The Predictive Investor - 12/8/24

Another week of record optimism

Welcome to The Predictive Investor weekly update for December 8th, 2024!

The SPX closed the week at a new all time high once again, and optimism is at record levels by a number of metrics. But the clearest example of bullish sentiment is Bitcoin hitting $100,000.

This is not just a reflection of the incoming Trump administration’s crypto-friendly policies, but also highlights broader marketing dynamics favoring risk assets.

The contrarian in me is always careful with sentiment extremes, but the optimism is supported by solid fundamentals.

Here’s my takeaways from the week.

The consumer is incredibly strong

Despite mixed consumer sentiment on the health of the economy, consumers haven’t stopped spending.

Cyber Monday was the biggest online shopping day in US history with a total of $13.3 billion in spending.

Domestic box office revenues exceeded $400 million, the highest ever Thanksgiving weekend in history.

The TSA screened over 3 million people at airports last Sunday, an all time daily record.

No question many folks are struggling and frustrated by inflation. But these are not exactly signs of an economy in distress.

Record earnings estimates for 2025

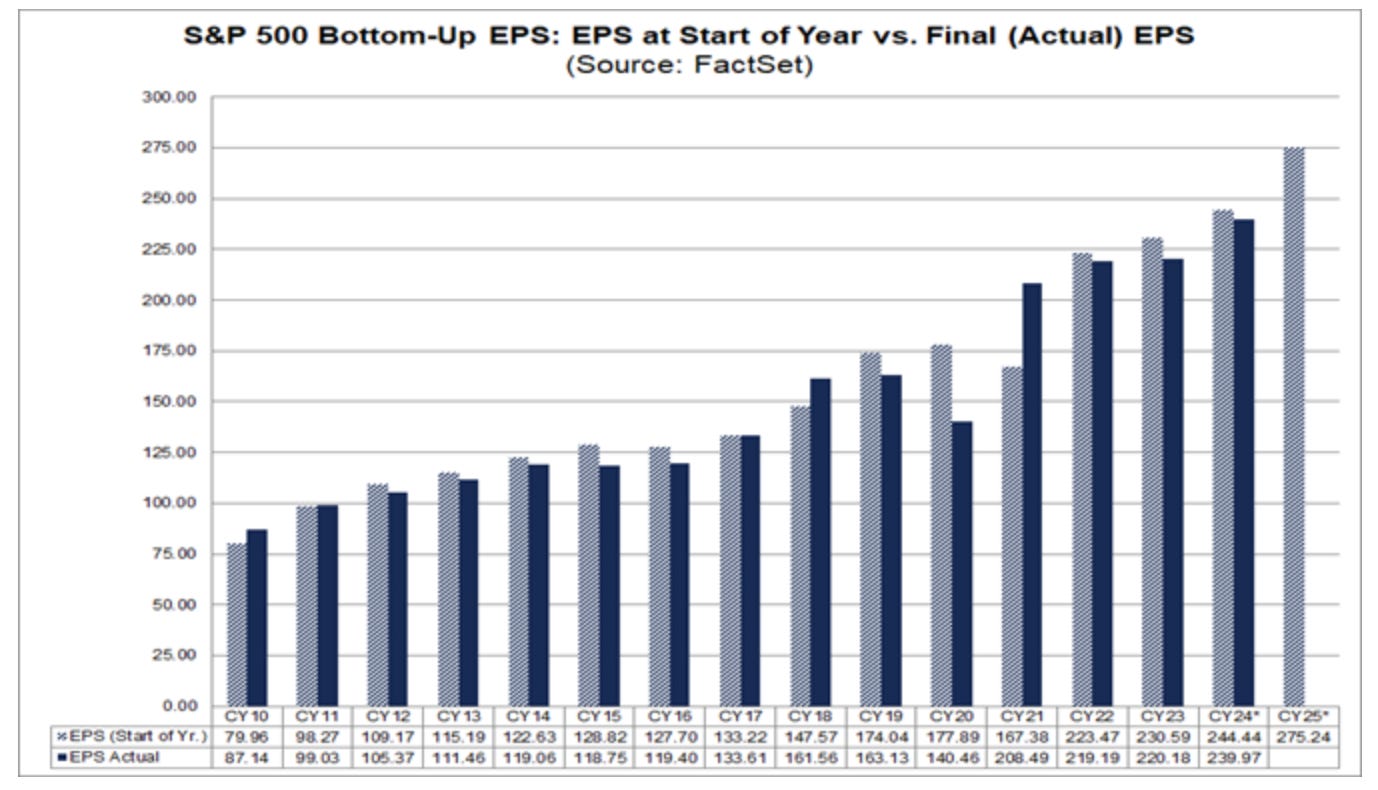

While most analysts' stock market price targets were too conservative heading into 2024, they have been relatively accurate at predicting forward earnings.

At the beginning of the year, analysts expected S&P 500 EPS of $244 for 2024, and with just a few weeks to go it’s looking like we’ll close the year at $240.

For next year they’re expecting a record $275 EPS for the S&P 500. Over the last 25 years, analysts on average have overestimated the final EPS number by 6.3% on year in advance. If we reduce next year’s estimate by the average overestimation, it would still be the highest annual EPS number in history.

U.S. crushes its peers in productivity

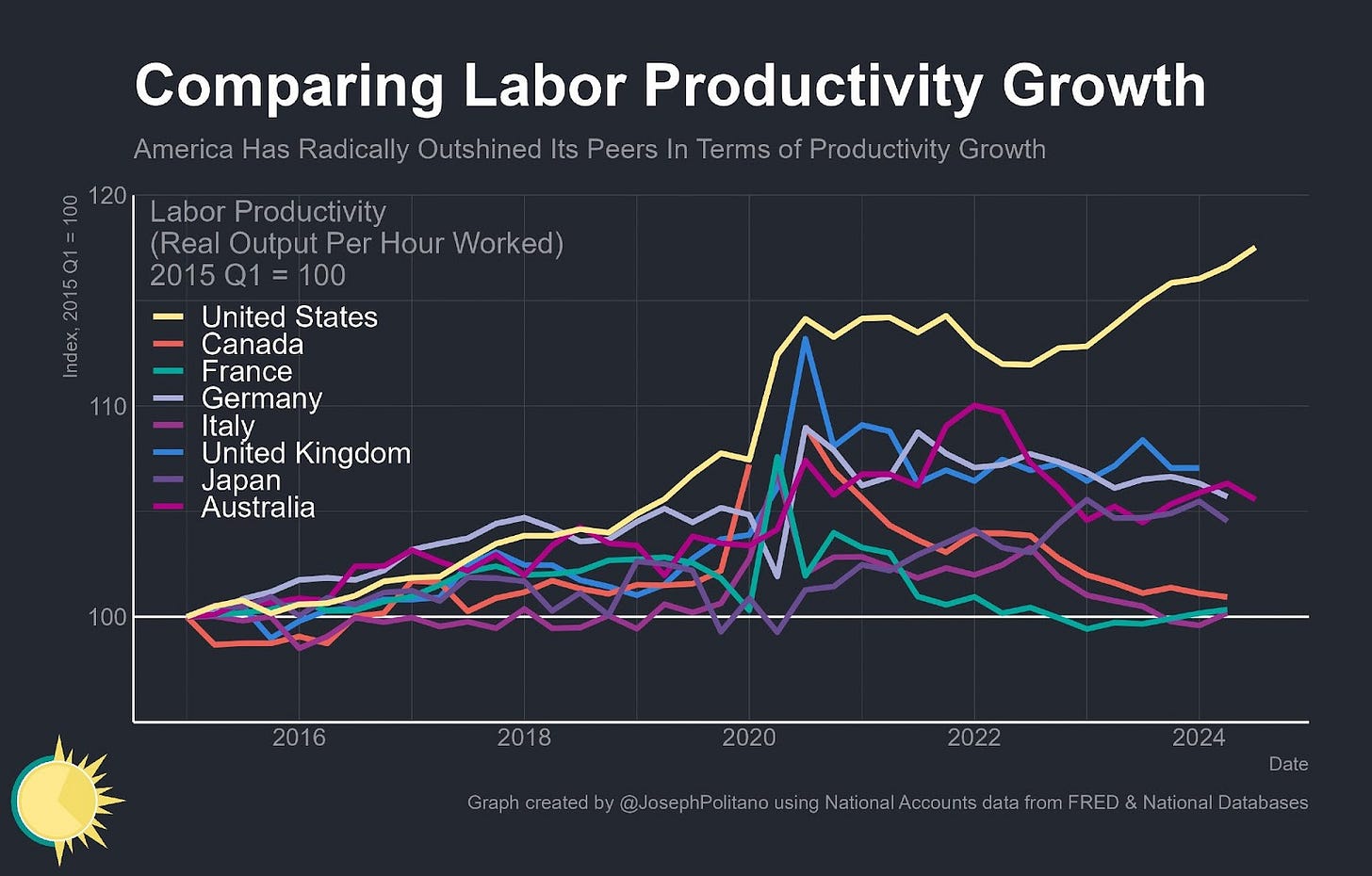

Productivity in the U.S. rose faster in the last 5 years than at any point since 2010, and is far above any of its peers.

Productivity is essentially GDP per hour worked, so it’s no surprise that GDP continues to be above trend.

The risk-on behavior we’re seeing in the markets also translates to the rest of the economy, and the incoming administration’s efforts to reduce regulation should continue to power economic growth into next year.

Market breadth softens

As the S&P 500 continues to make new highs, more of its components are slipping below their 50-day moving averages. This is not a sell signal in and of itself but definitely something to keep an eye on. The index is not in overbought territory just yet, but could get there soon if this rally continues through the new year.

Trade policy remains uncertain

The impact of Trump’s proposed 25% tariff on all goods coming from Canada and Mexico would be significant. And yet the market doesn’t seem to care.

I believe this is because investors don’t think they will be implemented. Trump has already opened a dialog with Canada’s Prime Minister and Mexico’s President. Historically, Trump has used the threat of tariffs with allies as a negotiating tool. Getting more cooperation from both countries on the border and drug trafficking would be a quick win for his administration.

I do expect Trump will impose additional tariffs on China. China has already taken steps to pre-emptively retaliate, by banning rare earth mineral exports to the U.S. Given the state of China’s economy, they may not be inclined to retaliate further. But trade policy remains a risk factor in 2025.