The Predictive Investor - 2/16/25

Headlines vs. Reality

Welcome to The Predictive Investor weekly update for February 16th, 2025!

Stocks closed up for the week despite higher inflation data and yet another tariff announcement.

After a wave of negative headlines and predictions of an immediate downturn, should we be worried?

Here’s my takeaways from the week.

Inflation coming in hot

Consumer prices increased 3% in January, vs. a forecast of 2.9%. A lot of ink was spilled over the fear of a resurgence of the inflation we saw two years ago. While anything is possible, I doubt that’s where we’re headed.

Yes, inflation remains above the Fed’s target. But the long term CPI average is 3%. So we’re not any better or worse off than usual.

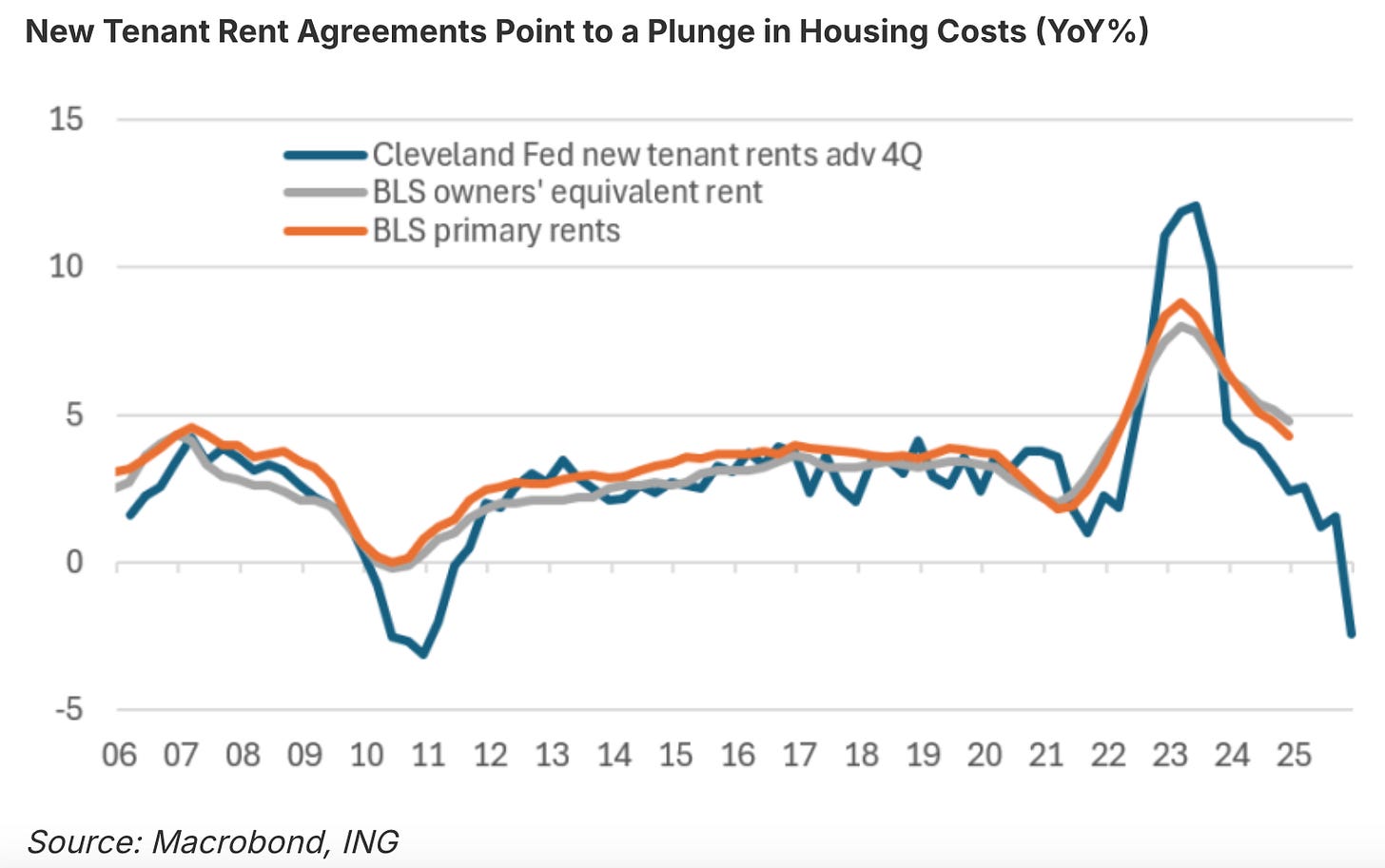

Additionally, rent is on a clear downward trajectory, and housing costs make up more than a third of the CPI.

The Trump administration is also looking to increase the supply of energy, which is also deflationary.

Balancing that against the inflationary effects of tariffs and protectionist trade policies, we're likely to get inflation that is sticky but not out of control.

Retail sales drops sharply

U.S. retail sales in January saw the largest drop in nearly two years, amid severe winter weather and the wildfires in southern California. (Read)

It’s hard not to attribute at least some of this to high prices. While the rate of inflation has come down since the peak in 2022, prices have not. Which explains the disconnect between the headlines and consumer sentiment around inflation.

So it’s not surprising to see continued store closures as low cost online retailers continue to take market share.

Despite the monthly drop, year-over-year retail sales were actually up 4.2%. Consumers remain resilient, but I would continue to avoid retail stocks. There’s just too much pressure on margins from inflation, increased competition from discount retailers, not to mention tariffs.

The market calls Trump’s bluff

Trump announced a plan to implement reciprocal tariffs and a 25% tariff on steel and aluminum imports effective March 12th. Stocks rallied anyway, despite the widespread belief that these tariffs would be both inflationary and a headwind to growth.

Traders are betting that these announcements are simply a negotiating tactic. And Trump seems to be betting that this will bring our trading partners to the table and encourage more companies to reshore their manufacturing. Both are risky propositions.

That’s because the uncertainty around trade policy could hurt the economy even if these tariffs are not implemented. Many companies that rely on imports may delay investment or hiring decisions until there’s more clarity on what will actually happen.

Good companies will prosper either way. But it could be a bumpy ride.

Sentiment is extremely bearish

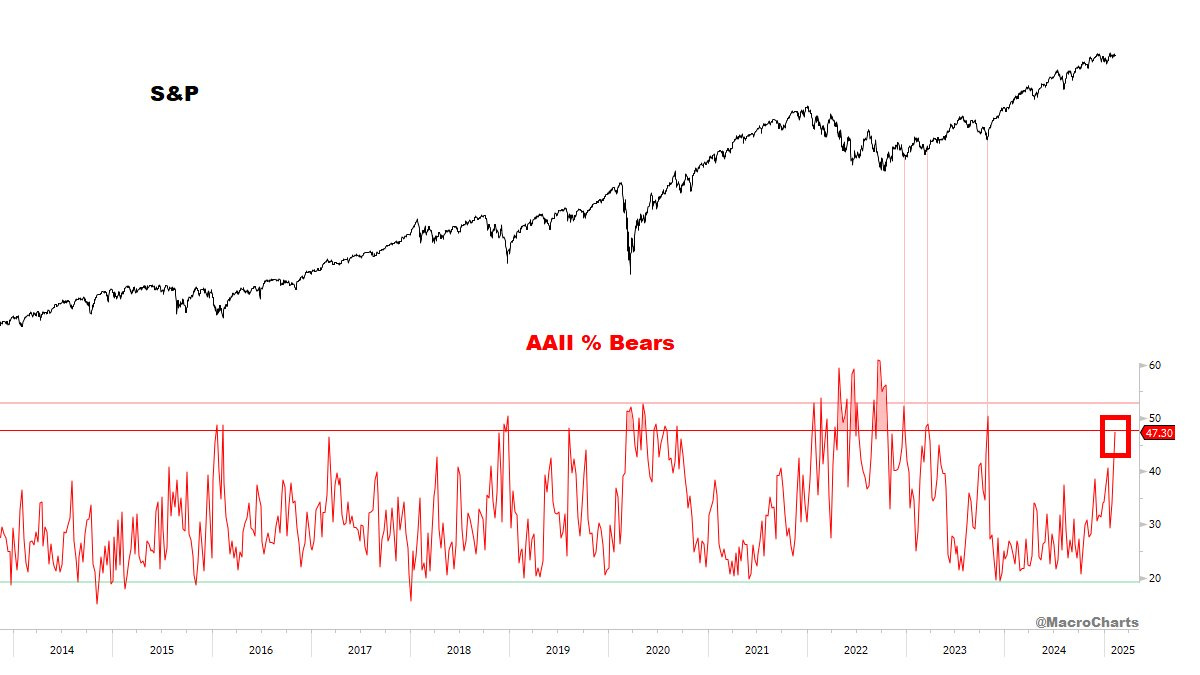

Meanwhile, the latest AAII survey came in with nearly half of investors indicating they’re bearish on stocks.

Less than 30% of investors were bullish, the lowest reading since the fall of 2023. And yet the S&P closed the week less than 1% below its all time high.

Bearish sentiment at these levels has provided a good buying opportunity in the past. I was expecting a stronger pullback this quarter, but it seems the market wants to continue higher before giving us a real correction.