The Predictive Investor - 1/26/25

New policies, new all time highs

Welcome to The Predictive Investor weekly update for January 26th, 2025!

Last week I went through a number of signs that the market was primed for the next leg higher. I also expected some volatility around new policy announcements.

One out of two ain’t bad. Trump did sign 26 executive orders on day one, more than any President in history. But his initial posture around immigration and tariffs were less severe than expected, which actually sent the VIX lower.

Meanwhile, the focus on pro-growth policies, including a number of AI-related investment announcements, sent the S&P 500 to a new all time high.

Here’s my takeaways from the week.

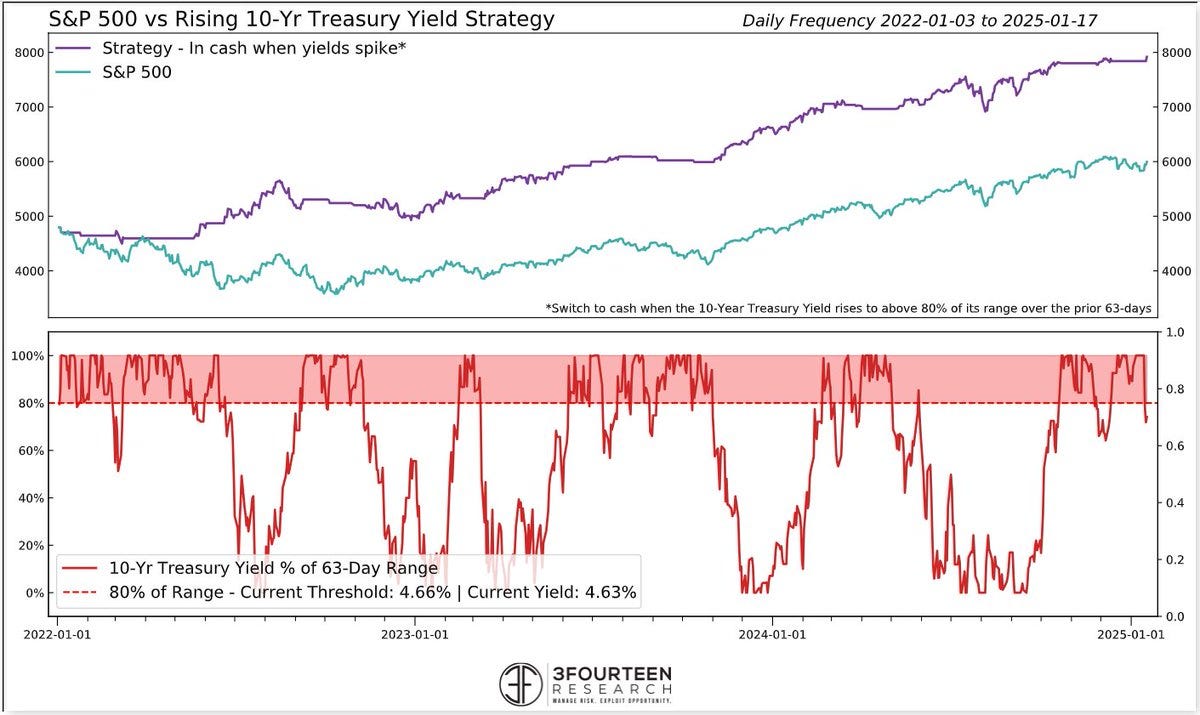

Yields take a slight breather

While yields were basically flat last week, the yield on the 10-year is now out of the danger zone that has served as a headwind for stocks in the past - the 80th percentile of its rolling quarterly range. That level is currently 4.66%.

As I mentioned last week, TLT hit pretty oversold levels and short interest remains high. But even if a relief rally does not materialize, staying flat from here will not impede stocks from advancing higher.

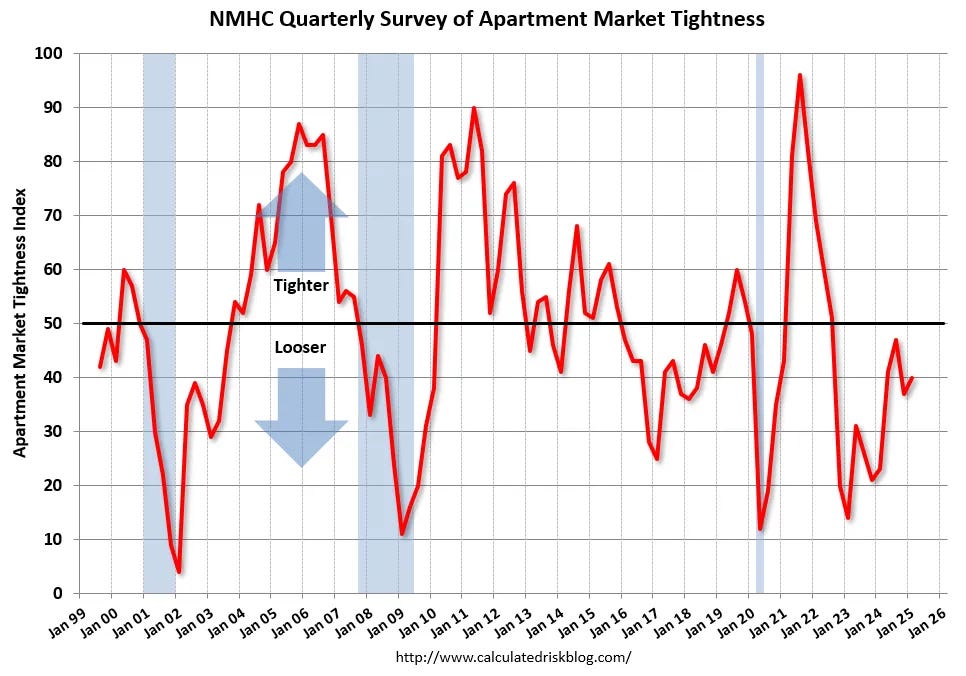

Housing signals cooler inflation

The National Multifamily Housing Council’s Apartment Tightness Index has now shown looser quarter-over-quarter conditions for 10 consecutive quarters.

Readings below 50 indicate looser conditions versus the previous quarter.

This is a leading indicator for vacancy rates, and suggests continued downward pressure on rents.

We also saw a 15.8% monthly increase in housing starts in December, with the highest number of starts since February 2024.

With shelter making up 30%-40% of the CPI, more supply and lower rents signal cooler inflation ahead, and could help offset some of the inflationary effects of tariffs.

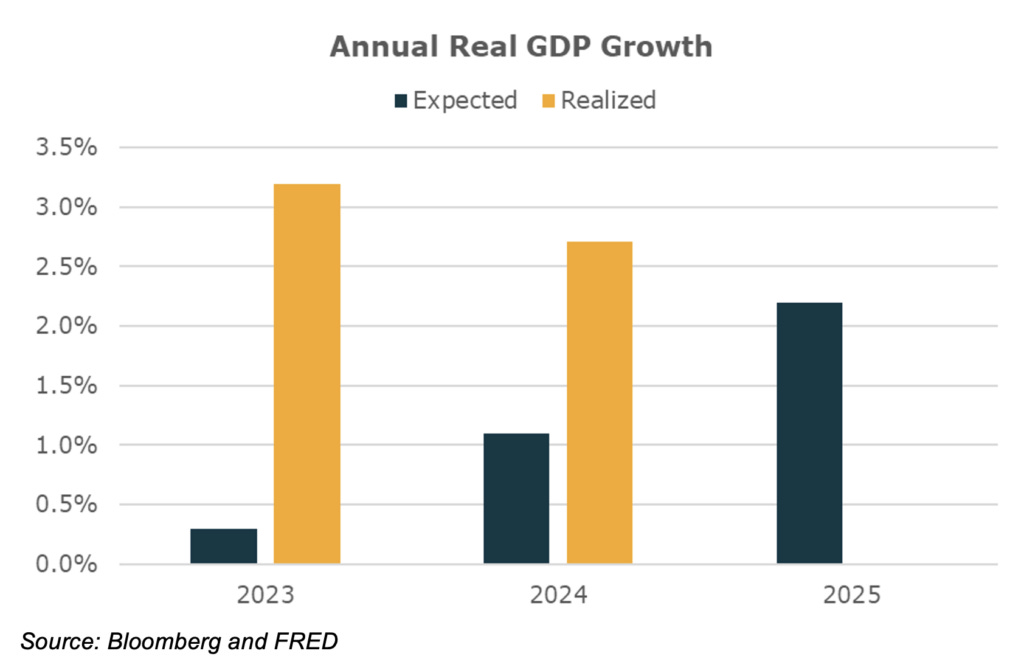

Economists raise the GDP bar

After unanimously predicting a recession in 2023, and falling far short of reality once again in their outlook for 2024, economists finally got serious about this bull market, raising their GDP expectations considerably for this year.

This means the bar for exceeding expectations is now much higher than any time over the last two years.

As we head into earnings season, I’ll be watching guidance very carefully. We’ve all seen stocks sell off even on good results when expectations are too high. That might provide an attractive entry point for stocks I missed on the way up.

DeepSeek causes an AI freak out

DeepSeek released an open source AI model that beats OpenAI on a number of key benchmarks at much lower cost. (Read)

Export controls on GPUs were designed to give Western firms an advantage in AI, but this just incentivized Chinese firms to use computing resources more efficiently.

The long term implication here is these AI models will become commoditized at some point. This is why Google, Microsoft and Amazon are investing in OpenAI and Anthropic. They know that the real value will be further up the stack, and they want these partnerships in place so they can integrate these models with other tools in their ecosystem.

The bigger investment opportunities will be in how companies use AI to boost productivity and create new revenue streams. Palantir PLTR 0.00%↑ remains my favorite AI play right now, and I would welcome a selloff from panicked investors so I can pick up more shares on the cheap.

Hindenburg throws in the towel

Famed short-seller Hindenburg Research recently decided to shut down operations. (Read)

This comes a year after short-seller Jim Chanos shut down his hedge fund.

While there are accusations of securities fraud at Hindenburg that involve ongoing litigation, there’s no question the rise in passive investing has made it much harder for short-sellers to make money.

Fewer shorts combined with a rise in passive investing mean less efficiency in the market. There’s never been a better time to be an active investor.