The Predictive Investor - 10/6/24

A US recession is highly unlikely

Welcome to The Predictive Investor weekly update for October 6th, 2024!

Over the last several months, the media has been filled with reports of economists calling for imminent recession. And week after week, I’ve been showing you data on why that is highly unlikely.

The latest data to support our bullish posture is the September jobs report. Nonfarm payrolls increased by 254k, far above the 150k that was expected. While we’ve seen several strong jobs numbers be revised downward months later, there were a few other positive developments in the report.

The unemployment rate came down slightly, and wages were up 4% year-over-year, above the rate of inflation, and the employment numbers from July and August were revised upward by 72k.

Geopolitics remains a concern (more on that below), but I continue to believe any upcoming volatility would represent a buying opportunity for investors. Because the fact is, the labor market and the economy are highly correlated. You cannot have a strong labor market with a weak economy, and vice versa.

Here’s my takeaways from the week.

Geopolitics remains a headwind

Geopolitics is taking center stage once again as tension in the Middle East flares up.

But the real question when it comes to assessing the war’s impact on markets is whether or not the conflict will lead to economic fragmentation.

According to Factset, the economic and military conflicts the world experienced over the last decade had very disproportionate impacts on global equities.

Events characterized by economic fragmentation, such as Brexit and sanctions on Russia, had a 7X bigger impact on equities than military conflicts did, with significantly more volatility.

This is because trade barriers and sanctions are longer-term in nature, and impact all sectors of the economy.

So the biggest risk to the global economy from war in the Middle East is if this conflict results in the extended closure of trade routes in the Red Sea and Persian Gulf. That would have huge global implications. For now, the conflict’s impact on global equities will be limited.

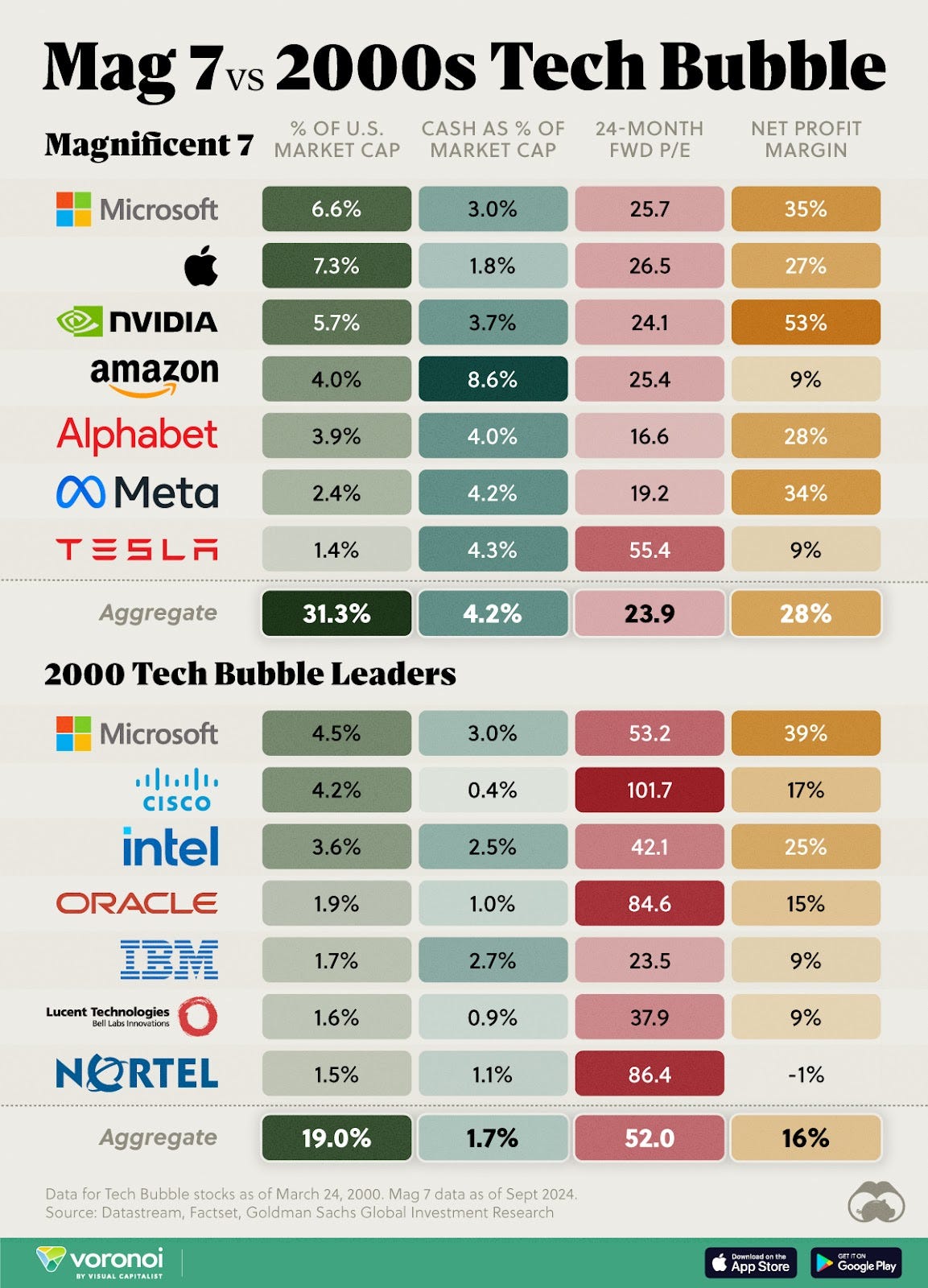

AI is not a bubble…

At least not yet. This great comparison from Visual Capitalist ranks the Mag 7 against the equivalent market leaders of the dot com tech bubble. The Mag 7 are trading at less than half the valuation and have nearly double the profit margins than the tech bubble leaders did.

In other words, this bull market is backed up by improving fundamentals, something I’ve been saying for the last year. Bubble status would require significantly higher valuations than what we’re seeing now.

There’s no chance AI spending slows down, as no one wants to get left out. But at a certain point the rush to adopt this technology will need to start delivering more consistent ROI. So that’s something I’ll be watching for very closely. Because more hype without profits to back it up could very well lead us to bubble territory.

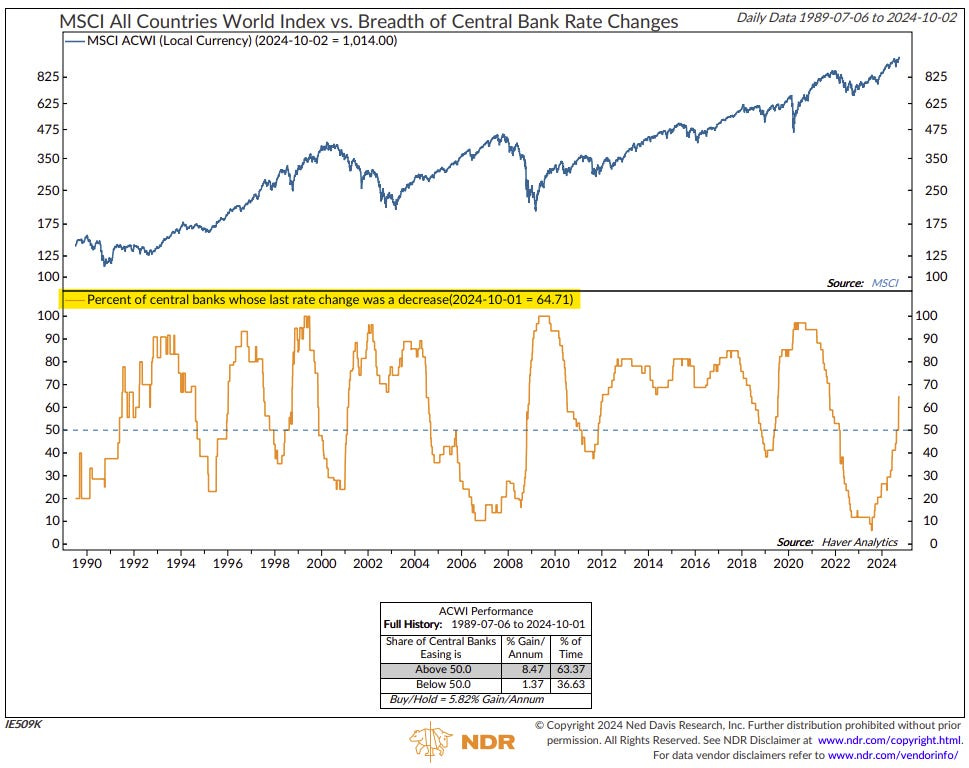

Impact of easing cycles on global equities

The benefits of central bank easing cycles are obvious, so I’m not going to get into the details here. What’s important is that two-thirds of the world’s central banks are now easing financial conditions.

Historically when more than half the central banks are easing, global equities averaged gains of 8.47% per year.

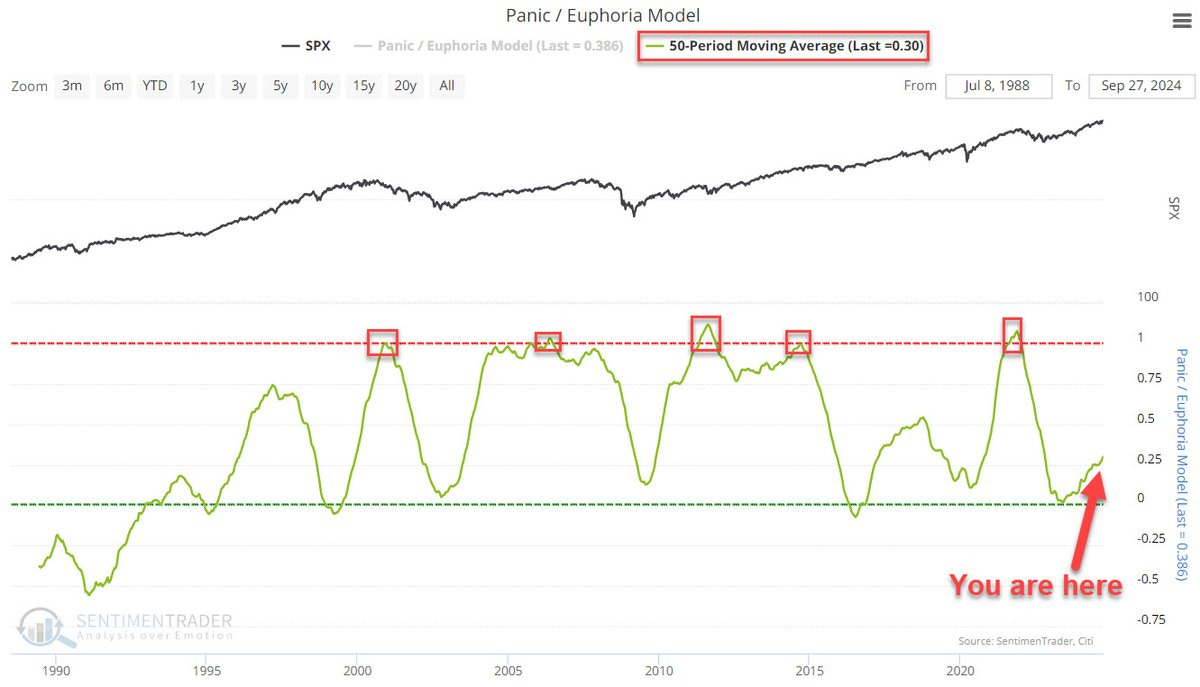

Investor enthusiasm remains low

Despite both improving fundamentals and easing financial conditions, investor enthusiasm remains relatively low.

I’ve said it before and I’ll say it again: this is one of the most hated bull markets in recent memory. And it’s good news for the bulls, as markets almost never top on pessimism.

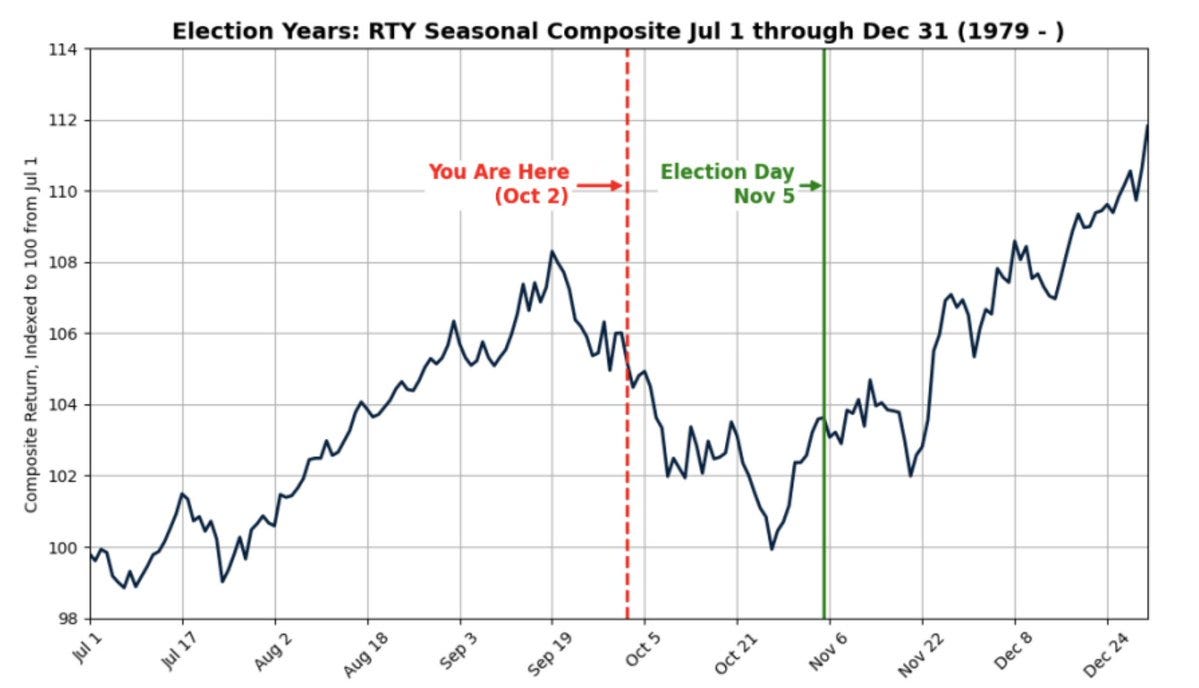

Small cap election year seasonality

Let’s now take a look at seasonality for the companies we focus on. The pullback we’ve seen in the Russell 2000 since mid-September is normal for an election year.

Remember, small caps are far more sensitive to domestic policy than large caps, so it’s natural for uncertainty around an election to depress stock prices. But once that uncertainty is removed, the outlook for small caps becomes much more favorable.

I don’t know about you, but I’ll be using this pullback as an opportunity to find companies that can deliver on their commitments regardless of the outcome on November 5th.

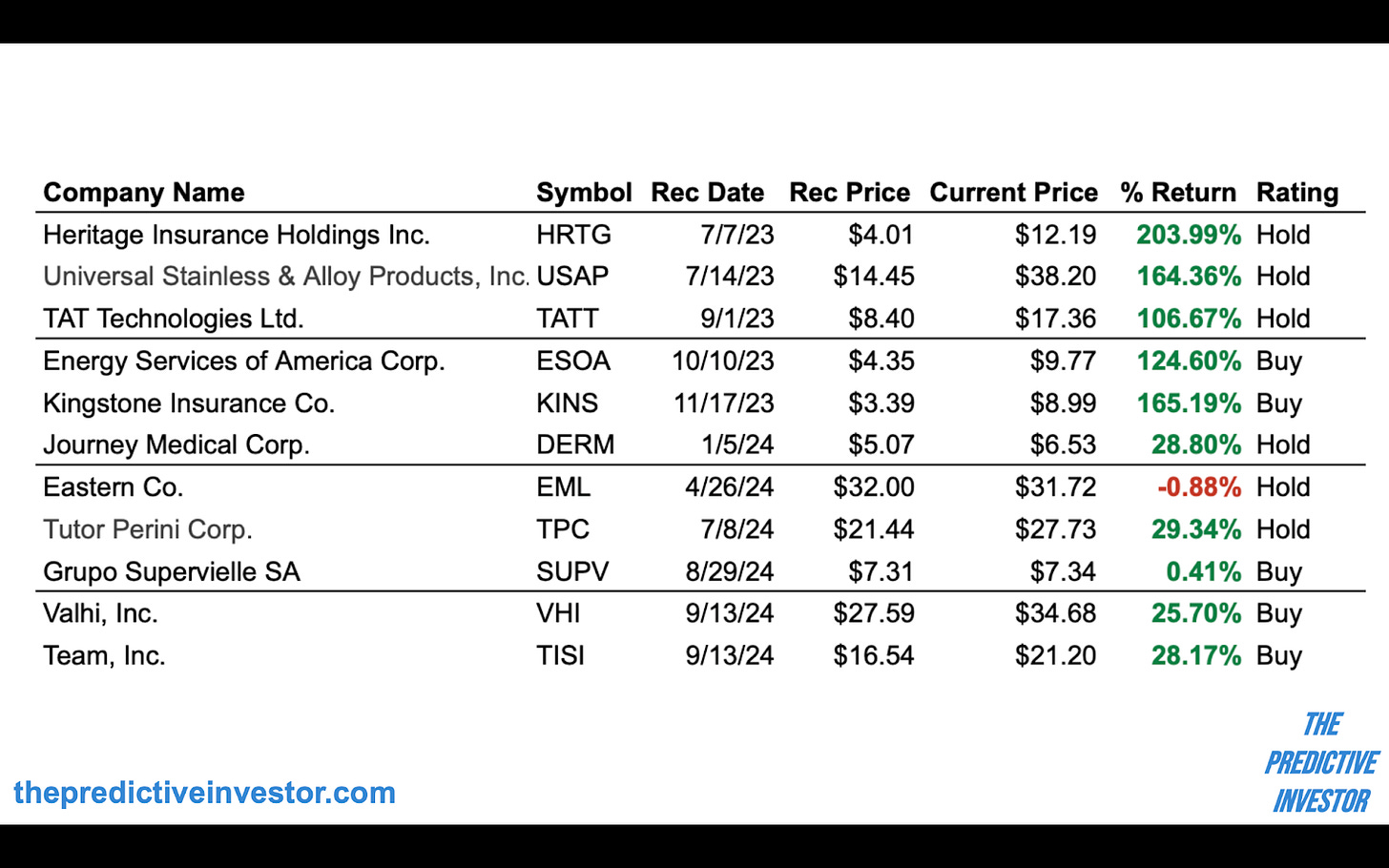

Stock Ratings

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

I changed the rating on HRTG to Hold. The stock has been under pressure for a month, after rallying strongly in August. Price support is closer to $11, and I’d like to see the stock stabilize a bit before changing it back to Buy.