The Predictive Investor - 11/17/24

Volatility cuts both ways

Welcome to The Predictive Investor weekly update for November 17th, 2024!

The S&P 500 pulled back only 2.4% from its post-election high, and already there’s a flood of stories about the rally fizzling. Pretty typical for the financial media.

Meanwhile, the YTD return for the index is the 11th best in history. It’s natural for the index to pull back after surging to a new high. And some of this churn will continue as the market reacts to potential policy changes from the new administration.

Traders are doing what they do best: taking advantage of the volatility. While we’re certainly overdue for a standard correction, investors would be wise to stay the course, as the markets have a clear upward bias over time.

Here’s my takeaways from the week.

Consumer sentiment is getting less reliable

The latest consumer sentiment reading of 73 is up from 70.5 in October, but below the long term average of 84.6.

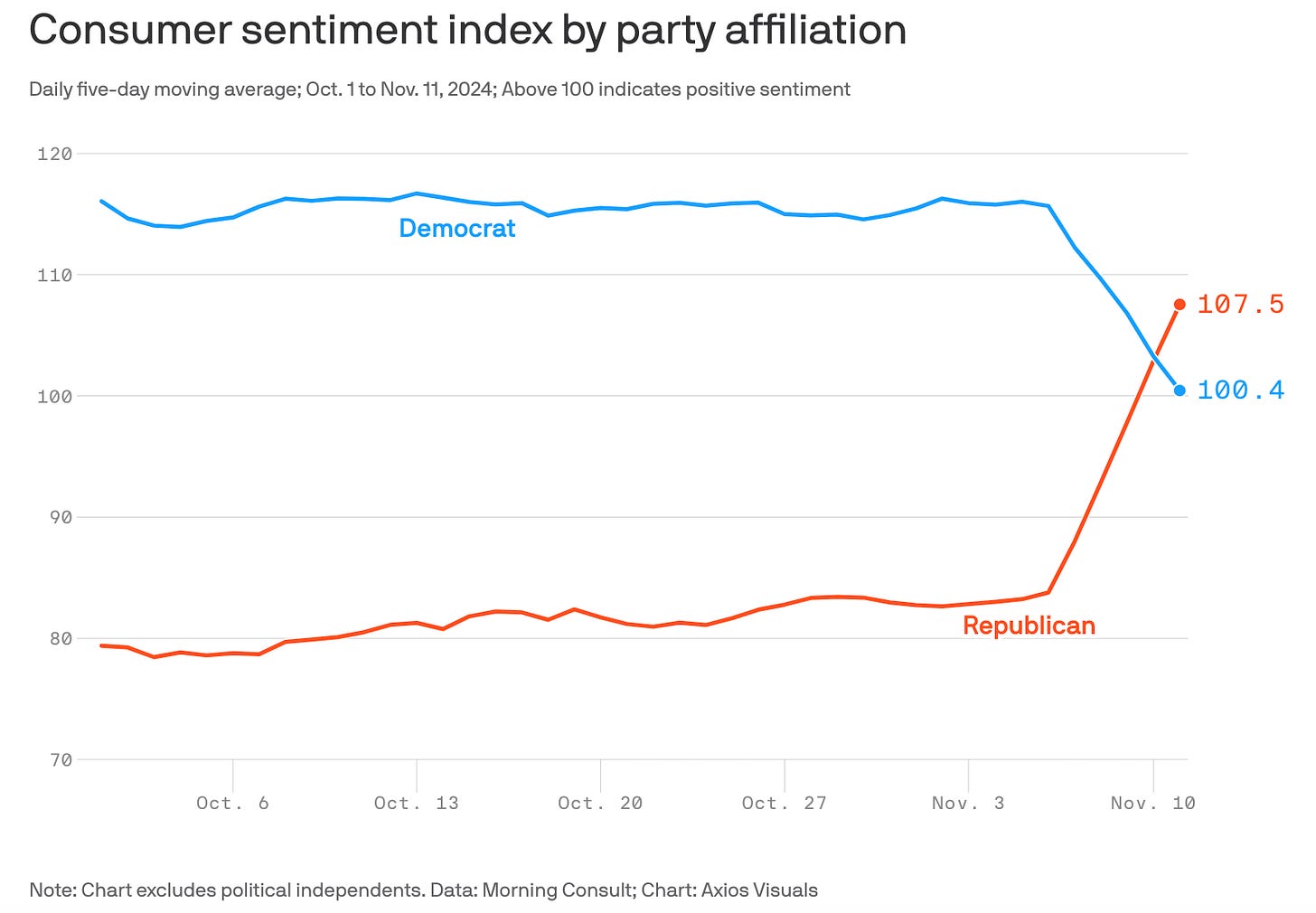

What’s more interesting is the divide by political party affiliation.

There are a number of reasons why sentiment is below average in a growing economy, including inflation and high housing costs.

But the fact that these surveys have grown increasingly political makes them less reliable as an indicator of economic conditions.

Going forward I will need to see more extreme readings in surveys like this in order to factor them into my market outlook.

Wages are powering economic growth

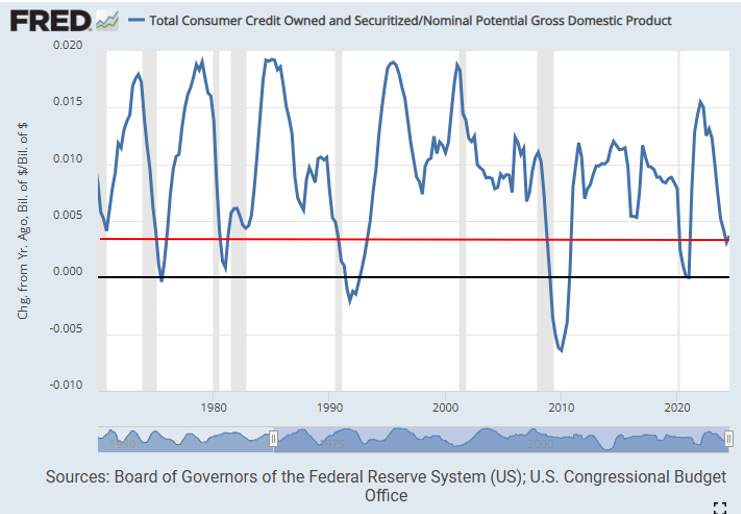

Speaking of consumers, much was made about credit card debt reaching an all time high. (Read)

However, the rate of credit growth has slowed as the economy continues to pick up speed. This implies GDP growth is being powered by increasing income, not overly indebted consumers.

Tariffs and inflation

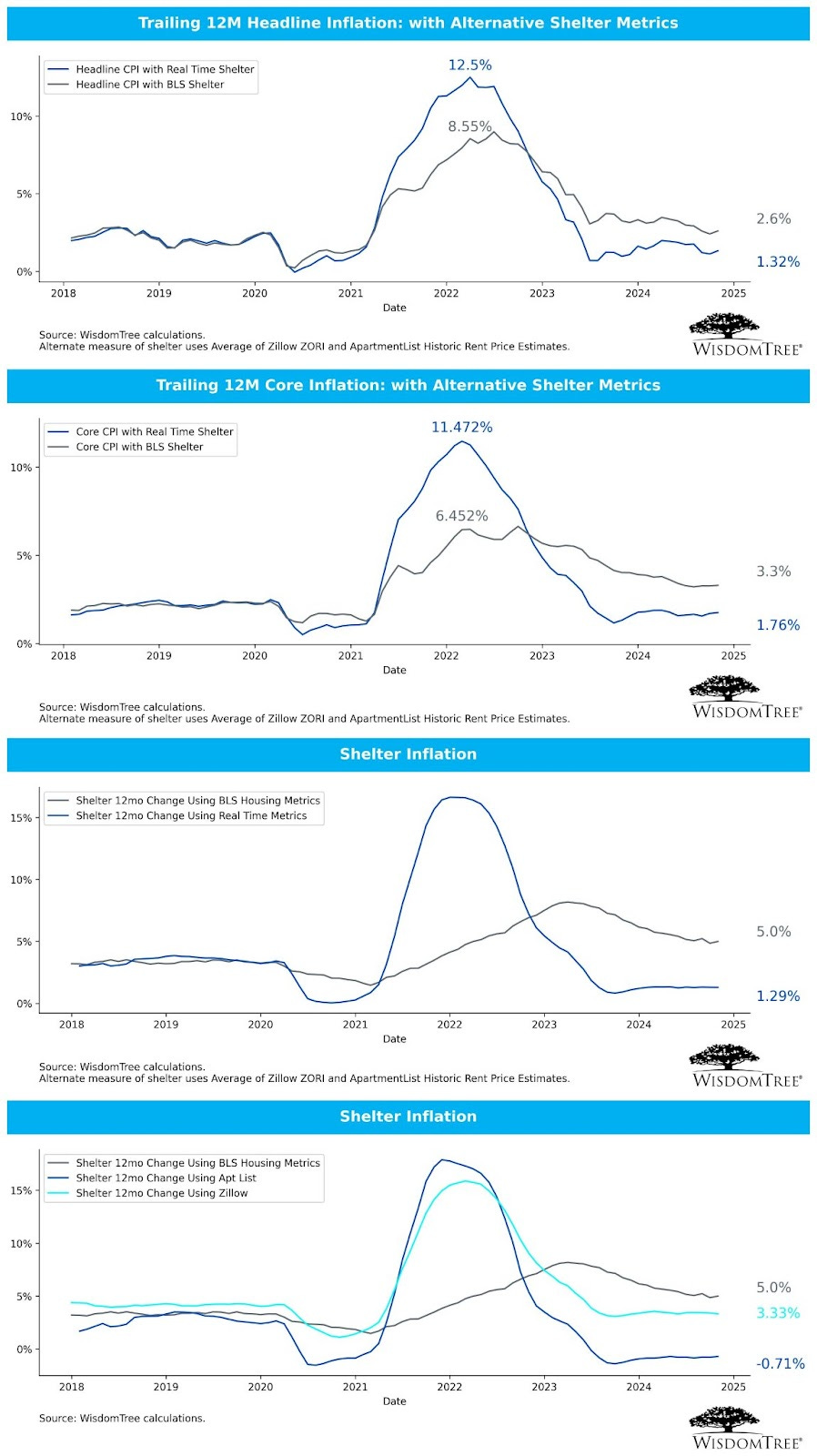

Last week’s CPI reading was in line with expectations, and shelter accounted for more than 65% of the total 12-month increase in core CPI.

While the market was concerned that CPI was up slightly from September, if we use real-time shelter data, the CPI drops from 2.6% to 1.3%. Based on that I think it’s reasonable to expect inflation to hit the Fed’s 2% target sometime next year.

What about Trump’s proposed tariffs? The 10-year Treasury and TIPS yield spread has not changed post-election. Which tells me either the market expects their impact on inflation to be limited, or they don’t think the tariffs that are implemented will be as severe as Trump has proposed.

A case can be made for both.

During the last Trump administration, $80 billion in were imposed but there were dozens of exemptions for American companies. And while prices did spike initially, they were not a long term driver of inflation.

Tariffs are imposed on the value at import, which means they don’t apply to subsequent costs such as transportation, wholesale and retail. Therefore, USB estimates that a 20% tariff would raise the retail price of a finished good by 8%. In many cases companies can offset a tariff by cutting costs elsewhere in the supply chain. Additionally, most tariffs applied to lower-frequency purchases, which means less emotional impact to consumers.

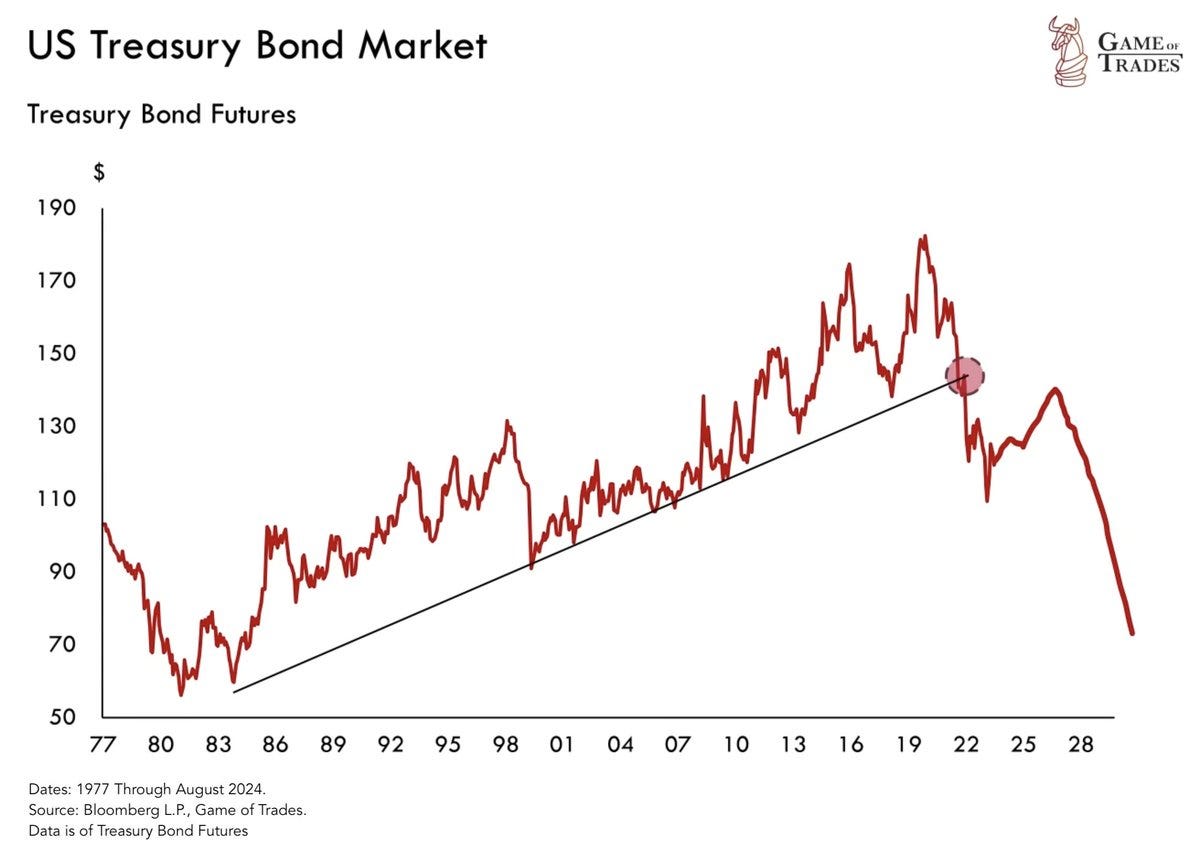

Treasury bond futures collapse

Treasury bond futures continue to slide, demonstrating that investor concerns over the fiscal situation in the U.S. are not going away.

At the end of the day the Fed’s rate decisions follow the market, which means analysts are likely expecting more rate cuts than the Fed will deliver.

I’ve been out of long term treasuries for a few years now, and don’t plan to get back in any time soon.

Small caps hit hard

Small caps led the selloff last week. As a small cap investor am I worried? Not really.

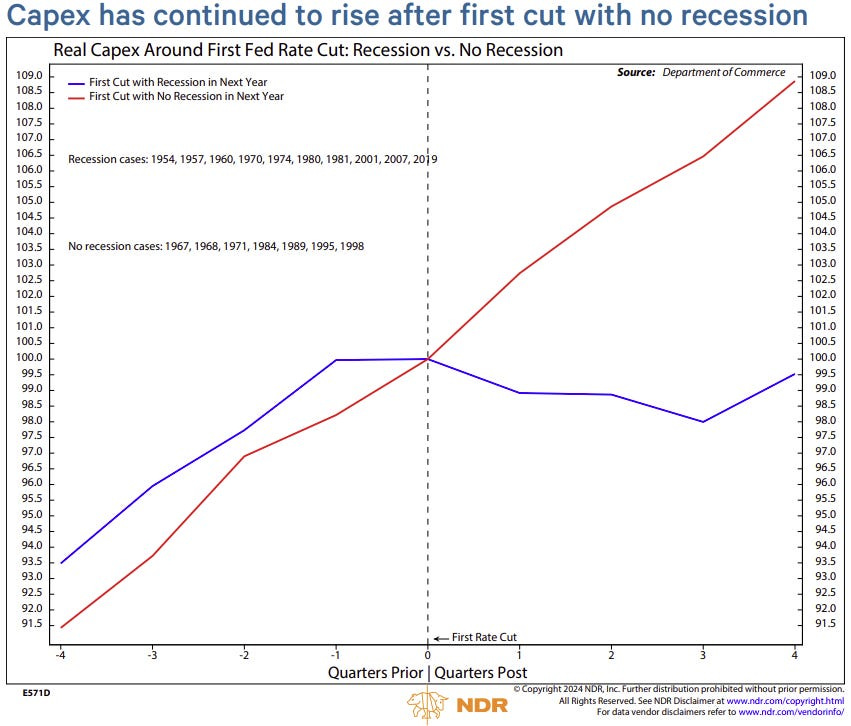

Small caps are highly correlated with the domestic economy and capex spending. Both are trending up.

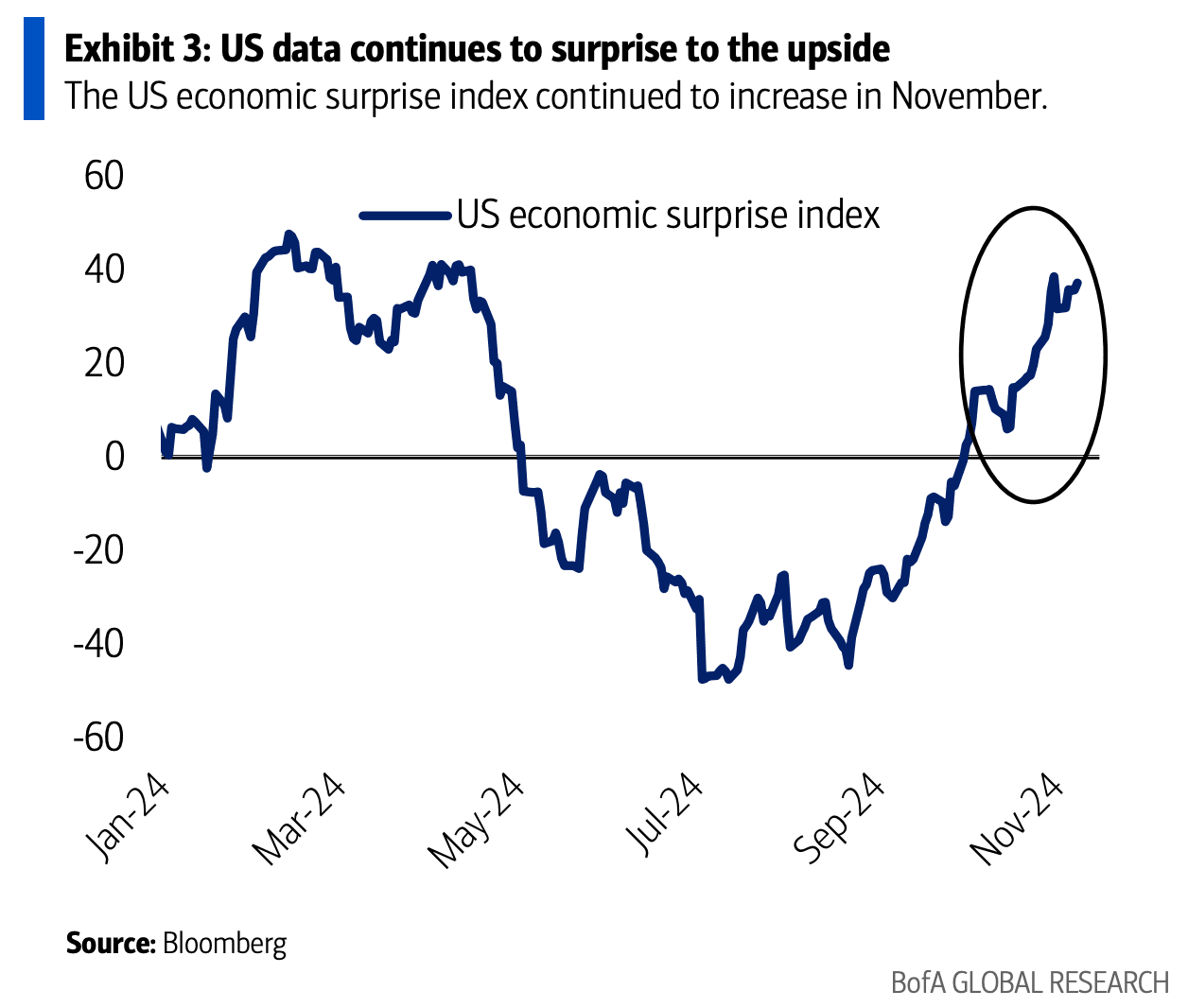

Economic data continues to surpass expectations, and GDP growth for 2024 is expected to be around 2.7%, above the average over the last 10 years.

Capex growth will continue through next year, driven by AI, infrastructure and reshoring supply chains. This is in line with previous rate cut cycles. In years when there was no recession, capex growth surged after the first Fed rate cut.

Stock Ratings

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

Rating changes

I changed the rating on VHI 0.00%↑ to Hold. The stock got caught up in last week’s selloff and dropped 42%. This comes after the company delivered a very strong earnings report, with significant year-over-year improvements in revenue growth and profitability. This feels like an overreaction, but a rules-based system requires us to stick to the rules. We’ll give it to the end of the month to stabilize.

New Addition - Alliance Entertainment Holding Corp. AENT 0.00%↑

I’m initiating coverage of Alliance Entertainment Holding Corp. AENT 0.00%↑ with a Buy rating. The company operates as a wholesaler, retailer and distributor for the entertainment industry globally. The stock is trading at a price-to-sales ratio of 0.2, below the industry average of 0.39, and has grown EPS 112% over the last year, far above sector average of 8%. The company ended FY24 in the green, a significant improvement over the prior year’s $35.4 million net loss. The company’s efforts to focus on higher-margin products and reduce costs through automation position it for sustained growth in 2025.