The Predictive Investor - 11/10/24

Election aftermath

Welcome to The Predictive Investor weekly update for November 10th, 2024!

Well, it’s finally over. Whether you’re happy or sad, the voters have spoken and the result was decisive. We should all be grateful the country avoided the chaos and violence that many experts feared.

If you’re looking for an analysis of the political ramifications of this election, there are many other places to go. My job here is to assess how Trump’s win impacts our investments.

The strong rally last week was a function of the following:

The uncertainty over who would win the election was removed.

The market expects Trump’s deregulation efforts to spur growth.

November through April is a seasonally bullish period for stocks.

The rally was broad across numerous sectors, including financials, industrials and energy. At 5,995 the S&P 500 is 23% above the average 2024 price target from Wall Street analysts. And the Russell 2000 saw the highest weekly close ever.

Overall this is very good news for both the market and our portfolio. Here’s my takeaways from the week.

Buffett is selling, should you?

Berkshire Hathaway’s stock sales and pause on buybacks seems to be making a lot of people nervous. (Read)

I am not one of those people. Yes, the company has an insane amount of cash - $325 billion to be exact. But the needs of a multinational corporation are far different from any of us.

My take is this has more to do with succession planning than Buffett’s views on the market. Berkshire’s board has given Buffett far more autonomy to make decisions than his successor will get. Making some tough decisions now will make it easier for his successor later on.

Meanwhile, the company’s current assets has averaged $344 billion this year vs. total assets of $1.1 trillion. Which means long term investments make up 70% of the company’s portfolio. Not exactly a sign the company is expecting an economic crisis.

Energy boom ahead

Conventional wisdom says that Trump’s strategy to lower inflation through cheaper energy will lead to less profits for energy companies. But deregulation does not only lead to more supply, it also lowers the cost of doing business, which should improve profit margins.

Demand for energy, despite a slowdown in China, is at an all time high, driven by emerging markets and data centers. In fact, the IAEA estimates that energy demand from data centers alone is increasing by nearly 1% per month and will exceed 8% of total U.S. power demand by 2030.

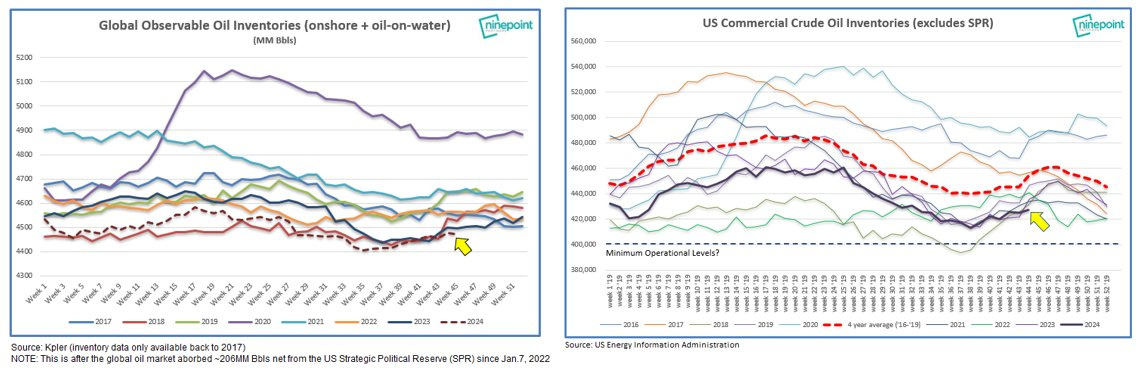

And global oil inventories, both domestically and abroad, are at their lowest seasonal levels in recent memory.

Oil supply might increase under Trump, but refining capacity is not something that can be expanded overnight, which sets a floor on how far prices can fall. I remain very bullish on energy long term, both non-renewable and alternative (e.g. nuclear).

Crypto gets respect

The crypto industry poured millions of dollars into this election in order to drive a more friendly regulatory environment. (Read)

These efforts were largely successful, and all but ensure a regulatory environment that gives the industry legitimacy, providing a huge tailwind not just to crypto but also decentralized finance.

No surprises here. I put out a video last month covering my thesis that stocks, Bitcoin and real estate would outperform long term bonds for the foreseeable future. And people were shocked I included Bitcoin on that list. And yet here we are.

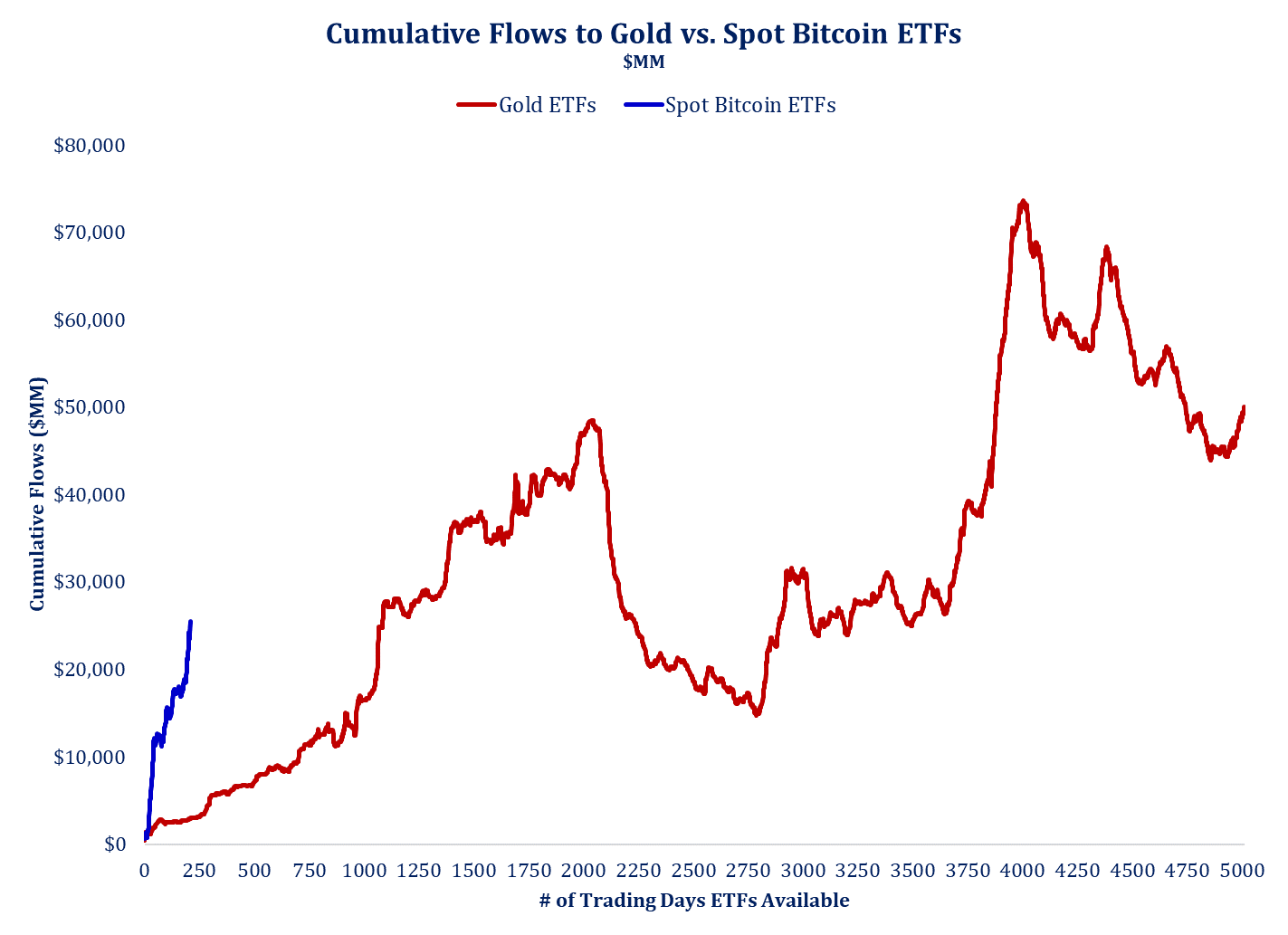

The Bitcoin ETF hit nearly $30 trillion in cumulative flows in just 20% of the time that it took the Gold ETF to hit the same benchmark.

I don’t own Bitcoin for a number of reasons, but it's clearly more than just a fad.

Small cap rally is just beginning

Fundstrat cofounder Tom Lee has been one of the more accurate analysts this cycle and thinks small caps could outperform large caps by 100%. (Watch)

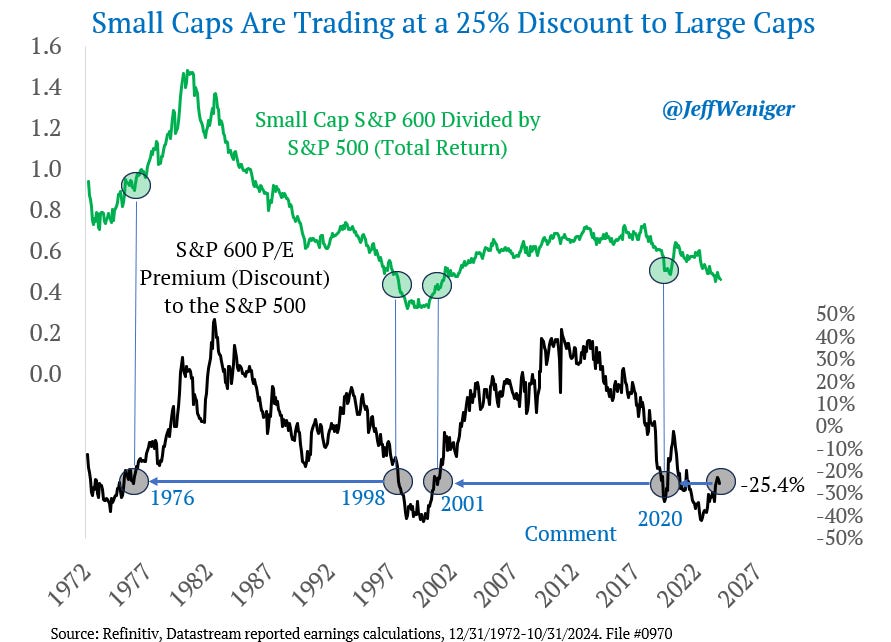

You may remember I told you back in July that small caps were set for a historic comeback.

Last week the S&P 600 closed at a new all time high. And yet it’s still trading at a 25% discount to the S&P 500, a level seen at several other market bottoms.

Trump’s win will accelerate some of the themes we’ve been talking about for months. But his administration will also lower the hurdles for M&A activity, which will benefit small companies given their historically low valuation.

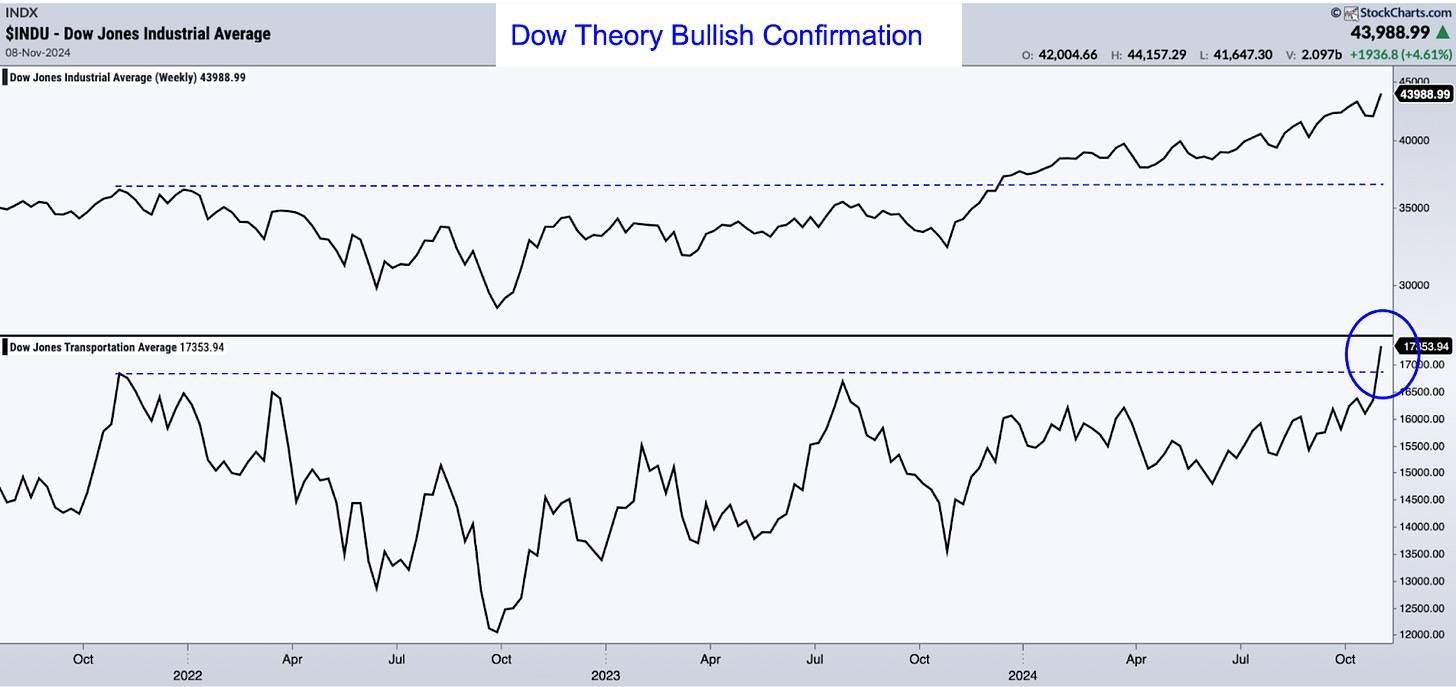

Dow Theory flashes bullish confirmation

Many technical analysts were skeptical of this bull market because when the Dow Industrials broke above its 2022 high in December 2023, the Dow Transports remained below its all time high for months. That changed last week.

Developed by Charles Dow, the theory is based on the idea that various stock indices should confirm one another. If business is good for industrials, then the companies that move the goods (i.e. transports) should also be doing well.

One could make the case that the semiconductor index, which confirmed the Dow industrial’s advance last December, is a better gauge of the movement of goods in a digital economy. But either way, the bears are running out of excuses. The breadth of this advance cannot be ignored.

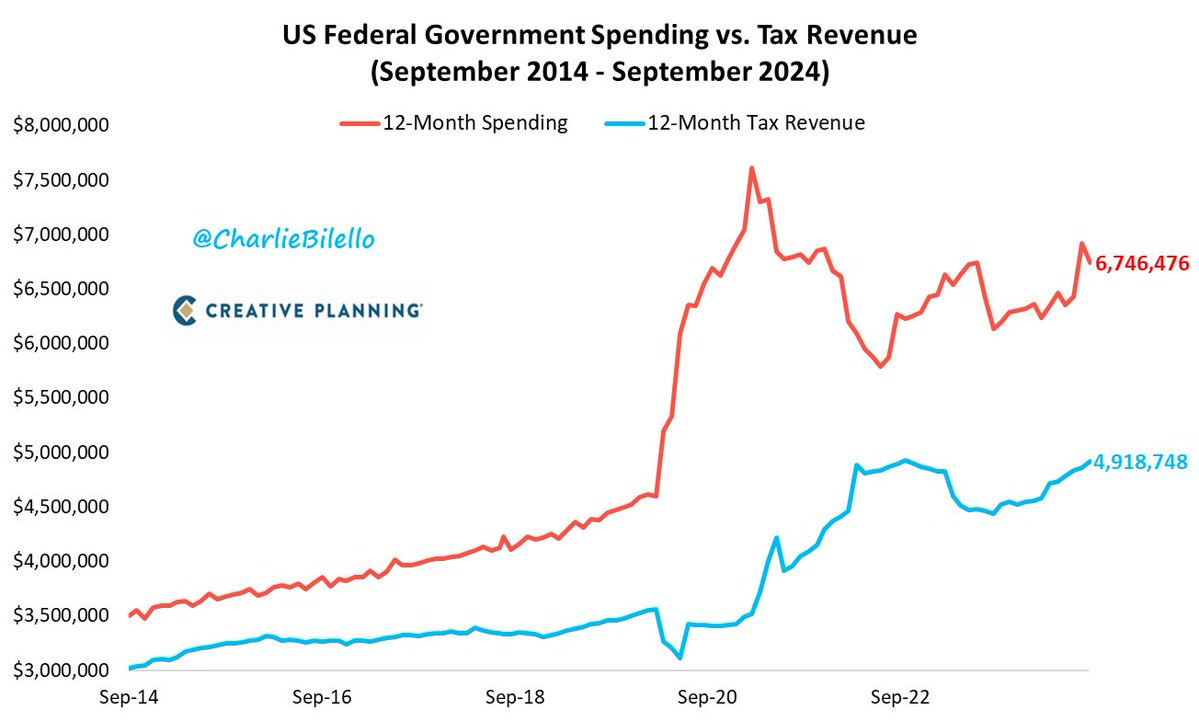

Debt remains the biggest risk

The biggest risk to the economy in my opinion continues to be the country’s financial situation.

Normally bond yields trend in the same direction as other interest rates. But in a week when the Fed cut rates, bond yields went up. Fixed income traders continue to be concerned with the country’s fiscal situation.

The gap between spending and tax receipts continues to widen in the wrong direction, and the expected continuation of tax cuts will increase deficits further.

Neither candidate campaigned with a clear plan to reduce government debt. But in general Trump expects deregulation to increase growth (and tax receipts), while cutting wasteful government spending.

That is likely not going to be enough to reduce the debt in a meaningful way, which means money printing continues. The question then becomes how this will impact inflation.

Pro-growth policies in the U.S. will attract more capital, strengthening the U.S. dollar. This will put downward pressure on commodity prices, which are priced in dollars. Tariffs may offset some of that, but it remains to be seen how aggressive they will be.

The stars seem to be aligning for the government’s desired result: monetary debasement through asset price inflation without goods price inflation.

I believe investors will continue to require higher rates of return to hold long term bonds, which will depress fixed income returns.

Stock Ratings

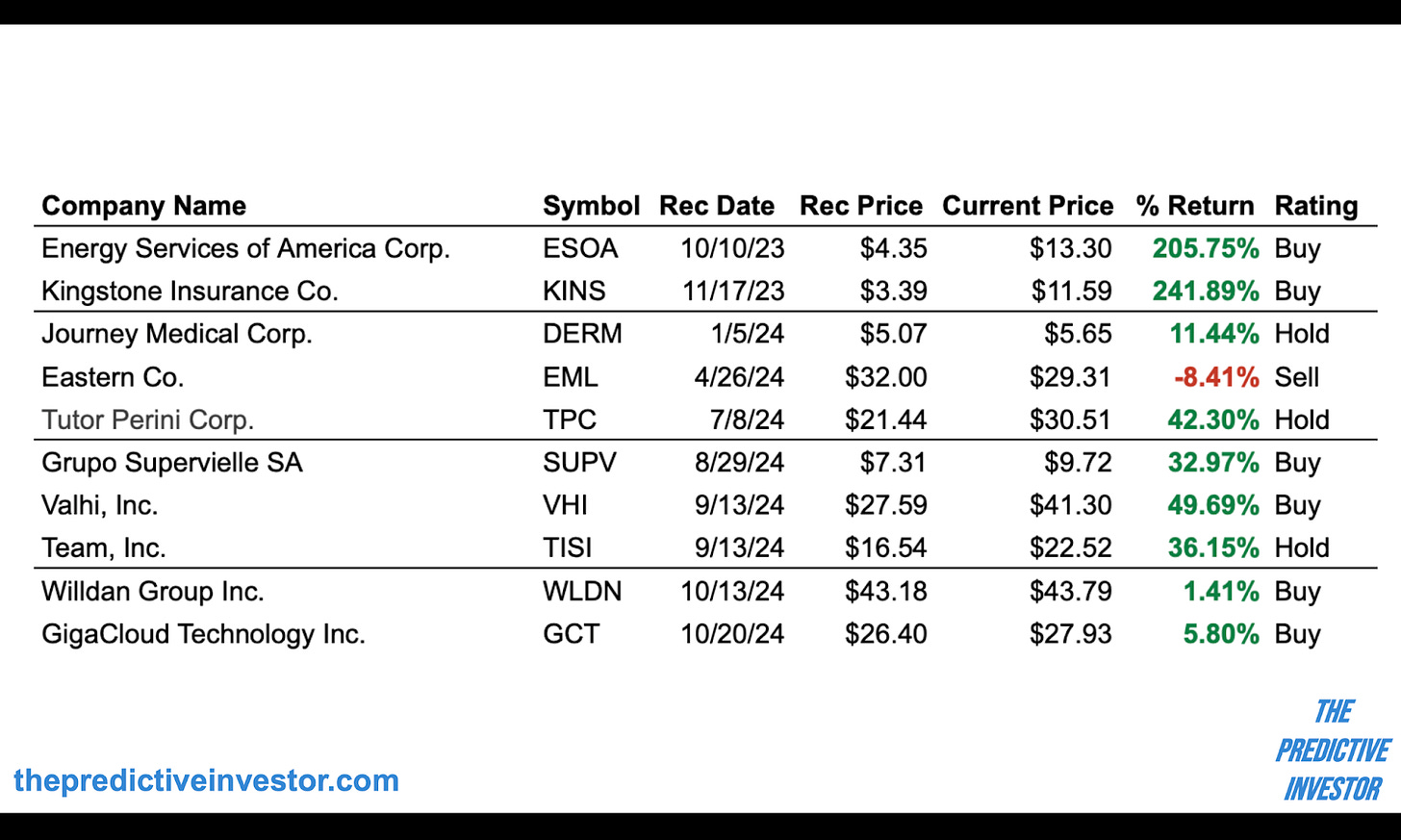

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

Rating changes

I changed the rating on EML 0.00%↑ to Sell. The stock sold off after its earnings call last week, on analyst disappointment with the company’s inability to contain costs. The stock has fallen in and out of qualification due to lagging momentum, and is now below our momentum cutoff.

I also changed the rating on GCT 0.00%↑ to Buy. The company reported Q3 results last week and beat EPS estimates by 46.3%. Last week the stock put in a bullish key reversal bar on the weekly chart on a 2.6X increase in volume.