The Predictive Investor - 11/24/24

Small caps lead the way

Welcome to The Predictive Investor weekly update for November 24th, 2024!

Stocks rallied last week, led by the Russell 2000, which closed the week up 4.5%.

Small caps are still in an earnings recession but analysts expect them to see 50% EPS growth through 2026. This is great news if you’ve been following along, as we have a number of small caps in our portfolio.

While this bull market started with cost cutting moves by big tech, more and more companies are delivering improved earnings. About 60% of S&P 500 companies delivered positive EPS growth this quarter vs. about 50% in Q1 of 2023.

The bull market continues to broaden out, as I’ve been expecting for months.

Here’s my takeaways from the week.

Tesla is ready for the future

Kim Kardashian made headlines challenging the Tesla Optimus robot to a game of rock-paper-scissors. (Read)

While the U.S. ranks 10th on the list of countries with the highest industrial robot density, investment is increasing fast because industrial automation is critical to keeping domestic manufacturing competitive.

Given Elon Musk’s support of Donald Trump and his involvement in the incoming administration, I expect Tesla to be a beneficiary of the government’s efforts to reshore manufacturing.

Tesla’s metrics do not yet place it in our investable universe. But that could change very soon.

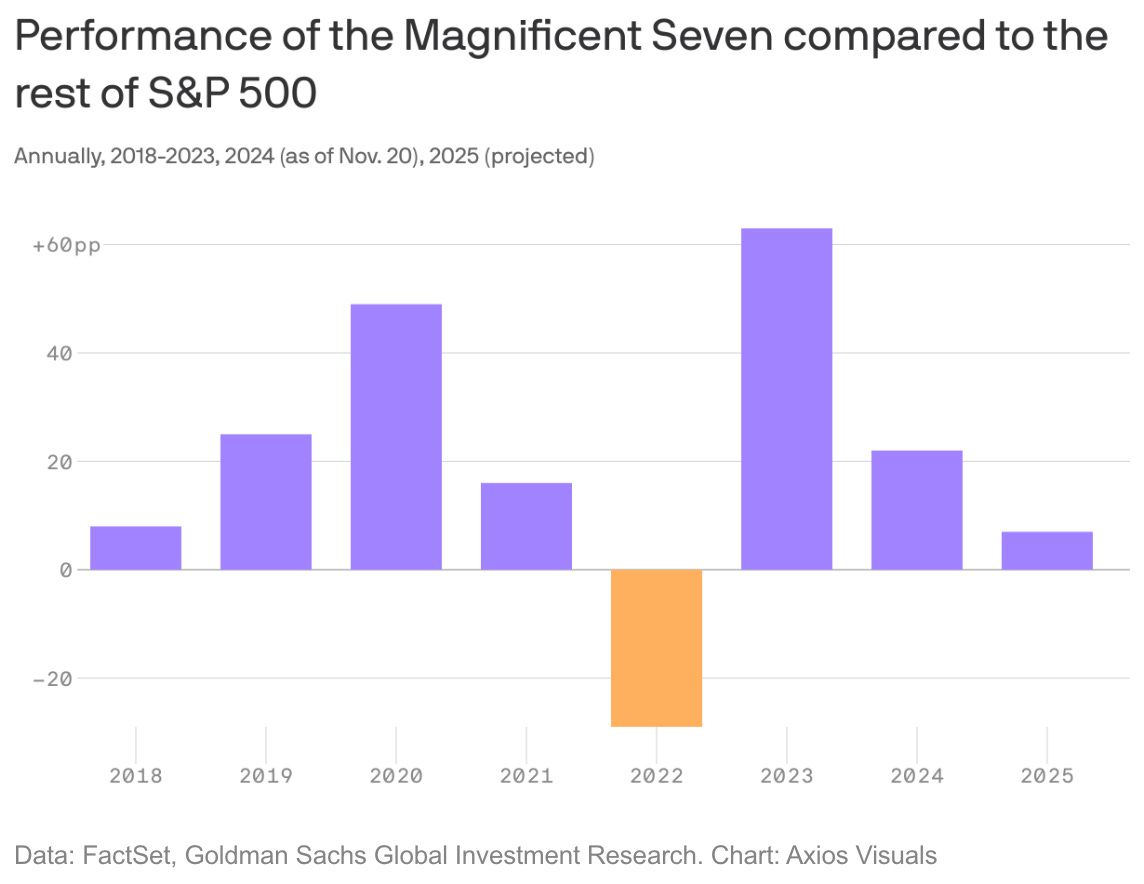

Excess returns for Mag 7 shrink

Speaking of Tesla, people are finally starting to notice the Mag 7 have been outperforming by smaller and smaller margins.

Here’s what I said to you in my update on September 1st:

“The Magnificent 7 just had its worst month relative to the S&P 500 since December 2022. And yet the S&P 500 equal-weight index closed at another all time high. August was a great month outside of big tech. Much of this has to do with the high expectations heading into earnings season.”

The question I’m now asking is whether there’s another reason for the shrinking outperformance of Mag 7 stocks outside of earnings already being priced in. Consensus says these companies will continue to win in the AI age because of their size and scale. And yet, many of Trump’s appointees are not exactly friendly to big business.

Vance has openly approved of efforts to break up Google, and many policies on RFK Jr.’s wish list would prove very disruptive to big pharma and agriculture. This is something I need to think through more carefully as I assess my own outlook heading into 2025.

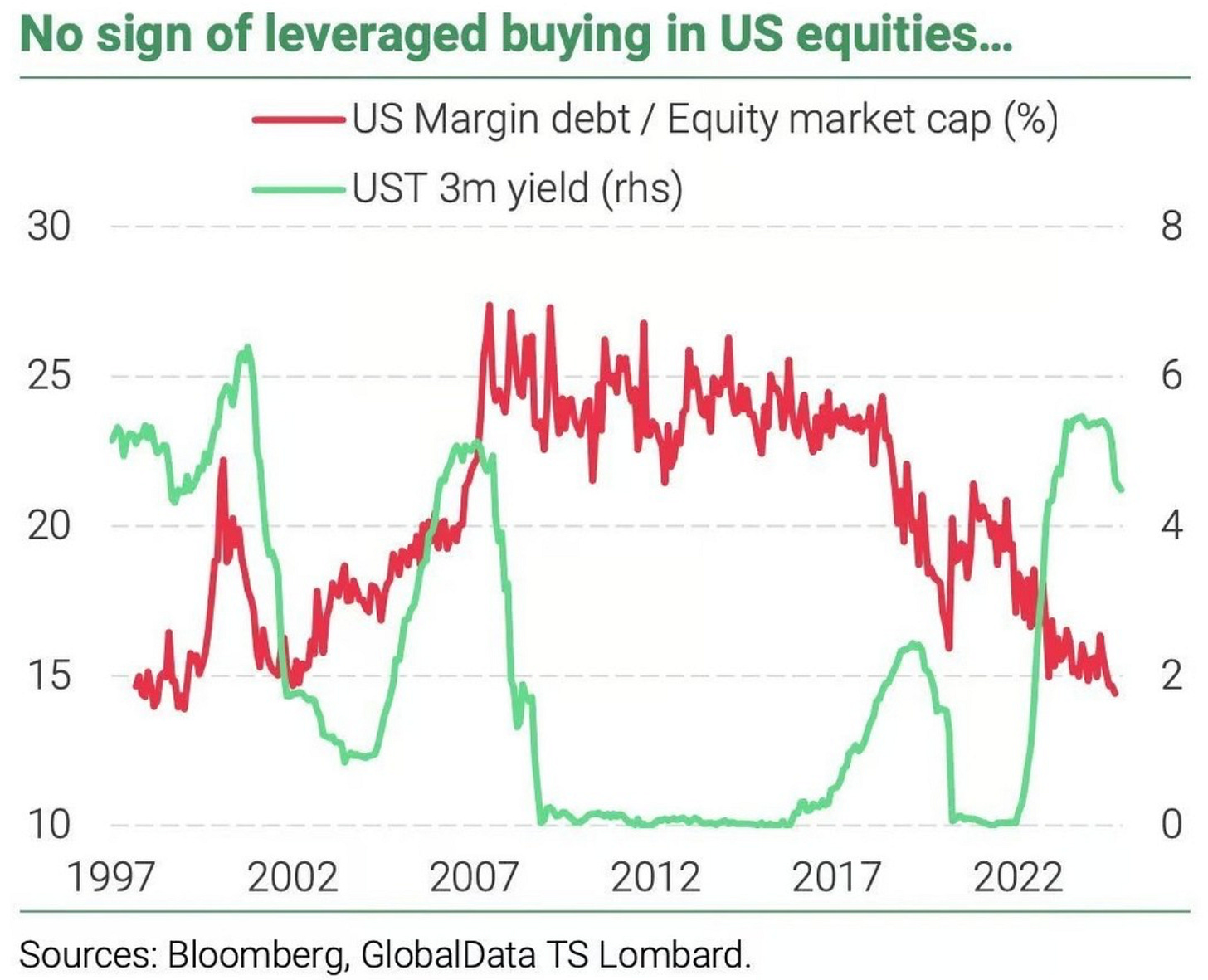

The relationship between rates and leverage

This is a great chart showing the relationship between short-term rates and leverage.

Yes, higher rates depress valuations because they reduce the present value of future cash flows. But higher rates also make it more expensive to borrow, which reduces money flowing into equities.

As a percentage of market cap, margin debt is the lowest it has been in 25 years. Not exactly a sign of a euphoric bubble that the media keeps warning us about. As short-term rates come down, it will provide a boost to stocks as traders take advantage of lower borrowing costs to increase leverage.

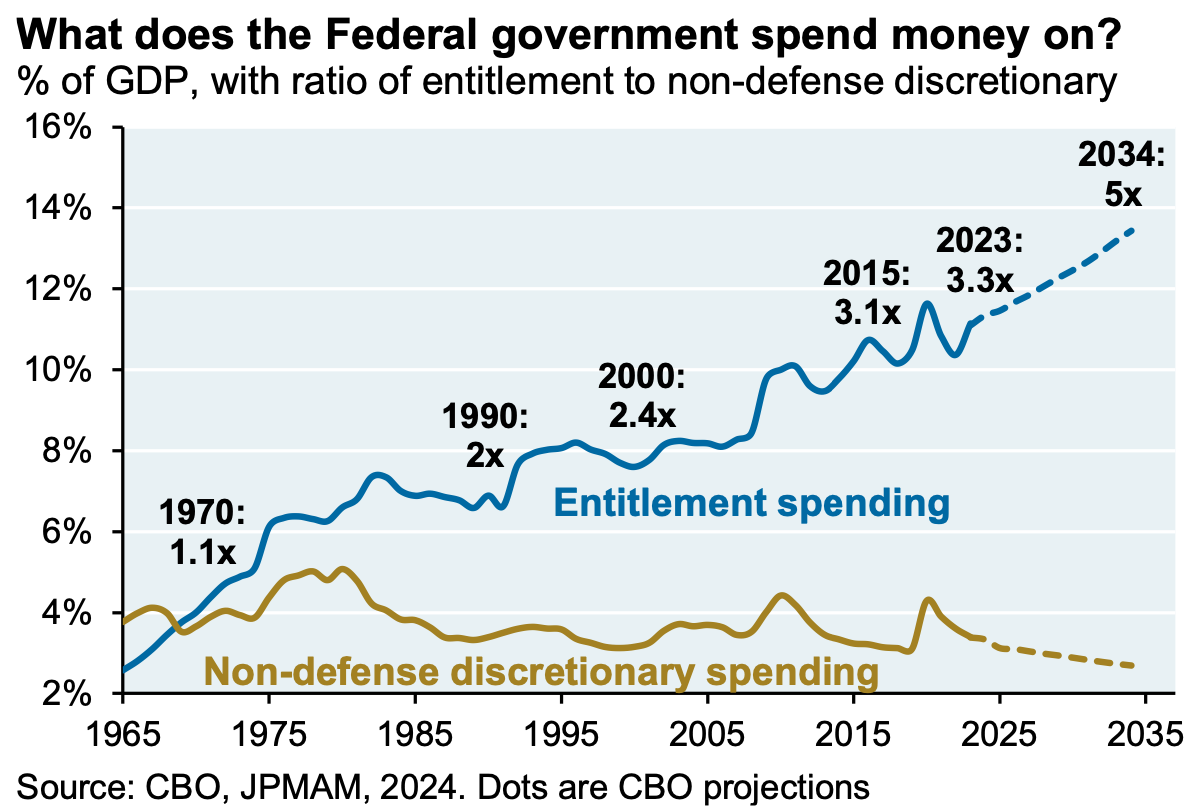

DOGE

Lots of buzz throughout the week over the newly formed Department of Government Efficiency. Co-heads Elon Musk and Vivek Ramaswamy have said they want to cut $2 trillion in spending.

A few folks have asked me if this changes my outlook on the U.S. fiscal situation and the potential for a full-blown debt crisis. In short, it doesn’t.

There’s no question there is tons of wasteful government spending, and we should all welcome efforts to make government more efficient.

But non-defense discretionary spending is already near the lowest share of GDP on record.

Defense, interest on the national debt and entitlement spending (social security, medicare, etc.) are the largest line items.

There are already proposals to cut Social Security benefits for new beneficiaries, extend the retirement age, and increase Medicare taxes for certain income brackets. But these are all difficult solutions to sell politically. And cutting defense is risky during a time of war. Not to mention government spending is a sizable component of GDP growth.

DOGE can definitely help stem the bleeding. But significant cuts are needed to improve the U.S. fiscal situation. And politicians rarely make those kinds of moves unless they’re forced to.

I think we may need the kind of debt crisis I’m expecting to force drastic change. I hope I’m wrong.

Kingstone breaks out of consolidation

KINS 0.00%↑ broke out of a 3-month consolidation on a 3x increase in volume week-over-week.

The stock has had an incredible run-up since I profiled it a year ago at $3.39, and the strength of the breakout suggests more upside ahead.

The stock is trading at 11 times earnings vs. an industry average of 15 and EPS is still growing fast, most recently at 266% quarter-over-quarter.

I expect a combination of multiple expansion along with earnings growth to continue to power the stock higher.

A fintech turnaround

I’ll be sending out a new addition to the portfolio this week to paid members. If you haven’t already, upgrade to a paid membership to get our best ideas first.