The Predictive Investor - 10/27/24

Today’s leaders started as small companies

Welcome to The Predictive Investor weekly update for October 27th, 2024!

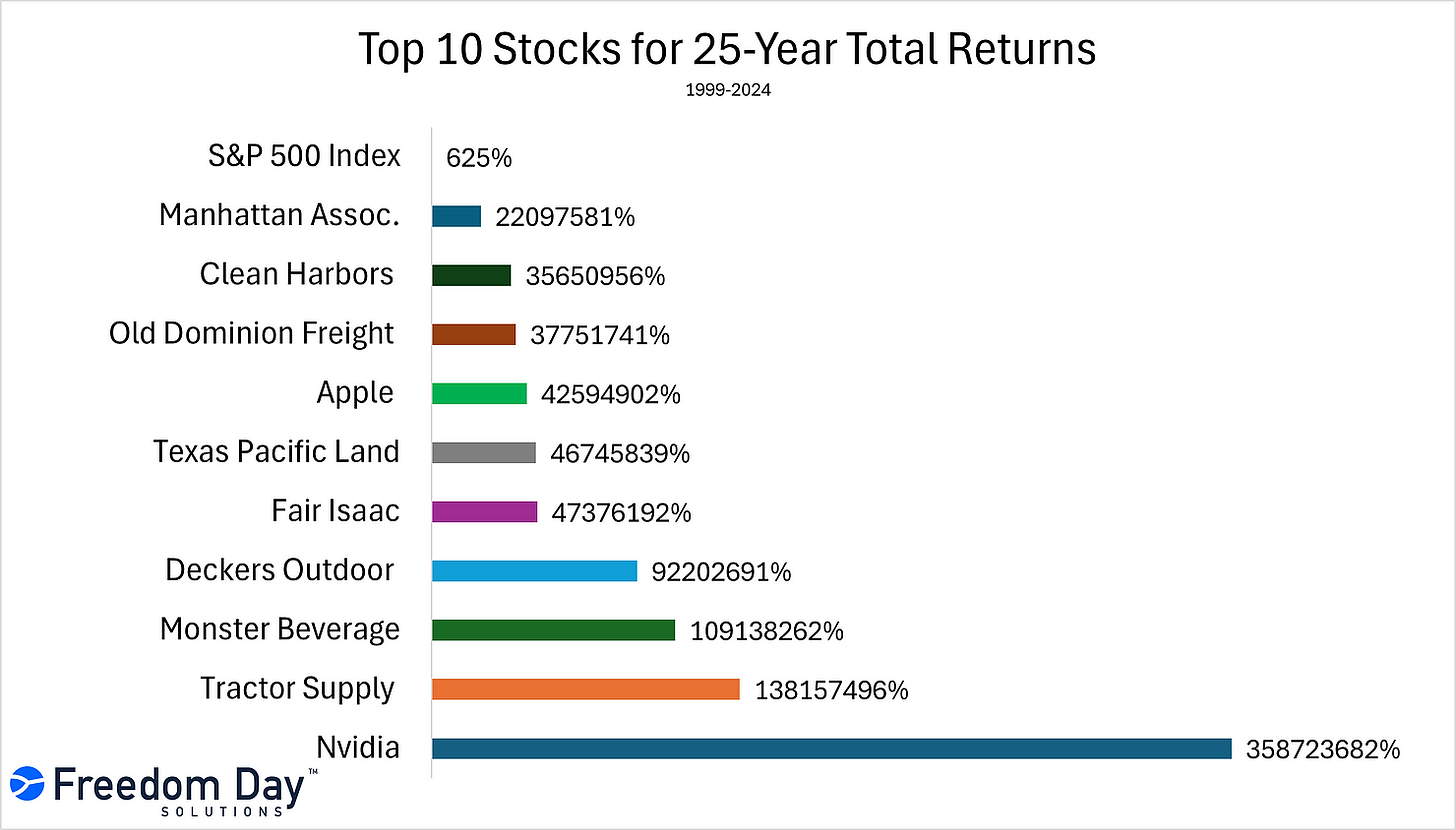

The media’s obsession with big tech obscures an important fact: today’s biggest winners over the last 25 years all started out as small or mid cap stocks.

Freedom Day Solutions published a blog post that looked at the top 10 biggest winners over the last 25 years. Only two of the top 10 are Mag 7 stocks.

While the headlines are focused on today’s leaders, analysts rarely give any attention to companies that have the potential to be future leaders. And that’s why I started The Predictive Investor.

So let’s get to work. Here’s my takeaways from the week.

Bond market revolts

You can’t say I didn’t warn you.

Long term bonds are now priced below where they were at the beginning of September, despite the near-universal calls to buy bonds ahead of the Fed’s jumbo rate cut. What’s going on?

Two things:

Economic data has surprised to the upside, as I’ve been reporting here for weeks. So the market is pricing in fewer rate cuts going forward.

Investors may also be finally signaling an unwillingness to finance large deficit spending without higher returns.

The U.S. debt increases by $1 trillion every 100 days. The government cannot get the debt under control without printing more money, which will erode the purchasing power of the dollar. Stay away from long term bonds.

BRICS lacks a plan

The BRICS countries met in Russia to advance their agenda for a multi-polar world. (Read)

China and Russia’s primary motivation is to bypass the U.S. dollar to avoid sanctions. But so far the alliance has yet to propose a viable plan for doing so. Finding a replacement currency that matches the stability and liquidity of the USD will be tough.

At some point China will make a play to take significant market share away from the USD. And their central bank’s hoarding of gold suggests they plan to back the yuan at least partially with gold.

An asset-backed Yuan would be a compelling alternative to the USD. But this would require China to do two things they’ve historically been unwilling to do: adopt a floating exchange rate and be willing to pump large amounts of yuan into the global economy to provide support during crises.

Currently, over 88% of forex transactions involve the USD on one side of the trade. Replacing the dollar as the reserve currency will take much longer than most people expect.

Manufacturing resurgence continues

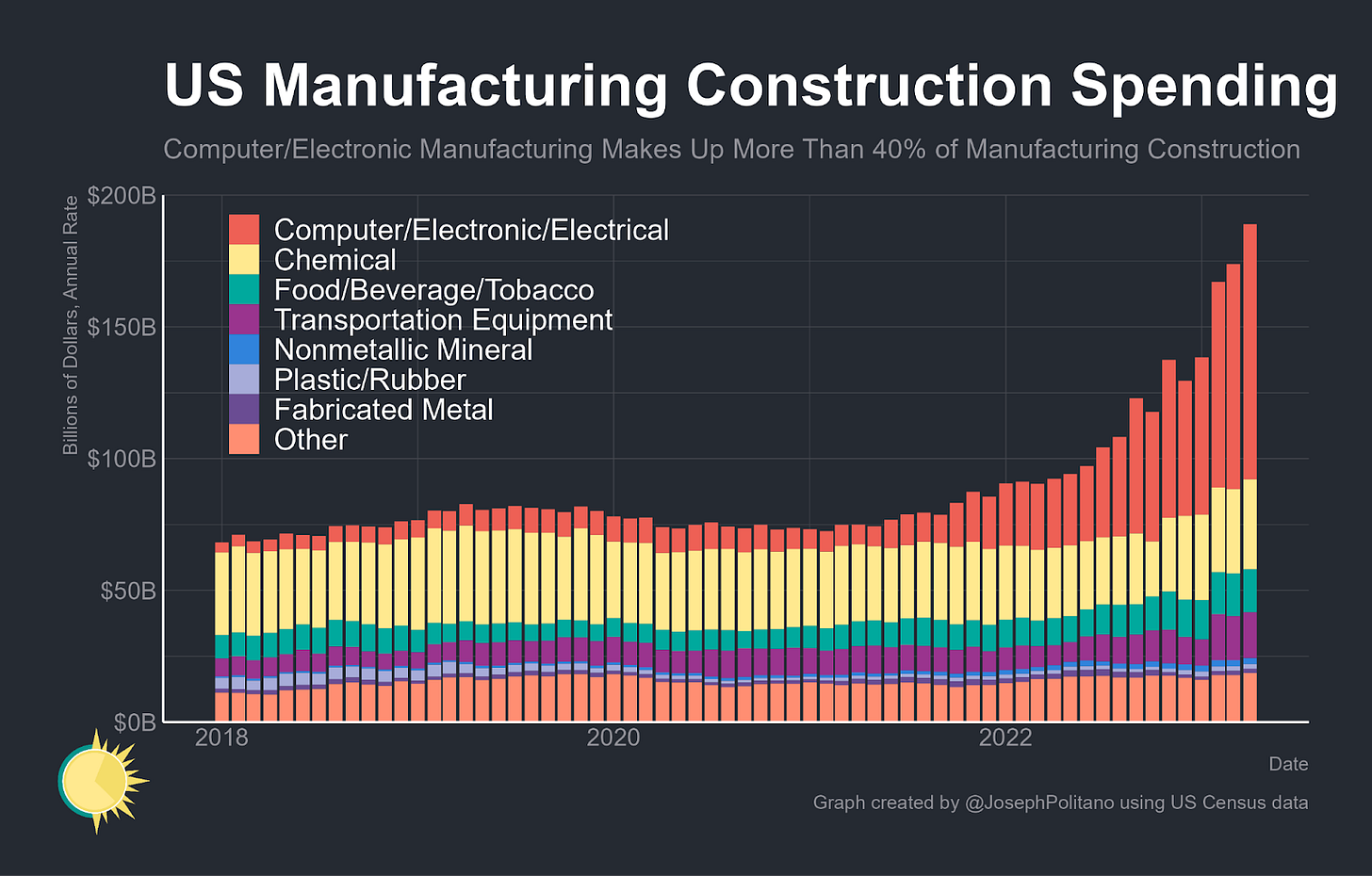

A few weeks ago I highlighted the recovery in manufacturing jobs. And the construction of manufacturing facilities shows no signs of slowing down. The biggest gains have come from computer/electronic manufacturing and transportation equipment.

Government stimulus to reshore manufacturing is something I flagged a year ago (see 5 Reasons to Buy Micro Cap Stocks Now). My thesis then was that this would disproportionately benefit small companies, as small cap sales growth is highly correlated with U.S. capex growth.

The tailwind that manufacturing investment will provide to small companies is just in its infancy. Since July 1st, the iShares Russell 2000 ETF IWM 0.00%↑ has outperformed the SPDR S&P 500 ETF SPY 0.00%↑, despite 40% of the Russell 2000 companies having negative earnings.

As you know we’ve done much better sticking to small companies with earnings momentum. Many of our picks, including VHI 0.00%↑, WLDN 0.00%↑ and TPC 0.00%↑ are all capitalizing on increased capex spending.

Housing market still frozen

Sales of existing homes are at their lowest level in nearly 30 years. (Read)

While many hoped that rate cuts would bring the housing market back to life, that has failed to materialize.

Here’s why: low interest rates combined with Covid-stimilus pushed home prices up. In fact, the ratio of home prices to median household income is at an all time high.

Buyers that locked in mortgages under 3% have very little incentive to move, with the average mortgage rate hitting 6.5% last week. Same goes for the 40% of homeowners that own their home with no mortgage.

This constrains supply, which keeps prices high. High rates + high prices yield a housing market that is effectively frozen.

One thing is clear: no matter who wins the election, incentives for expanding the housing supply will be passed.

Stock Ratings

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

Rating changes

I changed the rating on TATT 0.00%↑ to Sell. The stock more than doubled from our original buy point, and closed the week above our value limit for the portfolio.