The Predictive Investor - 12/22/24

Don’t let the market rattle you

Welcome to The Predictive Investor weekly update for December 22nd, 2024!

When I mentioned last week that we’re overdue for a pullback, I didn’t really expect one to materialize so quickly. But looking back the signs were there, including the Fed decision and pending debt ceiling negotiations.

So far this is a pretty standard drawdown, with the S&P 500 down about 4.5% from its December 6th high before recovering on Friday. The fact that the VIX had one of its biggest spikes ever on Wednesday, on a pullback with relatively average volume, indicates this is mostly driven by algorithmic trading and not institutional selling.

I still expect an uptick in volatility in Q1 of next year, driven by profit-taking and policy changes with the incoming Trump administration. If last week’s action scared you, now’s the time to review your allocation. And if it didn’t, get your shopping list ready.

Here’s my takeaways from the week.

The market sets the rate agenda

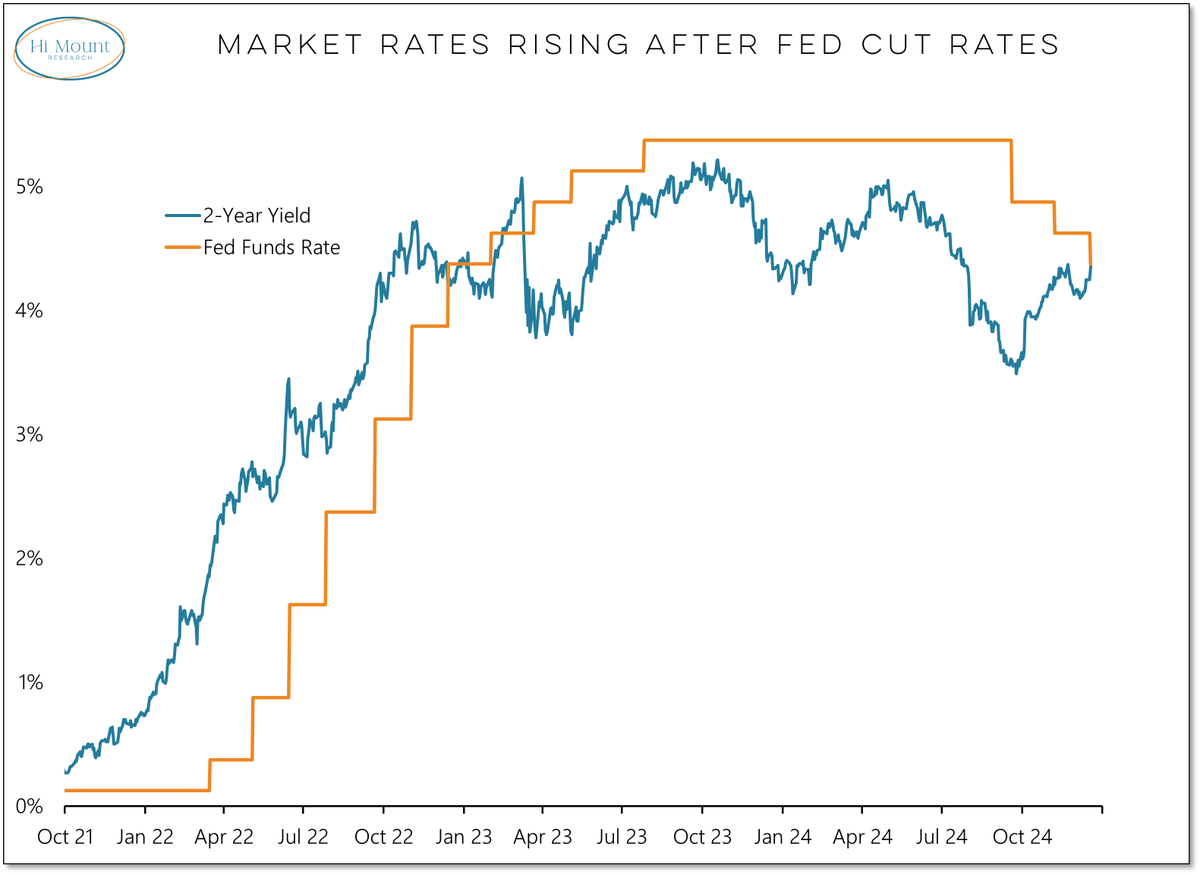

Contrary to what the media would have you believe, the Fed’s rate policy generally follows the market.

The ten year yield has been rising for two months. And last week the 2-year yield converged with the Fed Funds rate. No surprise then that the Fed is signalling fewer rate cuts in 2025.

After a rough couple years, bond investors are not going to accept yields below the rate of inflation. That’s not a bad thing. Yes, inflation remains above the Fed’s 2% target. But the fundamentals of the economy have not changed. The direction of rates over the next year is still down, and a slower rate cutting cycle is generally good for stocks, as it’s reflective of strong economic growth.

Stocks are extremely oversold

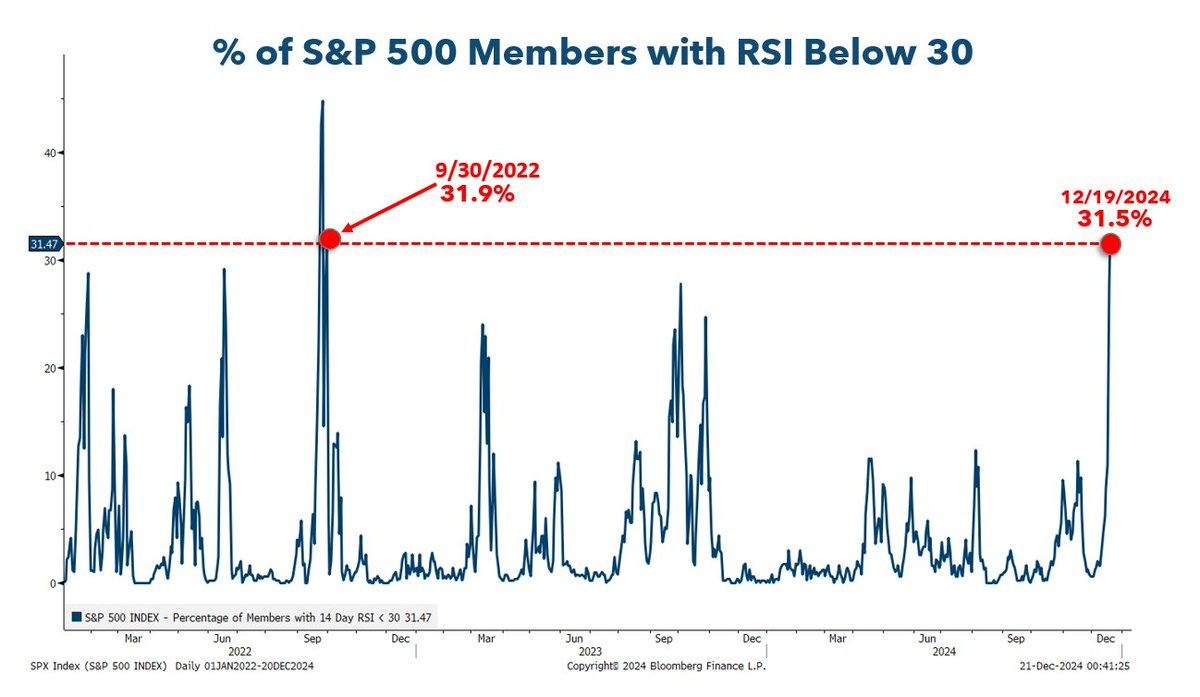

Last week the S&P 500 had the highest number of stocks with oversold RSI readings since September 2022.

And on Thursday the RSI reading on the S&P Equal Weight ETF $RSP was the lowest since the Covid crash of 2020.

Short term, the market is extremely oversold.

Strategists chase the market higher

While I expect the market to rebound over the short term, I have concerns over the next 3-6 months due to elevated sentiment against the policy uncertainty of the incoming administration, as I’ve repeatedly stated.

Wall Street strategists were caught off guard by this runaway bull market, and they don’t want to continue being wrong. What we’re seeing now is the highest 12-month increase in Wall Street market forecasts in over two decades. Unanimous consensus tends to create an environment that’s ripe for surprises.

What we saw last week was the outsized impact of small hiccups in a market priced for perfection. I continue to believe that Q1 of 2025 will bring more than a few surprises. Raise cash if you can, and get your buy list ready.

Factor investing wins even in a down week

Last week wasn’t all bad for our portfolio. SUPV 0.00%↑ continues to charge higher, up 11% for the week vs. a 2% loss for the S&P 500. We’re now sitting on a 110% gain in just 16 weeks.

My original investment thesis centered on the expectation that Javier Milei’s policies would grow Argentina’s economy, serving as a tailwind for the financial services sector. That continues to be true, as the country exited a recession in Q3 and is growing faster than expected. (Read)

The stock is now at a 6-year high, and shows no signs of slowing down. The benefits of a factor-based approach continue to pay off even in uncertain times.