The Predictive Investor - 12/15/24

Capitulation begins

Welcome to The Predictive Investor weekly update for December 15th, 2024!

The bears have been throwing in the towel with increasing frequency. JP Morgan and Merrill Lynch have both shifted to a bullish outlook in recent weeks. And now David Rosenberg, one of Wall Street’s most vocal bears, has essentially apologized for taking so long to get on the right side of the trade.

From Rosenberg’s Lament of a Bear:

“This is not some attempt at a mea culpa or a throwing in of any towel, as much as the lament of a bear who has come to grips with the premise that while the market has definitely been exuberant, it may not actually be altogether that irrational.”

He goes on to acknowledge that AI is a technological breakthrough, and that the bubble he originally forecasted could take years to materialize.

The intent here is not to pick on Rosenberg. Although I turned bullish in early 2023, I just as easily could have been wrong. What’s more interesting to me is the timing. A number of high profile bears are capitulating against the backdrop of extremely bullish sentiment.

This is not an immediate sell signal - sentiment is a bit more complex than that. But it is a reminder that a large part of this game is psychological. And the market rarely goes up in a straight line.

Here’s why I’ll be anticipating some volatility in Q1 of next year.

December is bullish for stocks

December is a seasonally bullish month for stocks, especially the latter half of the month. January is less bullish, closing in the green only 50% of the time over the last 20 years. The market has been pricing in Trump’s pro-growth agenda, but there remains much uncertainty over what policies will actually be implemented. We will get some additional clarity in January, which will likely lead to an uptick in volatility. As the saying goes, buy the rumor, sell the news.

Sentiment is extremely bullish

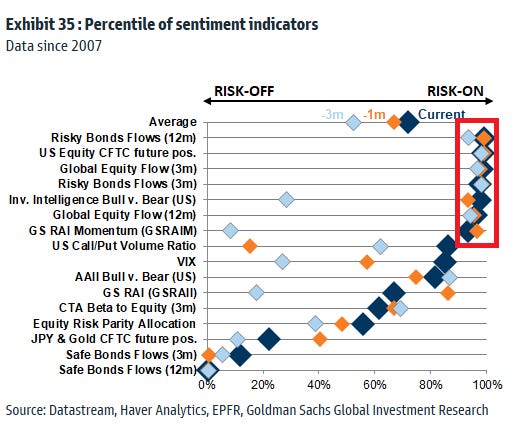

As I mentioned in last week’s update, a number of sentiment indicators are hitting bullish extremes. At a practical level, this means there are few buyers left over the short term, an ideal scenario for Wall Street to engineer a correction, given how many institutions have missed out on this bull market.

We’re due for a pullback

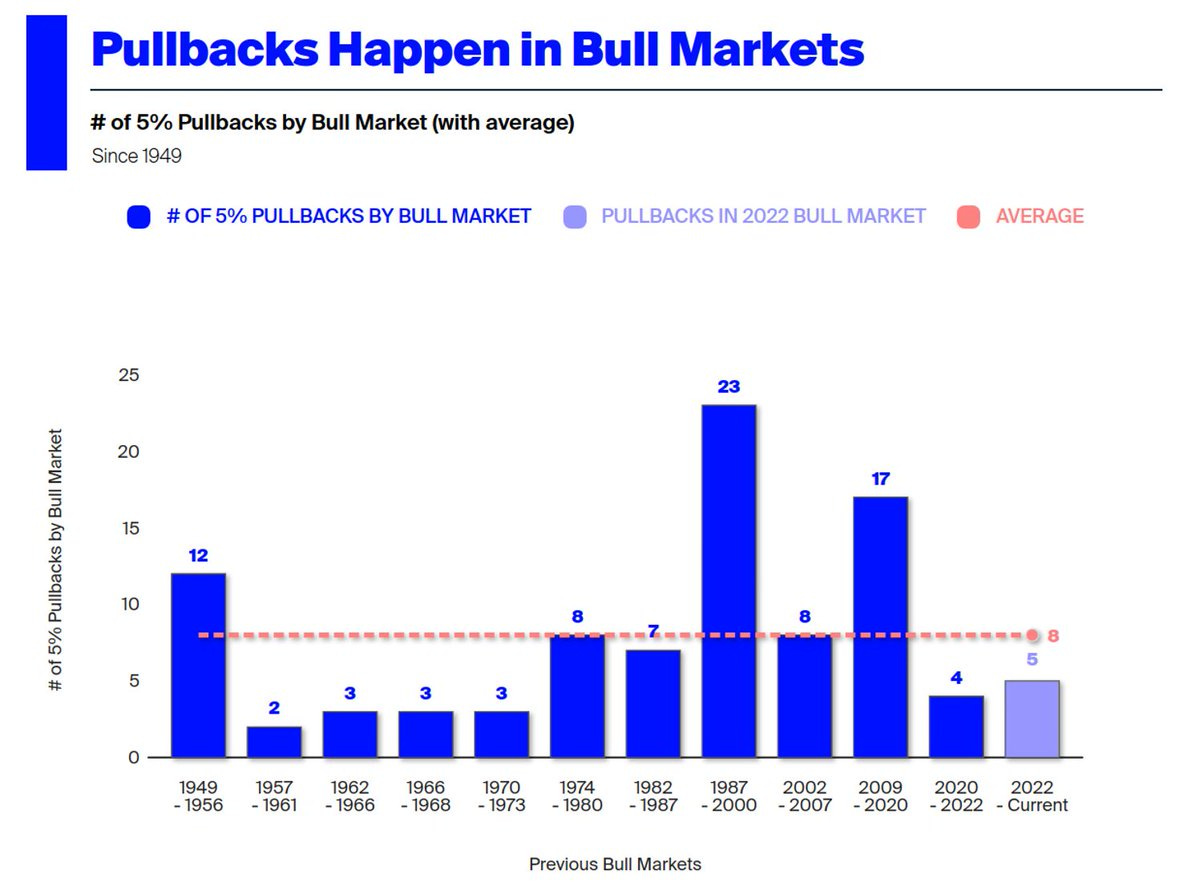

The average bull market has 8 pullbacks of 5%, and we’ve only had 5 since this bull market began in October 2022. Not only are we due for a pullback, but a correction would be healthy and set us up for the next leg higher. There’s a ton of money on the sidelines, and many investors are just waiting for a dip to buy.

Valuations will remain elevated

Part of what has been so frustrating for the bears is that traditional metrics like P/E ratios have been less predictive in the post-Covid era. Many investors are taught that high or low valuations will mean revert to fair valuation.

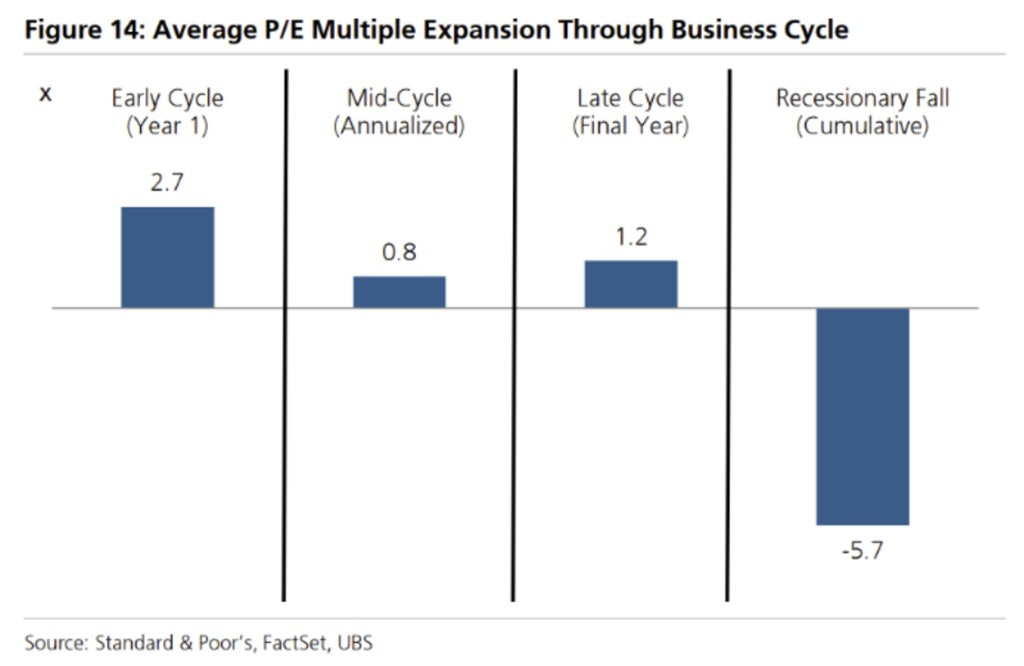

But research shows that valuations typically have an upward bias during non-recessionary periods, and then correct drastically during economic contractions.

I expect P/E ratios to remain elevated relative to historical averages throughout 2025.