inflation is a far bigger risk than a recession.

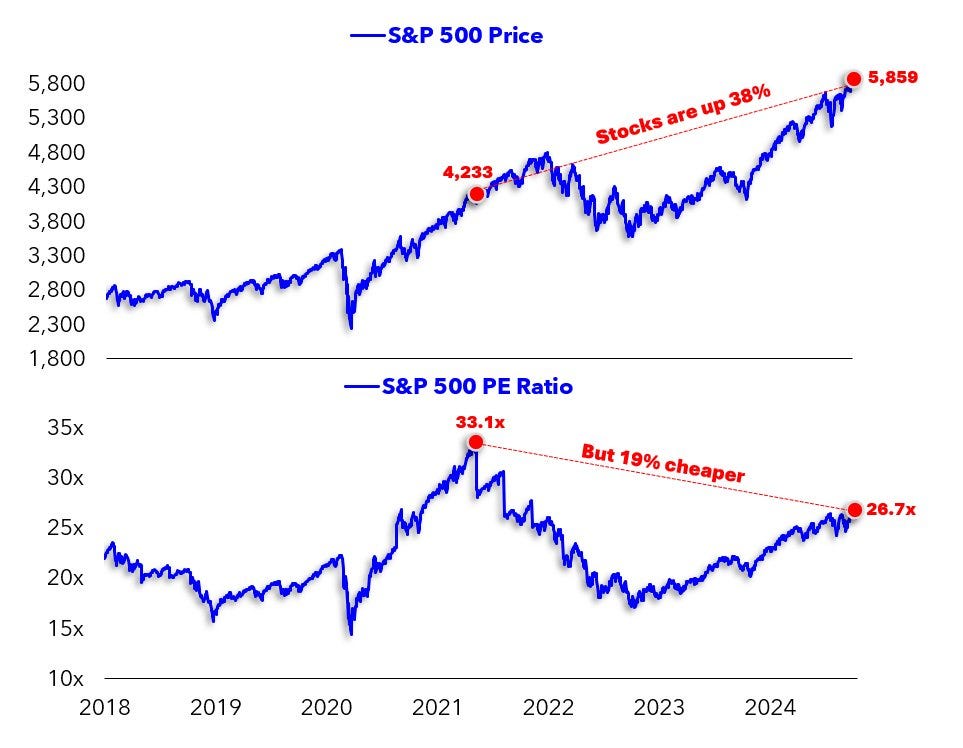

Stocks are cheaper now than in 2021

Here’s one of my favorite charts on X this week. The PE ratio for the SPX is down 19% from its 2021 peak. And yet the index is 38% higher over that timeframe.

The only way stocks become cheaper as they rally is through earnings growth.

All this talk of a bubble in stocks is totally overblown, IMHO.

Don’t be fooled by China’s stimulus

Longtime readers know I’ve had concerns over China’s economy, preferring India as the better option to play growth in Asia.

China’s recent stimulus changes very little for investors.

The Chinese government is now enforcing a tax of up to 20% on overseas investment gains. A tax increase is at odds with efforts to stimulate the economy. They should instead be providing incentives for wealthy individuals to invest in growth initiatives.

Meanwhile, the Chinese property market continues to deflate. Things will likely get worse before they get better.

Stock Ratings

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

Rating changes

I changed the rating on $USAP to Sell. The company is being acquired by Aperam for $45 per share, and the acquisition is expected to close sometime in Q1 of 2025. We’re sitting on a 200% gain, and it’s not worth holding another 3-5 months for an extra 3%.

New addition - GigaCloud Technology Inc. (GCT)

I’m adding coverage of GigaCloud Technology Inc. GCT 0.00%↑ with a Buy rating. The company helps businesses sell and distribute large parcel merchandise (furniture, fitness equipment, etc.). Their offering includes a global marketplace, logistics and warehousing solutions, fulfillment services and cross-border trade. The company’s price-to-sales ratio of 1.1 is slightly above the industry average of 0.8, but their trailing 12-month EPS growth is 190% vs. 8% for the sector. The company’s investment in warehousing and fulfillment centers allow it to scale efficiently and handle increased volume without much additional cost. And their integrated logistics solution saves customers money, which drives more usage. Despite the improving fundamentals, short interest has exploded over the last year, reaching 36% of the float at the end of last month. As the company continues to benefit from a growing economy, capitulation by the shorts could provide an increased tailwind for the stock.