The Predictive Investor - 2/2/25

Ready, fire, aim!

Welcome to The Predictive Investor weekly update for February 2nd, 2025!

The nervous money sold many AI-related stocks last week on the news that DeepSeek only spent $5.6 million to train its AI model. Even many energy stocks sold off, which makes very little sense.

If it’s really possible to reduce the cost of AI models by that much (something I’m skeptical about), then that pretty much guarantees increased use, which means energy demands will go up.

But this is pretty typical of the ready, fire, aim mentality that comes with increasingly computerized trading. We are likely to see some similar moves this week in the wake of Trump’s tariffs on China, Canada and Mexico.

Neither has me worried. The fears over DeepSeek cutting into America’s AI dominance are overstated. And tariffs are rarely permanent. While they may slow growth, companies do not stop operating simply because of increased costs.

I went shopping last week and hope you did too. The volatility represents an incredible opportunity for long term investors.

Here’s my takeaways from the week.

Strong earnings, strong economy

According to Factset, of the S&P 500 companies that have reported Q4 earnings, 77% beat EPS estimates and 63% beat revenue estimates.

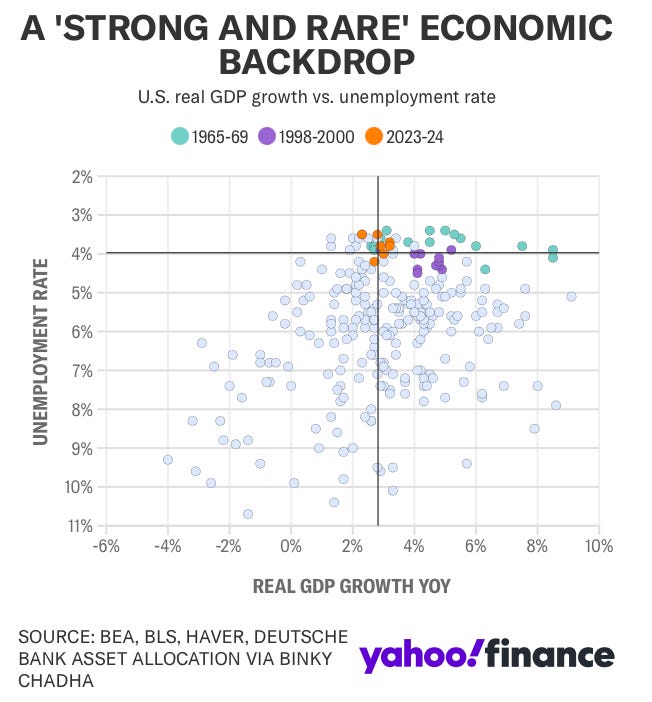

GDP grew at a 2.3% pace in Q4, and unemployment remains below historical averages.

Prior periods of low unemployment and strong GDP, such as the 60s and 90s, saw very strong stock market returns.

It’s not the end of the AI rally

There’s a few reasons why the DeepSeek news is very bullish for AI.

First, the cost disparity between DeepSeek’s model and American models is likely not as wide as initially reported. In fact, a report from SemiAnalysis estimates that DeepSeek’s actual hardware spend is at least $500 million. (Read)

Second, DeepSeek’s model is open source, which means big tech can learn from it and incorporate any efficiencies into their own models.

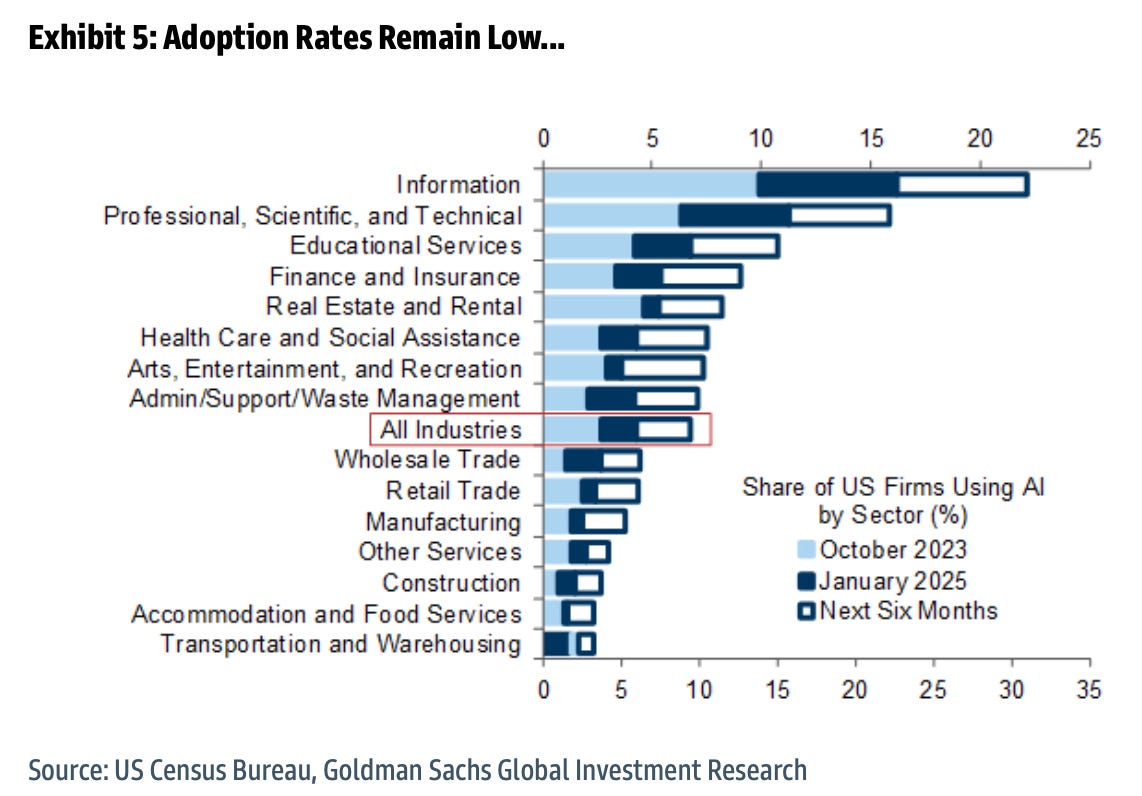

Third, any cost savings in these models just improves the ROI of using AI. This means even more chips, more energy and more infrastructure will be needed to support growth.

Research from Goldman Sachs shows only 6% of companies are using AI today. The upside remains tremendous.

Meanwhile, Palantir PLTR 0.00%↑ hit a new all time high last week and remains my favorite AI stock. They report earnings tomorrow. I can only hope for an overreaction on the downside so I can pick up more shares.

Time to go bullish on China?

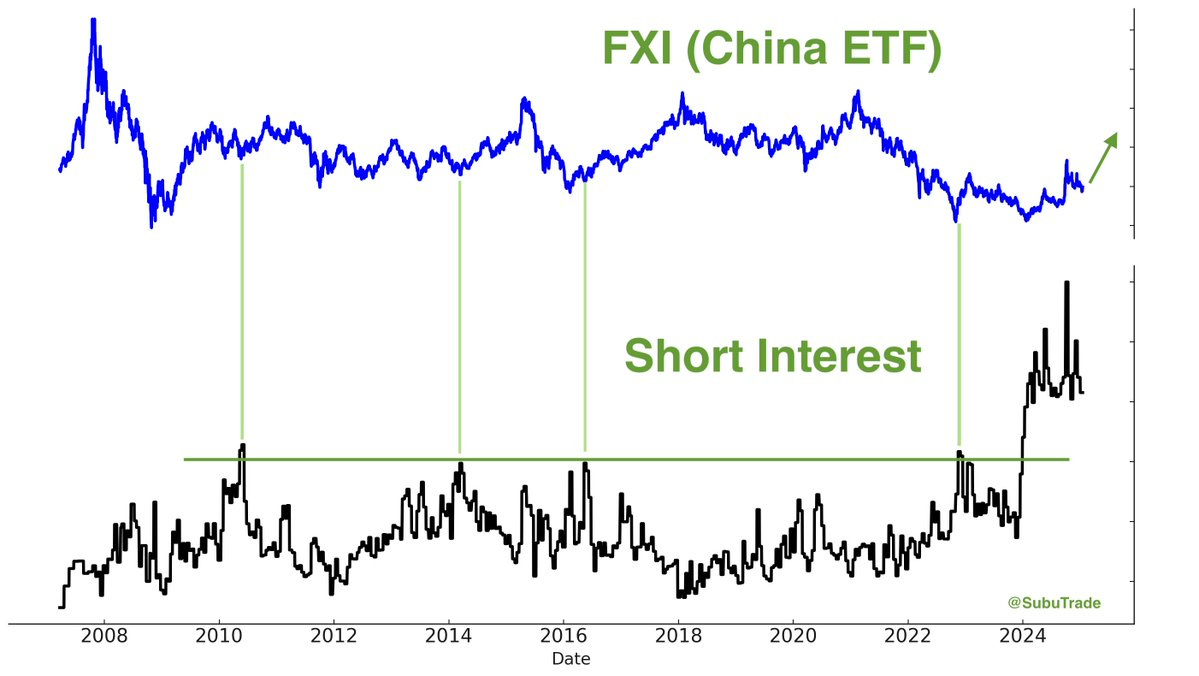

I’ve been bearish on China since 2023, favoring India as a better option to gain exposure to growth in Asia. Since then India has outperformed China by a large margin. But it might be time to re-think that thesis.

Despite many economic challenges, Chinese stocks have reversed their downward trend to the upside. And yet short interest remains at record levels. It seems we’ve reached peak pessimism.

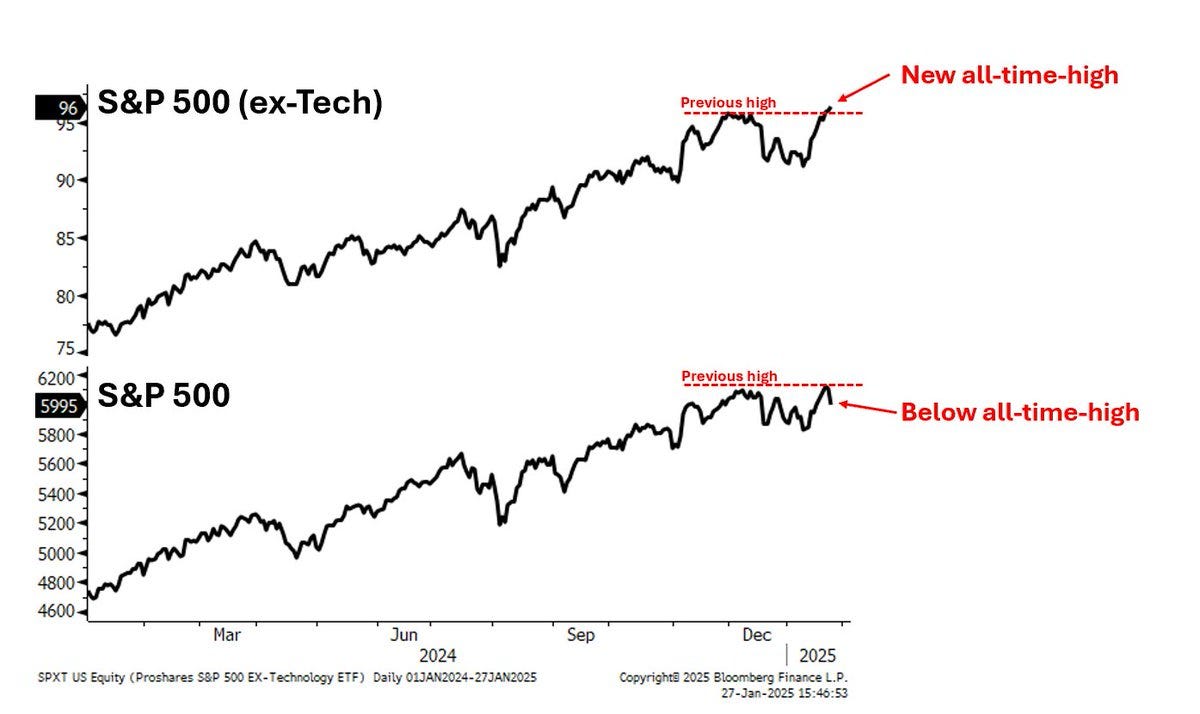

Bull market is broadening out

While traders are freaking out over AI, the S&P 500 ex-tech hit an all time high last week. A reminder that there’s plenty of opportunities in this market for investors who can tune out the noise.