The Predictive Investor - 1/19/25

Get ready for a policy avalanche

Welcome to The Predictive Investor weekly update for January 19th, 2025!

Last week I identified 5,780 as a critical level of support for the S&P 500. The index traded just below that level on Monday, before reversing course and closing the week up 2.9%. The index is now above the 12/6 anchored VWAP (red line on chart), indicating that the bulls are back in control.

Normally this would make me more decisively bullish, but we have a new administration starting work next week. I expect a wave of policy announcements to cause some churn as traders digest the potential economic impact of what’s announced.

That said, there’s an increasing number of signs that the market is ready for the next leg higher.

Here’s my takeaways from the week.

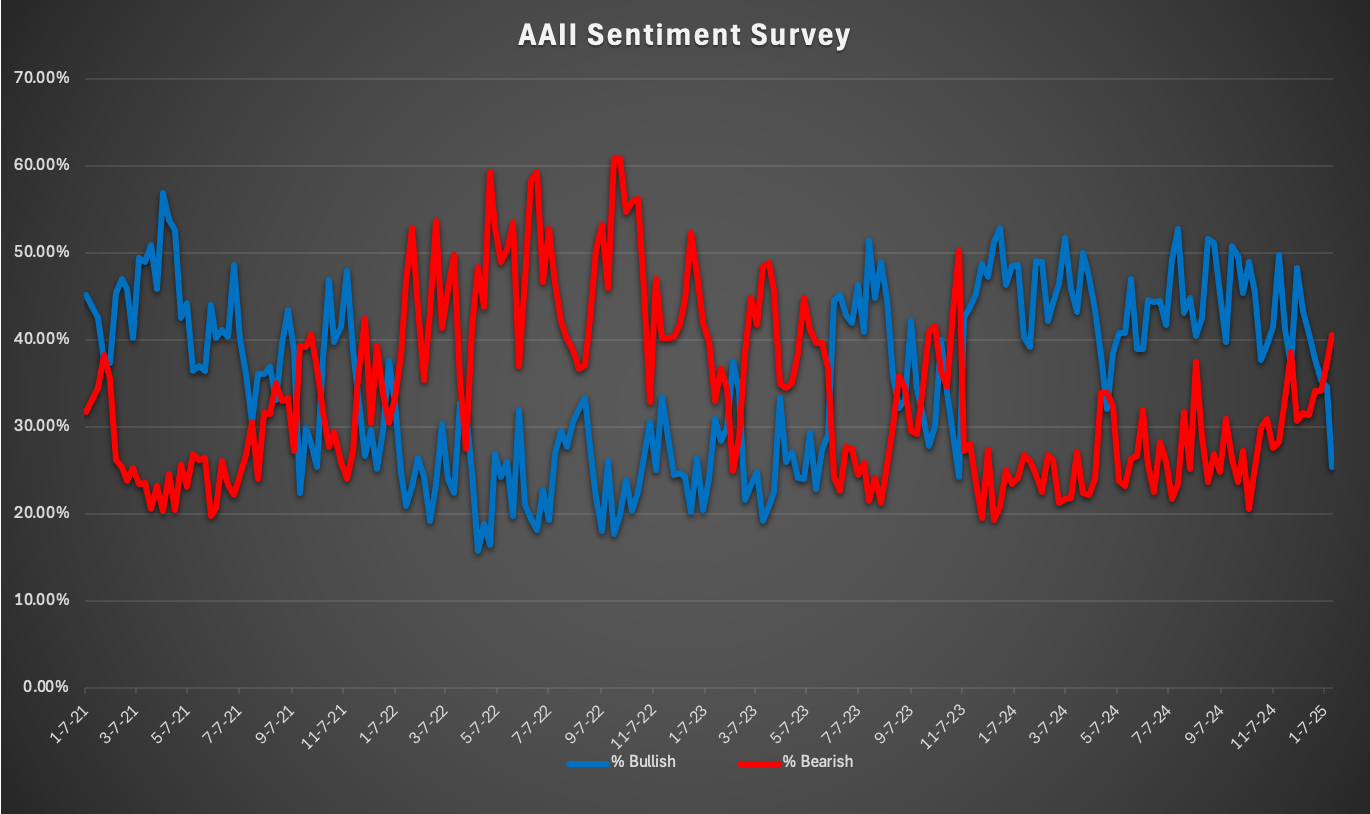

Bullish investors capitulate

Bullish investors in the latest AAII survey dropped to 25.4%, far below the historical average of 37.5%. Bears rose to 40.6%, above the historical average of 31%.

We’d have to go back to November 2023 to see bulls below 30% and bears above 40%, which turned out to be a great buying opportunity.

The unwinding of some of the extremes in bullish sentiment is a good thing. It means the weak hands are out, a necessary condition for stocks to reverse course.

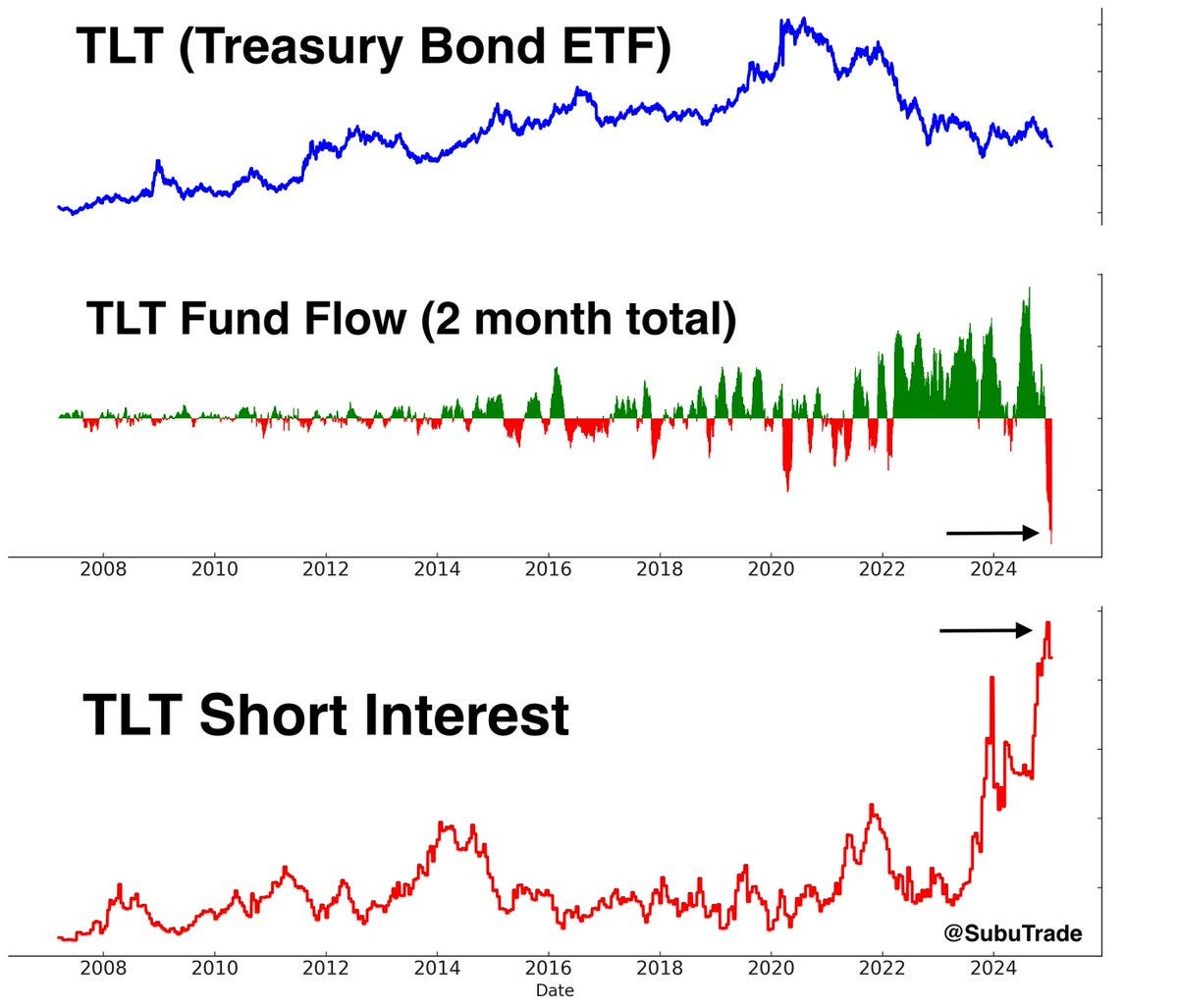

Treasury short squeeze?

Bonds rallied last week on better-than-expected inflation data. Despite my long term view on bonds, it appears over the short term that the selloff is overdone.

TLT 0.00%↑ has seen huge outflows over the last few weeks, and short interest is at record highs. If the first wave of policy announcements by the Trump administration doesn’t trigger fears of a second wave of inflation, these positions will be covered, triggering a rally in bonds. That means lower yields, which is bullish for stocks.

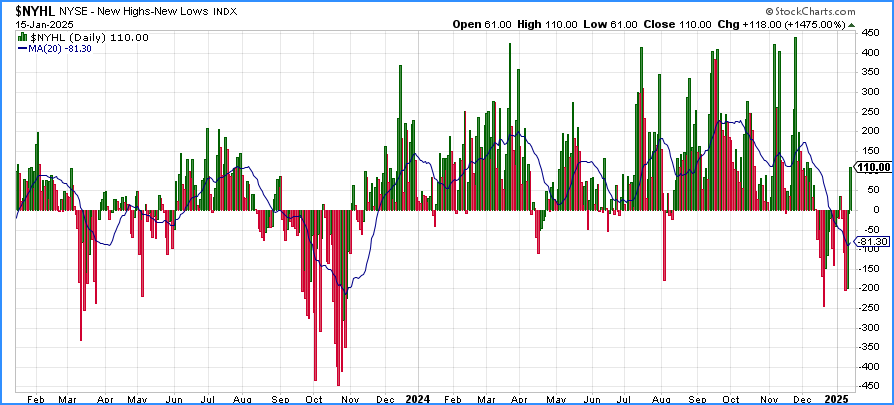

New highs exceed new lows

New highs minus new lows surged to its highest level in weeks. New highs now exceed new lows across 1, 3, 6 and 12-month timeframes.

The surge in the New Highs - New Lows index was an early indicator in November 2023 that the correction in stocks was over.

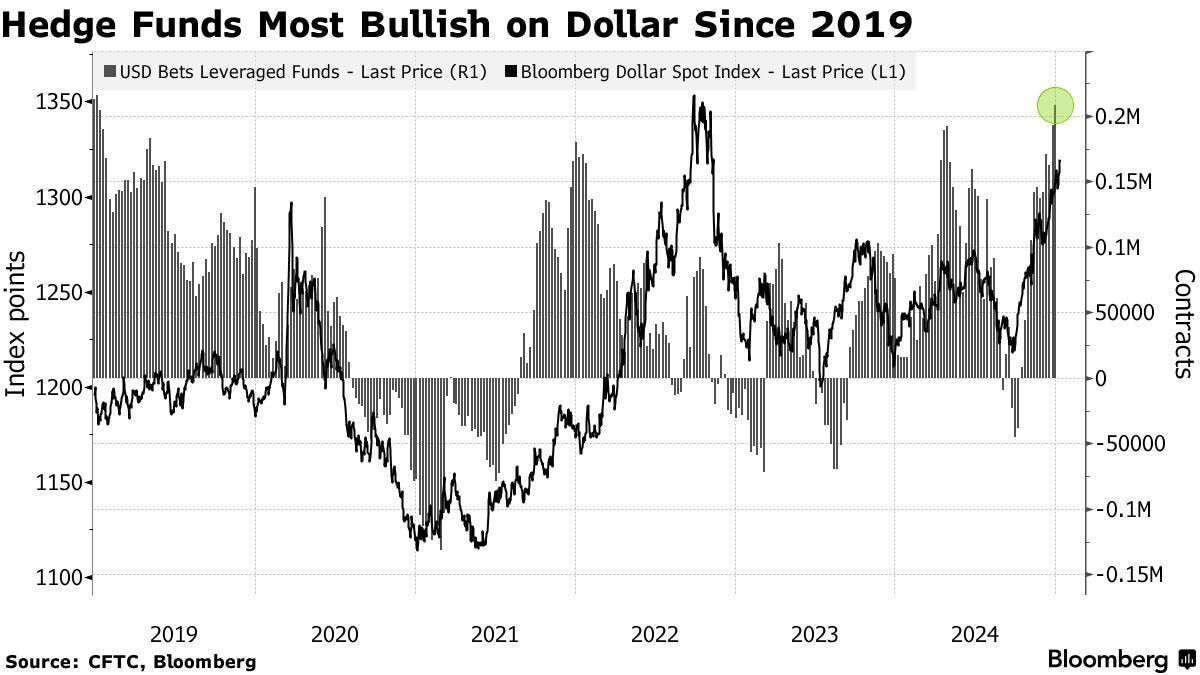

Hedge funds all-in on USD

Bullish sentiment around the USD has hit an extreme, driven by a slowdown in Europe and China, along with Trump’s pro-growth policies.

I wouldn’t be on the long side of that trade for much longer.

Trump wants a weaker dollar to help close the trade deficit with other countries. And ultimately the government will be forced to devalue the dollar to get the debt under control. That devaluation effort is likely to start later this year.

The challenge will be managing this monetary debasement without causing another wave of high inflation.

Trump’s favored approach here is to lower rates and cut regulation to spur growth, and reduce the inflationary pressures by shrinking government and increasing the supply of energy.

Done correctly, this is bullish for stocks, hard assets, and even crypto, and bearish for fixed income.

$TRUMP coin rallies 950%

Speaking of the incoming president, his new meme coin now exceeds $13 billion in market cap. (Read)

This comes after the market cap of FARTCOIN hit $2.5 billion.

Despite the fact that many are struggling with the effects of high inflation, this is proof there is still an awful lot of liquidity in the system, highlighting the potential risk of another wave of inflation.

What the government really needs is a repeat of the 2010s, where we had high asset price inflation without high goods price inflation.

And I believe this is partly why Trump is so crypto friendly. Yes, the crypto industry gave him millions of dollars in support of his campaign. But crypto is also an outlet that soaks up a lot of excess money in the system without impacting the CPI.