The Predictive Investor - 12/29/24

Happy holidays

Welcome to The Predictive Investor weekly update for December 29th, 2024!

Last week I said to expect a bounce in the markets due short term oversold readings. We certainly got that, but there’s still some technical pressure. More on that below.

With the short trading week, I’ll keep this week’s update brief. Next week I’ll talk more about my expectations for 2025.

Until then, wishing you and yours a very happy new year!

SPX under pressure

The S&P 500 is wedged between its 50-day moving average (support) and the 12/6 AVWAP (resistance). The index must decisively break above 6,000 for the uptrend to remain intact. Daily volume remains far below average for the month, so I expect next week to give us a better signal on the short term direction. I continue to expect Q1 of next year to bring some surprises, with an increase in volatility.

Commercial real estate turnaround?

The retail real estate market is finally turning around, thanks to high interest rates stifling new construction. (Read)

Vacancies are at record lows amid strong demand for open-air shopping centers. Landlords now have the upper hand in being able to raise rent as leases expire.

Add this to the list of other commercial real estate sectors that are booming, including data centers, industrial warehouses and self-storage facilities.

Public and private REITs are trading at attractive yields, and real estate should perform relatively well against the backdrop of continued deficit spending.

One of my favorite real estate plays is the Cohen & Steers Quality Income Realty Fund (RQI 0.00%↑), a closed-end fund that boasts a 7.84% yield. It’s currently trading at a 4.2% discount to NAV, which more than makes up for the management fees. The shares are approaching their 200-week moving average, an area of historical support.

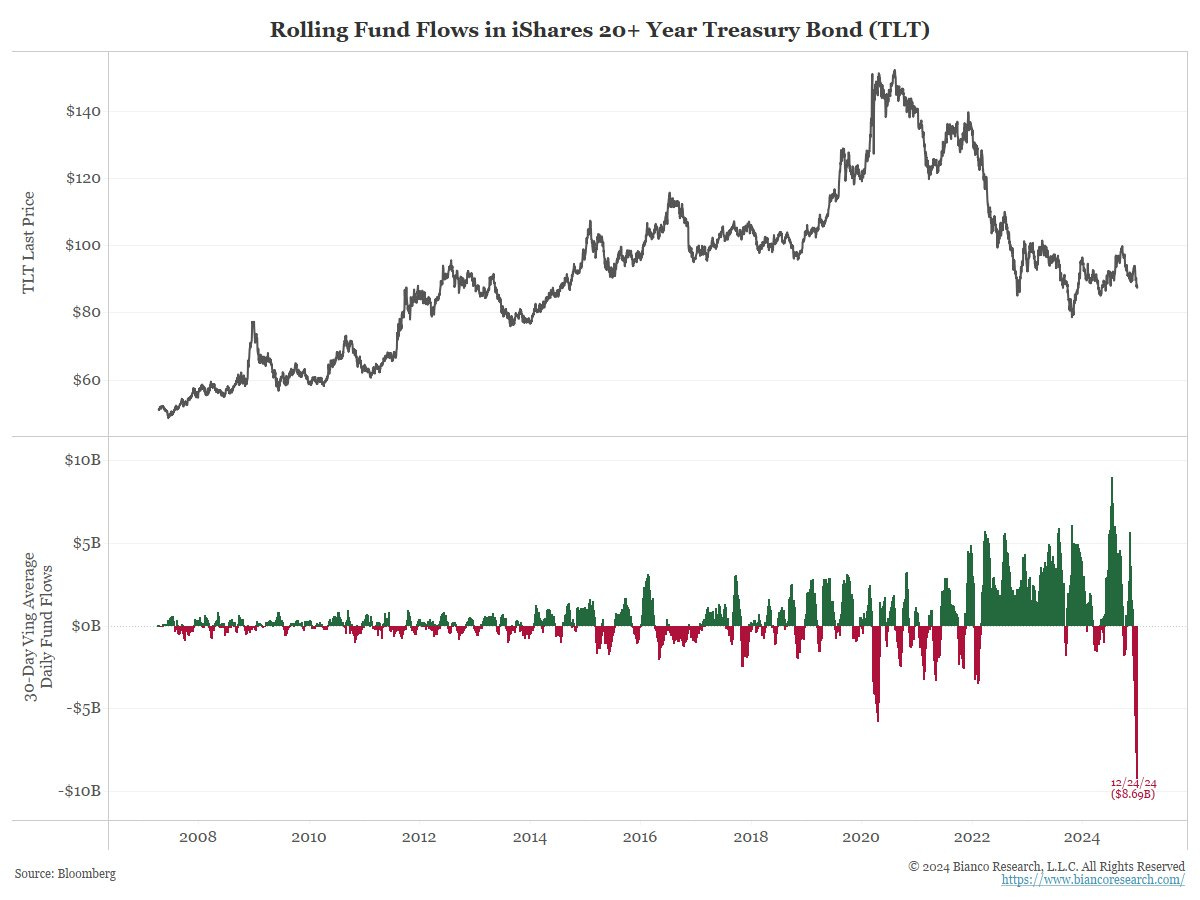

Bond selloff accelerates

It’s no secret that I’ve been bearish on long term bonds for some time now. In fact, back in August I said Bitcoin would outperform treasury bonds going forward, which drew more criticism than I expected. And yet, Bitcoin went on to double in value and TLT 0.00%↑ fell nearly 10%.

It seems counterintuitive that bonds would sell off as the Fed is lowering rates, until you realize that the Fed has very little control over anything outside of the funds rate.

The last month has seen the largest outflow in TLT’s history - about $8.7 billion. The bond market is not on board with the Fed’s easing cycle, which means rates will stay higher for longer through next year.

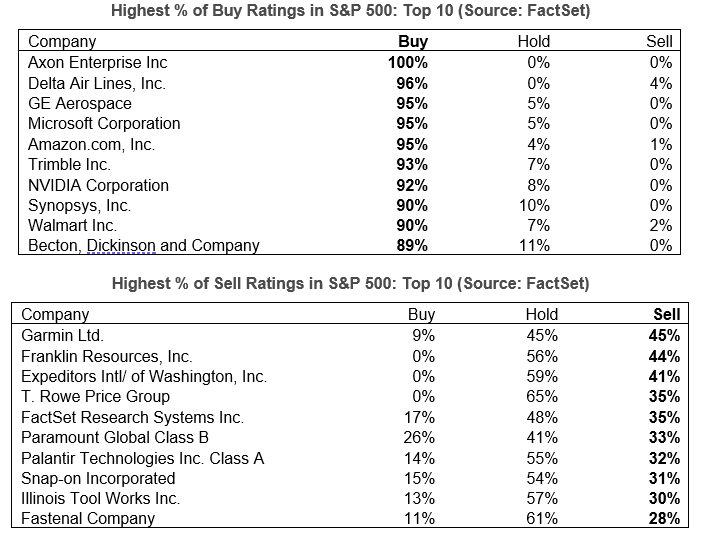

Analysts get it wrong on Palantir

Factset just came out with a list of the S&P 500 stocks with the highest percentage of buy/sell ratings. Analysts are still overwhelmingly bearish on Palantir PLTR 0.00%↑. No surprise there.

They missed it on the way up, and are still crying about valuation, etc. And all the while the company continues to deliver superior EPS growth. Stocks rarely top on universal negative sentiment.

We’re up over 300% since our original buy price. While the current valuation is certainly high, I’m hoping for a pullback so I can accumulate more shares.