The Predictive Investor - 1/12/25

Pullback or correction?

Welcome to The Predictive Investor weekly update for January 12th, 2025!

The difference between a pullback and correction is a question of degree. From a technical perspective, a pullback is a drawdown of less than 10%, while a correction is a drawdown of between 10% and 20%.

So far the SPX is down about 4.5% from its December 6th high. On average stocks experience 3-4 pullbacks of 5% per year and 1 correction of 10% each year.

Where we go from here depends on whether the SPX can hold 5,780.

Here’s my takeaways from the week.

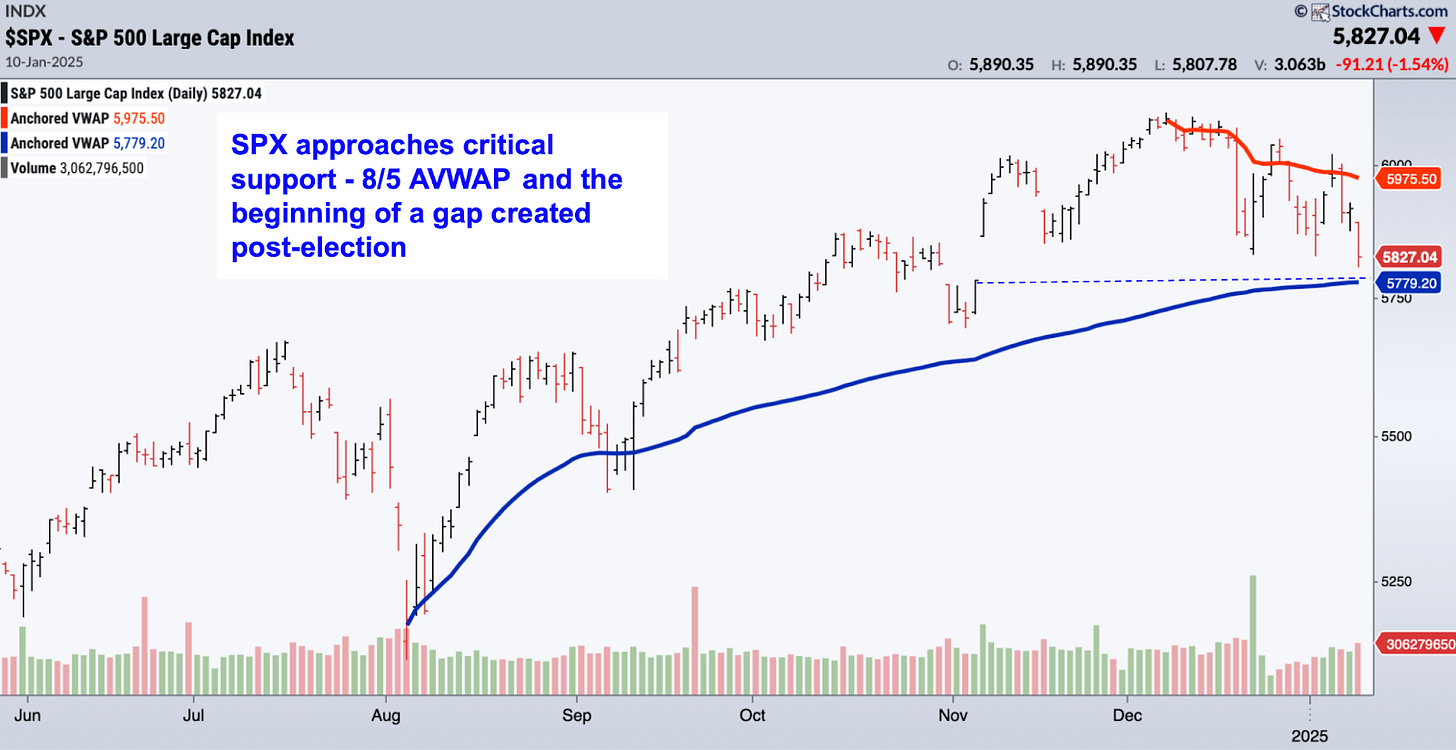

5,780 is critical for the S&P 500

5,780 is the level to watch next week, as it is the intersection between two support areas - the 8/5 VWAP (currently at 5,779) and the lower end of the gap created on November 6th (5,783).

The next area of support is 5,670.

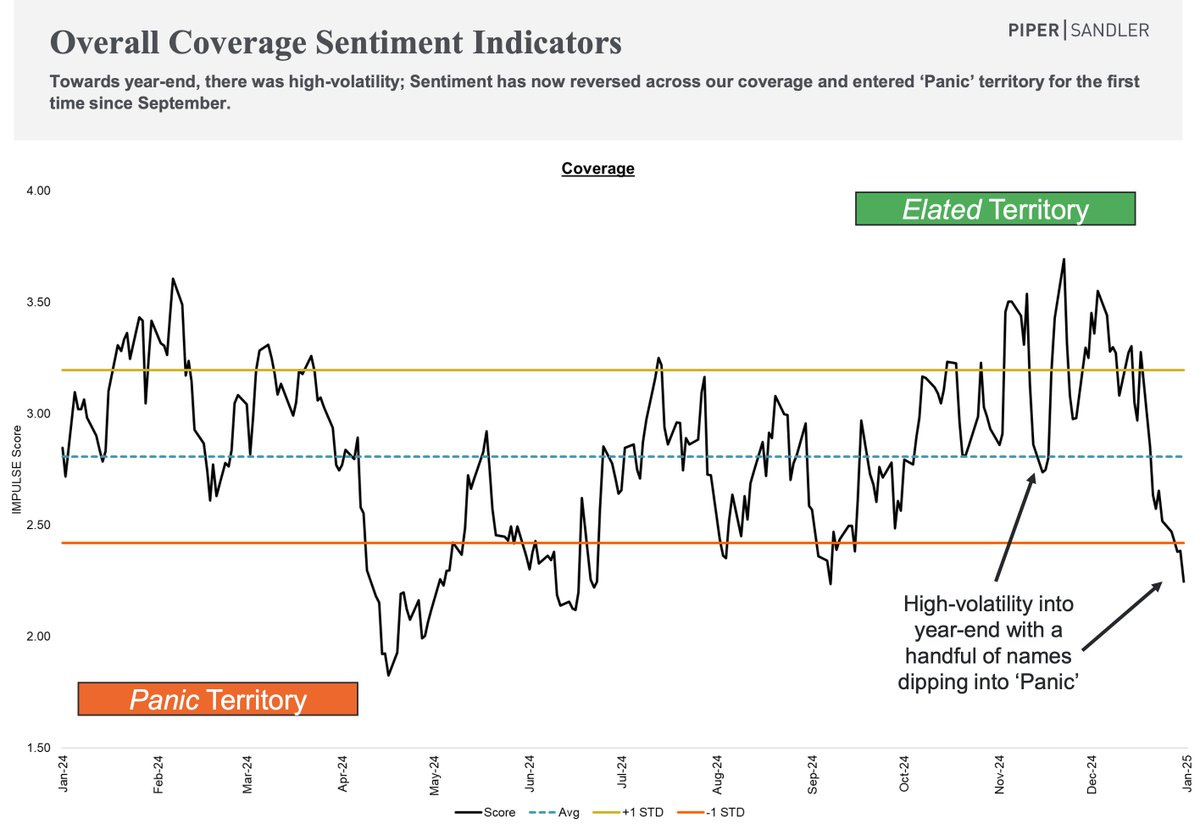

Panic sets in

It took less than 2 months for a number of technical indicators to go from euphoria to panic, which has been a good buy signal in the past. This suggests the market is close to putting in a short term bottom, and serves as a reminder that buying opportunities only look obvious in retrospect.

Jobs gains are not “too good”

Job growth accelerated in December, with payrolls increasing by 256k vs. the 165k that was expected. (Read)

This news accelerated last week’s selloff because it lowered the probability of another rate cut any time soon, and led to fears that inflation could remain sticky. Even if both are true, the fears are overblown.

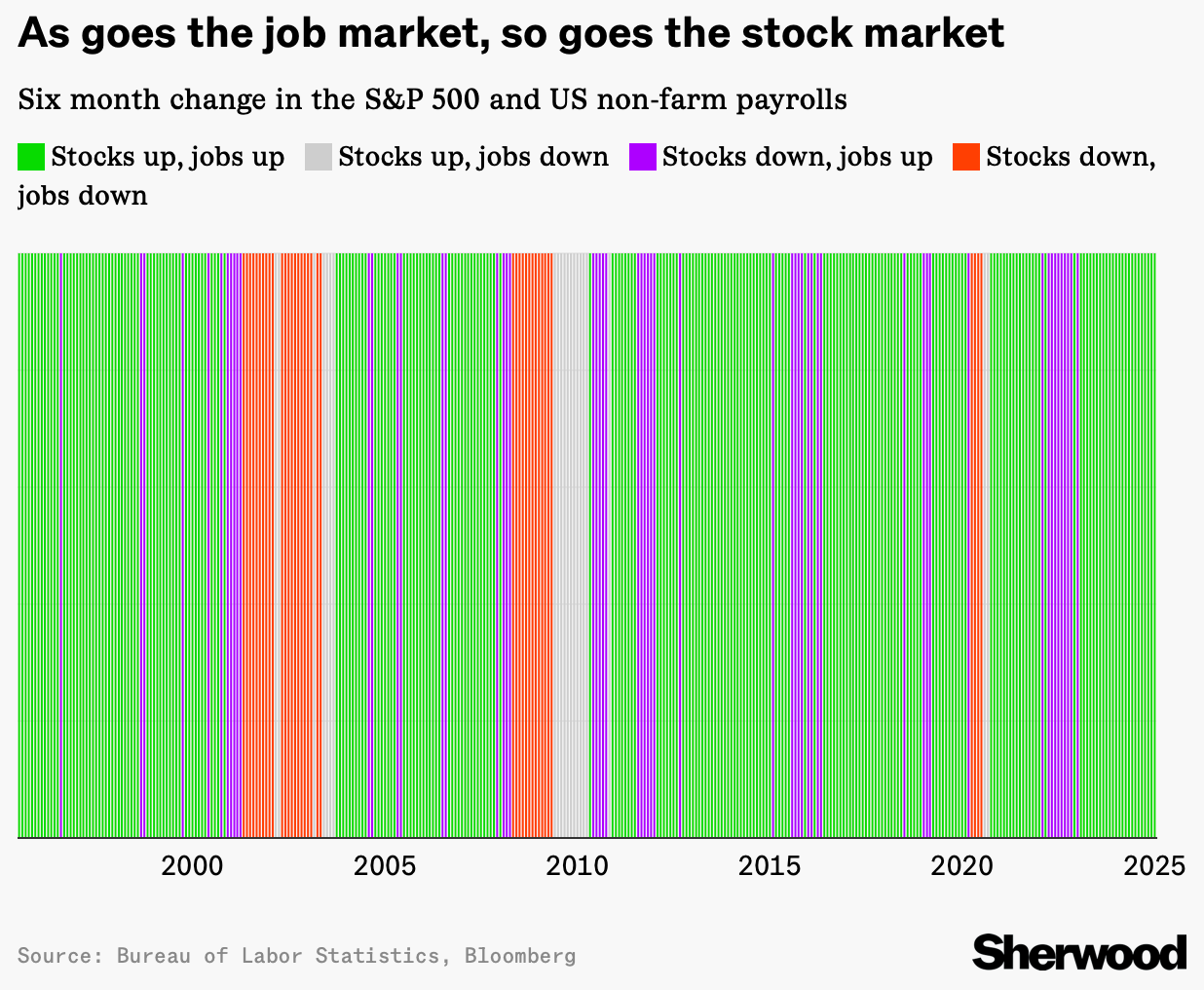

The unemployment rate remains below the long term average, wage gains exceed inflation, and the 6-month trend in payrolls and stocks are the same 80% of the time.

The idea that we need a weaker labor market so the Fed can cut rates for stocks to do well is just not supported by the data.

Bond issuance surges

The bigger clue that there will be fewer rate cuts is that companies issued $75 billion in investment-grade bonds in the first week of January, marking the busiest first week in history. (Read)

CFOs would not be doing this if they expected rates to come down.

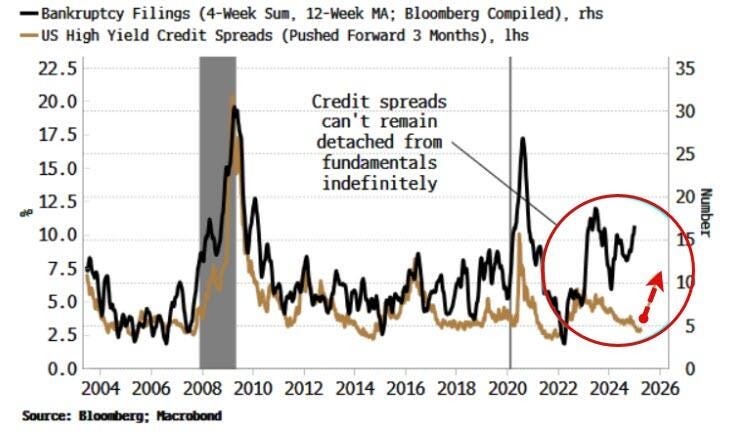

I’ve already addressed my outlook on long-term treasuries last week. For corporate bonds, quality is going to matter a great deal in the months ahead. We’ve already seen an uptick in bankruptcy filings over the last year. History suggests we should expect high yield bonds to come under pressure in response.