The Predictive Investor - 1/5/25

The 2025 Non-Forecast Issue

Welcome to The Predictive Investor weekly update for January 5th, 2025!

2025 is shaping up to be an exciting year, full of both opportunities and risks. And I look forward to exploring them together in the months ahead.

Once again it’s forecast season on Wall Street. I find forecasts to be interesting yet somewhat unhelpful. Much of what gets published is marketing material in disguise. And even the more accurate macro forecasters were caught off guard at the strength of last year’s rally.

A rules-based approach like the ones I explore here are typically agnostic of macro factors. But I do find it helpful to make a general assessment of what we know is true. This allows us to view the companies that qualify for our rules-based approaches in the context of larger macro trends.

But first, let’s take a look at how we did in 2024.

2024 Recap

What I got right: I expected a soft landing for the economy based on the tight labor market and the buildup of significant household savings. I expected inflation to remain above the Fed’s 2% target due to the structural costs involved in adjusting supply chains, along with higher energy prices. I was also bearish on long term bonds, with the thesis that investors would view high government debt levels as a risk that required higher yields even if inflation fell.

What I got wrong: I expected small caps to benefit more substantially from CapEx growth. While the Russell 2000 had a strong second half, it lagged the S&P 500 significantly in the first half of the year.

All in all, I’m satisfied with our results. The total return on our closed positions in 2024 was 27%, just beating the 25% total return of the S&P 500. The average gain on our open positions is currently 88%.

Stocks are likely to gain in 2025

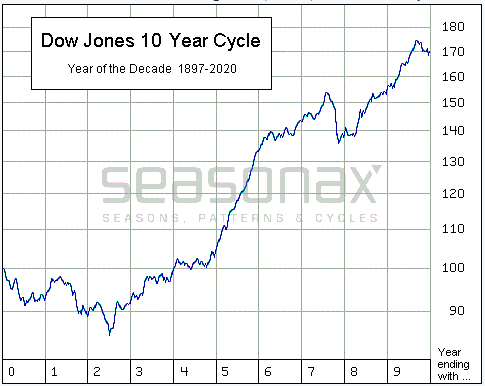

The S&P 500 is in a bull market 80% of the time, so statistically stocks are likely to gain ground this year. Additionally, the decennial cycle shows that bear markets tend to occur in the first third and last third of the decade.

The decennial cycle is not foolproof, but has been more accurate than not. And it’s partly why I turned bullish in early 2023.

But none of this means that 2025 will be an easy ride. The S&P 500 has been in a short-term downtrend since December 6th and I continue to expect a weaker first half, followed by a stronger second half of the year.

Flows into money market funds have surged over the last couple weeks, suggesting investors are taking profits. This is normal after such a strong year.

There’s currently $6.85 trillion sitting in money market funds. Many investors are waiting to get a better signal on what policies the incoming Trump administration will pursue. But as short term interest rates decline, the incentive to put this money to work will be strong.

Policy uncertainty

We have not entered a year with this much policy uncertainty in quite some time. Specifically, tariffs and immigration have the most potential to disrupt the economy.

Much ink has been spilled over predictions on the potential inflationary effects of tariffs. While it’s true that a 20% tariff would typically raise the price of a finished good by 8%, tariffs don’t exist in a vacuum. They can be offset by lowering costs elsewhere in the supply chain. China could also devalue their currency, which can offset the price increase.

With immigration, there are also many open questions. How many people will actually be deported? Over what time period? Will fewer workers put upward pressure on wages, leading to a second wave of inflation?

Anyone who pretends to have the answers to these questions is lying.

Uncertainty leads to surprises on the upside and downside. Therefore I expect an uptick in volatility this quarter and perhaps next, as the market digests the wave of policy announcements after Trump takes office.

Volatility isn’t something to fear if you’re prepared. Here’s some things I recommend:

Review your asset allocation, especially if December’s selloff made you nervous.

Dollar cost average into new positions.

Make a list of stocks you missed on the way up so you’re prepared to act in the event of a correction.

AI and energy as growth accelerators

According to Bloomberg, a single ChatGPT query requires nearly 10X as much electricity as a traditional Google search. And more energy is just the beginning in terms of resources required to support demand for AI. (Read)

AI, energy and the infrastructure to support both are areas that will see continued investment regardless of Trump’s agenda.

My favorite pure AI play continues to be Palantir PLTR 0.00%↑, which is up over 300% from our original buy point. My only mistake was not buying more aggressively. I would welcome a pullback to pick up more shares.

On the energy front, I’ve been very interested in the innovation happening in the nuclear space with small modular reactors. Some of these startups could really start to gain traction if the Trump administration is willing to reduce some of the red tape involved in bringing nuclear energy to market.

I also expect the buildout of new data centers and other infrastructure to increase demand for professional services to help bring these projects to completion. That was the thesis behind my recommendation of Willdan Group WLDN 0.00%↑, which helps organizations optimize energy infrastructure and consumption. I’m currently researching a few companies in this space and will have more to say in our portfolio review later this month.

2025 will be a stock pickers market

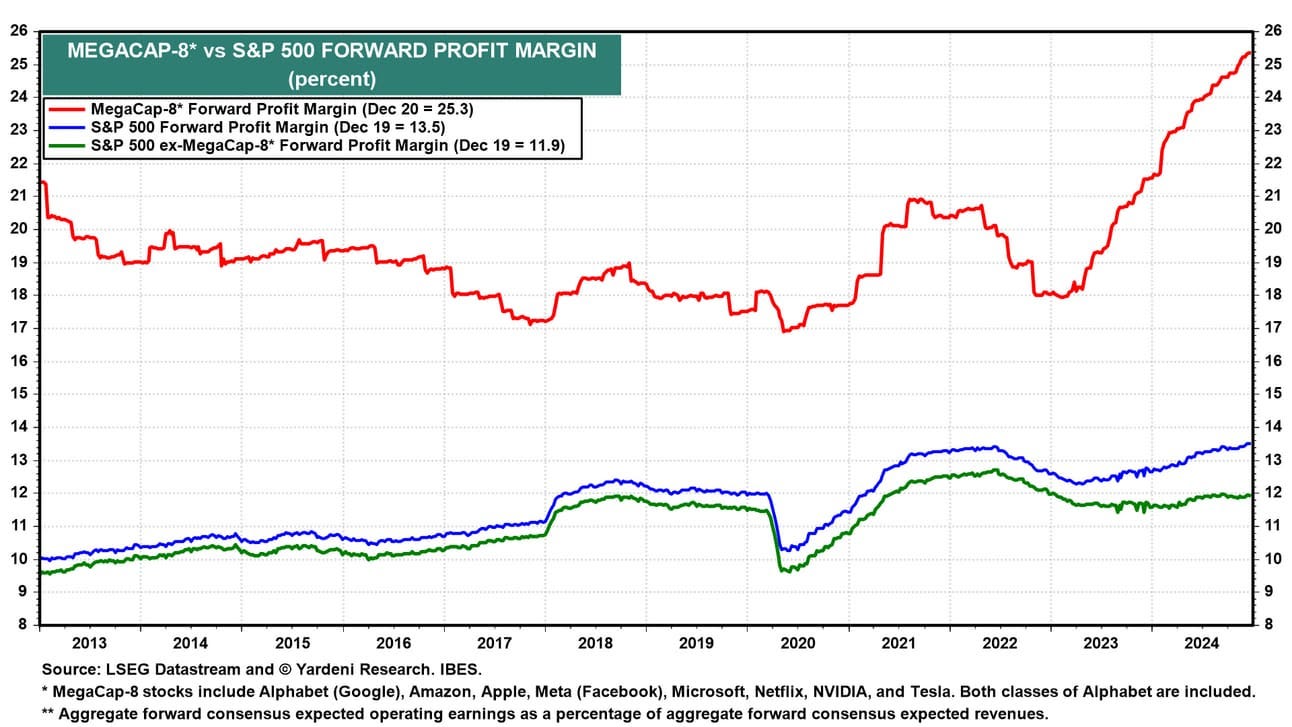

It turns out after all the anxiety over narrow market leadership, concentration is a feature and not a bug of the stock market. (Read)

The current market concentration is also backed by fundamentals. Forward profit margins for the 8 largest mega caps is more than double that of the rest of the S&P 500. This market is disproportionately rewarding companies that can scale efficiently.

I also believe this year will reward stock pickers in the small cap space as well. Deregulation and lower corporate tax rates will have a bigger impact on a percentage basis on the bottom lines of small companies than their larger counterparts. Smaller companies also tend to be more domestically-focused, so they’re less vulnerable to trade restrictions. But 40% of the Russell 2000 has negative earnings. As we saw last year, quality matters a great deal when it comes to small and micro cap companies.

I’ve never been more excited about using factor-based strategies to find tomorrow’s winners.

What could go wrong?

The bearish case generally involves trade wars, geopolitical tension and excessive debt serving as a headwind to growth.

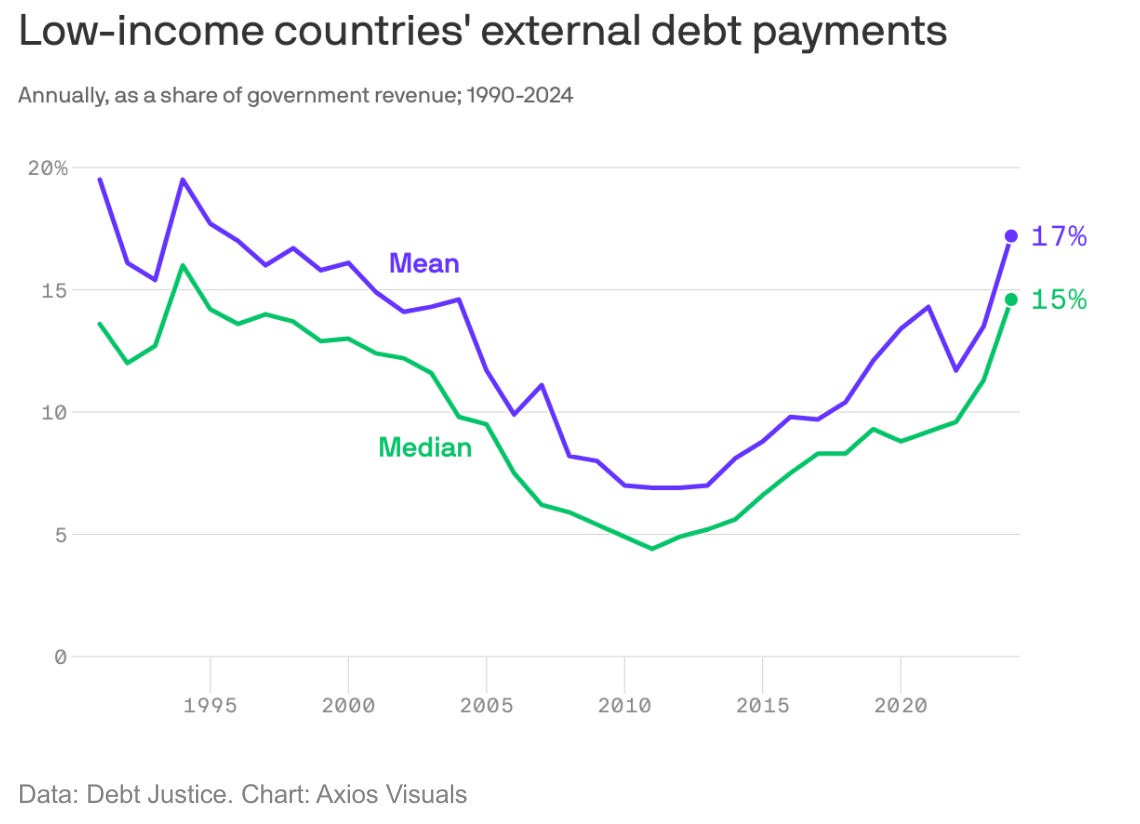

But I continue to believe the next major crisis will be caused by excessive government debt. And the crisis will most likely start abroad before ultimately hitting the U.S.

Debt payments as a percentage of revenue are at a 30-year high for the world’s poorest countries.

In the U.S. rising spending and interest expenses are outpacing tax revenue, and bond investors are clearly concerned. Total U.S. debt is expected to hit $50 trillion in the next 10 years, and debt service costs are on their way to being the largest line item in the budget. The world is sleepwalking towards a sovereign debt crisis.

While I welcome efforts by DOGE to cut wasteful spending, I believe it will take a real crisis to enact meaningful change.

None of this bodes well long term for inflation and the value of long term bonds. I continue to prefer dividend growth strategies over long term bonds for income.